1. Set up your Login

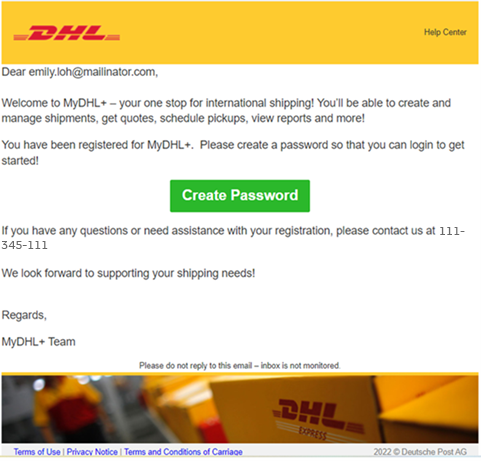

Upon your DHL account setup, a login on MyDHL+ will be automatically registered. You will just need to activate the login via an email sent to you from dhlSender@dhl.com.

Click on ‘Create Password’ to activate your login on MyDHL+.

Once activated, you are all set to go!

2. Get a Quick Quote and Transit Time

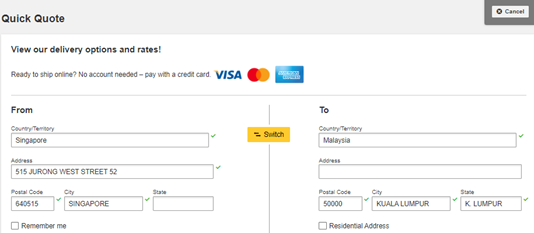

On MyDHL+, you can get a quick quote based on the account number you had saved under your profile.

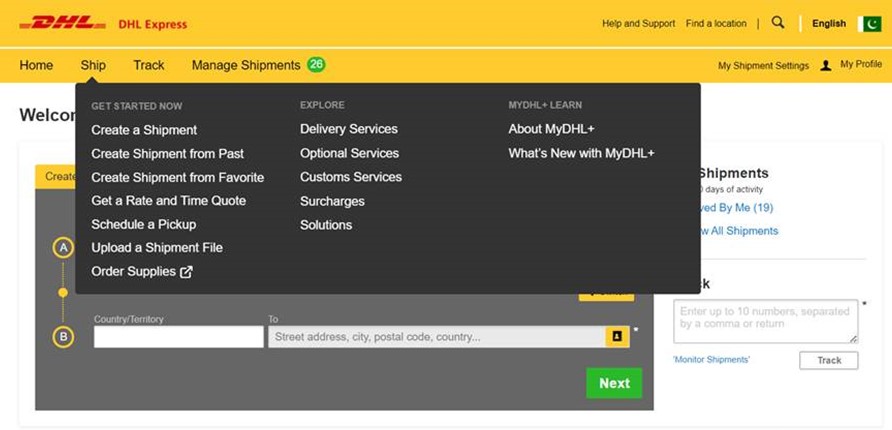

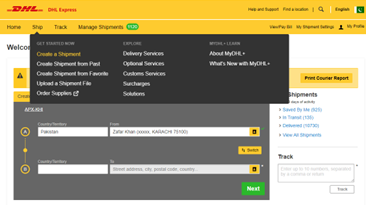

- Click 'Ship' then 'Get a Rate and Time Quote' on the top menu bar.

- Fill in the ‘From’ and ‘To’ country, city, and postal code.

- Provide the weight and dimension of your package or document.

- Select the account number from the dropdown panel that you would like to check for. If your account is not reflected, you will need to add the account into your profile.

- Lastly, click on ‘Get Quote’ to see an estimated quote and transit time.

