1. Set up your Login

Upon your DHL account setup, a login on MyDHL+ will be automatically registered. You will just need to activate the login via an email sent to you from dhlSender@dhl.com.

Click on 'Create Password' to activate your login on MyDHL+.

Once activated, you are all set to go!

.png)

2. Get a Quick Quote and Transit Time

On MyDHL+, you can get a quick quote based on the account number you had saved under your profile.

- Click 'Ship' then 'Get a Rate and Time Quote' on the top menu bar.

.png)

- Fill in the ‘From’ and ‘To’ country, city, and postal code.

- Provide the weight and dimension of your package or document.

- Select the account number from the dropdown panel that you would like to check for. If your account is not reflected, you will need to add the account into your profile.

- Lastly, click on ‘Get Quote’ to see an estimated quote and transit time.

.png)

.png)

.png)

3. Create a Shipment, Invoice and Waybill

As part of Pre-Shipment Planner, you are also able to check for customs requirements of the import and export countries, as well as customs documentations required.

Click 'Ship' then 'Create a Shipment' on the top menu bar.

.png)

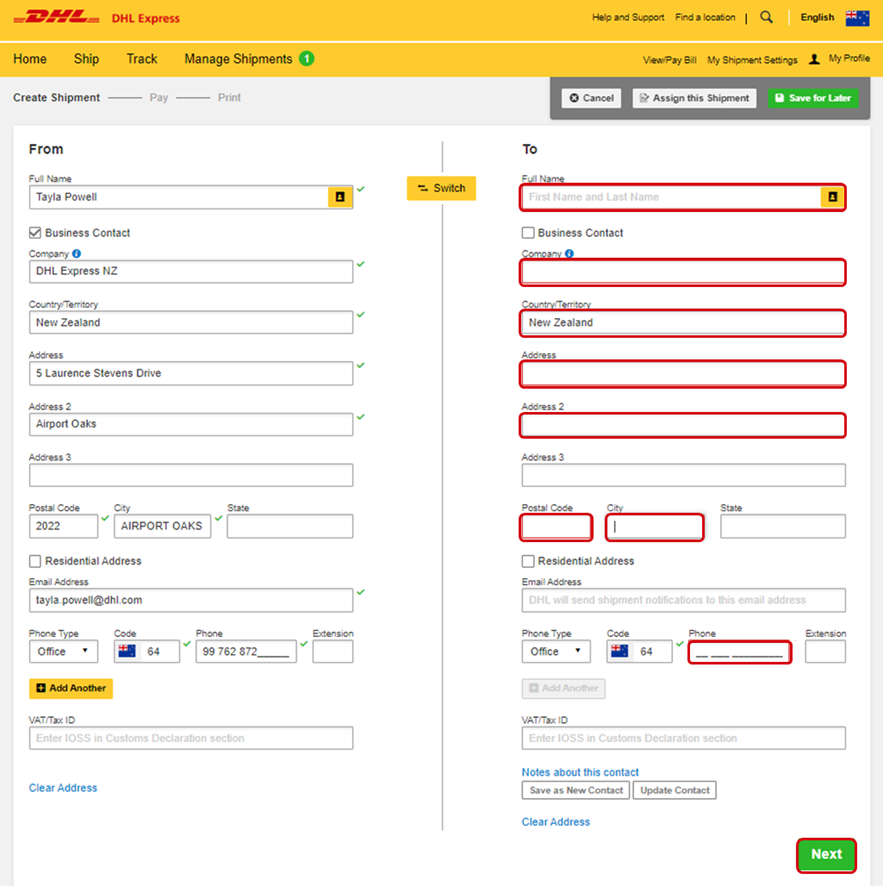

Complete the details of where you want the parcel collected from and delivered to. You will receive handy hints and information to help you complete the sections.

Select either 'Documents' or 'Packages' according to your shipment type.

.png)

- For Document shipment, select the document type from the dropdown list available.

.png)

- For Package shipment, please indicate the purpose of your shipment.

- For Repair and Return shipments, please indicate the serial number of the item for K2 declaration.

.png)

Next, you will be prompted to provide information about the items you are shipping. By entering the list of items in your shipment, this will help customs authorities in classifying your shipment accurately and speed up the clearing of your shipment.

