What is the tariff code? The ultimate guide

Importing and exporting goods into Malaysia and working with the country’s customs almost always come with cumbersome processes and paperwork. That includes Malaysia, which also requires businesses to declare the trade goods using an important identifier: HS code.

If you’re a business owner trying to ship your goods overseas, understanding HS codes is a must to ensure a smooth logistical operation. Here, we’ll give you a quick overview of how these tariff codes work as well as how to read and determine the HS codes for your goods.

Tariff Codes Explained

What is Tariff Code?

The first question that you might have right now might be, what is a Tariff code and how is it different from the HS Code that we just mentioned?

Well, the answer is simple. They are both the same.

Harmonized System (HS) codes are often used interchangeably with Tariff Code.

Tariff Code is an internationally recognized numerical system created by the World Customs Organization (WCO) with the purpose to facilitate international trade by easing the task of identifying and categorizing traded goods.

These numbers exist for every product involved in global commerce. While it may not be necessary for all international shipments, a tariff code is required on official shipping documents for tax assessment purposes.

This serves as the basis for the import and export classification system, ensuring uniformity of product classification worldwide.

Besides applying tariffs and duty rates, tariff codes can also be used to:

- Demonstrate custom competency

- Declare permits and rules of origin of goods

- Collect trade statistics

The tariff system assigns specific codes for varying classifications and commodities, with most of them ranging from 6 to 10 digits long.

In short, the more digits a tariff code has, the more specific the product classification.

Those with a string with less than 6 digits are referred to as partial tariff codes, representing a broad product category or chapter of products as opposed to a specific classification.

Import and Export Tariffs in Malaysia

One thing to note is that Malaysia follows two HS code classifications: Harmonized System (HS) and ASEAN Harmonised Tariff Nomenclature (AHTN).

Besides the standard HS, Malaysia also follows the AHTN for imported and exported goods originating specifically from any other members of the Association of Southeast Asian Nations (ASEAN).

Malaysia’s tariffs are typically imposed on an ad valorem basis, which means that the taxes levied on imported and exported goods will be in accordance with the property’s value as determined by an assessment or appraisal.

However, as a rule of thumb, when it comes to imported goods, you can expect the tariff rate to be anywhere from 0% to 50%, with the average rate being 6.1% for industrial goods.

That said, Malaysian customs apply higher tariff rates for specific duties that either have a considerably high domestic production rate or are considered ‘sinful’ goods. These goods can be products such as pork, wine, and alcohol.

On the other hand, raw materials for use in manufacturing exported goods may be subjected to either a reduced tariff or a tariff exemption altogether.

As for exported goods, Malaysian customs apply a tariff between 0% to 10%, following the same ad valorem rates.

In addition, according to Malaysia’s Customs Act (1976), companies may get a 90% refund on tariffs paid for exported goods originally sourced from their imported counterparts.

