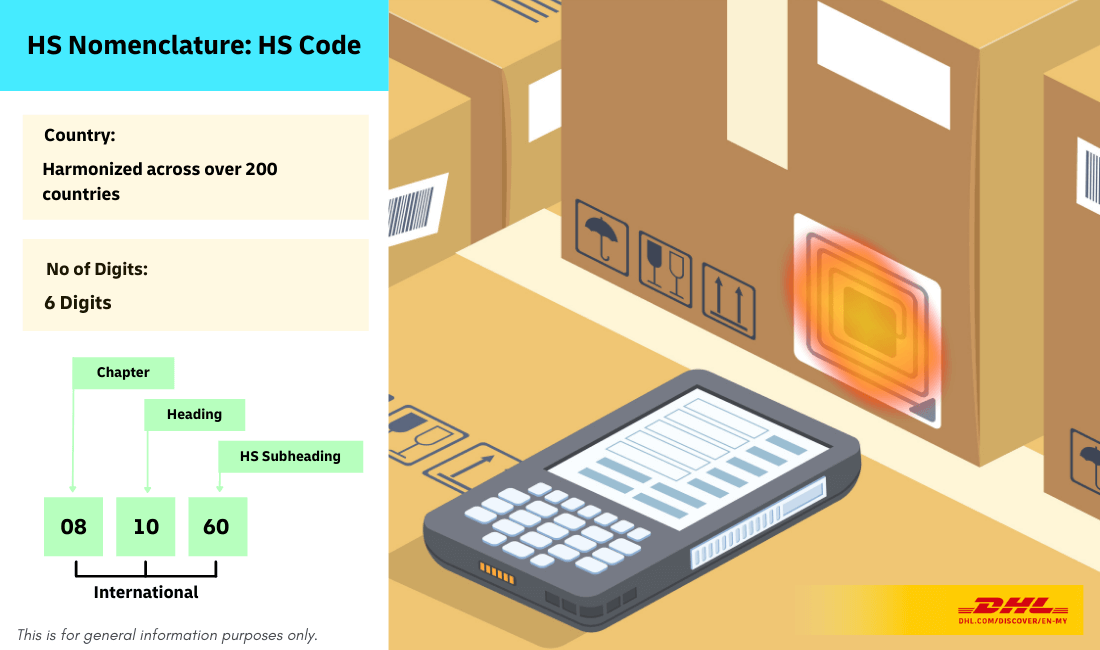

The Harmonized System (HS) Codes Worldwide

International HS Code

The primary universal economic language and code established by World Customs Organization (WCO) has 6 digits. It is known as Harmonized System code or HS code.

It's the foundation of the system used by 212 countries worldwide. While some countries adopt the 6-digits without modifications, most extend it to 7-12 digits to be more precise in their classification.

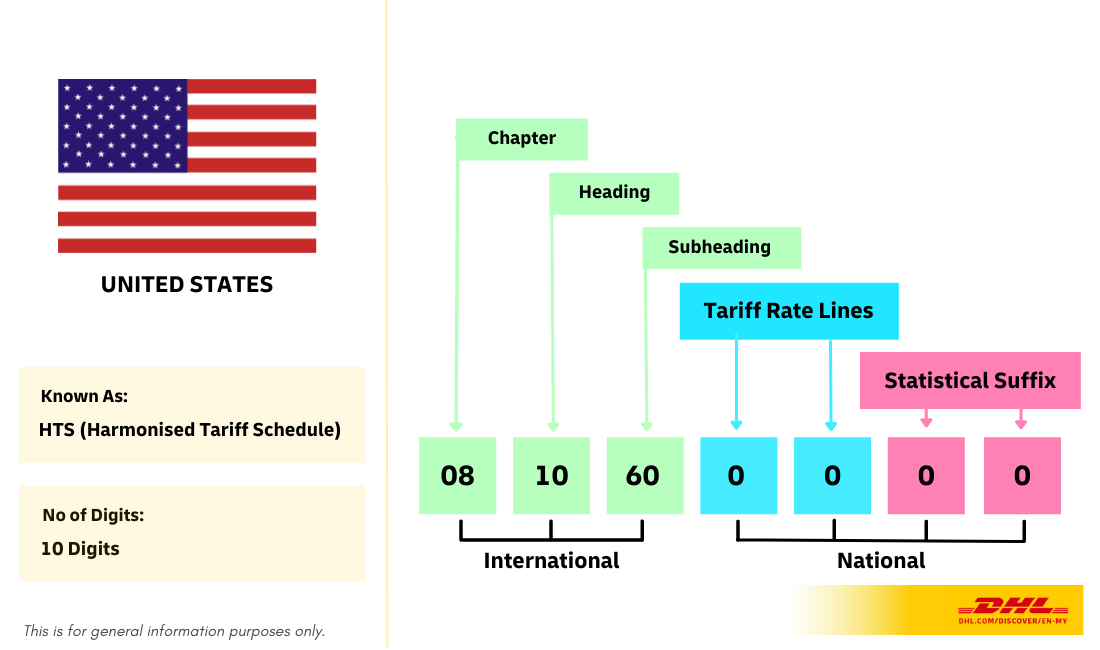

United States HS Code

In United States, HS code is commonly known as Harmonised Tariff Schedule (HTS).