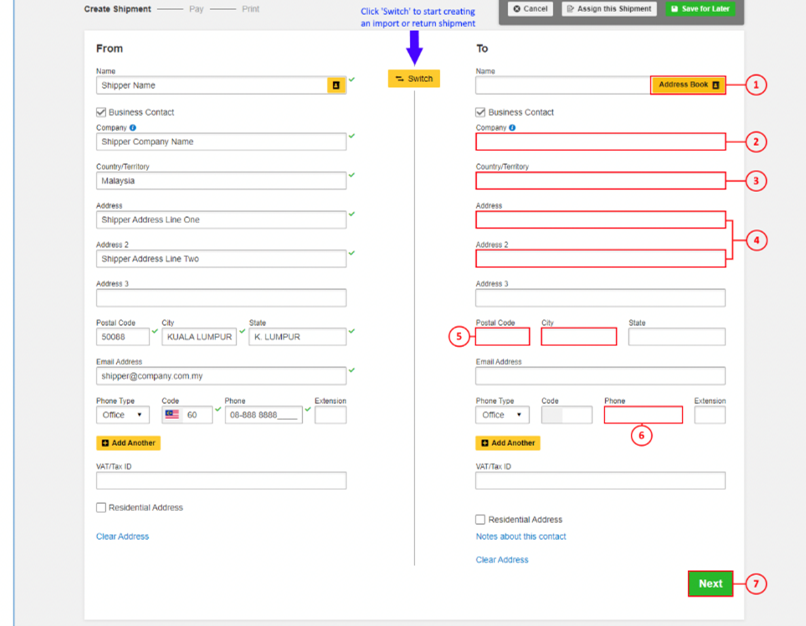

3. Create a Shipment

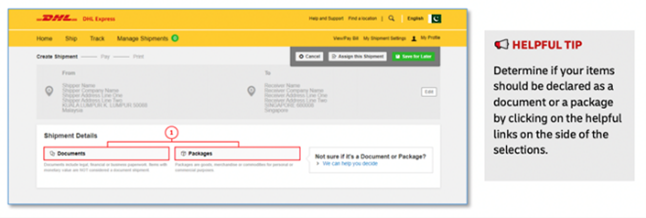

You will receive handy hints and information to help you complete the sections.

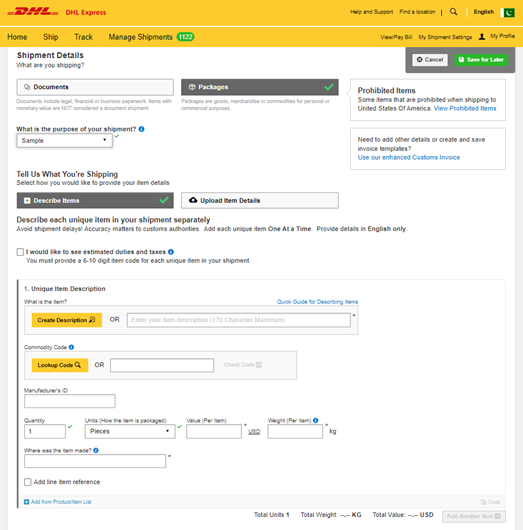

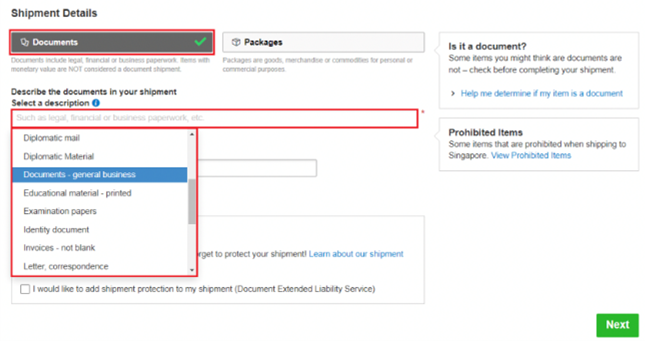

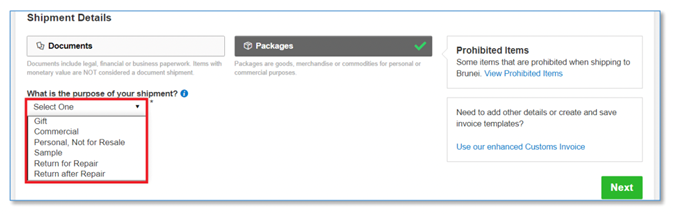

ii) For Document shipment, select the document type from the dropdown list available.

