Shipping cross-border can seem complex, and incorrect customs paperwork is one of the main causes of delays for SMEs shipping across borders.

To help you navigate customs complexities seamlessly and speed up international shipping, DHL Express has developed My Global Trade Services (MyGTS), an intuitive all-in-one portal.

You can log in with your existing DHL Express Business Account or register a new MyGTS account to access:

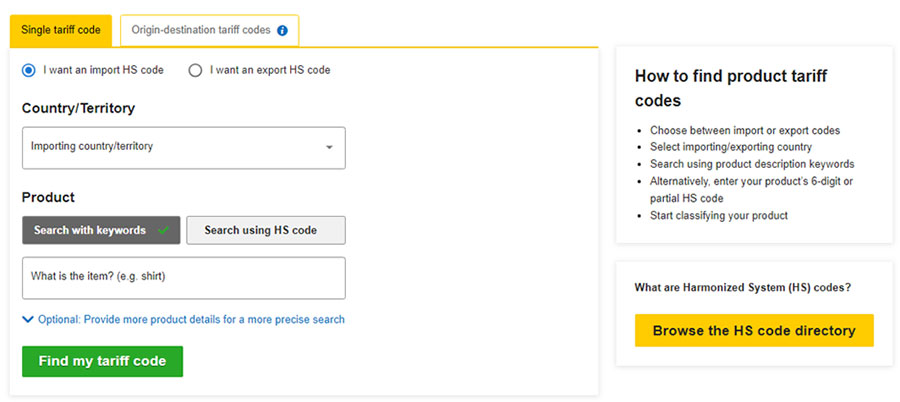

1. Find HS code for your product

No more guesswork. MyGTS leverages AI to give you the correct classification for your shipment every time, making customs clearance faster. Search for HS codes using keywords or the code directory.

2. Find out Destination Charges

Calculate the total cost of customs and trade to make better pricing decisions.

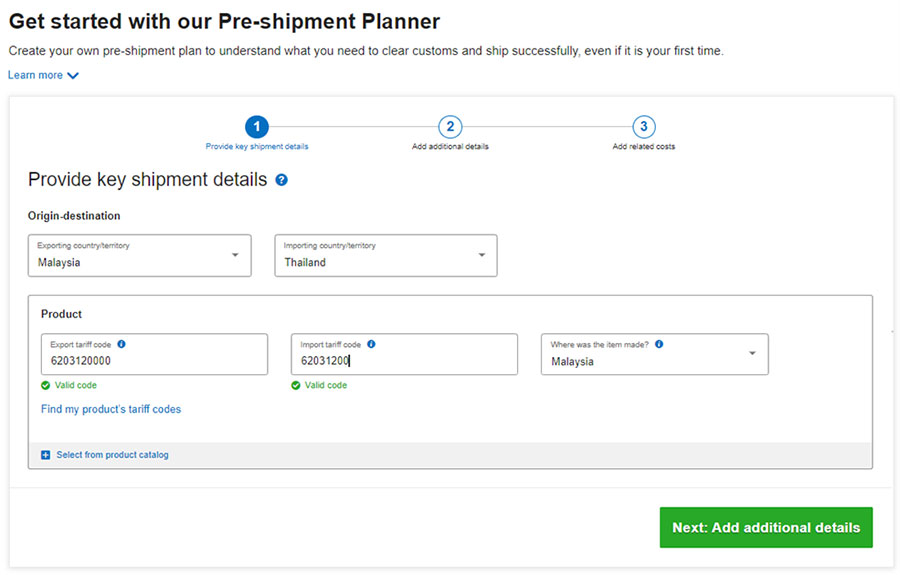

- Select your “Exporting country/territory” and “Importing country/territory”

- Enter your “Export tariff code” and “Import tariff code”

If you do not have your export or import tariff code, you can use the “Find my product's tariff codes” tool to search for your product’s tariff codes.

You will also be prompted to provide additional product characteristics and UOM for your product if these are required to calculate duties and taxes. - Select the country/territory for “Where was the item made?”

- Click on Add additional details” to proceed to the next step.