HTS codes have 10 digits and are regulated by U.S. Customs and Border Protection.

To check the HTS code of your goods, use the official HTS searcher of United States.

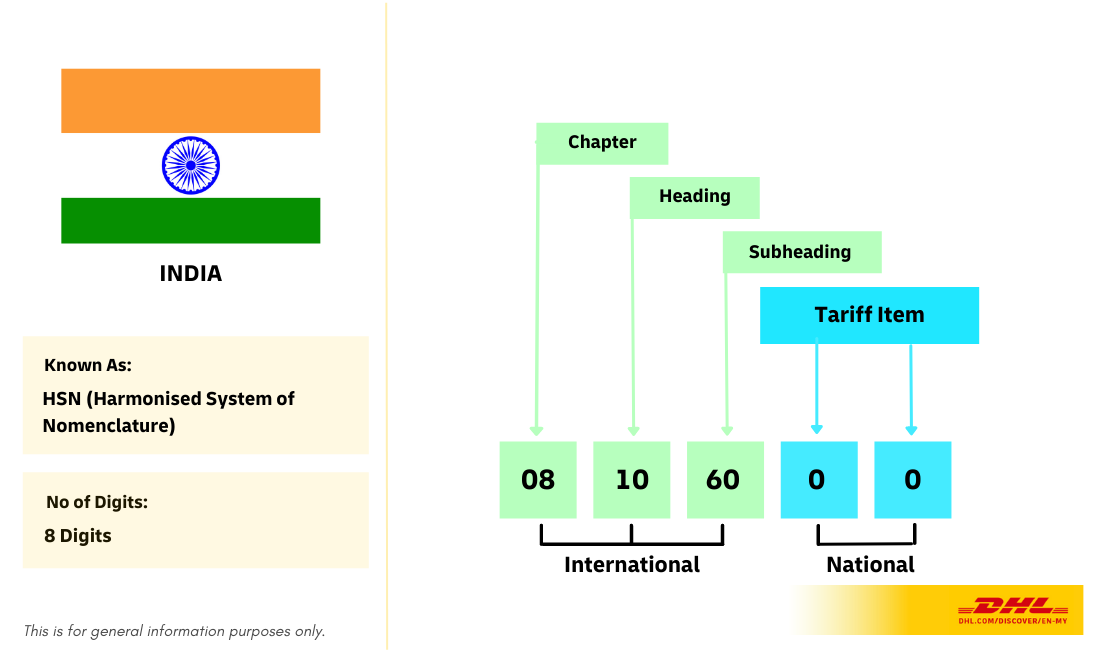

India HS Code

In India, the HS code is known as Harmonised System of Nomenclature (HSN) or India Trade Classification Harmonised System (ITC-HS). Although these terms are often used interchangeably, there's a slight difference between them.

HSN typically refers to a basic 6-digit code, while ITC-HS is an extended 8-digit HSN code. Customs in India requests the ITC-HS for thorough classification, but a basic 6-digit HSN code is sufficient for Goods and Service Taxes (GST) invoices.

Documents will specify the required HSN type. Simply put, HSN is the general term used in India to indicate HS code. ITC-HS will be mentioned only when a full 8-digit HSN code is necessary.

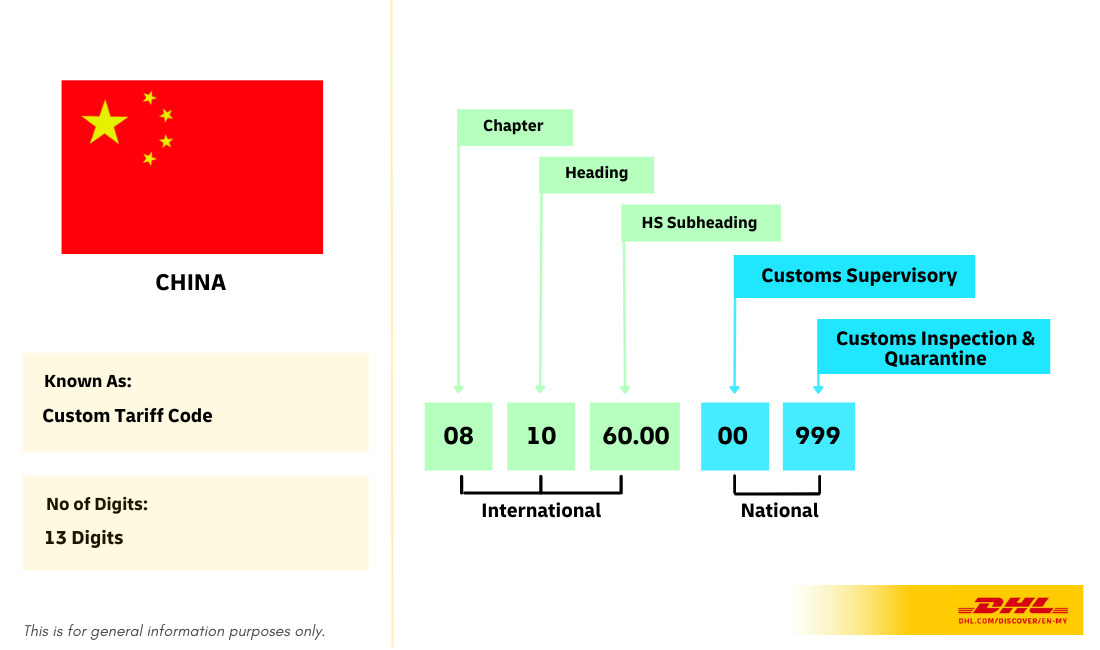

China HS Code

In China, HS code is known as China Customs Commodity HS Code (CCCHS).