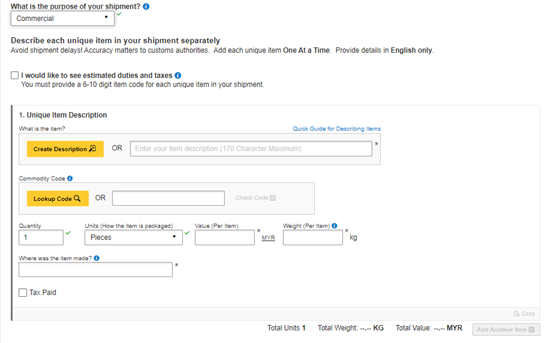

- Next, you will be prompted to provide information about the items you are shipping. By entering the list of items in your shipment, this will help customs authorities in classifying your shipment accurately and speed up the clearing of your shipment.

- Enter your item details as accurately as possible or you may use the ‘Create Description’ button.

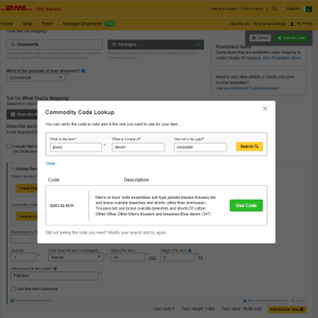

- You can also use ‘Lookup Code’ to find the tariff code for your item.

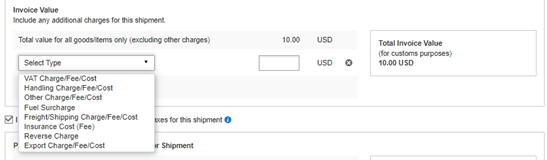

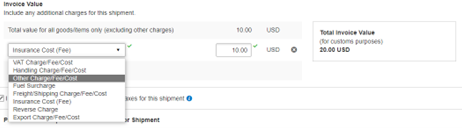

- You may indicate additional charges involved in handling your shipment such as handling fee, packaging, insurance, etc. if applicable.

Optional: Preset commodity types are available and will appear as a drop-down when you enter a brief description of your product. Choose whichever is most similar to your item and a commodity code will be assigned to it.

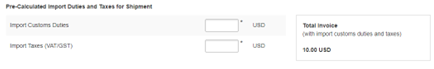

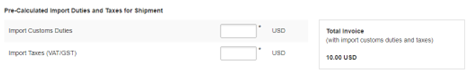

Optional: Please provide pre-calculated duties and taxes on the commercial invoice (if the receiver pays them as part of the price of goods being shipped).

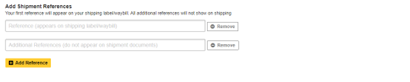

Optional: You may include your shipment reference in the field below. Click on the [ + ] sign to add additional reference if applicable. You may add up to 50 references in a single shipment. Please note that only the first reference will be printed on the waybill.

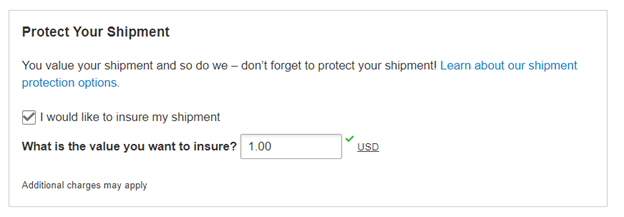

- You may also opt to protect your document/shipment by selecting the insurance service.

- We recommend this comprehensive protection for your documents, valuable or personal shipments, giving you peace of mind in the unlikely event of physical damage or loss.

- Please enter the value of the shipment you want to insure. For 100% protection, please input the amount to be the same as your total declared value.