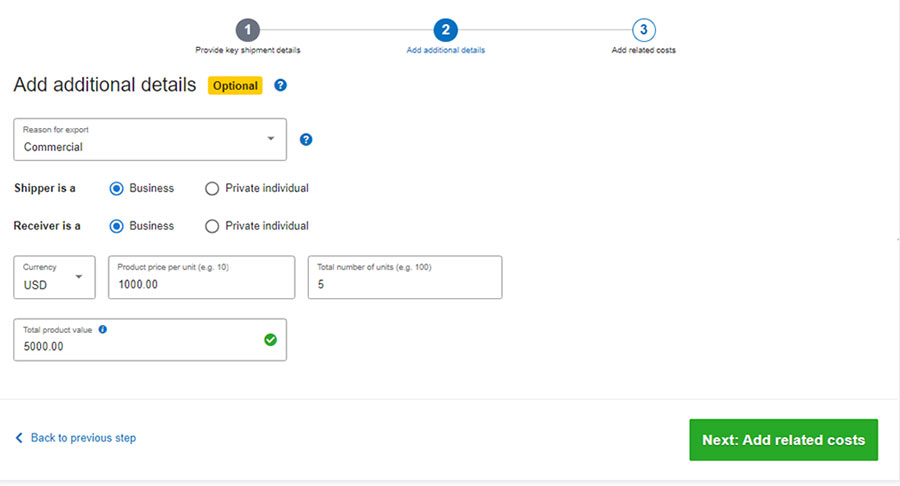

- Select “Reason for export”.

- Select if Shipper and Receiver is a “Business” or “Private individual”.

- Enter the “Product price per unit” and “total number of units”.

- Change the “Currency” to your desired currency if needed.

- Confirm your “Total product value”.

- Click on “Next: Add related costs” to proceed to the next step.

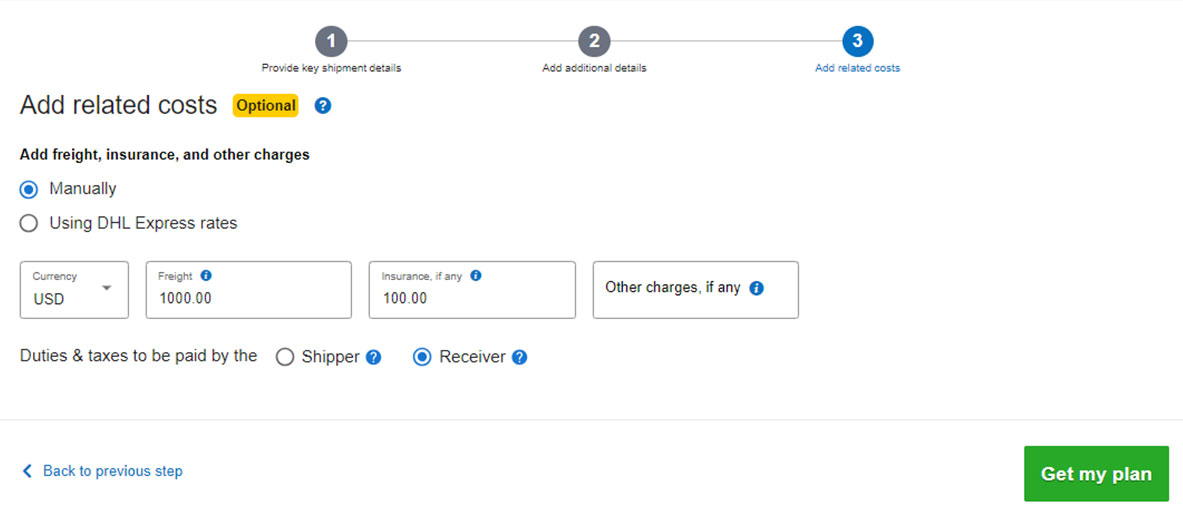

In this step, you will be asked to provide any related costs for your shipment such as freight and insurance charges.

- Select “Manually” if you would like to manually add freight, insurance, and other charges.

- Select “Using DHL Express rates” if you would like to use DHL Express rates to calculate your landed cost.

- Select if you have a DHL Express account.

- Select the Packaging type, quantity and package weight.

- Add another package if needed.

- Select if you would like to include shipment protection.

- Indicate whether Duties & taxes are to be paid by the Shipper or Receiver.

- Enter Other charges, if any to include as costs for this shipment.

- Lastly, click on “Get my plan” to generate your Pre-shipment Plan.