CCCHS codes have 13 digits and are regulated by General Administration of Customs of China (GACC). To look for the CCCHS code for your goods, use the China HS code searcher.

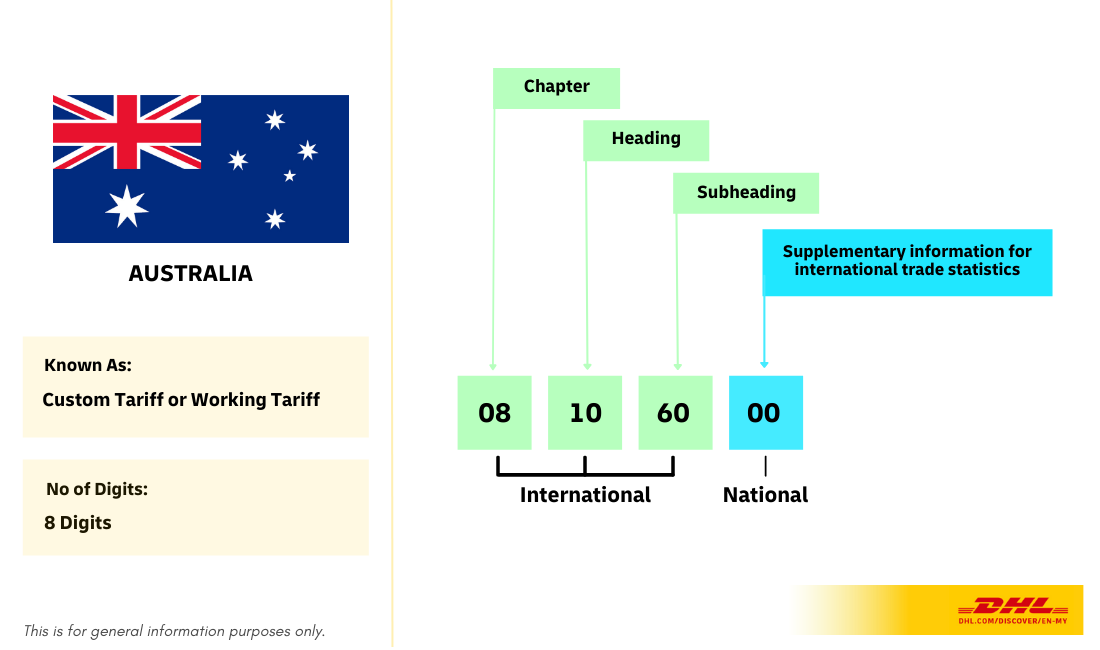

Australia HS Code

In Australia, HS code is commonlly referred to as Customs Tariff or Working Tariff.

They have 8 digits and are regulated by the Australian Border Force. To find the customs tariff of your goods, use the official FTA portal of Australia.

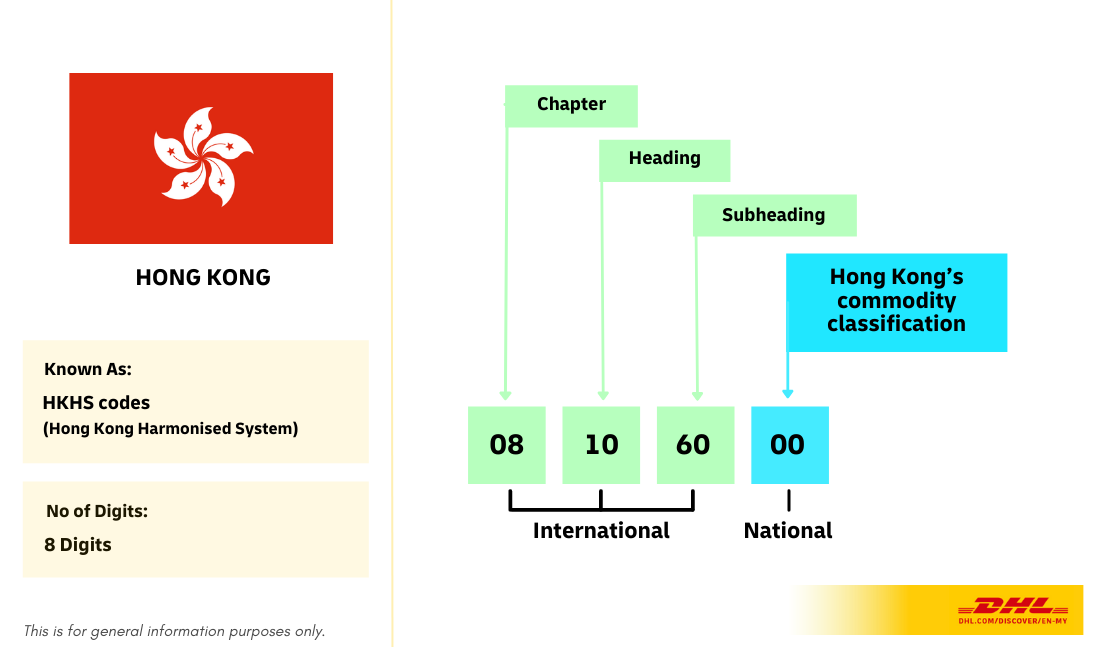

Hong Kong HS Code

In Hong Kong, HS code is referred to as HKHS Code (Hong Kong Harmonised System code).

