HOW TO SHIP VIA DHL EXPRESS

Shipment weight

- Please weigh and measure your shipment.

- If you are sending a large but lightweight shipment, where its volumetric (dimensional) weight exceeds its actual weight, the cost of the shipment is calculated on the space your consignment takes up on the aircraft. This is a standard IATA method. To calculate the volumetric weight of your shipment, simply multiply the length by height by width in centimeters, then divide the total sum by 5,000 for each piece in the shipment.

- Any piece in the shipment may be re-weighed and/or re-measured by DHL Express to confirm this calculation.

Prepare your waybill

Your waybill is arguably the most important piece of document when you are shipping internationally. It contains all the instructions and information about the contents and characteristics of your shipment that is necessary for transportation and tracking. But more importantly, your DHL waybill is the document that proves the ownership of the shipment – based on the details of the sender and recipient.

Properly furnishing the details of your waybill can play a big part to facilitate a smooth journey for your shipment. Below we will discuss the various fields of the DHL waybill, and how you can go about creating one in a few minutes!

The waybill is usually attached to the exterior of the shipment for anyone handling the shipment to easily access important details.

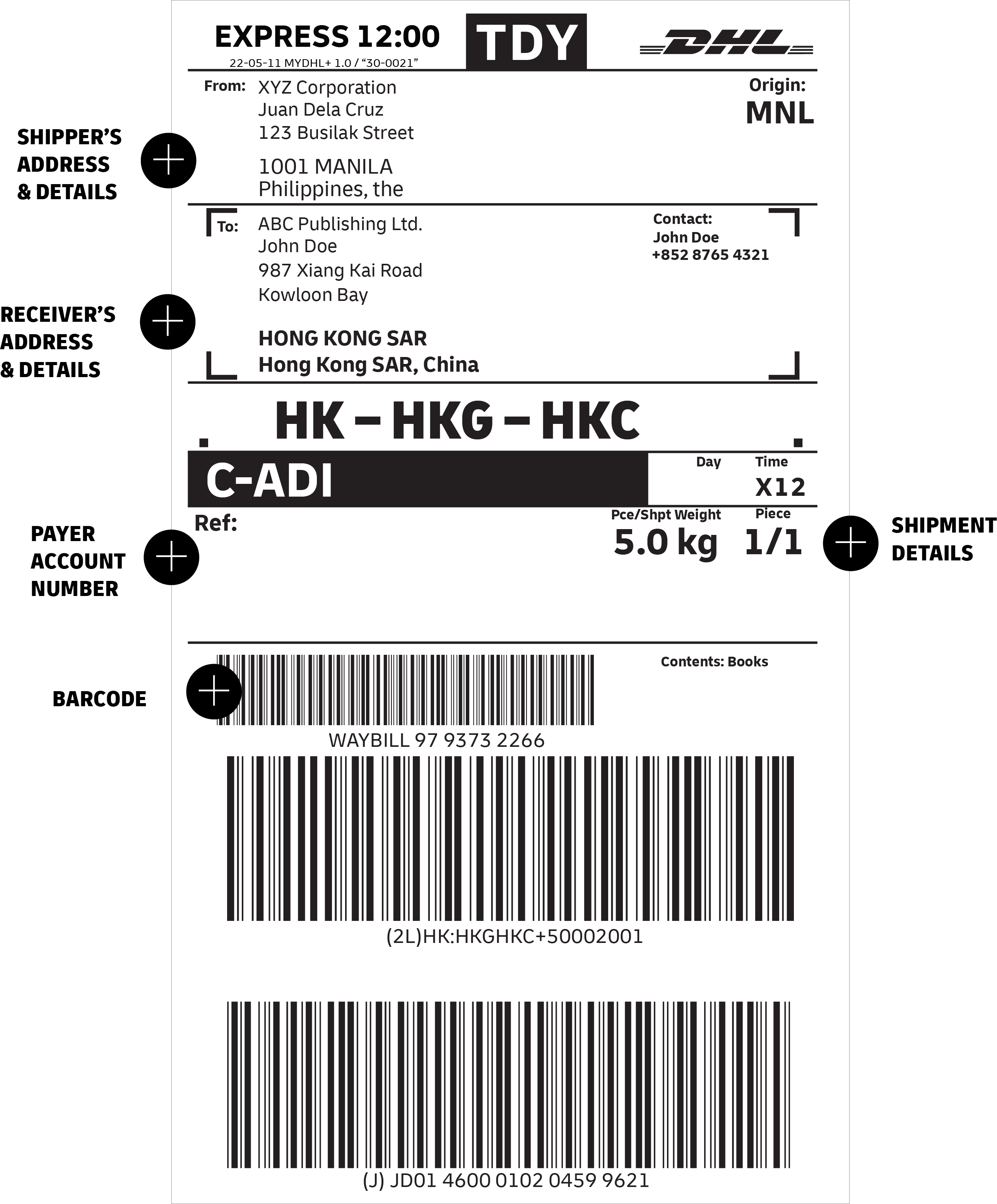

A look at a DHL Express waybill example:

SHIPPER DETAILS & DETAILS

Details will be referred to as the main point of contact in-charge of the shipment.

RECEIVER’S ADDRESS & DETAILS

Identifies your intended recipient and the destination address.

PAYER ACCOUNT NUMBER

A valid DHL Express account number to determine who pays for the transport fees.

SHIPMENT DETAILS

State the weight, dimensions, and a clear description of the contents should be accurately.

BARCODE

The barcode is scanned throughout the network to give you accurate tracking updates! Make sure this portion of the waybill is not defaced or blocked before handing over your shipment.

