All You Need to Know About Malaysia’s Import Tax and Duties

When importing goods into Malaysia, understanding the complexity of the tax system is crucial.

Three main taxes are applied to imported goods: Import Duty, Sales Tax, and Excise Duty.

In this guide, we will look into each of these taxes and shed light on areas where tax exemptions can be obtained. Additionally, we will explore the benefits of Free Trade Agreements (FTAs), Free Trade Zones (FTZs), and Licensed Manufacturing Warehouses (LMWs), which provide opportunities for tax exemptions when importing into Malaysia.

Import Duty

Import Duty, also known as Customs Duty, is a crucial tax applied to goods entering Malaysia from overseas. It is one of the three main taxes charged on imports and plays a fundamental role in regulating international trade. Import Duty is charged to protect domestic industries, regulate the inflow of goods, and generate revenue for the government.

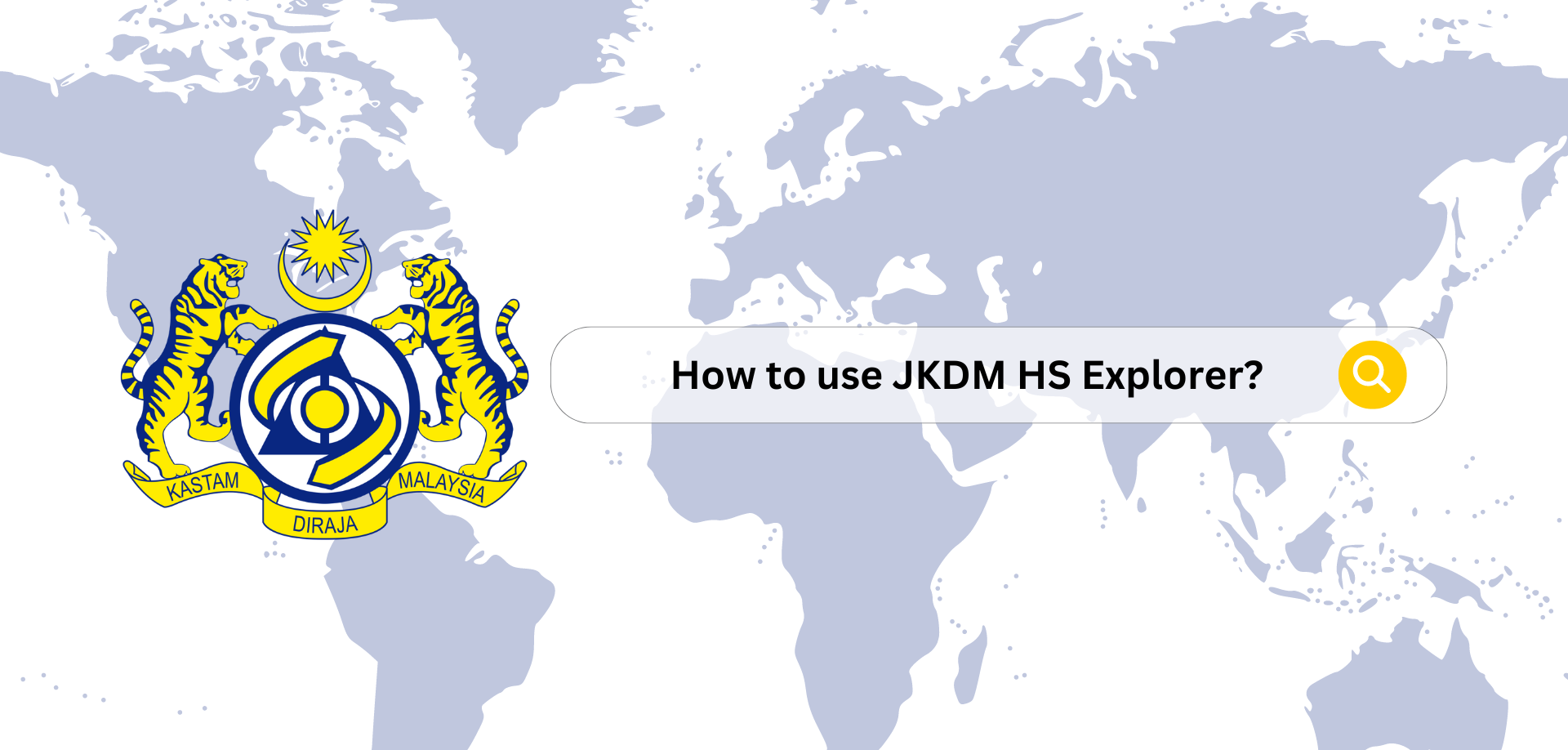

This tax is calculated based on either the ad valorem basis, as a percentage of the value of the goods, or on a specific basis, as a fixed sum per unit. The import duty rates can range from 0% to 60% on an ad valorem basis and vary for specific goods on a specific basis. These rates are determined by the Malaysian Customs Department and are categorized based on the Harmonized Systems Code (HS Code) that identifies the type of goods.

Certain individuals and goods may be eligible for import duty exemptions, as outlined in the Customs Duties (Exemption) Order 2017. Exemptions can be granted for various reasons, such as promoting specific industries, fulfilling international agreements, or supporting socio-economic development.

To calculate the import duty, you need the HS Code of the goods and the corresponding import duty rate. Payment can be made at Customs import offices or through third-party platforms like ePayment and eDagangNet, providing convenience and flexibility for importers.

Discover detailed information, including specific rates, exemptions, and calculation methods, in our import duty article.

Sales Tax

Sales Tax is the second key tax in Malaysia's import tax structure, following Import Duty. Implemented under the Sales and Service Tax (SST) system, it plays a crucial role in regulating the import of goods into the country.