HKHS codes have 8 digits and are regulated by Hong Kong Customs and Excise Department (C&ED).

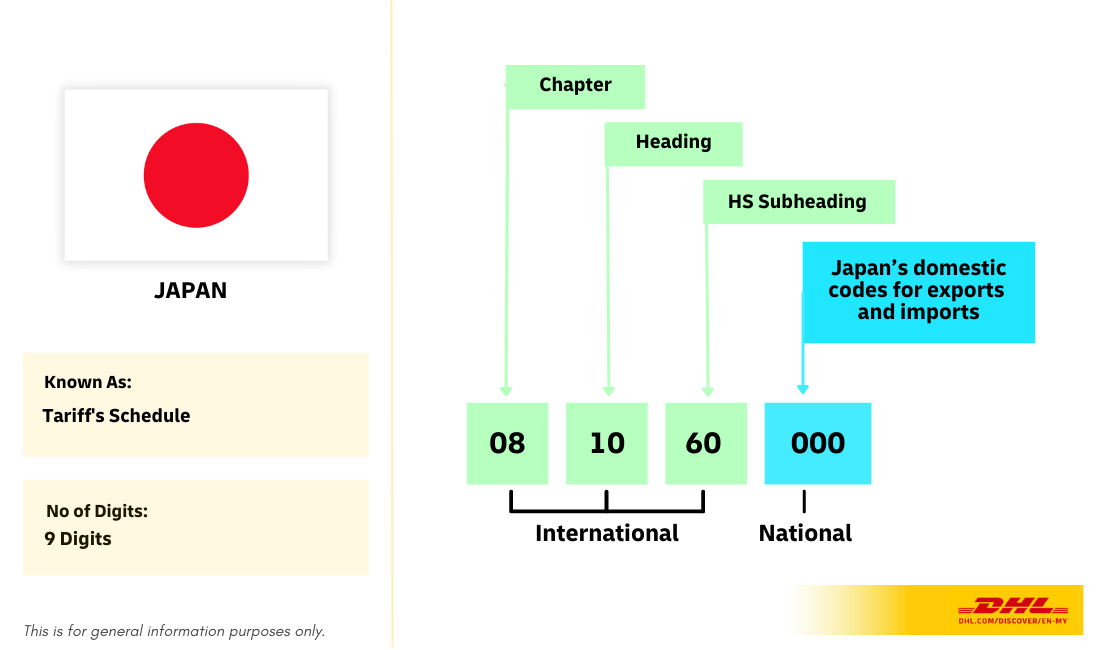

Japan HS Code

In Japan, HS code is known as statistical code.

They have 9 digits and are regulated by Customs and Tariff Bureau under Ministry of Finance Japan. The first 6 digits follow the standard gloabl HS code established by WCO, while the following 3 digits are unique to Japan.

The 3 digits differ for imports and exports. Hence, verify the statistical code based on the nature of your shipment. For Malaysian exports to Japan, follow the import statistical code.

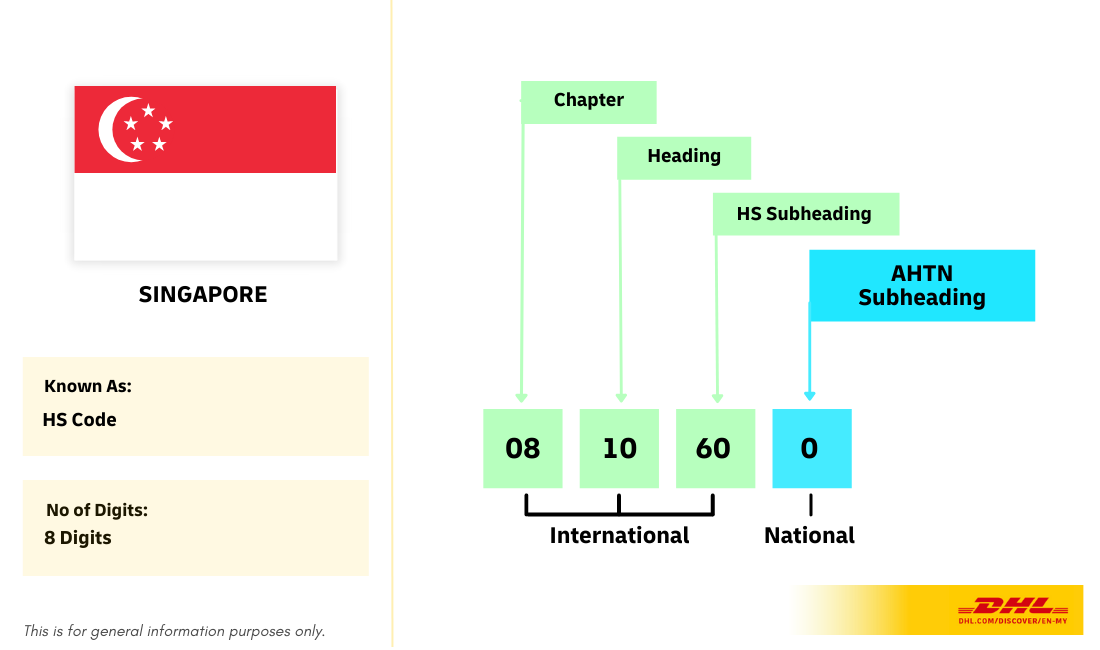

Singapore HS Code

In Singapore, the term HS code is used in all formal and informal communication and documentation.