Click on ‘Add Charges’ and a dropdown will be displayed for you to indicate the type of fees involved. It is important to declare all additional fees that make up the total value of your shipment as it determines how quickly your goods can move through the customs process. This section is optional.

Optional: Preset commodity types are available and will appear as a dropdown when you enter a brief description of your product. Choose whichever is most similar to your item and a commodity code will be assigned to it.

Optional: Please provide pre-calculated duties and taxes on the commercial invoice (if the receiver pays them as part of the price of goods being shipped).

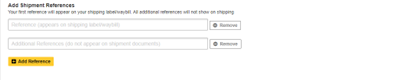

Optional: You may include your shipment reference in the field below. Click on the [ + ] sign to add additional reference if applicable. You may add up to 50 references in a single shipment. Please note that only the first reference will be printed on the waybill.

This is only required for parcel shipments (not document shipments).

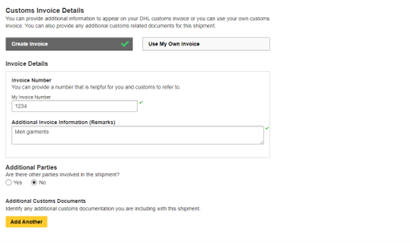

Your invoice is used to clear customs, so it must be accurate and correspond with the contents of your shipment and your AWB.

You will have an option either to: -

- Create Invoice

- If you do not have your own invoice – this will be created using DHL invoice template

- Invoice number field is mandatory for export from Pakistan, please enter an invoice number of any format (e.g.: INV_DDMMYY)

- Use My Own Invoice

- Please indicate your invoice number for this shipment

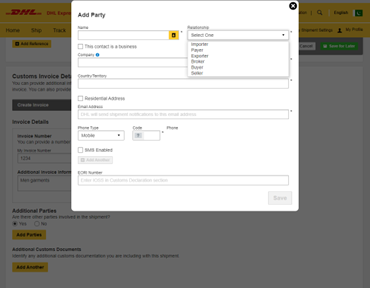

If there are any additional parties involved in this shipment, you may declare their information by clicking on ‘Add Parties’.

b. A light box will open for you to fill out information about the additional parties involved. You may import the existing contact details directly from your address book or input their details manually. Multiple parties can be added to a single shipment consecutively.

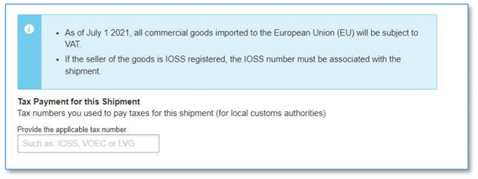

Shipments to EU & other applicable destinations: In the Shipment Tax ID field, you are urged to enter the relevant Tax ID number (if applicable), depending on the destination countries of your dutiable shipments. For example, enter your IOSS number for dutiable shipments entering the European Union if you have paid your Value Added Tax (VAT) in advance.

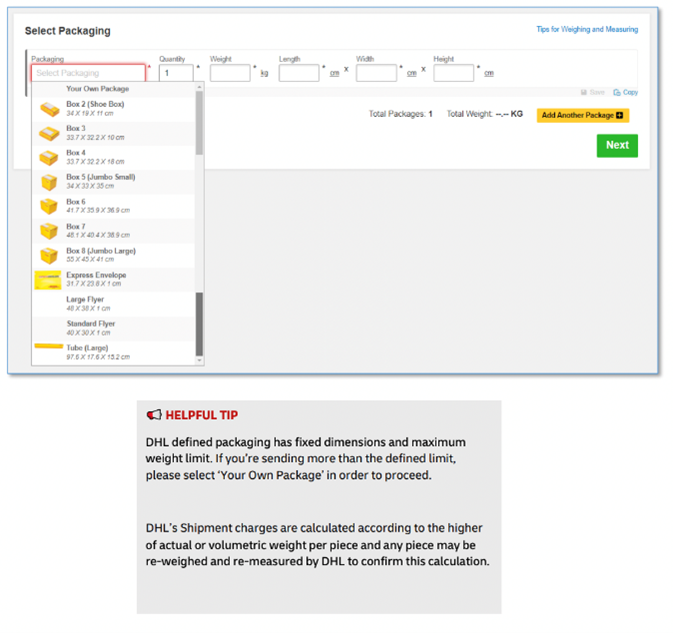

- Document: Common packaging type are either ‘Express Envelope’ or ‘Standard Flyer’