Under the SST system, Sales Tax encompasses two categories: Sales Tax on Taxable Goods and Sales Tax on Low-Value Goods (LVG). Sales Tax on Taxable Goods applies to both imported and domestically manufactured goods that are sold, used, or disposed of within Malaysia. The tax rate varies depending on the goods' Harmonized Systems Code (HS code), with rates ranging from 10% or 5% to specific rates for certain products.

In addition, Sales Tax on LVG is specifically imposed on goods sold online with a value not exceeding RM500, delivered from overseas to customers in Malaysia. Starting from 1st January 2024, a fixed 10% rate will be applied to LVG for online transactions.

Certain goods listed in the Sales Tax (Goods Exempted from Sales Tax) Order 2022 are eligible for exemptions. Furthermore, the Sales Tax (Persons Exempted from Payment of Tax) Order 2018 outlines exemption eligibility for specific individuals and goods.

To calculate the Sales Tax, importers need to determine the HS code of the goods and consider the applicable rates for Import Duty, Excise Duty, and Sales Tax. Payment can be made directly at Customs Import Offices or through third-party platforms such as ePayment and eDagangNet.

More about sales tax, including its regulations, rates, exemptions, and calculation methods, we've covered everything in detail in our sales tax article.

Excise Duty

As the last of the three taxes applicable to imported goods in Malaysia, Excise Duty serves as a regulatory measure targeting specific products. Unlike Import Duty and Sales Tax, Excise Duty does not apply to all imports but rather is targeted at certain goods.

The rates of Excise Duty vary depending on factors such as the goods' Harmonized Systems Code (HS code) and their specific attributes. This tax is designed to ensure the proper control and regulation of specific goods entering the country.

Individuals and goods may qualify for exemptions from Excise Duty, as outlined in the Excise Duties (Exemption) Order 2013. These exemptions provide relief for eligible entities, ensuring a more favourable import process.

If Excise Duty is applicable, the calculation involves considering the HS code, import duty rate, and the specific excise duty rate that applies to the goods in question. Payments for assessed excise duties can be conveniently made at Customs import offices or through designated third-party platforms.

For a more detailed understanding of Excise Duty, including information on rates, exemptions, and payment methods, read our article on excise duty.