The country adopts a 8-digit tariff system, administrated by Singapore Customs.

However, all Malaysian exports to Singapore will adhere to the ASEAN Harmonized Tariff Nomenclature (AHTN), an 8-digit HS code adopt by all ASEAN member states (AMS).

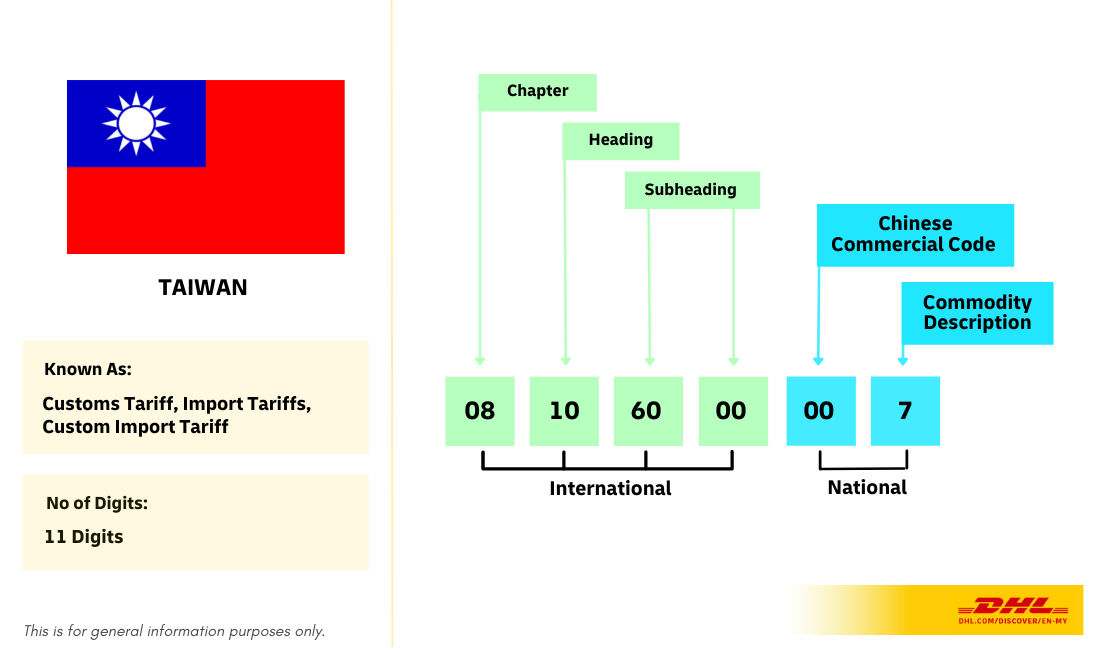

Taiwan HS Code

Besides HS code, Taiwan also uses the terms customs tariff and import tariff.

It has 11 digits and is regulated by Customs Administration under Ministry of Finance. The first 8 digits are internationally standardized and referred to as the tariff code. The 9th and 10th digit represent the Chinese Commercial Code (CCC), and the last 2 digits commodity description.

To find the HS code for your exports, use Taiwan's Customs Tariff Database Search System.