How to describe your items:

- Click the ‘Describe Items’ button

- Enter your item details as accurately as possible or you may use the ‘Create Description’ button.

- You can also use ‘Lookup Code’ to find the tariff code for your item.

- Be sure to enter the Quantity, Units, Value and Weight of the item.

- For multiple line items click on ‘Add Another Item’

.png)

Optional: Commodity Code Lookup is available. Simply select Lookup Code and enter what the item is, what is it made of and how it will be used, suggested commodity codes will then appear for you to select. Choose whichever is most similar to your item and a commodity code will be assigned to it.

.png)

How to Upload Item Details:

- Download the Sample File template in either CSV, TXT or XML format

- Add line descriptions into this file in the correct format, save & file for upload – file away for future use as a template

- Ensure the Field Delimiter is set to (,) Text Delimiter to (“) then retrieve & upload the saved

CSV, TXT or XML formatted file using the Browse for File link

.png)

You may indicate additional charges involved in handling your shipment such as handling fee, packaging, insurance, etc. if applicable.

Click on ‘Add Charges’ and a dropdown will be displayed for you to indicate the type of fees involved. It is important to declare all additional fees that make up the total value of your shipment as it determines how quickly your goods can move through the customs process.

.png)

Optional: Please provide pre-calculated duties and taxes on the commercial invoice (if the receiver pays them as part of the price of goods being shipped).

Click the tick box to see to fill out the Duties and/or Taxes.

.png)

Optional: You may include your shipment reference in the field below. Click on the [ + Add Reference] sign to add additional reference if applicable. You may add up to 50 references in a single shipment. Please note that only the first reference will be printed on the waybill.

.png)

You may also opt to protect your document/shipment by selecting the insurance service.

- We recommend this comprehensive protection for your documents, valuable or personal shipments, giving you peace of mind in the unlikely event of physical damage or loss.

- Please enter the value of the shipment you want to insure. For 100% protection, please input the amount to be the same as your total declared value.

.png)

This is only required for parcel shipments (not document shipments).

Your invoice is used to clear customs, so it must be accurate and correspond with the contents of your shipment and your AWB.

You will have an option either to: -

- Create Invoice

If you do not have your own invoice - this will be created using DHL invoice template. - Use My Own Invoice

Please indicate your invoice number for this shipment

.png)

If there are any additional parties involved in this shipment, you may declare their information by clicking on 'Add Parties'.

.png)

A box will open for you to fill out information about the additional parties involved. You may import the existing contact details directly from your address book or input their details manually. Multiple parties can be added to a single shipment consecutively.

Shipments to EU & other applicable destinations: In the Shipment Tax ID field, you are urged to enter the relevant Tax ID number (if applicable), depending on the destination countries of your dutiable shipments. For example, enter your IOSS number for dutiable shipments entering the European Union if you have paid your Value Added Tax (VAT) in advance.

Click on the ‘Packaging’ column to see the dropdown list of packaging selections.

- Document: Common packaging type are either ‘Express Envelope’ or ‘Standard Flyer’

- Packages: If you’re using your own box, select ‘Your Own Package’ on the top of the list

- Fill in the Quantity (per box/packaging) and the Weight of each box

- If you have more than one package that is of different weight/dimension, click on

[ Add Another Package ]

.png)

