All You Need to Know About China Import Duty and Taxes

In June 2023, China imported USD 9.08 billion from Malaysia, indicating a large market for businesses looking to grow.

To penetrate China’s market, you need to know China’s import duties and taxes. Thus, this article will tell you about China's import duties and taxes.

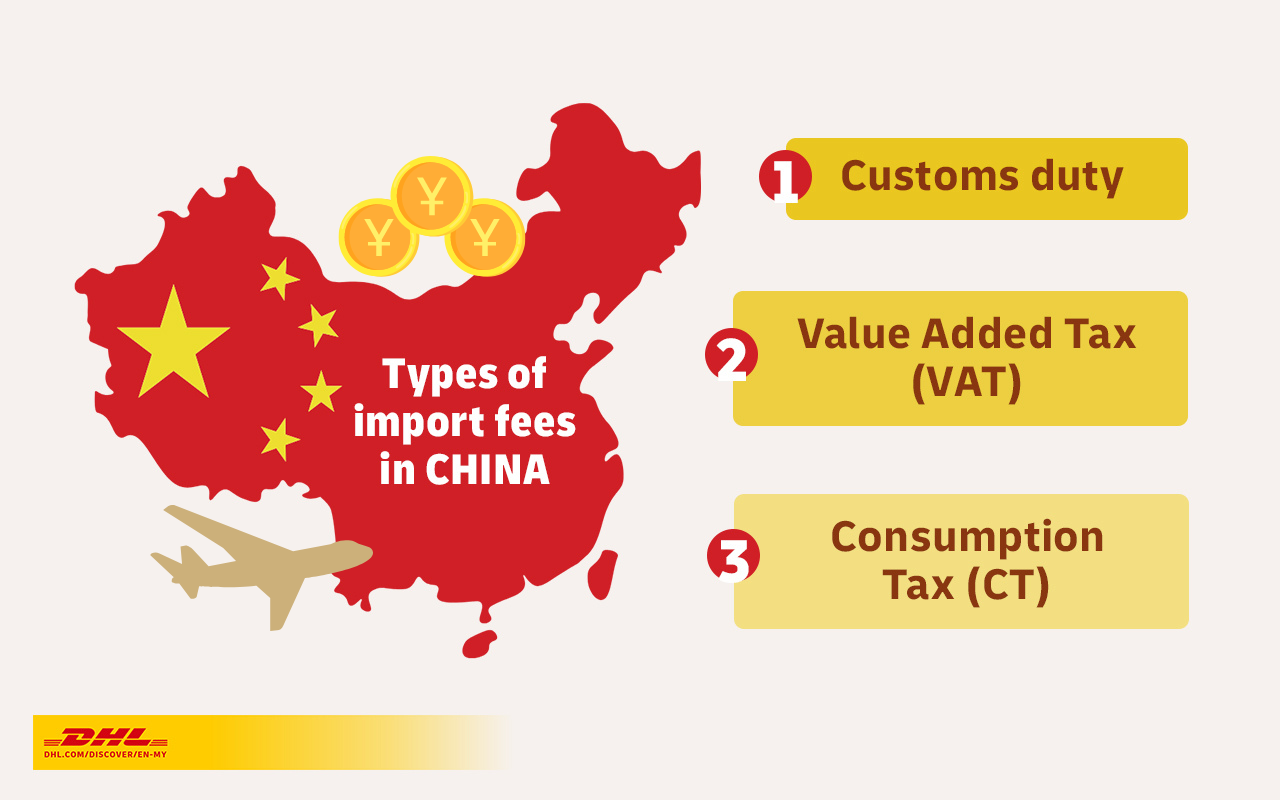

Types of Duties and Taxes

There are three main types of import duty when shipping goods from Malaysia to China:

Customs duty

Value-Added Tax (VAT)

Consumption Tax (CT)

The precise tax rate depends on the types of commodities you're shipping, with the possibility of additional taxes being applied to your goods. However, there is generally a standard system for determining the duties and taxes imposed.

Customs Duty

Like Malaysia, China tabulates its customs duty payable based on ad valorem rates or according to the quantity of the goods shipped.

Customs duty of China can be further brokendown into 5 categories - general duty, most favoured nation duty, conventional duty, special preferential duty, tariff rate quota duty, and temporary duty rate.

The type of custom duty apply depends on the originating country of the shipment and the type of commodities.

Duties Included in Customs Duties

General duty

As China is an MFN member, shipments entering the country from most nations are subject to the tariff rates established under the MFN treatment.

However, goods from countries or territories without agreements or treaties with China, or with unknown origin, are subject to the general import duty.

Most Favoured Nation (MFN) duty

MFN duty refers to the rates nations promise to use with other members of the World Trade Organisation, unless there is a unique trade arrangement between them.

MFN duty is usually applied to the following:

Goods imported to China from WTO member countries;

Goods originating from countries or territories with concluded bilateral trade agreements with the provision of MFN treatment with China; and

Goods originating from China.