- Packages: If you’re using your own box, select ‘Your Own Package’ on the top of the list

- Fill in the Quantity (per box/packaging) and the Weight of each box

- If you have more than one package that is of different weight/dimension, click on

[ Add Another Package ]

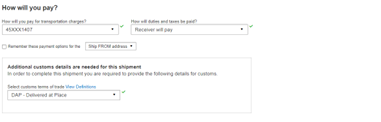

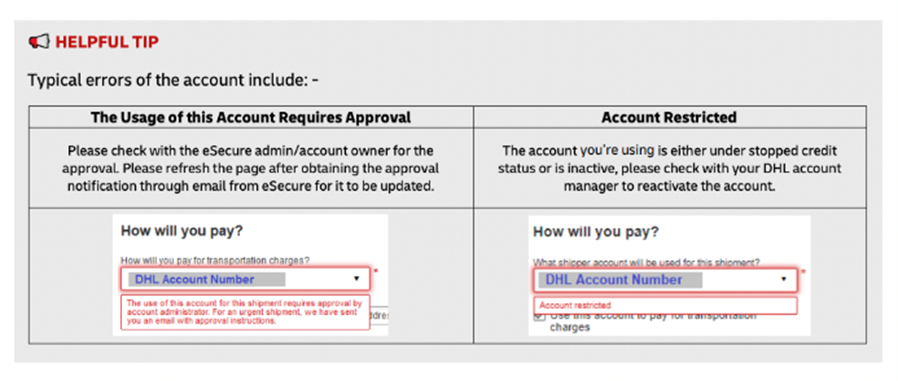

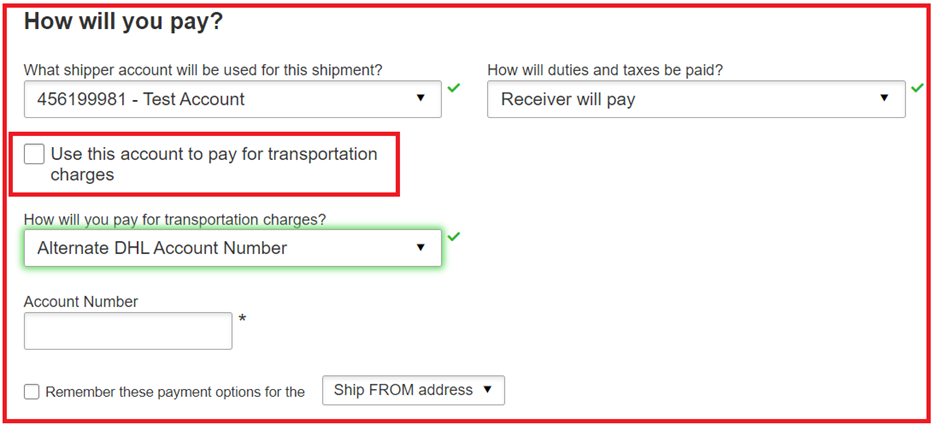

By default, your registered DHL account will appear for transportation charges and the duties and taxes will be under ‘Receiver will pay’. You can have more than one account registered in the profile.

If you wish to absorb the duties and taxes charges, please select your account or enter the 3rd party account number that will bear the duties and taxes. Duties and taxes charges are determined by the destination customs authorities. There will be an additional service charge of XX per shipment for DTP service.

