Which online payment services should you be offering at checkout? It’s a decision that could be the difference between your customers completing or abandoning their transactions. In this article, we’ll help you understand more about increasing conversion rates with diverse payment systems.

The Importance of Offering Diverse Payment Processing Methods

Understanding Consumer Behavior at Checkout

So much of e-commerce is about the user experience, and the checkout is a significant part. Your customers want choice and flexibility – to be able to pay via their preferred payment method – or else they’ll go elsewhere. In fact, “payment options” (or a lack of them) is cited by 40% of online shoppers as a leading reason for cart abandonment1. That’s why it’s crucial your business integrates payment services that meet your customers’ needs. Artificial intelligence can play a role here – monitoring customer behaviors to detect patterns and predict future preferences – meaning you can offer customised payment choices during checkout.

Global Trends in Payment Preferences

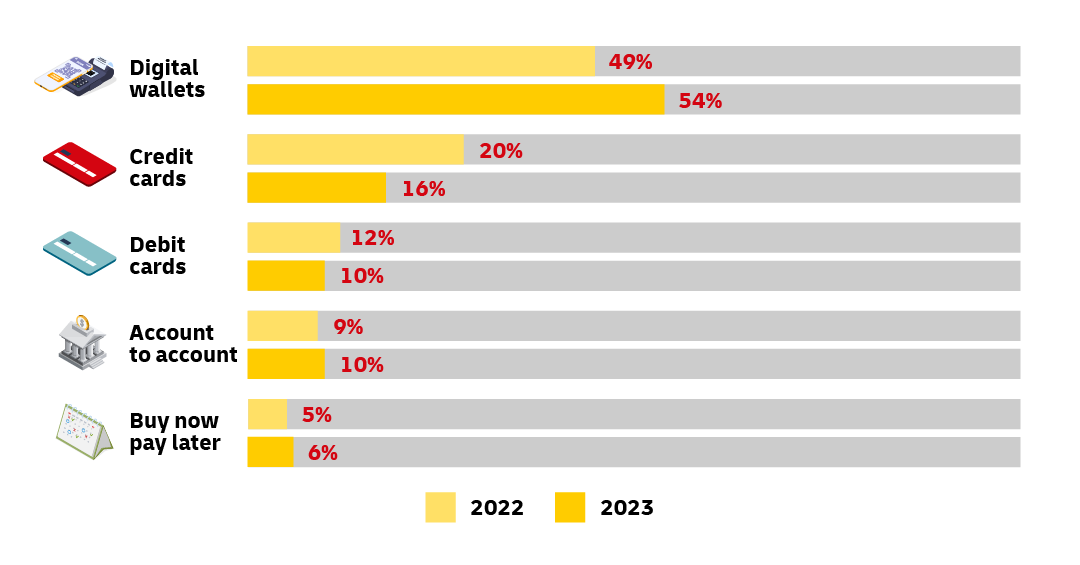

Online consumers’ demand for quick and frictionless payment combined with widespread smartphone usage is making digital wallets the preferred choice at checkout.

Impact of Payment Options on Conversion Rates

Choosing the right payment options for your online store can have a direct impact on your conversion rate – improving it by as much as 30%3. Amongst cross-border shoppers, it’s particularly important – many are deterred from shopping with foreign brands due to concerns about authenticity, but seeing a familiar payment service at checkout could reassure them enough to complete the transaction.

Exploring Key E-commerce Payment Methods

Credit Cards: Still Relevant or Losing Ground?

Whilst credit cards were once the leading payment method for e-commerce transactions, they’ve been losing market share to digital wallets, which allow a quicker checkout process. In response, many credit card companies are diversifying their products to appeal to consumers – such as offering BNPL services, and integrating biometric technology like fingerprint and facial recognition.

Despite competition, credit cards remain the second most popular payment method, so merchants should continue accepting them as standard. They’re regulated by compliance standards, offering both the buyer and seller reassurance that their transactions are secure. Many shoppers are also incentivised to spend on credit cards to have access to their banks’ reward programs.

Stripe4 is one of the market leaders for processing online merchants’ credit card transactions. It promises to increase conversions with built-in optimisations, access to 100+ payment methods, and one-click checkout. Furthermore, it supports cross-border transactions to 195+ countries and lowers the costs of multi-currency management.

The Rise of Digital Wallets: Convenience and Security

When it comes to mobile-friendly payment solutions for e-commerce websites, digital wallets (also known as mobile wallets) are a must-have. They are forecast to account for 54% of global e-commerce payment transactions by 2026, making them the most popular online payment method worldwide5.

