When you need to ship internationally, you’ll need to create a shipment, which will involve the generation of an air waybill (AWB). Your air waybill is arguably the most important piece of documentation associated with your shipment. It contains all the instructions and information about the contents and characteristics of your shipment that is necessary for transportation. But more importantly, the AWB is the document that proves the ownership of any DHL package – based on the details of the sender and recipient.

Properly furnishing the details of your waybill can play a big part to facilitate a smooth journey for your shipment. Below we will discuss the various fields of the AWB, and the steps needed for online AWB generation.

The waybill is usually attached to the exterior of the shipment package, whether it’s a DHL Express box or DHL envelope. This allows for anyone handling the shipment to easily access important details. New to shipment preparation? Check out our packaging guide to learn how best to prepare your shipment.

Let’s take a closer look at the DHL Express waybill.

SHIPPER DETAILS & DETAILS

Details will be referred to as the main point of contact in-charge of the shipment.

RECEIVER’S ADDRESS & DETAILS

Identifies your intended recipient and the destination address.

PAYER ACCOUNT NUMBER

A valid DHL Express account number to determine who pays for the transport fees.

SHIPMENT DETAILS

State the weight, dimensions, and a clear description of the contents should be accurately.

BARCODE

The barcode is scanned throughout the network to give you accurate tracking updates! Make sure this portion of the waybill is not defaced or blocked before handing over your shipment.

SHIPPER DETAILS & DETAILS

Details will be referred to as the main point of contact in-charge of the shipment.

RECEIVER’S ADDRESS & DETAILS

Identifies your intended recipient and the destination address.

PAYER ACCOUNT NUMBER

A valid DHL Express account number to determine who pays for the transport fees.

SHIPMENT DETAILS

State the weight, dimensions, and a clear description of the contents should be accurately.

BARCODE

The barcode is scanned throughout the network to give you accurate tracking updates! Make sure this portion of the waybill is not defaced or blocked before handing over your shipment.

Useful information when filling in your DHL waybill

- Unless the duties & taxes paid (DTP) service is selected, they will be borne by the consignee. If nothing is indicated, duties & taxes unpaid (DTU) is the default.

- The weight and dimensions of your DHL Express package that you have declared will be subject to re-weighing and you will be billed accordingly, if applicable.

- The shipper’s address and details should reflect you or your company’s name, telephone or mobile number, email address and your complete mailing address including postal code.

- The receiver’s address and details must include the company or individual’s name – a valid contact person, contact number, email address, as well as complete mailing address, including postal code.

- The shipment information will be used for customs clearance to ensure that the details tally with the actual contents of your DHL box or package, as well as the shipping invoice.

- Air waybills have an expiration date and will be invalid beyond that.

Before you conclude your shipment preparation, check your new DHL Express air waybill for a unique 10-digit code known as your AWB number. It acts as the reference for your shipment in the event that you need to contact us regarding your shipment.

Have questions about your DHL Express waybill or our international shipping rates? Or maybe you have queries on how to use MyDHL+? Feel free to contact us here via chat or message us. For preferential rates and enhanced shipping support, sign up for a DHL account now. Simply fill out our online form to register.