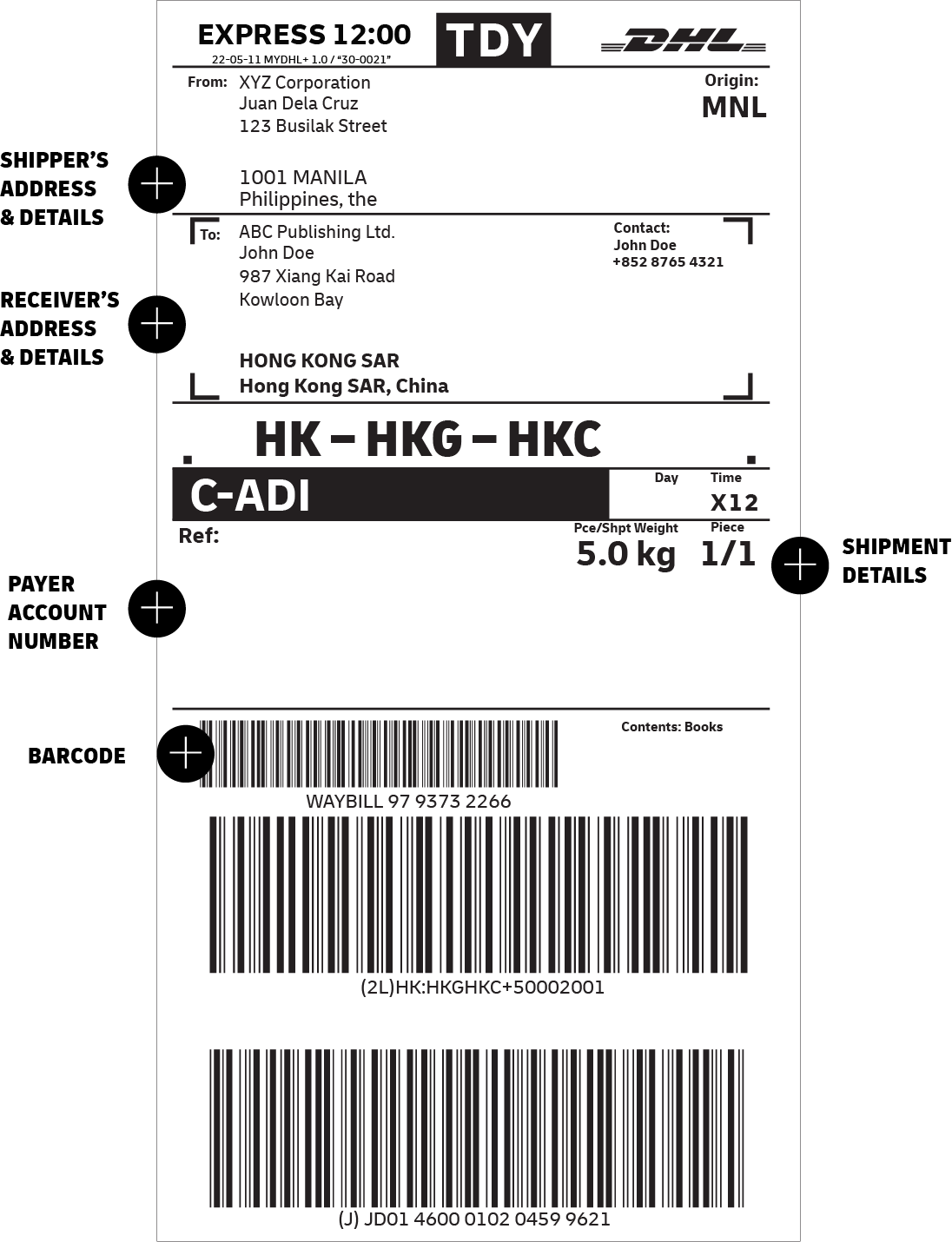

SHIPPER DETAILS & DETAILS

Details will be referred to as the main point of contact in-charge of the shipment.

RECEIVER’S ADDRESS & DETAILS

Identifies your intended recipient and the destination address.

PAYER ACCOUNT NUMBER

A valid DHL Express account number to determine who pays for the transport fees.

SHIPMENT DETAILS

State the weight, dimensions, and a clear description of the contents should be accurately.

BARCODE

The barcode is scanned throughout the network to give you accurate tracking updates! Make sure this portion of the waybill is not defaced or blocked before handing over your shipment.

- Unless the duties & taxes paid (DTP) service is selected, they will be borne by the consignee. If nothing is indicated, duties & taxes unpaid (DTU) is the default.

- The weight and dimensions of your shipment that you have declared will be subject to re-weigh and you will be billed accordingly, if applicable.

- The shipper’s address and details on your waybill should reflect you or your company’s name, telephone or mobile number, email address and your complete mailing address including postal code.

- The receiver’s address and details on your waybill must include the company or individual’s name, a valid contact person, contact number, email address, as well as complete mailing address including postal code.

- The shipment information on your waybill will be used for customs clearance to ensure that the details tally with the actual contents and the shipping invoice.

- DHL waybills have an expiration date and will be invalid beyond that.

Your new DHL waybill will be identified by a unique 10-digit code known as your AWB number. It acts as the reference for your shipment in the event that you need to communicate with us for anything about your shipment! Now you’ve learnt how to create your own waybill, create a business account to ship today!

Prepare your shipping invoice

Invoices are only required for parcel shipments – they do not apply for shipping documents. The invoice is used to clear customs and should contain accurate information that corresponds to the contents of the shipment, and what is indicated on your DHL waybill.

