All You Need to Know About Import Tax When Shipping Goods into Singapore

Did you know that Singapore is recognized as the world's leading business environment for the 15th consecutive year? And economic analyst anticipated that the nation will uphold this title for the next 5 years.

The country has a close-to-perfect score in policy towards foreign investment and foreign trade and exchange controls, which is something you should leverage for your business expansion.

However, to begin, you must first ensure you have a firm grasp of the country's import duties and tax regulations. Take this as a complete guide.

Types of Duties and Taxes

Despite having 3 types of duties and taxes - excise tax, customs duties and goods and services tax (GST) in place for imported shipments, only GST applies to all imported goods into the country, regardless of their value.

Excise Tax

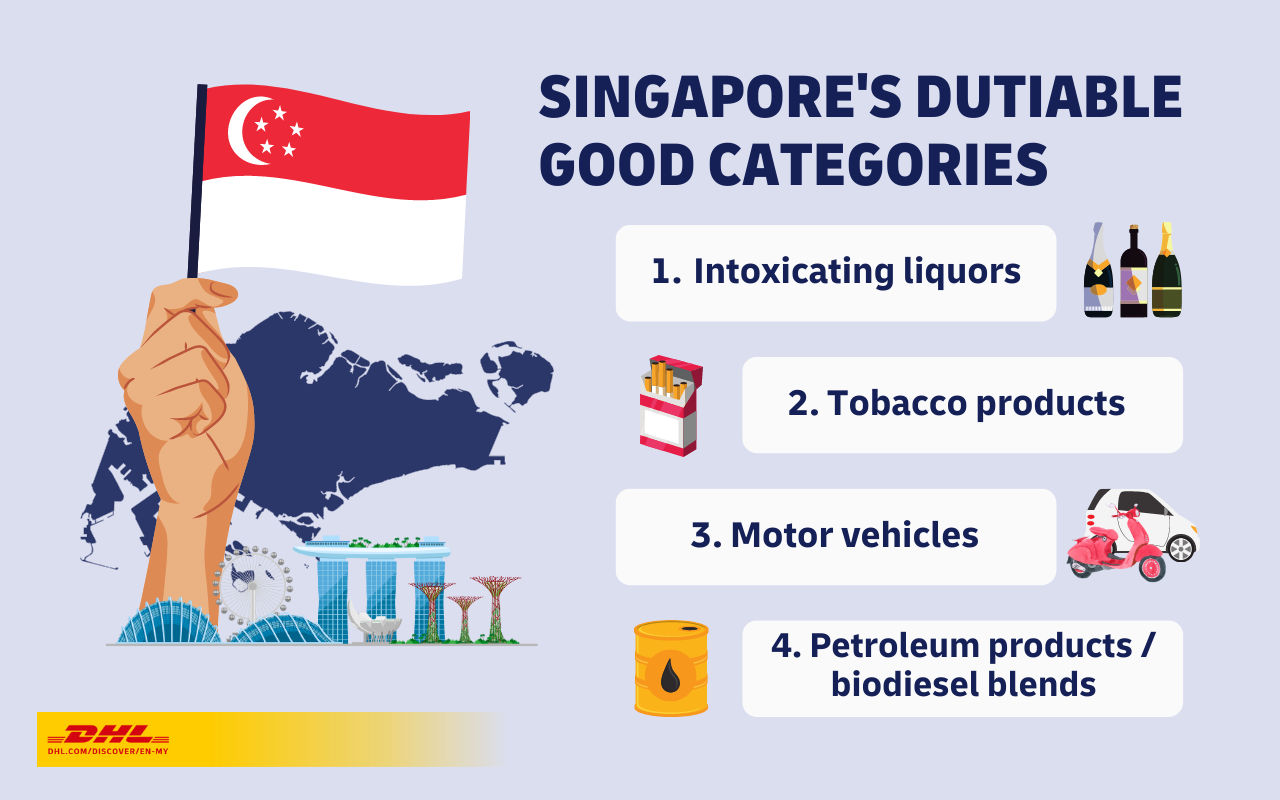

Singapore imposes Excise Tax on 4 types of dutiable goods:

Intoxicating liquor

Tobacco products

Motor vehicles

Petroleum or biodiesel fuel

Customs Duties

Customs duties are among the taxes collected by Singapore Customs, but they only applicable to particular alcohol imports such as stout, porter, ale, and samsu.

The customs duty rate in Singapore varies, ranging from SGD 8 to SGD 16 per litre, depending on the type of alcohol.

A Complete list of Singapore's Customs Duty Rate

Goods and Services Tax (GST)

Additionally, Singapore Customs collects GST on all imports into the country regardless of their value. Currently, the GST rate is 8%. However, this rate will subsequently increase to 9% in 2024.

Calculating Duties and Taxes

As stated above, while Singapore has 3 types of duties and taxes, only GST applies to all goods regardless of their value.

Each of the duties and taxes has a different calculation method.

Calculating Excise Tax

When it comes to excise tax, each category of goods will have its own calculation. The table below shows the complete calculation formula for the respective products' duties payable.

Calculating Customs Duty

Customs duty rates differ based on the product type, and they should be calculated using the rates specified for each respective product. Find the complete list of duty rates above.