For transportation charges paid by receiver or 3rd party, please un-tick the checkbox and select ‘Alternate DHL Account Number’ to enter the payer DHL account number. The shipper account will be your registered DHL account number.

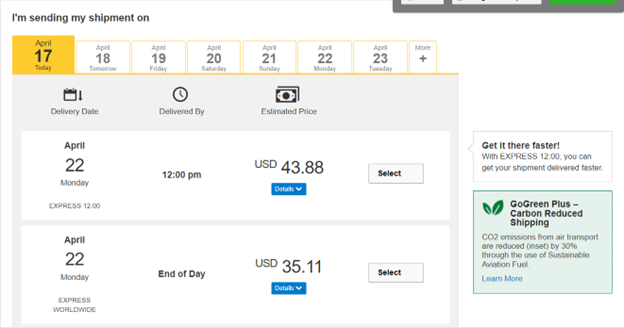

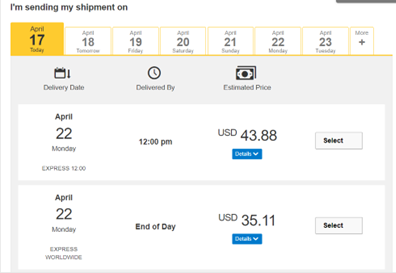

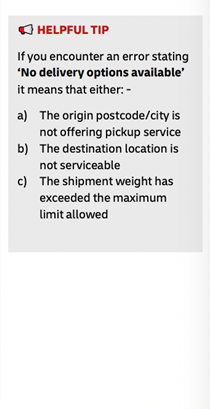

Select your shipment date (in yellow) and the estimated delivery dates will be shown below. Estimated delivery date and time is subjected to customs clearance for parcel shipments.

The product selection varies depending on the destination and limits that you have entered. The normal delivery option is under ‘Express Worldwide’. Time definite service will be incurred a premium when selected.

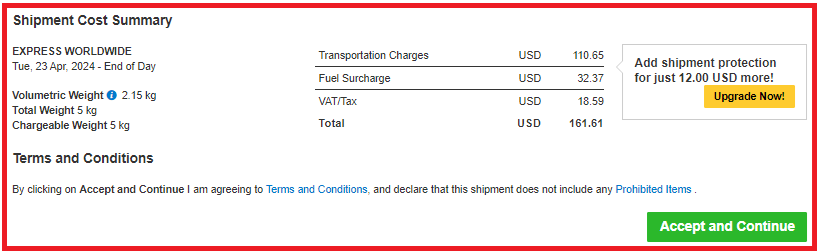

The price shown is an estimate based on destination, the higher net weight or volumetric weight, the declared value entered, and services opted in the Shipment Details section above.

- Click on ‘Details’ at the bottom of the price to show breakdown charges. If you have selected for the transportation charges under an alternate account, there will be no price displayed.

- Click ‘Select’ to proceed to the next page.

In this way, we give you the flexibility to choose the service that best fits your needs when using our express delivery services worldwide.

- Please note that the Optional Services selections varies depending on the destination.

- Additional charges may apply.

- Refer to DHL website for the latest update on the service charges: https://mydhl.express.dhl/my/en/ship/optional-services.html

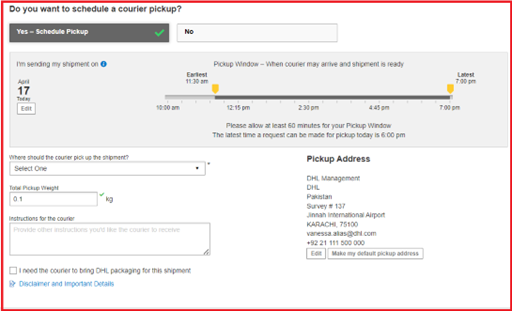

You can arrange for pickup by our courier or drop off the shipment at the nearest DHL Express Service Points.

Please do note that DHL might not be able to attend to the preferred pickup time specifically as the courier will be moving around on his planned route in his coverage area.