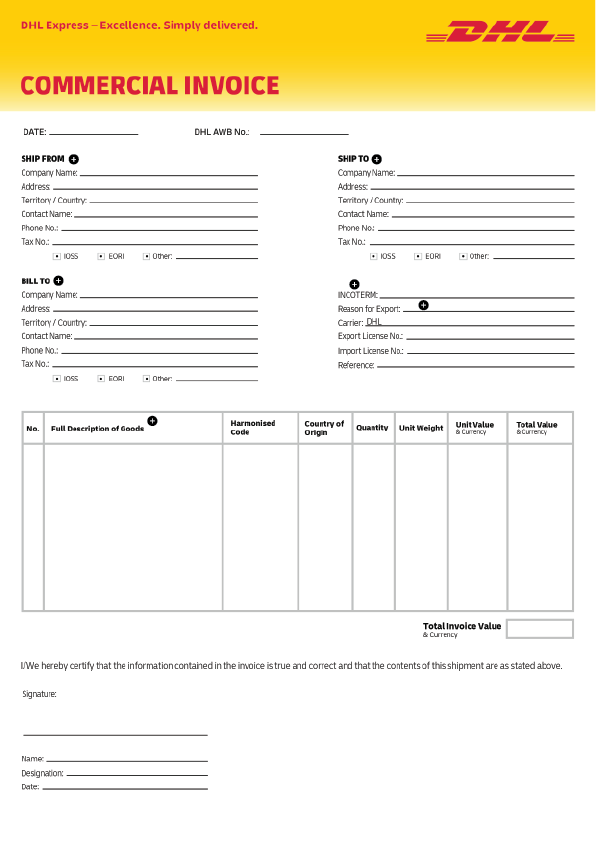

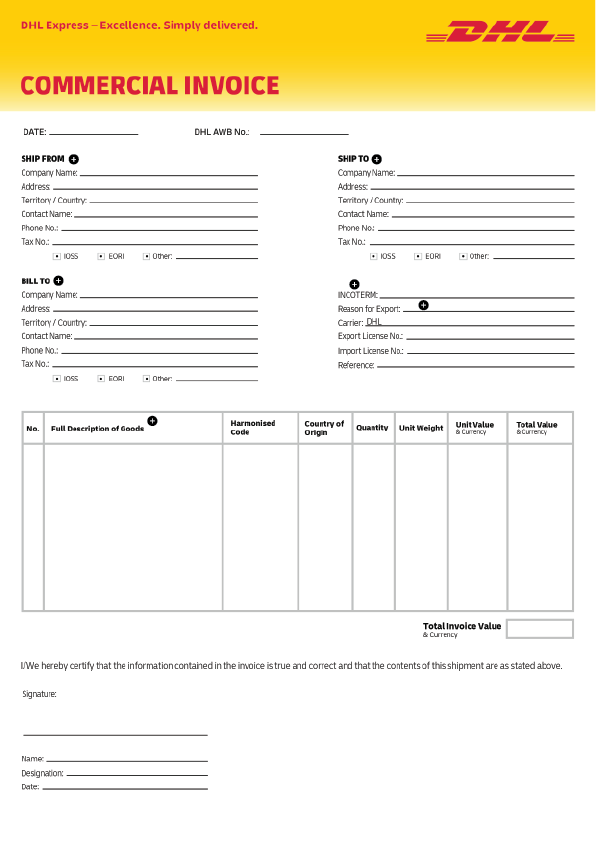

Apply for a business accountInvoices are only required for parcel shipments – they do not apply for shipping documents. The invoice is used to clear customs and should contain accurate information that corresponds to the contents of the shipment, and what is indicated on the waybill.

Take a closer look at the details required in your shipping invoice.

SHIPPER & RECEIVER

Indicate the details of the sender. In most cases, the shipper will be the main point of contact should DHL Express need to contact anyone for instructions.

INCOTERM

Indicate the shipping terms between shipper and receiver. Read more about Incoterms here.

SHIP TO

Indicate the details of the receiver.

DESCRIPTION OF GOODS

Details (in English) of the contents you are shipping, the quantity, weight, dimensions and total value. This portion should be as descriptive as possible as it will be used by customs to determine how the shipment is categorised and cleared. Discrepancies might lead to unnecessary delays or, in most drastic situations, confiscation by customs.

BILL TO

Indicate the correct billing agency. A different entity from the same country as the recipient that will be paying for the duties and taxes of the shipment. If this field is left blank, the receiver will be accountable.

REASON FOR EXPORT

Specify the reason for shipping, it is best to indicate the intended end purpose of the shipment.

SHIPPER & RECEIVER

Indicate the details of the sender. In most cases, the shipper will be the main point of contact should DHL Express need to contact anyone for instructions.