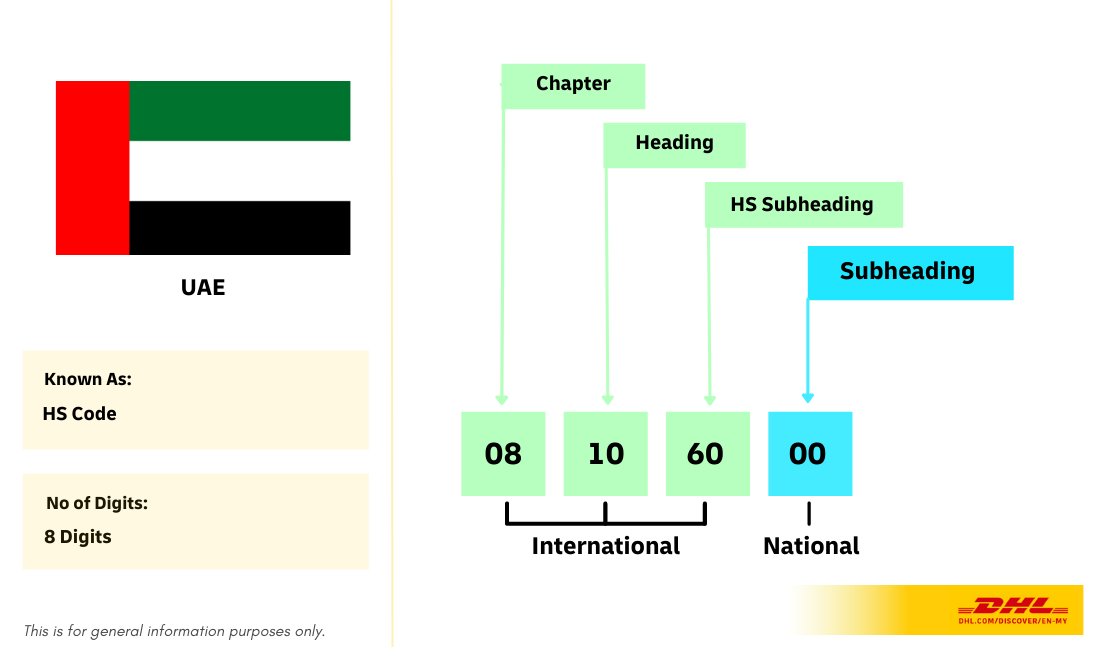

United Arab Emirates (UAE) HS Code

UAE uses the term HS code in all their formal and informal communication.

It has 8 digits and is regulated by the Federal Authority for Identity, Citizenship, Customs and Port Security.

To look for UAE HS code, use The Emirates' official HS code searcher.

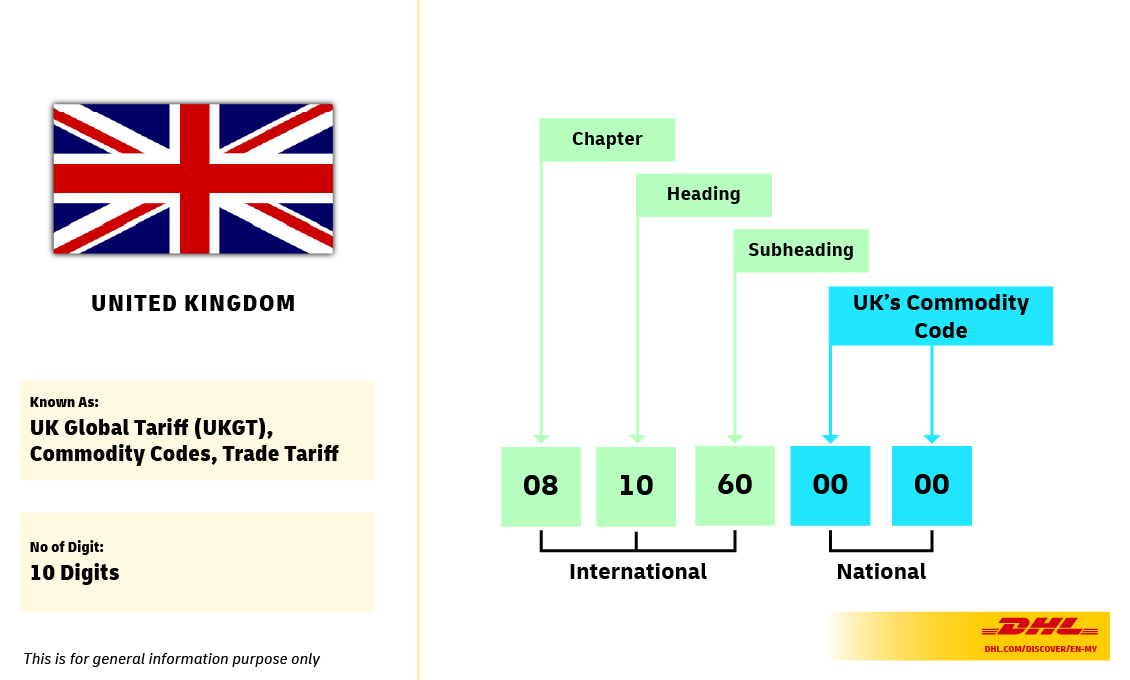

United Kingdom HS Code

In the United Kingdom, the official term for the HS code is the United Kingdom Global Tariff (UKGT). Additionally, commodity codes and tariff codes are two other terms commonly used for this system.

It has 10 digits and is regulated by HM Revenue and Customs. The first 6 digits follows the global HS code from WCO, while the last 4 digits are unique to United Kingdom. All Malaysian exports to United Kingdom shoudl follow the import tariff, a 10 digits commodity code.

To look for a UKGT, use the commodity code searcher by the official UK customs.

