Malaysia HS Code Search Guide: JKDM HS Explorer

What is JKDM HS Explorer?

JKDM (Jabatan Kastam Diraja Malaysia) HS Explorer helps you find:

- HS Code

- Import / Eksport Rate

- Import / Eksport Prohibition

- SST

- Excise Duty

There are 3 ways to use JKDM HS Code Explorer:

- Get Product Description: Find product description using HS code.

- Find Product HS Code: Search for the HS code of a product.

- Check Applied Tariff: Determine if a special FTA tariff applies to a product.

1. Get Product Description

To start, visit JKDM HS Code Explorer.

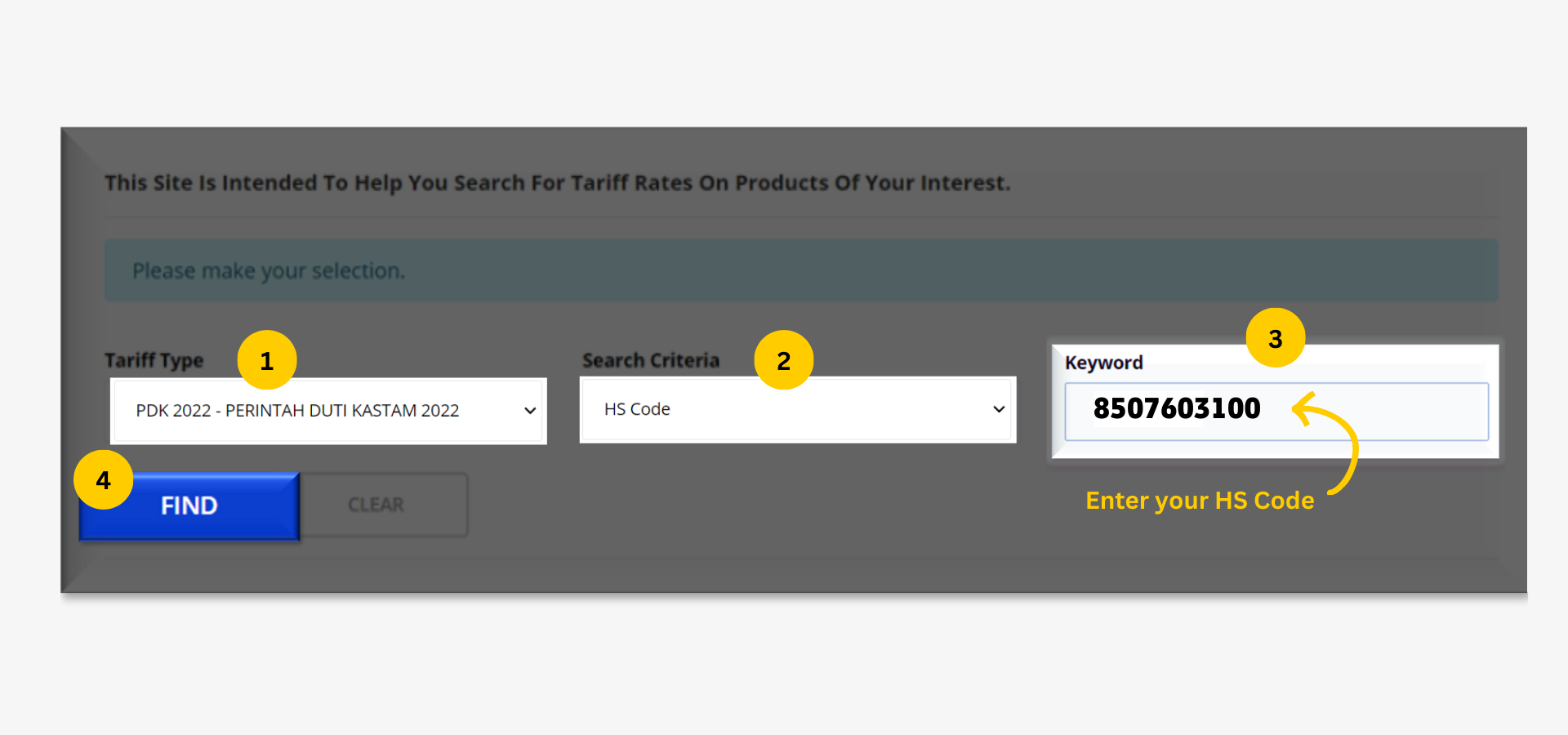

Follow these 3 steps:

- Tariff Type: Keep the default (PDK 2022 - Perintah Duti Kastam 2022)

- Search Criteria: Keep the default (HS Code)

- Keyword: Enter the HS Code number

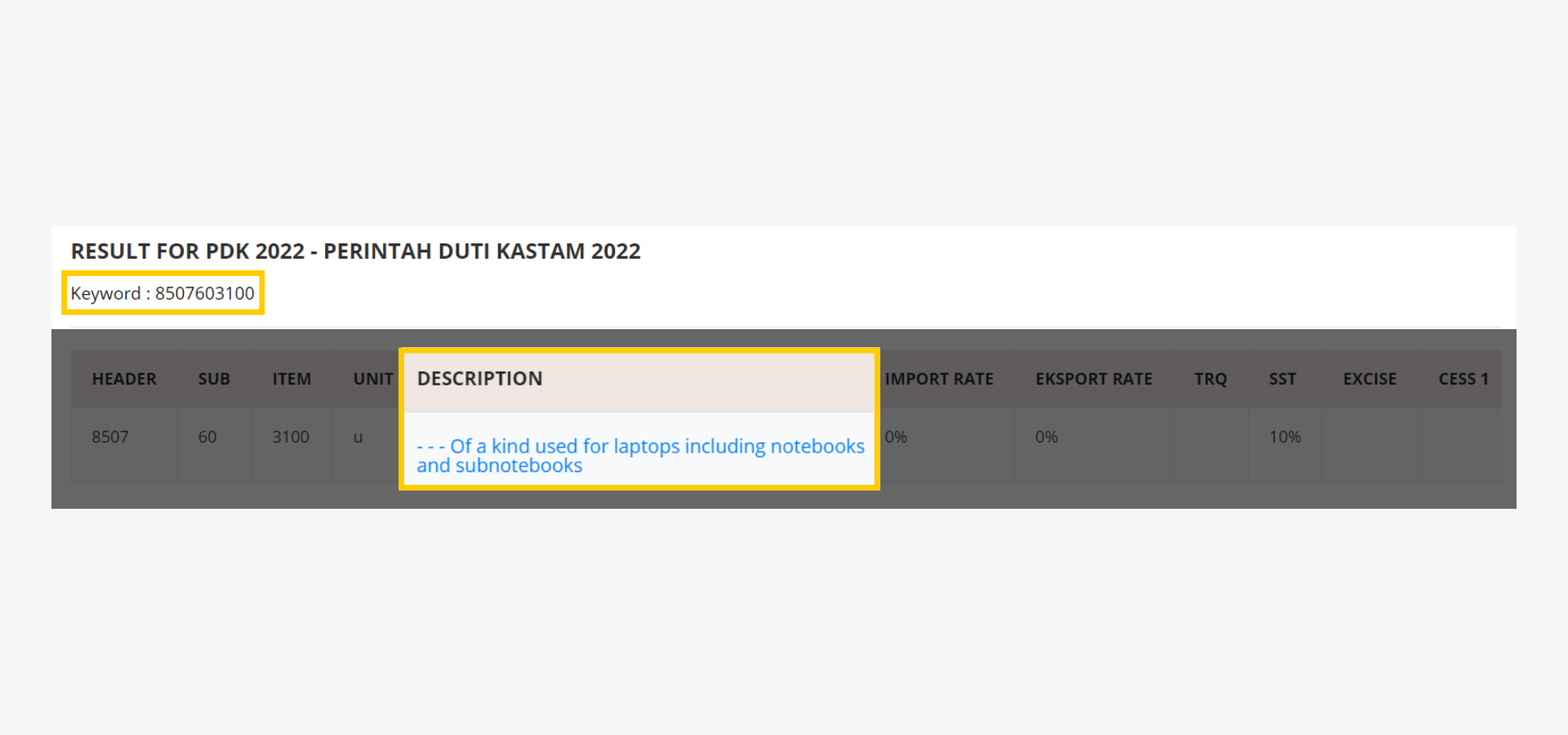

The description of goods should accurately reflect product's characteristics.