INCOTERM

Indicate the shipping terms between shipper and receiver. Read more about Incoterms here.

SHIP TO

Indicate the details of the receiver.

DESCRIPTION OF GOODS

Details (in English) of the contents you are shipping, the quantity, weight, dimensions and total value. This portion should be as descriptive as possible as it will be used by customs to determine how the shipment is categorised and cleared. Discrepancies might lead to unnecessary delays or, in most drastic situations, confiscation by customs.

BILL TO

Indicate the correct billing agency. A different entity from the same country as the recipient that will be paying for the duties and taxes of the shipment. If this field is left blank, the receiver will be accountable.

REASON FOR EXPORT

Specify the reason for shipping, it is best to indicate the intended end purpose of the shipment.

- The invoice is mainly used as a supporting document for the value declared on the AWB.

- You can create an invoice on MyDHL+ or you can fill in this template.

- Make sure your invoice accessible on the shipment – do not seal the invoice within the box.

- If you are shipping multiple items, your invoice should give a breakdown of each item.

- If you are shipping a used or personal item, you should still declare the original dollar value of the item, but indicate clearly on your invoice and waybill that it is a used or personal item.

It is important to understand that the creation of your air waybill and shipment invoice is your responsibility. The details of these documents acts as your declaration. DHL Express will assist to guide you by offering advice and tips – but we will not be able to create it on your behalf.

Now that you’re orientated to the necessary paperwork for sending an international shipment, you’re almost ready to hand over your shipment to us!

Create your Invoice on MyDHL+ now!Harmonized System (HS) codes are internationally recognized codes that allow regulatory bodies, businesses, and industries to classify all commodities accurately. Learn how HS codes are relevant to your business.

According to the latest Customs’ announcement, the Singapore Trade Classification, Customs and Excise Duties (STCCED) 2022, will be effective from Sunday, 19 June 2022. To avoid unnecessary permit rejections caused by outdated HS codes, be sure to review these new regulations or check with our customer service team on live chat. Once you are all set and ready to ship, open a business account to get started today!

What is HS code (Harmonized System Code) ?

How to get HS code for a product in Singapore?

Singapore adopts the ASEAN Harmonized Tariff Nomenclature (AHTN) – where the first six digits still take reference from the international HS codes, but there is an additional two digits at the end that further breaks down the sub-headings. Here’s a guide on how you can get your HS code for your product.

You can visit (Singapore Customs TradeNet) and search for any of your commodity.

How does DHL Express perform classification of goods?

DHL will refer to the invoice provided by the shipper for HS Code classification. If there is no classification done, DHL will use the STCCED 2022 to classify the goods listed in the invoice to the best of our knowledge.

Why is HS Code important?

The HS contributes to the harmonization of Customs and trade procedures, and the trade data interchange in connection with such procedures, thus reducing the costs related to international trade.

It is also extensively used by governments, international organizations and the private sector for many other purposes such as internal taxes, trade policies, monitoring of controlled goods, rules of origin, freight tariffs, transport statistics, price monitoring, quota controls, compilation of national accounts, and economic research and analysis. The HS is thus a universal economic language and code for goods, and an indispensable tool for international trade.

How is the HS code structured?

Each HS code comprises of six digits. The first two digits identify the section of which the HS code falls under. There are a total of 21 sections, each chapter provides a description to generalize the category. The next 4 digits comprise of the heading and sub-heading within the chapter.

ASEAN countries follow the ASEAN Harmonized Tariff Nomenclature (AHTN) – where the first six digits still take reference from the international HS codes, but there is an additional two digits at the end that further breaks down the sub-headings. Commodities shipped within ASEAN normally use the eight digit AHTN classification.

You can visit (Singapore Customs TradeNet) and search for any of your commodity.

Which countries use the HS code?