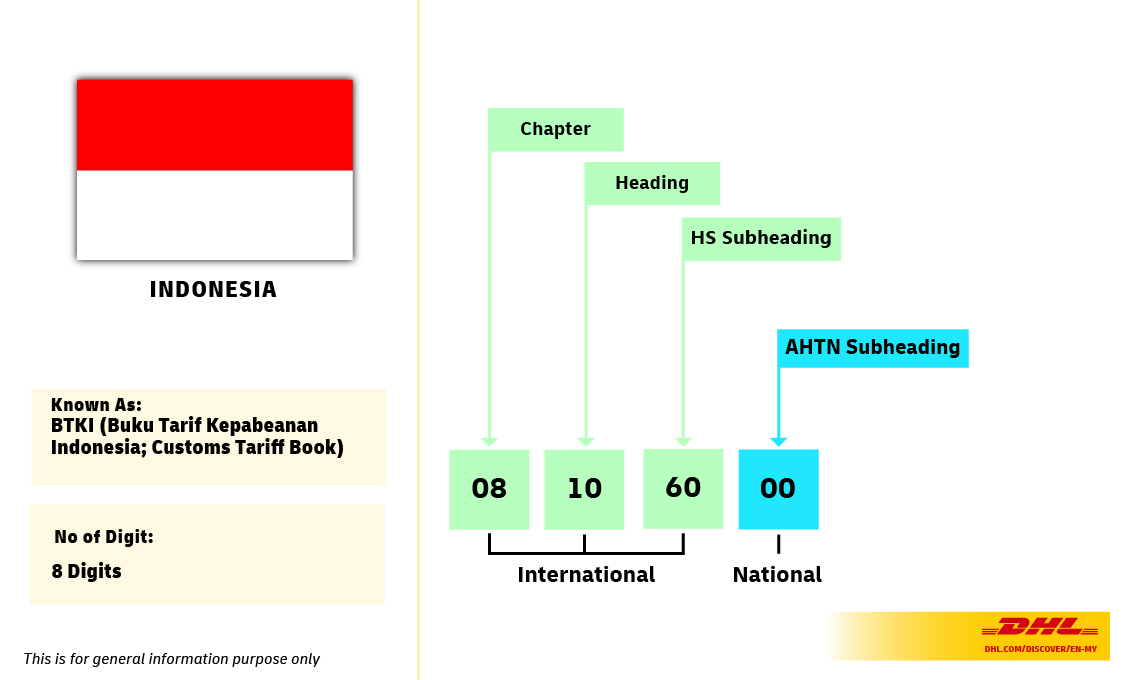

Indonesia HS Code

In Indonesia, the HS code is called the Indonesian Tariff Book (BKTI).

It's an 8-digit code regulated by the Ministry of Trade.

However, all Malaysian exports to Indonesia should adopt the AHTN HS system since both countries are part of ASEAN member states.

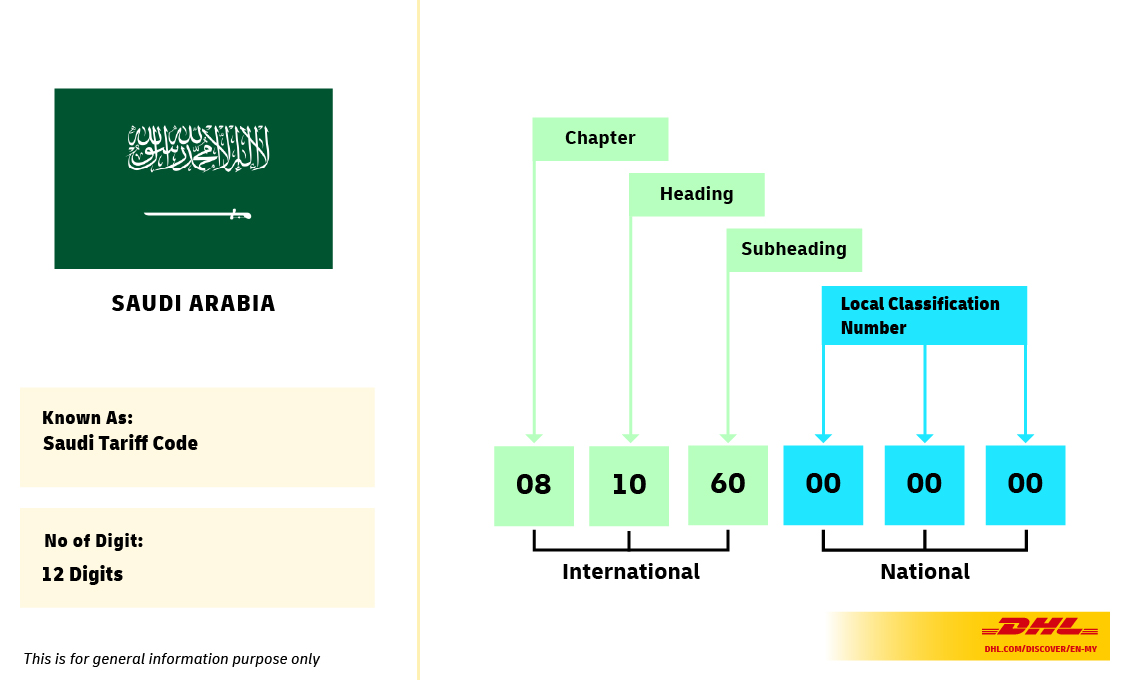

Saudi Arabia HS Code

In Saudi Arabia, HS code is known as Saudi tariff codes.

The complete Saudi tariff codes have 12 digits and are regulated by the Zakat, Tax, and Customs Authority. The first 6 digits of Saudi tariff codes follow the HS code established by the WCO, the next 2 digits are adopted from the Unified Gulf Cooperation Council's tariff system, and the last 4 digits are specific to Saudi Arabia.

To find Saudi tariff codes for your exports, use Saudi Arabia Customs' official HS searcher.