A. Export Pickup – from/within Malaysia

- Click ‘Yes – Schedule Pickup’

- Click ‘No’ if you have already a pickup scheduled.

- Click ‘Drop off at DHL Service Point’ if you will be dropping off your shipments.

- Check the pickup date and time slider

- The latest time available is the booking cut-off time for your area.

- Check your Pickup Address

- If it is in a different location, please click ‘Edit’ below the address to amend.

- Click ‘Save’ below the address once confirmed.

- Pickup Address will not be printed on the waybill copy.

- Select the location of the pickup and enter pickup instructions for courier (if any).

- Click ‘Next’ once confirmed

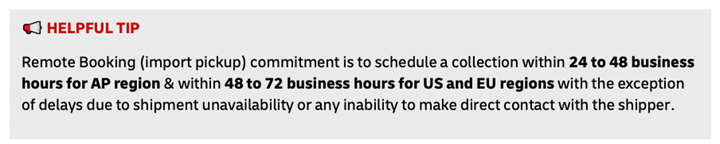

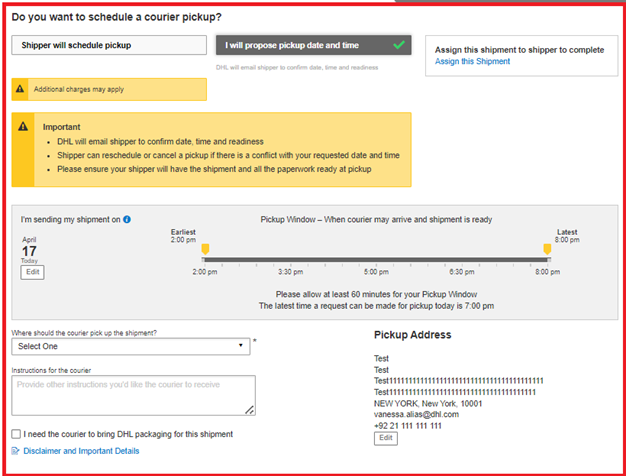

B. Import Pickup – from other countries/territories

- Click on ‘I will propose pickup date and time’ if you’ll be arranging the pickup on behalf of the shipper.

- Please send the pickup confirmation email to the shipper by clicking on ‘Send Documents’ after shipment completion.

- You may opt for shipper to arrange pickup if shipment is not ready yet.

- Default pickup address is the same as shipper address.

- If pickup is from a different location, click on ‘Edit’ at the bottom and click ‘Save’ once amended.

- Click ‘Next’ once confirmed.

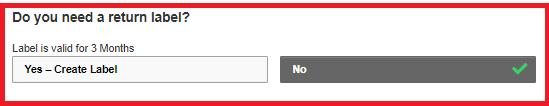

This is typically meant for return delivery shipment (2-way).

If you’re only sending a 1-way shipment, please click ‘No’ to proceed.

- Amount will only be shown for transportation charged to shipper’s account.

- If you need to amend any details, click ‘Edit’ on the fields above.

- Once details are confirmed, click ‘Accept and Continue’ to proceed.

- If you need to amend any details after confirmation, please create a new waybill.

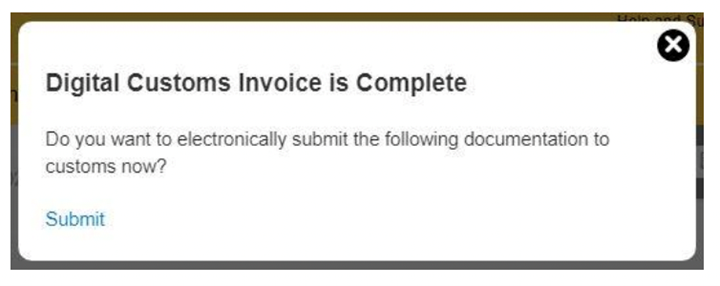

- If you have opted for Digital Customs Invoice service, please click ‘Submit’ for the files to be uploaded.