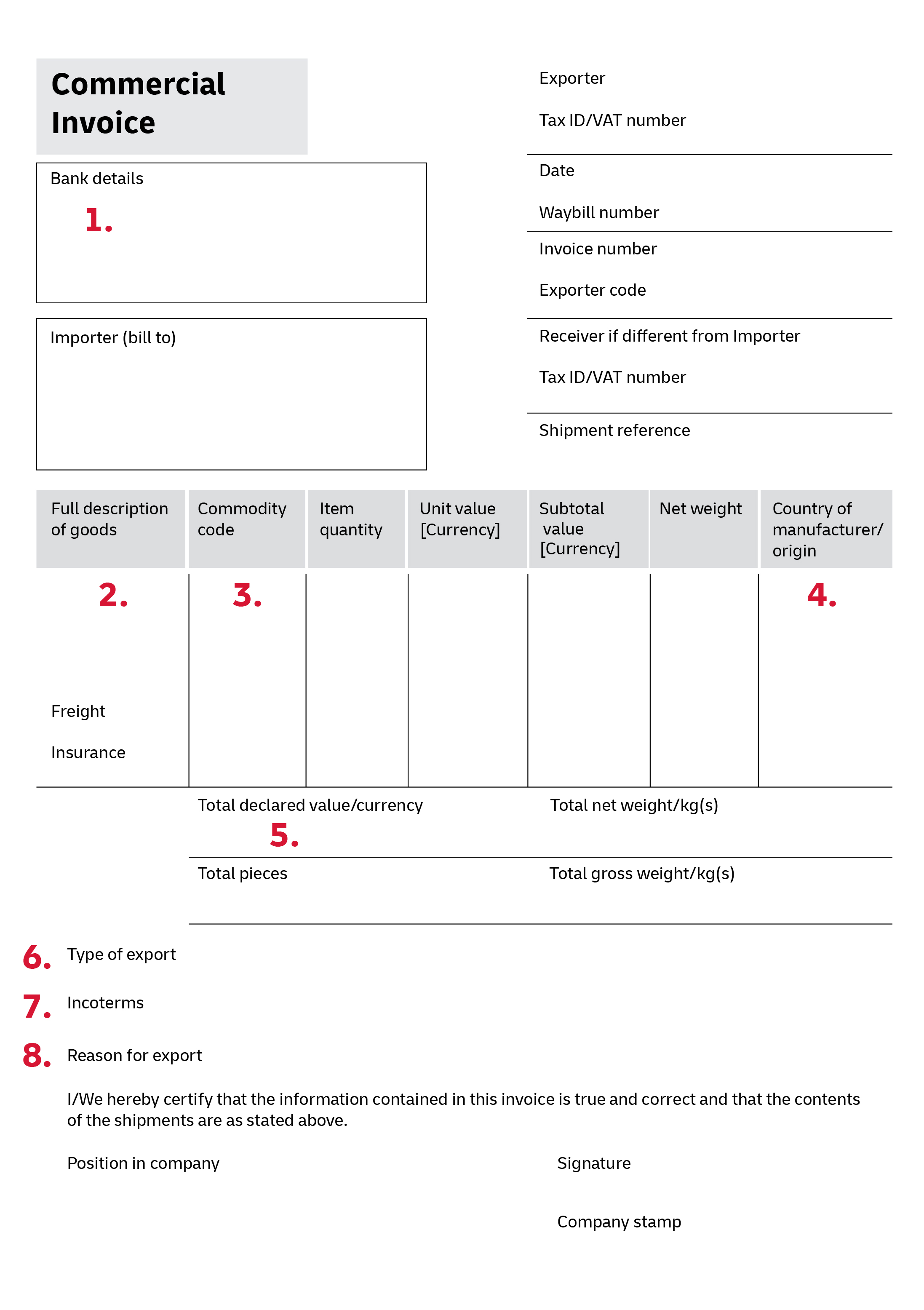

Take a closer look at the details required in your shipping invoice:

BANK DETAILS

These are the bank details that will be used for the transaction between the seller and buyer. These details are not required for non-commercial/proforma invoices.

DESCRIPTION

Generic or broad descriptions are no longer permitted and are likely to cause delays. Descriptions should include the items, how many there are, what they are made of, and what they will be used for. Describing items as ‘samples’, ‘parts’ or ‘electronics’ is not acceptable for customs classification, safety and security reasons. Instead of ‘electronics’, for example, use a description such as ‘television’.

COMMODITY CODE

This is the product identification code used by the exporting country to classify the goods to be exported It assists clearance and avoids delays.

COUNTRY OF MANUFACTURE/ORIGIN

This relates to the place of manufacture, not the country of export. If items are manufactured in more than one country, please list the origins.