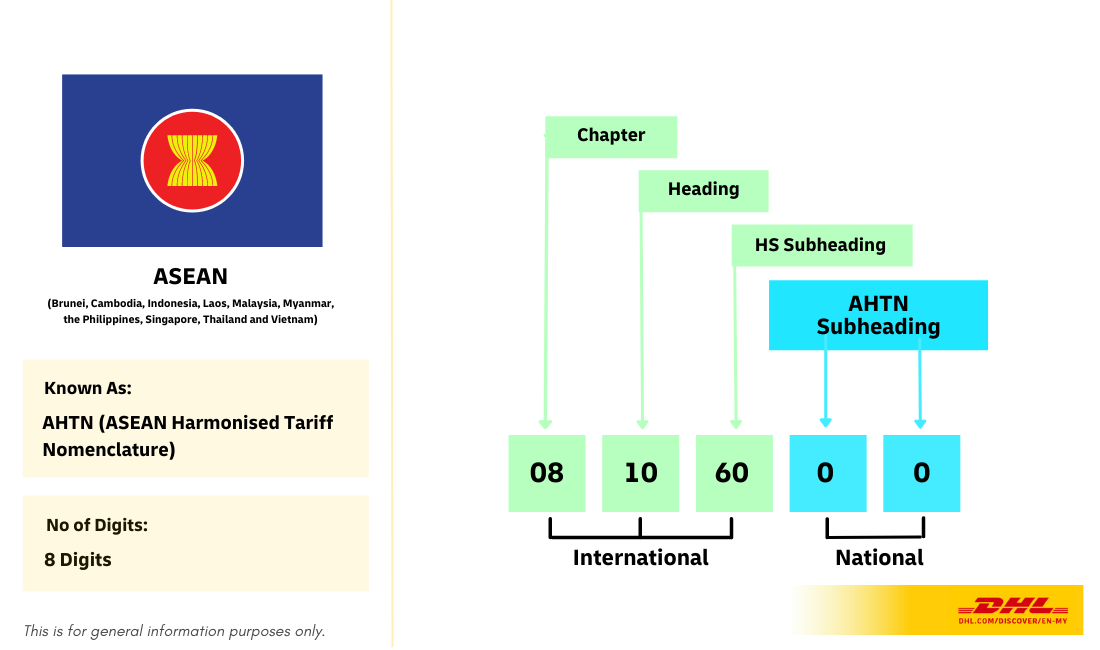

ASEAN HS Code

AHTN (ASEAN Harmonised Tariff Nomenclature) is a tariff system created and adopted by the 10 ASEAN member states - Malaysia, Brunei, Singapore, Thailand, Indonesia, Vietnam, Cambodia, Laos, Myanmar, and the Philippines.

It consists of 8 digits. The first 6 digits follow the globally standardized HS code from WCO, and the last 2 digits are unique to each ASEAN member state.

Each country in this agreement has its own AHTN, available on the official AHTN repository.

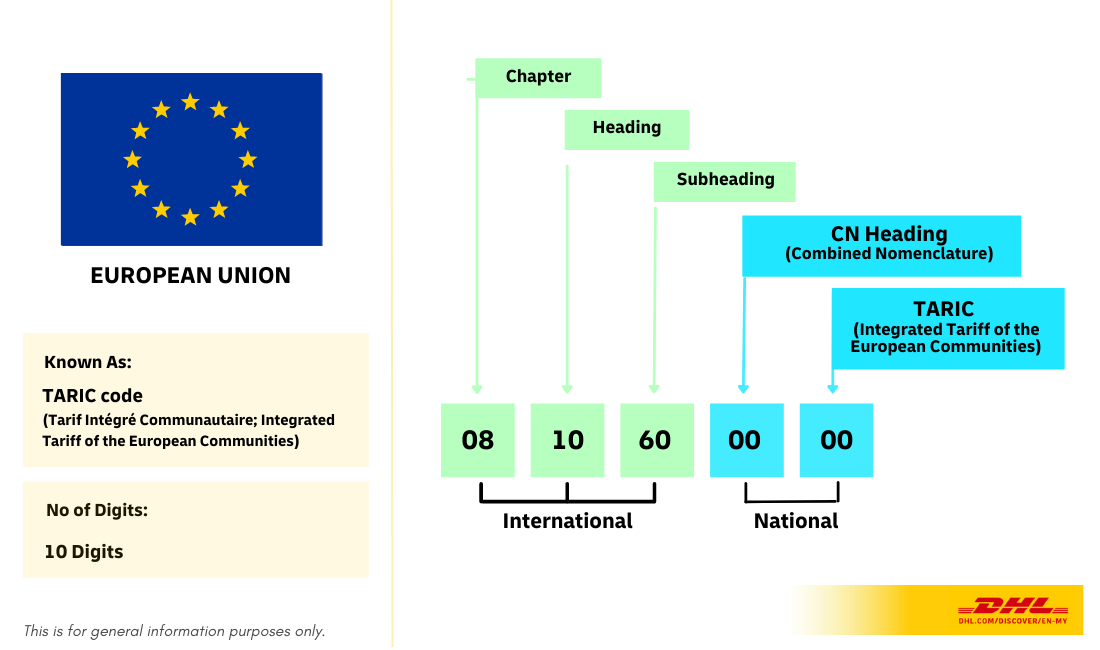

European Union HS Code

Countries under the European Union refers to HS code as TARIC code, which is a shorten form of the integrated Tariff of the European Union.

It consists of 10 digits and is overseen by Taxation and Customs Union under European Commission.

A quick way to search for TARIC code for your goods is through the European Customs portal.

![Why is your package stuck in customs [Solution + Prevention]](/discover/content/dam/malaysia/logistics-advise/1080x470-discover-header-banner-shipment-stuck-solutions.png)