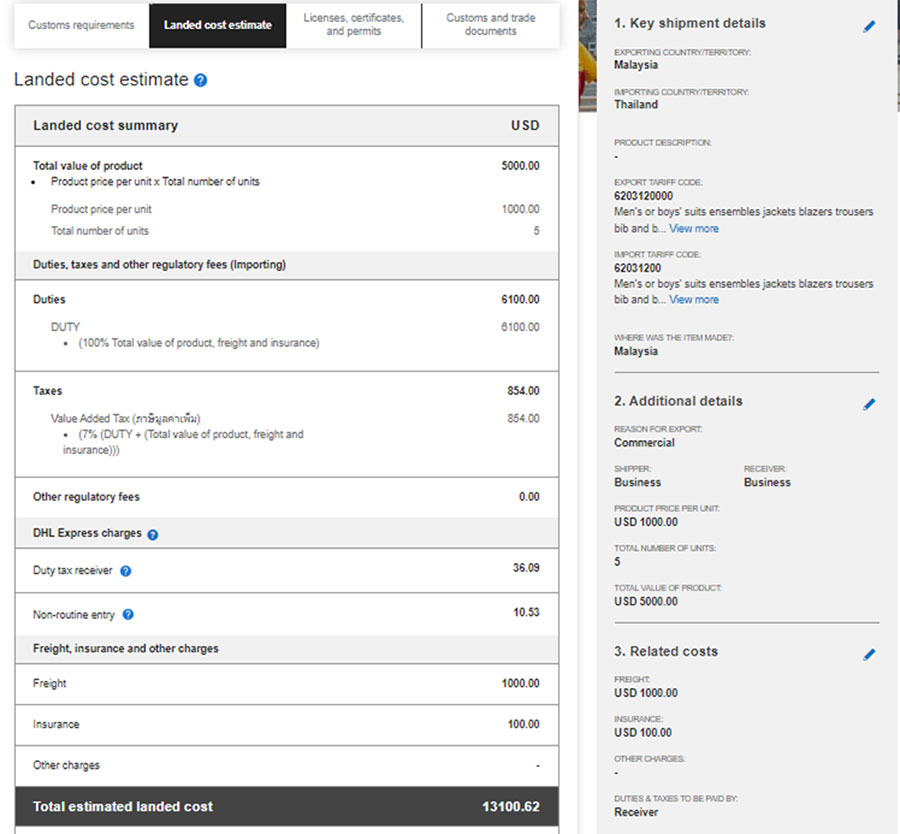

A Pre-Shipment plan will be generated based on the details you entered in the earlier page. Click on ‘Landed Cost estimate’ to see the applicable duty, taxes and other charges for your shipment.

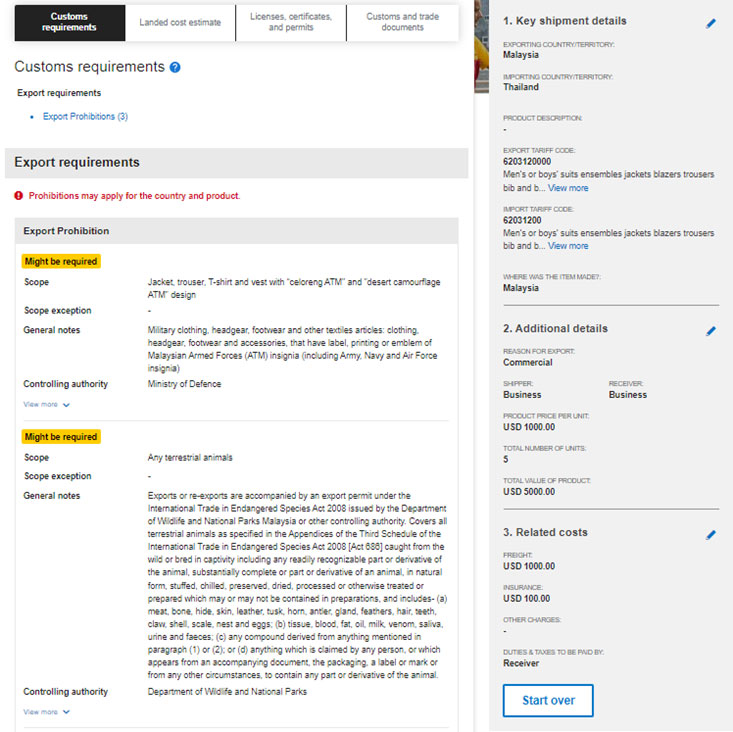

3. Check for Import and Export Customs Requirements

As part of Pre-Shipment Planner, you are also able to check for customs requirements of the import and export countries, as well as customs documentations required.

Click on ‘Customs Requirements’ on the top row to see the full list of export and import requirements for your shipment.