2. Find Product HS Code

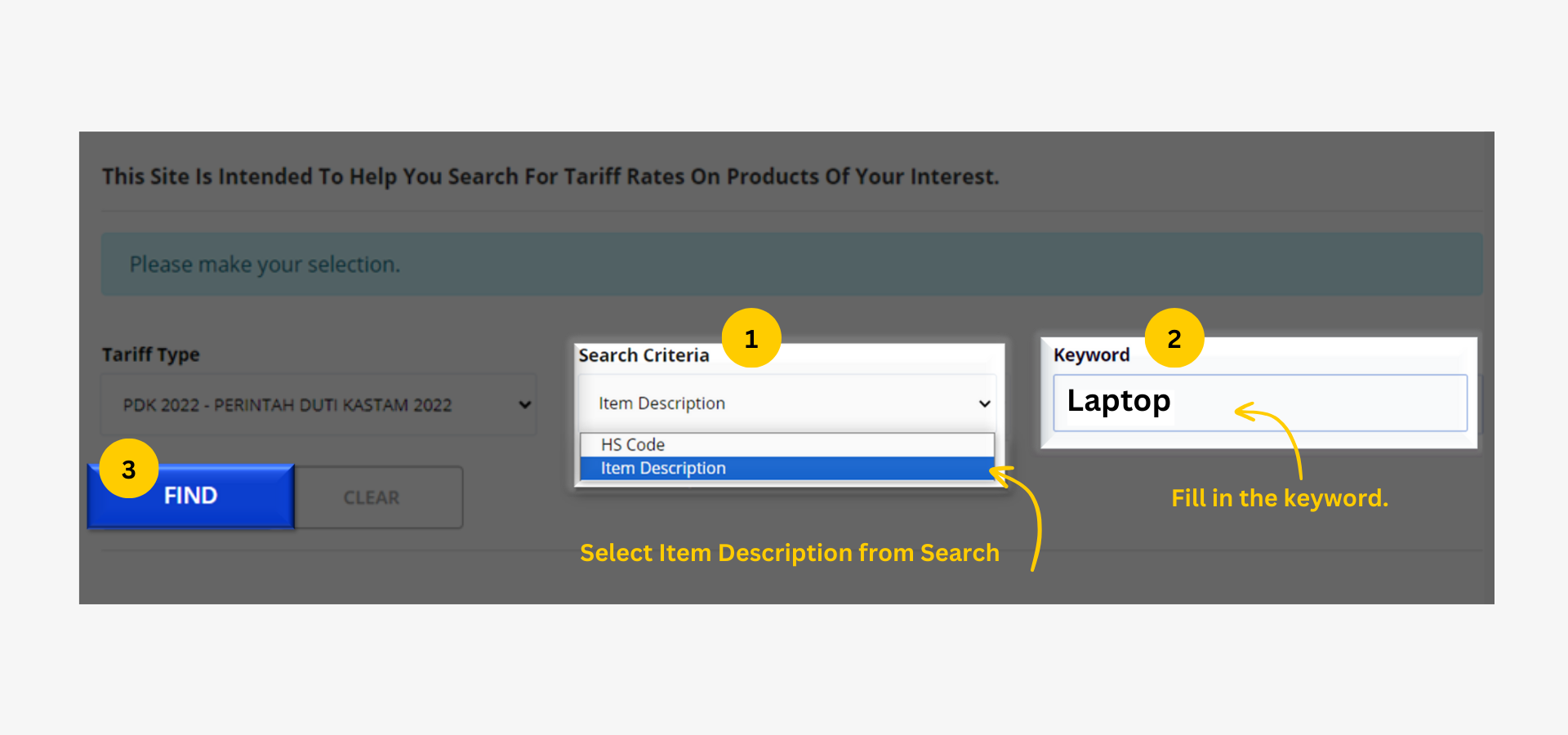

Follow these 3 steps:

1. Tariff Type: Keep the default (PDK 2022 - Perintah Duti Kastam 2022)

2. Search Critieria: Select "Item Description".

3. Keyword: Enter product name (e.g Honey, Laptop, etc.).

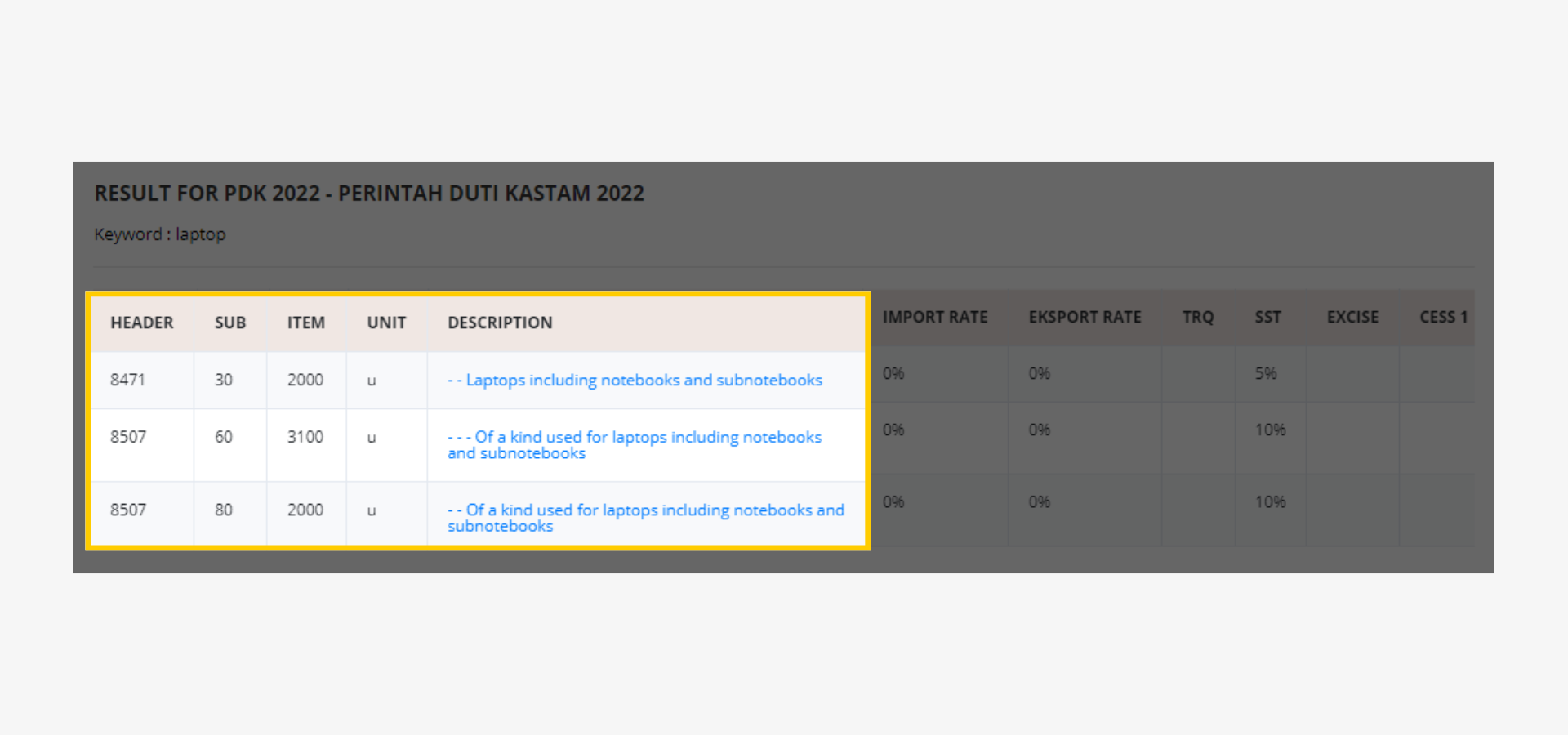

It will show multiple HS Codes.

Choose the HS Code that best matches the characteristics of the product.