The Harmonized System (HS) is used by more than 200 countries and economies as a basis for their Customs tariffs and for the collection of international trade statistics. It is also used for many other purposes, including for the monitoring of controlled goods, as a basis of rules of origin and for trade negotiations, and it is a vital element of core Customs controls and procedures.

This publication contains the list of countries, territories or customs or economic unions applying the HS.

What happens if I use the incorrect HS code?

Incorrectly classifying a product can lead to overpayment/underpayment of duties, non-compliance penalties, shipment delays, failure to utilize free trade agreements, seizure of the products, or even a denial of import/export privileges.

When in doubt it is best to seek expert advice and let our Certified International Specialist classify your products. Read more about our customs services.

How do I find my HS code for export?

You can find the HS Code for your product with the Tariff Classification tool from Singapore Customs TradeNet or seek expert advice and let our Certified International Specialist classify your products for export.

Similarly, to move goods in and out of the US, you can use the US Census Bureau’s Schedule B search tool or the US International Trade Commission’s HTS search tool. For the UK, you can use the Trade Tariff tool, provided you know the type of your product, the material used to make it, and its production method.

Is HS Code the same for all countries?

Over 98 % of the merchandise in international trade is classified in terms of the HS. However, countries’ HS code can go beyond the WCO-prescribed six digits. This is because countries are allowed to add more digits to the original six-digit code for further classification. These additional digits typically vary from country to country to categorize and define commodities at more detailed level without modifying or changing first six digits.

For example, Singapore adopts the eight-digit ASEAN Harmonized Tariff Nomenclature (AHTN). In United States, 10-digit codes are used where the first six digits are the WCO-provided HS code. The US code is called a Schedule B number for export goods and a Harmonised Tariff Schedule (HTS) code for import goods. Similarly, in India, goods for export and import have an eight-digit code called an Indian Tariff Code (ITC). This system has two schedules – Schedule I for imports and Schedule II for exports.

What are the consequences of improper HS code use?

Tariff classifications can be open to interpretation, which can result in a shipment being misclassified. Regardless of the reason, misclassified shipments can have multiple adverse consequences including:

- Overpayment/Underpayment of duties

- Failure to utilize free trade agreements

- Lead fines, liquidation and other penalties

- Unexpected customs clearance delays

- Seizure of the products

- Denial of import/export privileges

What is the purpose of HS code in import and export?

HS codes are used to classify and define goods traded internationally to determine rate of duty, eligibility for exemptions, qualification for approved manufacturer/assembler tariff provisions and calculation of any other additional taxes (e.g. excise).

What will happen if DHL Express Singapore have cleared using a wrong HS Code? Is the customer still liable to pay the duty/ tax?

HS Code declaration is based on the commodity that is being shipped. DHL is required to ensure declaration of HS Code is referred to the invoice provided. However, if there is no HS Code indicated in the invoice, DHL Express will classify the goods to be best of their knowledge. If there is an error, it may cause a short-fall or over-payment of duties to Customs resulting in penalties and unnecessary work.

Are Singapore Customs allowed to make amendments on the HS Code after the shipment has been cleared?

Any amendment to the permit after a shipment has been cleared may be approved by Customs on a case by case basis.

How do we ensure the correct HS Code is being used during Customs clearance?

Importers/exporters can seek advice from their Customs agency to determine the proper classification of their goods.

You can visit (Singapore Customs TradeNet) and search for any of your commodity.

What is Customs Classification ?

Customs classification is the numbered category in a country’s customs tariff schedule to which goods being imported or exported are determined to belong for the purpose of

- Imposing duties and taxes

- Recording into the country’s international trade statistics

Most countries classify goods in accordance with the harmonized commodity description and coding system, popularly known as harmonized system.

What is the benefit of a commodity that has been approved by Customs Classification department?

If a specific item has a customs ruling on its HS Code classification, the clearance of the shipment will always refer to the customs ruling. The customs ruling will provide ease of clearance with customs officers. No customs officer can overrule the customs ruling issued by Customs HQ.