The Breakdown of HS code

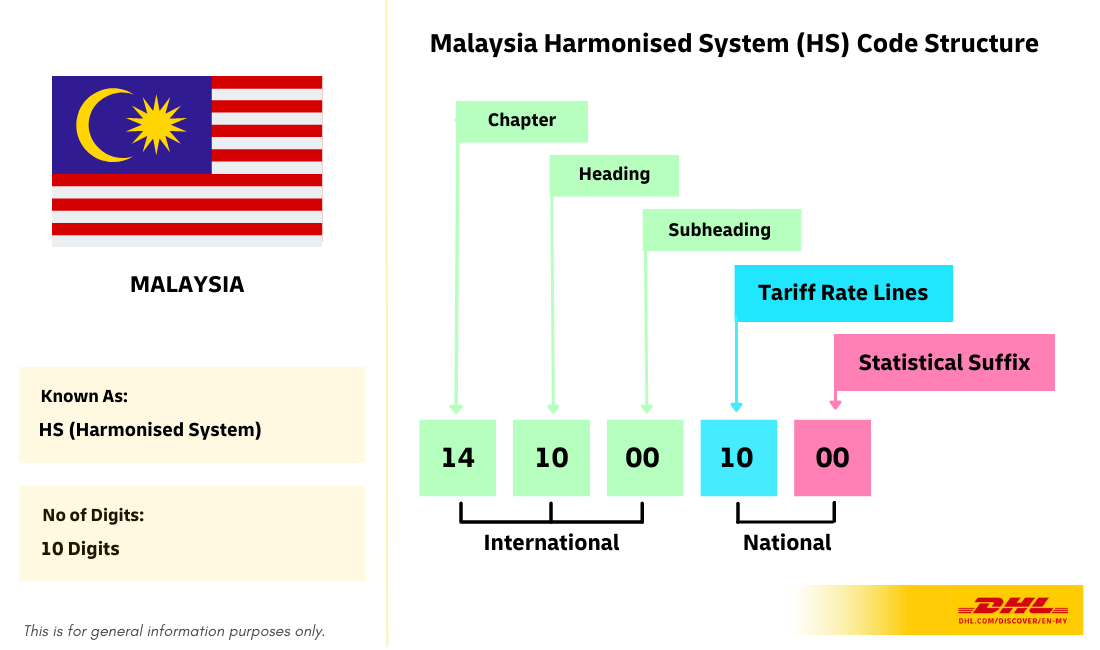

Every HS code has a layer-by-layer structure, broken down into 5 different sections to represent the respective categories: chapters, headings, subheadings, subheadings (tariff rate lines), and statistical suffixes.

The first 6 digits are the HS number under the international HS, while the last 4 digits (if any) are specific to the country.

Chapter: The first 2 digits identify the chapter in the HS.

Heading: The next 2 digits represent the heading within the said chapter in the HS.

Subheading: The next 2 digits identify the subheading within the heading.

Subheading (tariff rate lines): These 2 digits establish the duty rates, and are specific to Malaysia.

Statistical suffixes: The last 2 digits are statistical suffixes used to collect trade data. Similarly, these digits are specific to Malaysia.

Chapter: The first 2 digits identify the chapter in the HS.

Heading: The next 2 digits represent the heading within the said chapter in the HS.

Subheading: The next 2 digits identify the subheading within the heading.

Subheading (tariff rate lines): These 2 digits establish the duty rates, and are specific to Malaysia.

Statistical suffixes: The last 2 digits are statistical suffixes used to collect trade data. Similarly, these digits are specific to Malaysia.

Below is overview of the 21 sections of the HS Code:

SECTION I LIVE ANIMALS; ANIMAL PRODUCTS | |

Section Notes. | 0100-2022E |

Live animals. | 0101-2022E |

Meat and edible meat offal. | 0102-2022E |

Fish and crustaceans, molluscs and other aquatic invertebrates. | 0103-2022E |

Dairy produce; birds' eggs; natural honey; edible products of animal origin, not elsewhere specified or included. | 0104-2022E |

Products of animal origin, not elsewhere specified or included. | 0105-2022E |

SECTION II VEGETABLE PRODUCTS | |

Section Note. | 0200-2022E |

Live trees and other plants; bulbs, roots and the like; cut flowers and ornamental foliage. | 0206-2022E |

Edible vegetables and certain roots and tubers. | 0207-2022E |

Edible fruit and nuts; peel of citrus fruit or melons. | 0208-2022E |

Coffee, tea, maté and spices. | 0209-2022E |

Cereals. | 0210-2022E |

Products of the milling industry; malt; starches; inulin; wheat gluten. | 0211-2022E |

Oil seeds and oleaginous fruits; miscellaneous grains, seeds and fruit; industrial or medicinal plants; straw and fodder. | 0212-2022E |

Lac; gums, resins and other vegetable saps and extracts. | 0213-2022E |

Vegetable plaiting materials; vegetable products not elsewhere specified or included. | 0214-2022E |

SECTION III ANIMAL, VEGETABLE OR MICROBIAL FATS AND OILS AND THEIR CLEAVAGE PRODUCTS; PREPARED EDIBLE FATS; ANIMAL OR VEGETABLE WAXES | |

Animal, vegetable or microbial fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes. | 0315-02022E |

SECTION IV PREPARED FOODSTUFFS; BEVERAGES, SPIRITS AND VINEGAR; TOBACCO AND MANUFACTURED TOBACCO SUBSTITUTES; PRODUCTS, WHETHER OR NOT CONTAINING NICOTINE, INTENDED FOR INHALATION WITHOUT COMBUSTION; OTHER NICOTINE CONTAINING PRODUCTS INTENDED FOR THE INTAKE OF NICOTINE INTO THE HUMAN BODY | |

Section Note. | 0400-2022E |

Preparations of meat, of fish, of crustaceans, molluscs or other aquatic invertebrates, or of insects. | 0416-2022E |

Sugars and sugar confectionery. | 0417-2022E |

Cocoa and cocoa preparations. | 0418-2022E |

Preparations of cereals, flour, starch or milk; pastrycooks' products. | 0419-2022E |

Preparations of vegetables, fruit, nuts or other parts of plants. | 0420-2022E |

Miscellaneous edible preparations. | 0421-2022E |

Beverages, spirits and vinegar. | 0422-2022E |

Residues and waste from the food industries; prepared animal fodder. | 0423-2022E |