3. Check Applied Tariff

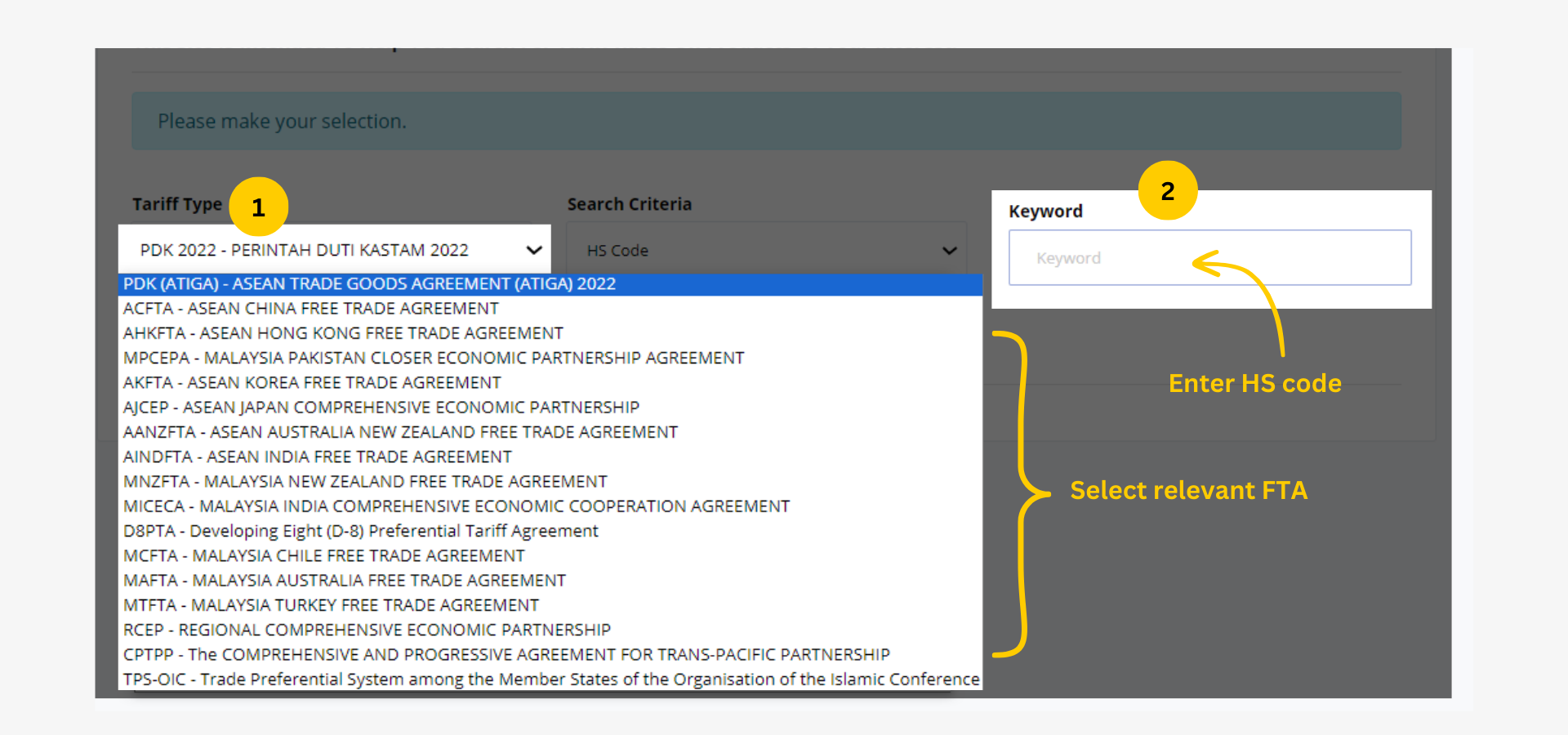

There are 18 types of tariffs to select:

- Default tariff: PDK 2022 - Perintah Duti Kastam 2022 is applied in all cases.

- Free Trade Agreements: Malaysia has 17 FTA. Duties and taxes is different for each free trade agreement.