They act like a prepaid credit account, storing the customer’s personal data and funds. It's quick and easy; users are redirected from the e-commerce site’s checkout to the digital wallet’s page where they can simply log in with their existing username and password to complete the purchase. This is particularly handy for those shopping on mobile, where a smaller screen can make filling in lots of details very frustrating.

Digital wallets also benefit from encryption security which encodes debit and credit card details so the numbers are never shared with a merchant – making them a secure option.

4 digital wallets to consider

PayPal

PayPal’s 400+ million active users(6) can send or receive payments across the world instantly by simply logging into their account. The platform accepts cross-border payments (with automatic currency conversion), making it an attractive option for SMEs looking to grow internationally.

Amazon Pay

Amazon Pay is the e-commerce giant’s online payment processing service. Partner retailers can embed a button on their websites to give their customers a quick checkout experience.

Apple Pay

Apple Pay uses fingerprint and facial recognition technology, making it one of the most secure digital wallets out there. It comes pre-installed on Apple smartphones, and can be used in store, in apps, and on the web.

Google Pay

Let’s not forget Android users. Google Pay allows them to make payments online and in-app with their smartphones by connecting to the payment card(s) they have on file in their Google Accounts.

Buy Now Pay Later (BNPL) Options: Meeting Changing Consumer Needs

The BNPL sector’s growth has been astronomical – and it shows no signs of slowing down. The global market is projected to grow from US$30.38 billion in 2023 to US$122.19 billion by 2030 – a whopping CAGR rate of 22%7.

As inflation continues to squeeze economies across the world, paying for purchases in installments is an attractive prospect for budget-conscious consumers. Millennials and Gen Z are the biggest users of BNPL services8, so choosing the right BNPL service for your e-commerce site is an important decision. Research the most popular providers in your target markets and make sure you include them as options.

3 leading BNPL solutions for your SME

One of Europe’s BNPL market leaders, Klarna offers a range of payment plans including “Pay in 30 days” and “Pay in 3 installments”. Merchants are charged fixed and variable fees on all transactions; in the US, for example, the latter is between 3.29% to 5.99%.

The Clearpay app allows customers to pay for purchases in interest-free installments spread over six weeks. The company claims merchants enjoy a 15% increase in overall profit margins after adding Clearpay at checkout.

PayPal’s BNPL service is easy to add for merchants with existing PayPal accounts. Businesses benefit from the platform’s soft user credit check – and of course the vast reach and brand recognition of the payment giant.

Optimising Your E-commerce Payment Strategy

Choosing the Right Payment Processor

A payment processor is a platform that manages the financial transactions between a merchant and a customer, from various channels including credit cards and debit cards. When a customer makes a purchase, the payment processor receives the transaction details, and requests authorisation from the issuing bank to ensure the customer has sufficient funds – and to verify their identity. The merchant account is then credited with the transaction amount. It’s a fast, seamless and secure system used by millions of SMEs across the world, every day.

There are many payment processors available – the most popular being PayPal – so your business should consider the following factors when choosing one:

Fees: these vary by payment processor; some charge a fee per transaction, others via a monthly subscription. There are also set-up and cancellation fees to consider, too.

Accepted payment methods: ensure the payment processor supports the payment methods your customers most commonly use, whether that’s credit cards, digital wallets, or BNPL.

International availability: if you’re selling cross-border, look for a payment processor that supports multiple currencies and popular local payment methods.

Customer experience: choose a well-known payment processor, and your customers will be reassured to complete the transaction at checkout.

Tailoring Payment Options for International Markets

Businesses selling internationally need to consider that e-commerce consumers’ preferred payment methods vary by market. Italians favor digital wallets9, whilst the Argentinians10 and South Koreans11 have remained loyal to credit cards. Meanwhile, in some countries cash on delivery is still the norm. And that’s just a snapshot of a varied and diverse global landscape. So, whichever market you’re looking to target, it’s important you do your research into local payment trends first. Our Export Guides contain these insights (and many more) to help you.

Streamlining Your Checkout for Improved User Experience

It’s crucial you offer your customers a quick, flexible and frictionless experience. Follow these tips:

Offer choice! The more payment options you can offer at checkout the better. Remember, if customers can’t pay via their preferred method, they’re likely to abandon their purchases, so don’t overlook this crucial step!

Think minimal clicks: let customers check out using their digital wallets so they don’t have to input all their payment information.

Offer one-click checkout. By saving your customers payment details to their account, they can pay via one click every time they shop with you.

Reassure customers about security: provide well-known payment options, display security badges, and emphasise your data protection policy.

After the payment is complete, it’s time to think about shipping! Open a DHL Express Business Account for fast, international shipping with the experts.

4 – Stripe

10 - Statista, May 2023