TOTAL DECLARED VALUE

This is the total value of the transaction for customs purposes based on the Incoterm selected. The total declared value should include freight and insurance charges if the seller is responsible for these two elements.

TYPE OF EXPORT

The options are: (1) Permanent; (2) Temporary; and (3) Repair & Return.

INCOTERM

Insert the Incoterm that best describes the terms of the transaction. For example, DAP (Delivered At Place).

REASON FOR EXPORT

This could be: For Sale; For Repair; After Repair; Gift; Sample; Personal Use Not For Resale; Replacement; Intercompany Transfer; or Personal Effects.

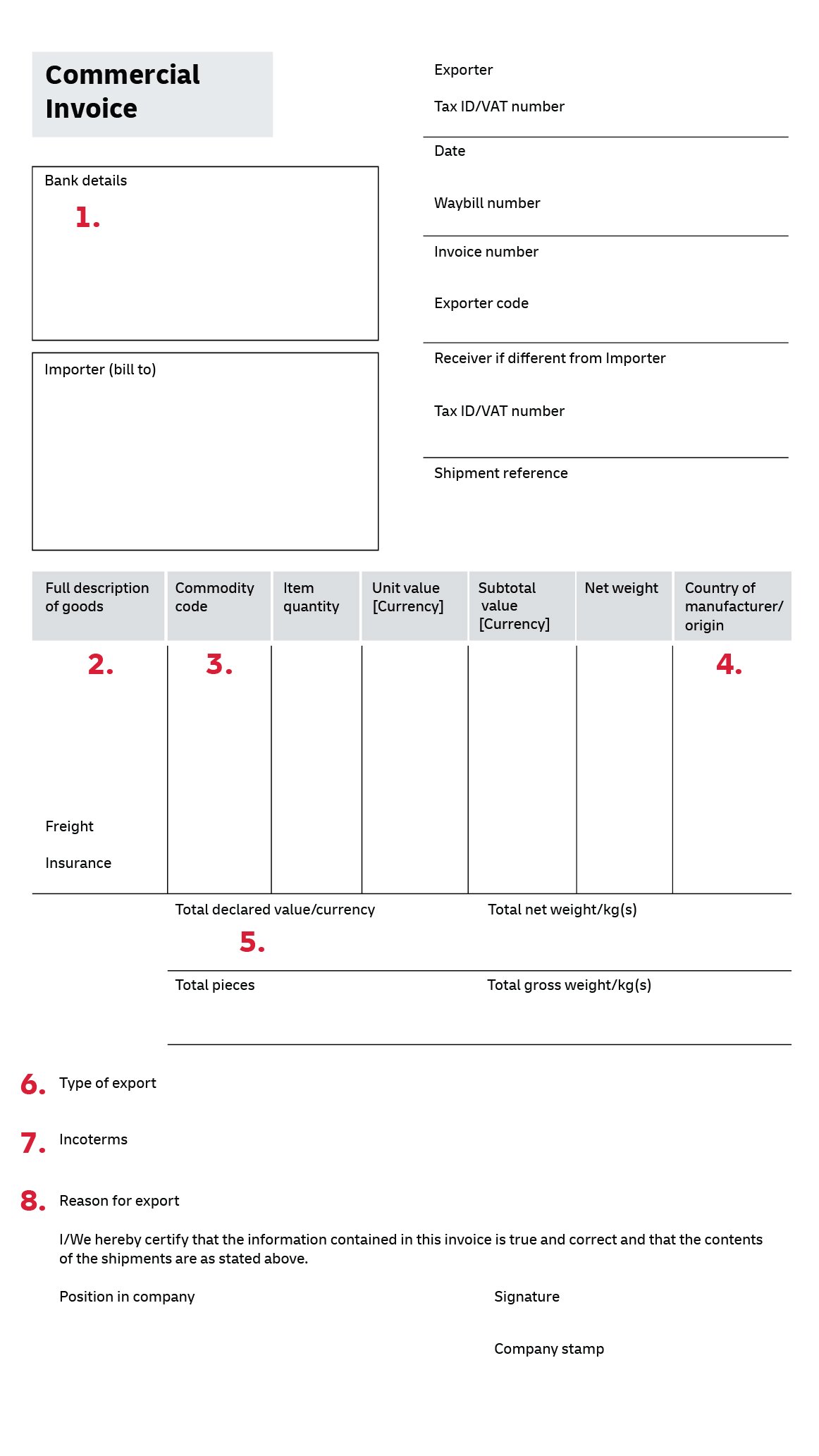

DESCRIPTION

Generic or broad descriptions are no longer permitted and are likely to cause delays. Descriptions should include the items, how many there are, what they are made of, and what they will be used for. Describing items as ‘samples’, ‘parts’ or ‘electronics’ is not acceptable for customs classification, safety and security reasons. Instead of ‘electronics’, for example, use a description such as ‘television’.

COMMODITY CODE

This is the product identification code used by the exporting country to classify the goods to be exported It assists clearance and avoids delays.

COUNTRY OF MANUFACTURE/ORIGIN

This relates to the place of manufacture, not the country of export. If items are manufactured in more than one country, please list the origins.

TOTAL DECLARED VALUE

This is the total value of the transaction for customs purposes based on the Incoterm selected. The total declared value should include freight and insurance charges if the seller is responsible for these two elements.

TYPE OF EXPORT

The options are: (1) Permanent; (2) Temporary; and (3) Repair & Return.

INCOTERM

Insert the Incoterm that best describes the terms of the transaction. For example, DAP (Delivered At Place).

REASON FOR EXPORT

This could be: For Sale; For Repair; After Repair; Gift; Sample; Personal Use Not For Resale; Replacement; Intercompany Transfer; or Personal Effects.

- The invoice is mainly used as a supporting document for the value declared on your DHL waybill.

- You can create an invoice on MyDHL+ or you can fill in this template.

- Make sure your invoice accessible on the shipment – do not seal the invoice within the box.

- If you are shipping multiple items, your invoice should give a breakdown of each item.