For FTA, these are the 2 steps to follow:

1. Tariff Type: Select the applicable tariff agreement.

2. Keyword: Enter the product HS code.

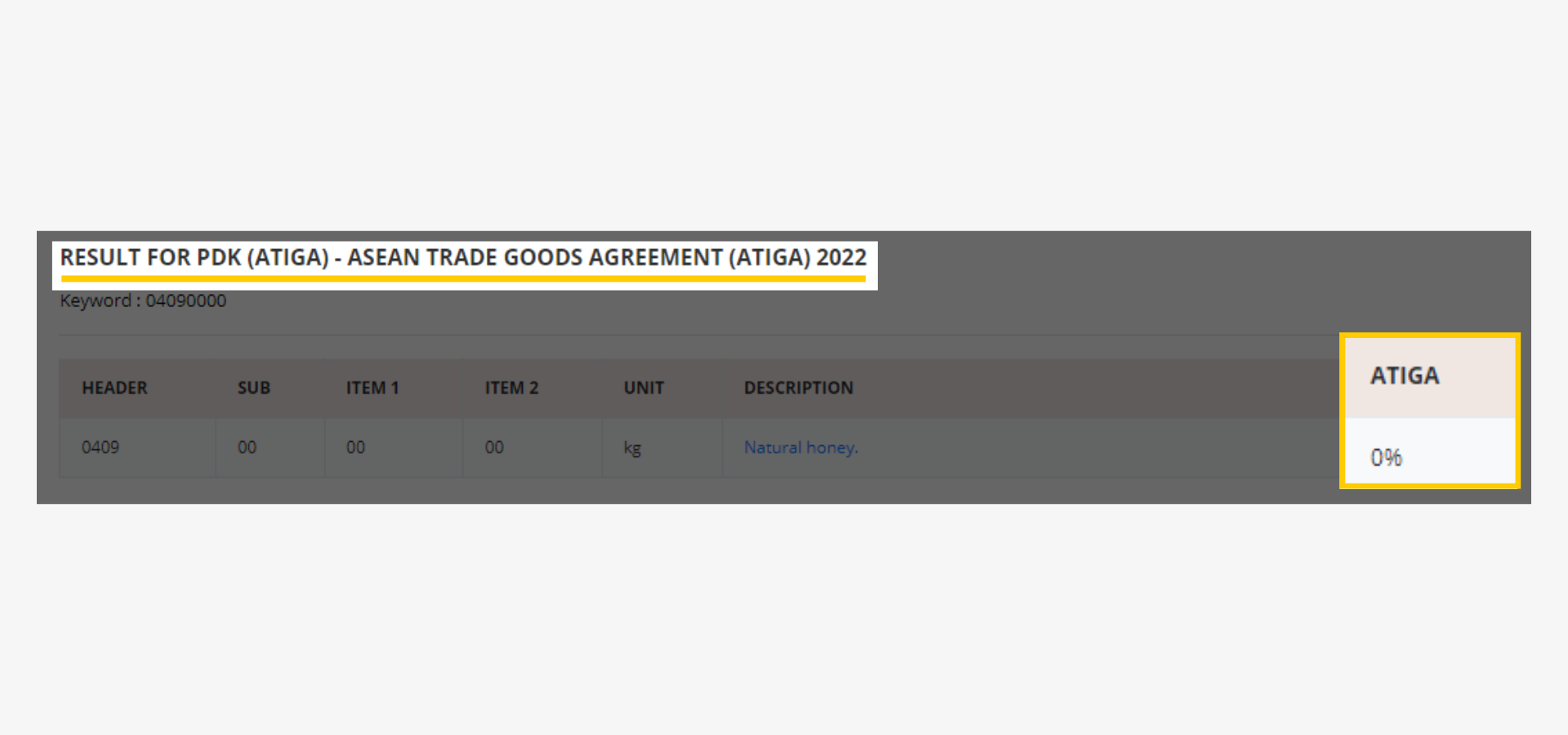

In this example, ATIGA is the chosen Free Trade Agreement, and the tariff rate is 0%.

HS codes are crucial in international shipping. Errors can cause problems like shipment seizures or unexpected duty charges.

DHL Express helps businesses with accurate shipping and smooth customs clearance every day. To have a stress-free international shipping experience, sign up for DHL Express Business account!