Tobacco and manufactured tobacco substitutes; products, whether or not containing nicotine, intended for inhalation without combustion; other nicotine containing products intended for the intake of nicotine into the human body. | 0424-2022E |

SECTION V MINERAL PRODUCTS | |

Salt; sulphur; earths and stone; plastering materials, lime and cement. | 0525-2022E |

Ores, slag and ash. | 0526-2022E |

Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes. | 0527-2022E |

SECTION VI PRODUCTS OF THE CHEMICAL OR ALLIED INDUSTRIES | |

Section Notes. | 0600-2022E |

Inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals, of radioactive elements or of isotopes. | 0628-2022E |

Organic chemicals. | 0629-2022E |

Pharmaceutical products. | 0630-2022E |

Fertilisers. | 0631-2022E |

Tanning or dyeing extracts; tannins and their derivatives; dyes, pigments and other colouring matter; paints and varnishes; putty and other mastics; inks. | 0632-2022E |

Essential oils and resinoids; perfumery, cosmetic or toilet preparations. | 0633-2022E |

Soap, organic surface-active agents, washing preparations, lubricating preparations, artificial waxes, prepared waxes, polishing or scouring preparations, candles and similar articles, modelling pastes, “dental waxes” and dental preparations with a basis of plaster. | 0634-2022E |

Albuminoidal substances; modified starches; glues; enzymes. | 0635-2022E |

Explosives; pyrotechnic products; matches; pyrophoric alloys; certain combustible preparations. | 0636-2022E |

Photographic or cinematographic goods. | 0637-2022E |

Miscellaneous chemical products. | 0638-2022E |

SECTION VII PLASTICS AND ARTICLES THEREOF; RUBBER AND ARTICLES THEREOF | |

Section Notes. | 0700-2022E |

Plastics and articles thereof. | 0739-2022E |

Rubber and articles thereof. | 0740-2022E |

SECTION VIII RAW HIDES AND SKINS, LEATHER, FURSKINS AND ARTICLES THEREOF; SADDLERY AND HARNESS; TRAVEL GOODS, HANDBAGS AND SIMILAR CONTAINERS; ARTICLES OF ANIMAL GUT (OTHER THAN SILK-WORM GUT) | |

Raw hides and skins (other than furskins) and leather. | 0841-2022E |

Articles of leather; saddlery and harness; travel goods, handbags and similar containers; articles of animal gut (other than silk-worm gut). | 0842-2022E |

Furskins and artificial fur; manufactures thereof. | 0843-2022E |

SECTION IX WOOD AND ARTICLES OF WOOD; WOOD CHARCOAL; CORK AND ARTICLES OF CORK; MANUFACTURES OF STRAW, OF ESPARTO OR OF OTHER PLAITING MATERIALS; BASKETWARE AND WICKERWORK | |

Wood and articles of wood; wood charcoal. | 0844-2022E |

Cork and articles of cork. | 0845-2022E |

Manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork. | 0846-2022E |

SECTION X PULP OF WOOD OR OF OTHER FIBROUS CELLULOSIC MATERIAL; RECOVERED (WASTE AND SCRAP) PAPER OR PAPERBOARD; PAPER AND PAPERBOARD AND ARTICLES THEREOF | |

Pulp of wood or of other fibrous cellulosic material; recovered (waste and scrap) paper or paperboard. | 0847-2022E |

Paper and paperboard; articles of paper pulp, of paper or of paperboard. | 0848-2022E |

Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans. | 0849-2022E |

SECTION XI TEXTILES AND TEXTILE ARTICLES | |

Section Notes. | 1100-2022E |

Silk. | 1150-2022E |

Wool, fine or coarse animal hair; horsehair yarn and woven fabric. | 1151-2022E |

Cotton. | 1152-2022E |

Other vegetable textile fibres; paper yarn and woven fabrics of paper yarn. | 1153-2022E |

Man-made filaments; strip and the like of man-made textile materials. | 1154-2022E |

Man-made staple fibres. | 1155-2022E |

Wadding, felt and nonwovens; special yarns; twine, cordage, ropes and cables and articles thereof. | 1156-2022E |

Carpets and other textile floor coverings. | 1157-2022E |

Special woven fabrics; tufted textile fabrics; lace; tapestries; trimmings; embroidery. | 1158-2022E |

Impregnated, coated, covered or laminated textile fabrics; textile articles of a kind suitable for industrial use. | 1159-2022E |

Knitted or crocheted fabrics. | 1160-2022E |

Articles of apparel and clothing accessories, knitted or crocheted. | 1161-2022E |

Articles of apparel and clothing accessories, not knitted or crocheted. | 1162-2022E |

Other made up textile articles; sets; worn clothing and worn textile articles; rags. | 1163-2022E |