- If you are shipping a used or personal item, you should still declare the original dollar value of the item, but indicate clearly on your invoice and waybill that it is a used or personal item.

- It is important to understand that the creation of your DHL waybill and shipment invoice is your responsibility, meaning the details of these documents acts as your declaration. DHL Express will assist to guide you by offering advice and tips – but we will not be able to create it on your behalf.

Now that you’re orientated to the necessary paperwork for sending an international shipment, you’re almost ready to hand over your shipment to us!

To ensure that your shipments travel safely and securely through the DHL Express global network, it is important that they are packaged and labeled correctly.

Packaging guidelines

- If you are re-using envelopes or boxes, please ensure that old labels and markings are removed

- Securely fix a waybill to each piece in your shipment. The waybill can be thought of as the shipment’s airline ticket and it will delay delivery if it becomes separated from your shipment

- The barcodes on the waybill are scanned at numerous points during your shipment’s journey. Please ensure the barcode is flat and not covered by tape, shrinkwrap or strapping

- Place a waybill on the top or side of each piece in your shipment and please ensure it does not overlap the corners or edges of boxes

- Use adequate protective wrapping for fragile or delicate items and ensure they are packed as far away as possible from the corners of boxes

- To prevent injury to our employees, please pay special attention to the packaging of sharp items. There should not be any possibility of the contents piercing the packaging

- Any individual pieces over 70kg should be placed on a pallet. If you are sending a multi-piece shipment, it is not necessary to place the individual pieces on a pallet unless they exceed 70kg. For example, a shipment comprising four 25kg pieces does not have to be placed on a pallet

You can pay for DHL Express services either with cash, a credit card or by bank transfer. You can open an account with DHL Express to pay via bank transfer; and all account customers receive invoices on a pre-agreed basis. For more details, please contact us.

Visit our FAQ page for more information