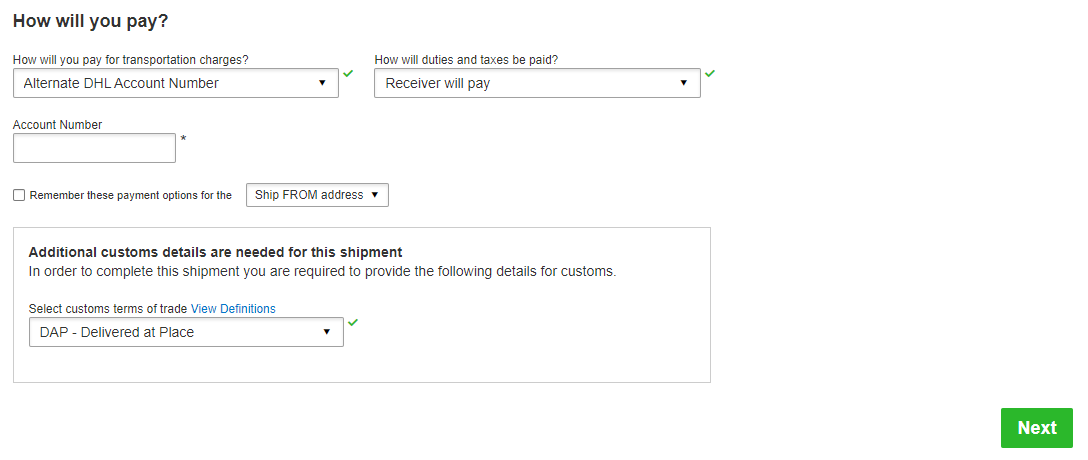

By default, your registered DHL account will appear for transportation charges and the duties and taxes will be under ‘Receiver will pay’. You can have more than one account registered in the profile.

If you wish to absorb the duties and taxes charges, please select your account or enter the 3rd party account number that will bear the duties and taxes. Duties and taxes charges are determined by the destination customs authorities. There will be an additional service charge of XX per shipment for DTP service.

For transportation charges paid by receiver or 3rd party, please un-tick the checkbox and select ‘Alternate DHL Account Number’ to enter the payer DHL account number. The shipper account will be your registered DHL account number.

.png)

Select your shipment date (in yellow) and the estimated delivery dates will be shown below. Estimated delivery

date and time is subjected to customs clearance for parcel shipments.

The product selection varies depending on the destination and limits that you have entered.

The normal delivery option is under ‘Express Worldwide’. Time definite service will be incurred a premium when selected.

The price shown is an estimate based on destination, the higher net weight or volumetric weight,

the declared value entered, and services opted in the Shipment Details section above.

- Click on ‘Details’ at the bottom of the price to show breakdown charges. If you have selected for the transportation charges under an alternate account, there will be no price displayed.

- Click ‘Select’ to proceed to the next page.

.png)

DHL offers a wide range of Optional Services. In this way, we give you the flexibility to choose the service that best fits your needs when using our express

delivery services worldwide.

- Please note that the Optional Services selections varies depending on the destination.

- Additional charges may apply.

- Refer to the MyDHL+ website for the latest update on the service charges:

.png)

Use the upload feature to digitalise the invoice for digital access & a prompt customs clearance

- Create Invoice – Tick Yes to confirm the MyDHL+ created invoice as Paperless Trade (PLT) or untick to print the required 2 hardcopies to attach to the shipment

- Use My Own Invoice – Tick Yes click on the Browse for File to attach the user created customs invoice or untick to print the required 2 hardcopies to attach to the shipment

.png)

You can arrange pickup by our courier or drop off the shipment at the nearest DHL Express Service Points.

Please do note that DHL might not be able to attend to the preferred pickup time specifically as the courier will be

moving around on his planned route in his coverage area.

How to a schedule a pick up:

- Click ‘Yes – Schedule Pickup’

- - Click ‘No’ if you have already a pickup scheduled.

- - Click ‘Drop off at DHL Service Point’ if you will be dropping off your shipments.

- Check the pickup date and time slider

- - The latest time available is the booking cut-off time for your area or you can check a post code’s cut-off time here.

- Check your Pickup Address

- - If it is in a different location, please click ‘Edit’ below the address to amend.

- - Click ‘Save’ below the address once confirmed.

- - Pickup Address will not be printed on the waybill copy.

- Select the location of the pickup and enter pickup instructions for courier (if any).

- Click ‘Next’ once confirmed

.png)

This is typically meant for return delivery shipment (2-way). If you’re only sending a 1-way shipment, please click ‘No’ to proceed.

.png)

Shipment cost summary is the estimated total breakdown charges for your shipment.

- Amount will only be shown for transportation charged to shipper’s account.

- If you need to amend any details, click ‘Edit’ on the fields above.

- Once details are confirmed, click ‘Accept and Continue’ to proceed.

- If you need to amend any details after confirmation, please create a new waybill.

.png)

- If you have opted for Digital Customs Invoice service, please click ‘Submit’ for the files to be uploaded.

.png)

- If you need to amend any details after confirmation, please create a new waybill.