The Regional Comprehensive Economic Partnership (RCEP) is the world’s largest free-trade bloc and members will enjoy preferential trade and tax benefits with China such as the lowered MFN import tax rates.

Malaysia is a signatory state of the RCEP and will also get to enjoy low import fees from relevant exports to China.

Conventional duty

Conventional duty rates are applied to goods which are shipped to China from countries or territories which have regional trade agreements containing preferential provisions on import tax rates.

Special preferential duty

The import fees payable under the special preferential duty is generally lower than the MFN or conventional duty rates. They are usually levied on imported goods which originate from countries or territories with trade agreements containing special preferential duty provisions with China.

Tariff Rate Quota (TRQ) duty

China’s TRQ rates apply to eight categories of goods, namely:

Wheat

Corn

Rice

Sugar

Wool

Cotton

Fertiliser

Under the TRQ schemes, goods imported within the quota are subject to a lower customs tariff rate while those above the quota are charged with higher rates.

Temporary duty

Periodically and according to market movements and predictions, China also implements temporary duty rates to boost imports and meet rising demands. For example, since the start of the year, China has raised the tariff rates on pork imports when domestic prices surged greatly.

Value-Added Tax (VAT) rates

Like the Malaysian Sales and Services Tax (SST), VAT is levied on imports from any location into China. The standard VAT rate in China is 13%, and it applies to all taxable goods except agricultural and utility items. For these a 9% VAT rate is applicable instead.

The import VAT can be calculated based on the following formula:

| Import VAT = Composite Assessable Price × VAT Rate |

|---|

= (Duty-Paid Price + Import Duty + Consumption Tax) × VAT Rate = (Duty-Paid Price + Import Duty) / (1-Consumption Tax Rate) × VAT Rate |

Example of VAT Calculation

For example, you want to import unroasted and caffeinated coffee beans into China valued at CNY 2000. The VAT rate for this product is 13%.

To determine the VAT tax, multiply the value of goods and the Value Added Tax (VAT) rate:

CNY 2000 x 13% = CNY 260

You'll get CNY260. That's the VAT payable for unroasted and caffeinated coffee beans valued at CNY 2000.

Consumption Tax

CT is imposed on companies and organisations that manufacture and import taxable products for processing under consignment or selling. They include products that can be harmful to one’s health such as tobacco or alcohol, high-end or luxury items such as jewellery or cosmetics, and automobiles such as motor cars or motorcycles.

For such goods, the CT rate varies according to the type of product. Calculating consumption tax can be done by using either the ad valorem method, quantity-based method, or the compound tax method. The formulas to compute the consumption tax are as follows:

Ad valorem method

Consumption Tax Payable = Taxable Sales Amount × Tax Rate

Quantity-based method

Consumption Tax Payable = Taxable Sales Quantity × Tax Amount per Unit

Compound tax method

Consumption Tax Payable = Taxable Sales Amount × Tax Rate + Taxable Sales Quantity × Tax Amount per Unit

Example of Consumption Tax Calculations

Imagine, you're importing cigars containing tobacco valued at CNY 2000 into China. The tax rate for the goods will be 36%.

To determine the consumption tax for your shipment, multiply the value of goods by the consumption tax rate:

CNY 2000 x 36% = CNY 720

You get CNY 720. That's the Consumption Tax payable for cigars containing tobacco valued at CNY 2000.

Other types of import tax

Apart from those mentioned above, there are a few other types of duties to consider when shipping to China. For instance, the Cross Border e-Commerce import tax is applicable to:

Goods purchased from merchants registered within China’s cross border e-commerce network; and

Goods purchased from overseas merchants and shipped by a courier company that can produce a commercial invoice, airway bill and proof of payment, and that can be legally responsible for the import.

Personal imports like these, with a Customs Value (CIF – Cost, Insurance & Freight) of up to ¥5,000 (approximately RM3,299) and an accumulated transacted value of not more than the personal annual limit of ¥26,000 (approximately RM17,157), are exempted from import duty. They are, however, subject to 70% of VAT and CT rates.

Imports that cross these limits will be subject to the duties and taxes, where applicable.

Duties and Taxes Threshold

China has an import de minimus value of CNY 300. Any imported goods above this threshold must pay duties and taxes.

Duties and Taxes Exemption

China levies duty exemption on duties and taxes below the de minimus value of CNY 300.

Additionally, Malaysia has a Free Trade Agreement with China under the ASEAN-China FTA (ACFTA). Through ACFTA, there is a customs duty exemption on most imports from Malaysia.

Payment Method

Payment of Duties and Taxes on imports into China can be conducted online through the China International Trade Single Window Website.

China International Trade Single Window is a one-stop website for importers and exporters to conduct customs-related businesses. \

The joint venture between the General Administration of Customs of the People’s Republic of China (specifically, the National Office of Port Administration) and Cross-Border Regulatory Agencies (CBRAs) allows declarations and payments on imports and exports to be conducted online via the China International Trade Single Window.