SECTION XII FOOTWEAR, HEADGEAR, UMBRELLAS, SUN UMBRELLAS, WALKING-STICKS, SEAT-STICKS, WHIPS, RIDING-CROPS AND PARTS THEREOF; PREPARED FEATHERS AND ARTICLES MADE THEREWITH; ARTIFICIAL FLOWERS; ARTICLES OF HUMAN HAIR | |

Footwear, gaiters and the like; parts of such articles. | 1264-2022E |

Headgear and parts thereof. | 1265-2022E |

Umbrellas, sun umbrellas, walking-sticks, seat-sticks, whips, riding-crops and parts thereof. | 1266-2022E |

Prepared feathers and down and articles made of feathers or of down; artificial flowers; articles of human hair. | 1267-2022E |

SECTION XIII ARTICLES OF STONE, PLASTER, CEMENT, ASBESTOS, MICA OR SIMILAR MATERIALS; CERAMIC PRODUCTS; GLASS AND GLASSWARE | |

Articles of stone, plaster, cement, asbestos, mica or similar materials. | 1368-2022E |

Ceramic products. | 1369-2022E |

Glass and glassware. | 1370-2022E |

SECTION XIV NATURAL OR CULTURED PEARLS, PRECIOUS OR SEMI-PRECIOUS STONES, PRECIOUS METALS, METALS CLAD WITH PRECIOUS METAL AND ARTICLES THEREOF; IMITATION JEWELLERY; COIN | |

Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal and articles thereof; imitation jewellery; coin. | 1471-2022E |

SECTION XV BASE METALS AND ARTICLES OF BASE METAL | |

Section Notes. | 1500-2022E |

Iron and steel. | 1572-2022E |

Articles of iron or steel. | 1573-2022E |

Copper and articles thereof. | 1574-2022E |

Nickel and articles thereof. | 1575-2022E |

Aluminium and articles thereof. | 1576-2022E |

(Reserved for possible future use in the Harmonized System) | 1577-2022E |

Lead and articles thereof. | 1578-2022E |

Zinc and articles thereof. | 1579-2022E |

Tin and articles thereof. | 1580-2022E |

Other base metals; cermets; articles thereof. | 1581-2022E |

Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal. | 1582-2022E |

Miscellaneous articles of base metal. | 1583-2022E |

SECTION XVI MACHINERY AND MECHANICAL APPLIANCES; ELECTRICAL EQUIPMENT; PARTS THEREOF; SOUND RECORDERS AND REPRODUCERS, TELEVISION IMAGE AND SOUND RECORDERS AND REPRODUCERS, AND PARTS AND ACCESSORIES OF SUCH ARTICLES | |

Section Notes. | 1600-2022E |

Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof. | 1684-2022E |

Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles. | 1685-2022E |

SECTION XVII VEHICLES, AIRCRAFT, VESSELS AND ASSOCIATED TRANSPORT EQUIPMENT | |

Section Notes. | 1700-2022E |

Railway or tramway locomotives, rolling-stock and parts thereof; railway or tramway track fixtures and fittings and parts thereof; mechanical (including electro-mechanical) traffic signalling equipment of all kinds. | 1786-2022E |

Vehicles other than railway or tramway rolling-stock, and parts and accessories thereof. | 1787-2022E |

Aircraft, spacecraft, and parts thereof. | 1788-2022E |

Ships, boats and floating structures. | 1789-2022E |

SECTION XVIII OPTICAL, PHOTOGRAPHIC, CINEMATOGRAPHIC, MEASURING, CHECKING, PRECISION, MEDICAL OR SURGICAL INSTRUMENTS AND APPARATUS; CLOCKS AND WATCHES; MUSICAL INSTRUMENTS; | |

Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof. | 1890-2022E |

Clocks and watches and parts thereof. | 1891-2022E |

Musical instruments; parts and accessories of such articles. | 1892-2022E |

SECTION XIX ARMS AND AMMUNITION; PARTS AND ACCESSORIES THEREOF | |

Arms and ammunition; parts and accessories thereof. | 1993-2022E |

SECTION XX MISCELLANEOUS MANUFACTURED ARTICLES | |

Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; luminaires and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated name-plates and the like; prefabricated buildings. | 2094-2022E |

Toys, games and sports requisites; parts and accessories thereof. | 2095-2022E |

Miscellaneous manufactured articles. | 2096-2022E |

SECTION XXI WORKS OF ART, COLLECTORS' PIECES AND ANTIQUES | |

Works of art, collectors' pieces and antiques. | 2197-2022E |

Source: World Customs Organisation

Finding the right HS code

For more information about the HS Code and how you can obtain a code for a product in Malaysia, head over to our FAQ section.