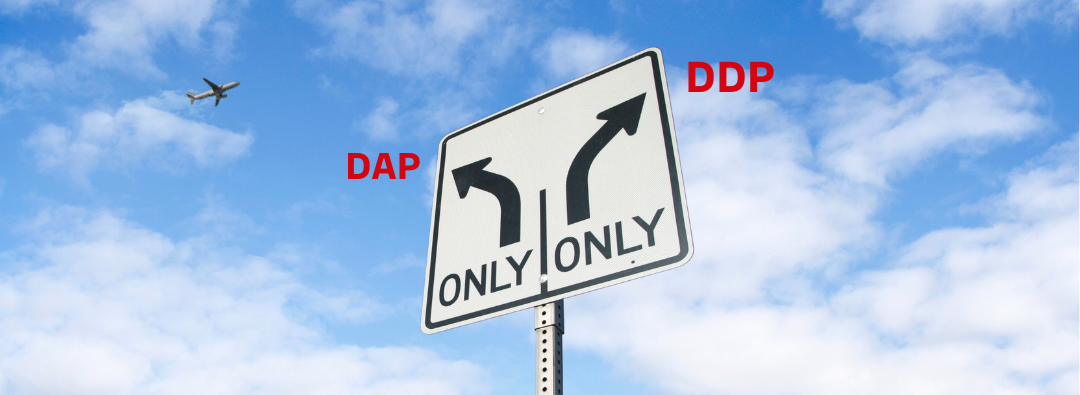

After understanding the taxes that are applied when importing goods into Malaysia, it’s important to explore the opportunities for tax exemptions and benefits offered by trade agreements and designated areas.

These avenues can provide importers with the chance to reduce or even eliminate their tax obligations, making their imports more cost-effective and competitive in the Malaysian market.

Free Trade Agreements (FTAs)

Free Trade Agreements (FTAs) are an essential facilitation for importers to obtain tax exemptions when importing goods into Malaysia. These agreements play a significant role in Malaysia's import tax landscape by offering preferential treatment and tax advantages.

FTAs are agreements between two or more countries that aim to reduce tariffs and introduce mutually beneficial measures, promoting international trade and economic growth. Malaysia has signed 16 FTAs, including 7 bilateral FTAs and 9 multilateral FTAs, providing advantages such as lower or zero customs taxes, making Malaysian businesses more competitive.

To benefit from FTA tariff preferences, products must meet specific criteria, including being covered by a specific FTA, complying with the Rules of Origin (ROO) requirements, and having a Certificate of Origin (CO). The ROO criteria include being wholly obtained or produced in an ASEAN member country, undergoing a substantial transformation, or containing a certain percentage of ASEAN content.

By checking the tariff schedules of relevant FTA partners and ensuring compliance with the rules of origin, importers can qualify for preferential tariff treatment and enjoy the tax exemptions and competitive advantages provided by the FTAs.

For more comprehensive information on FTAs, including regulations, eligibility criteria, and how to check the rates from preferential tariff treatment, read it on our FTA article.

Free Trade Zones (FTZs) and Licensed Manufacturing Warehouse (LMW)

FTZs and LMWs are designated areas that offer minimal customs supervision and tax exemptions for most goods and services. They provide importers with the opportunity to reduce or eliminate their tax obligations, making their imports more cost-effective and competitive in the Malaysian market.

FTZs are divided into two types: Free Industrial Zones (FIZs) and Free Commercial Zones (FCZs). FIZs focus on manufacturing and exporting goods, while FCZs promote commercial and trade activities. Businesses operating within these zones benefit from duty and tax exemptions, with a few exceptions for specific goods. This is made possible by the connectivity facilitated by Malaysia's transportation infrastructure, the government's focus on supporting FTZs, and the cost-effectiveness resulting from low operational and labour expenses.

To establish a business in an FTZ, importers must register as a private limited company, meet capital and permit requirements, and register with Customs as SMK Dagang Net users. The Free Zone Authority, appointed by the Ministry of Finance, oversees and regulates FTZs in Malaysia. There are 22 FIZs and 24 FCZs located nationwide, including prominent zones like Port Klang Free Zone and Pasir Gudang.

Similarly, LMWs are unique facilities in Malaysia that combine warehousing and manufacturing activities to support export-oriented industries. These warehouses operate under the provisions of the Customs Act 1967 and offer tax exemptions on imported raw materials, components, machinery, and equipment used directly in the manufacturing process. Eligible companies typically export at least 80% of their total production and import the majority of their raw materials. LMW activities also extend to product design, quality control, testing, research and development (R&D), and more.

To apply for an LMW license, companies must meet eligibility criteria, prepare the required documents, submit the application, comply with conditions, undergo inspection and evaluation, receive approval, and obtain the license. LMW companies must adhere to license conditions, submit monthly and annual statements to the Customs Office, and comply with regulations regarding the utilization of duty-free imports.