To calculate customs duty, multiply the specific duty rates that apply to the goods in your shipment by the volume of the goods. The formula is as follows:

Find the complete list of duty rate for all dutiable product.

Calculating GST

To calculate the applicable GST for your product, multiply the GST rate (8%) by the CIF value. It's important to note that the CIF value is the total sum of the goods' value, insurance, and freight costs.

The formula is:

Duties payable = 8% x CIF value

For example, you want to import 2000 umbrellas worth SGD 5 each and the insurance and freight cost is SGD 100.

Example calculation:

Duties Threshold

Singapore has an import de minimus value of SGD 400.

Despite having an import de minimus threshold at the value of SGD 400, all imports are subjected to 8% GST fee, regardless of its value. Additionally, Singapore does not levy customs duty on imported goods except for the aforementioned types of alcohol.

Duties Exemption

Singapore exempts customs duties on all shipments entering the country, except for certain types of alcohol, such as stout, porter, ale and samsu.

While customs duty is exempt for 90% of imported goods, all of them are subject to an 8% GST.

Payment Method

There are 2 ways to pay import duties and taxes in Singapore.

Use Inter-Bank GIRO (IBG) to pay directly to Singapore Customs

First, you will need to register for an IBG account with Singapore Customs. That can be simply done by following this:

1. Get an IBG application form on Singapore official customs website

2. Fill in the form

3. Mail the completed form to Singapore Customs at:

Registration Unit,

Procedures & Systems Branch,

Singapore Customs,

55 Newton Road,

#02-01 Revenue House,

Singapore 307987

Once the registration is done, you can conduct payment through your IBG account one day after it has been approved.

Payment will be debited automatically on the payment due date from your chosen bank account as indicated in your Interbank GIRO application form.

Please note that if the payment falls on a weekend or Public Holiday, the deduction will be made on the previous working day.

Appoint a Declaring Agent to pay on your behalf.

Through this method, the tax payment will be deducted directly from the Declaring Agent’s IBG.

You can authorize your declaring agent to use your IBG account to pay for your duties and taxes one day after your IBG application is approved. To do this, submit an application to Singapore Customs for your declaring agent to access your IBG account.

One good thing about this option is that it's available for use, even if you don't hold an IBG account with Singapore Customs.

To put it simply, trading with Singapore is fairly simple due to the lenient import duties and taxes. This favourable trade practice has attracted businesses from Malaysia to Singapore.

However, this comes at a cost as customers across the causeway expect quick delivery due to Singapore's proximity to Malaysia despite shipping internationally.

To meet this demand, you can rely on DHL Express to provide next-day delivery for shipments from Malaysia to Singapore. With DHL Express’ extensive network, serving more than 500 airports worldwide, and Singapore as our regional hub, your delivery is guaranteed to arrive promptly.

Begin shipping your goods to Singapore by creating a DHL Express account, and let’s cross the bridge together.

FAQ

Do I have to pay duty on items shipped to Singapore?

Yes, your import shipment is subjected to duty if it falls under any of these 4 categories of dutiable goods:

Intoxicating liquor

Tobacco products

Motor vehicles

Petroleum products and biodiesel blend

How do I calculate Singapore import duty for my items?

To calculate the import duty for your shipments, you'll first need to determine the type of your shipment and then follow the duty rate specified for that category.

Here are the formulas for the respective categories of goods:

Alcohol:

2 methods to calculate -

1. Alcoholic products with duty rates based on per litre alcohol

Duties payable = Total quantity in litres x Customs and/or excise duty rate x Percentage of alcoholic strength

2. Alcoholic products with duty rates based on dutiable content (weight/volume):

Duties payable = Total dutiable quantity in kilogrammes x customs duty rate

Tobacco products:

All tobacco products should follow this formula, except cigarettes:

Duties payable = Total weight (in kilogrammes) x Excise duty rate

For cigarettes, use this formula:

Duties payable = Total number of sticks x Weight of individual sticks (every gramme or part thereof) x Excise duty rate

Motor vehicles:

Duties payable = Customs value x Excise duty rate

Petroleum products and biodiesel blend:

3 ways to calculate duty rates for petroleum products and biodiesel blends.

1. Petroleum products

Duties payable = Total volume x Excise duty rate

2. Compressed natural gas(Cng)

Duties payable = Total weight x Excise duty rate

3. Biodiesel blend

Duties payable = Volume of diesel x Excise duty rate

How to pay Singapore customs duties and taxes?

You have 2 options to pay for your customs duties:

1. Through you own Inter-Bank GIRO (IBG) with Singapore Customs

2. Appoint a declaring agent to pay on your behalf

For either option, you'll need to submit an application to Singapore Customs.

What are the Singapore import tax and duties?

Although Singapore is a free port with customs duties exempted for all non-excise goods, there are 3 types of duties enforced on all incoming shipments:

1. Customs duties

2. Excise duties

3. GST

Who pays the Singapore import tax?

Sender or receiver, either party can pay for the import duties.

If you're a DHL Express account holder, you can easily pay on behalf of your customer or the receiver through your account.

How much is the VAT if I import to Singapore?

Some countries refer consumption tax as value-added tax (VAT), but Singapore uses the term Goods and Services Tax (GST) to describe the same concept.

All imported shipments to Singapore are liable for an 8% GST.