Grow your business with the Discover newsletter

Logistics advice & insights straight to your inbox

Subscribe now

Temporary export is a facility that allows individuals, businesses, and professionals to bring goods into a foreign country for a limited period without paying duties and taxes. This option is made possible through ATA Carnet, an international customs document that enables the temporary entry of goods in 77 participating countries.

Also known as the 'Merchandise Passport' or 'Passport for Goods,' ATA Carnet streamlines customs procedures, replacing the need for multiple customs forms. Instead of paying duties and taxes, a security deposit is required, and the goods must be exported to the next country within the allowed period. Supported by the Malaysian International Chamber of Commerce and Industry (MICCI), ATA Carnet provides a convenient and cost-effective solution for temporary exports.

It covers 3 general categories of imported goods which include commercial samples, professional equipment, and goods for display or use at events, fairs & exhibitions. However, admission of these goods may vary by country.

There are also categories of goods that are not covered:

Postal traffic

Unmounted gems or gemstones

Items already sold or offered for sale

Goods intended for processing or repair

Vehicles intended as means of transport

Perishable, consumable and disposable goods

For example, a fashion brand participating in a major trade fair in multiple countries can utilize ATA Carnet to temporarily export its clothing samples, accessories, and promotional materials without incurring additional costs. By using ATA Carnet, they can seamlessly navigate customs procedures, ensuring that the goods are exported within the allowed timeframe. This allows them to showcase their products to a global audience, expand their market presence, and establish valuable international connections.

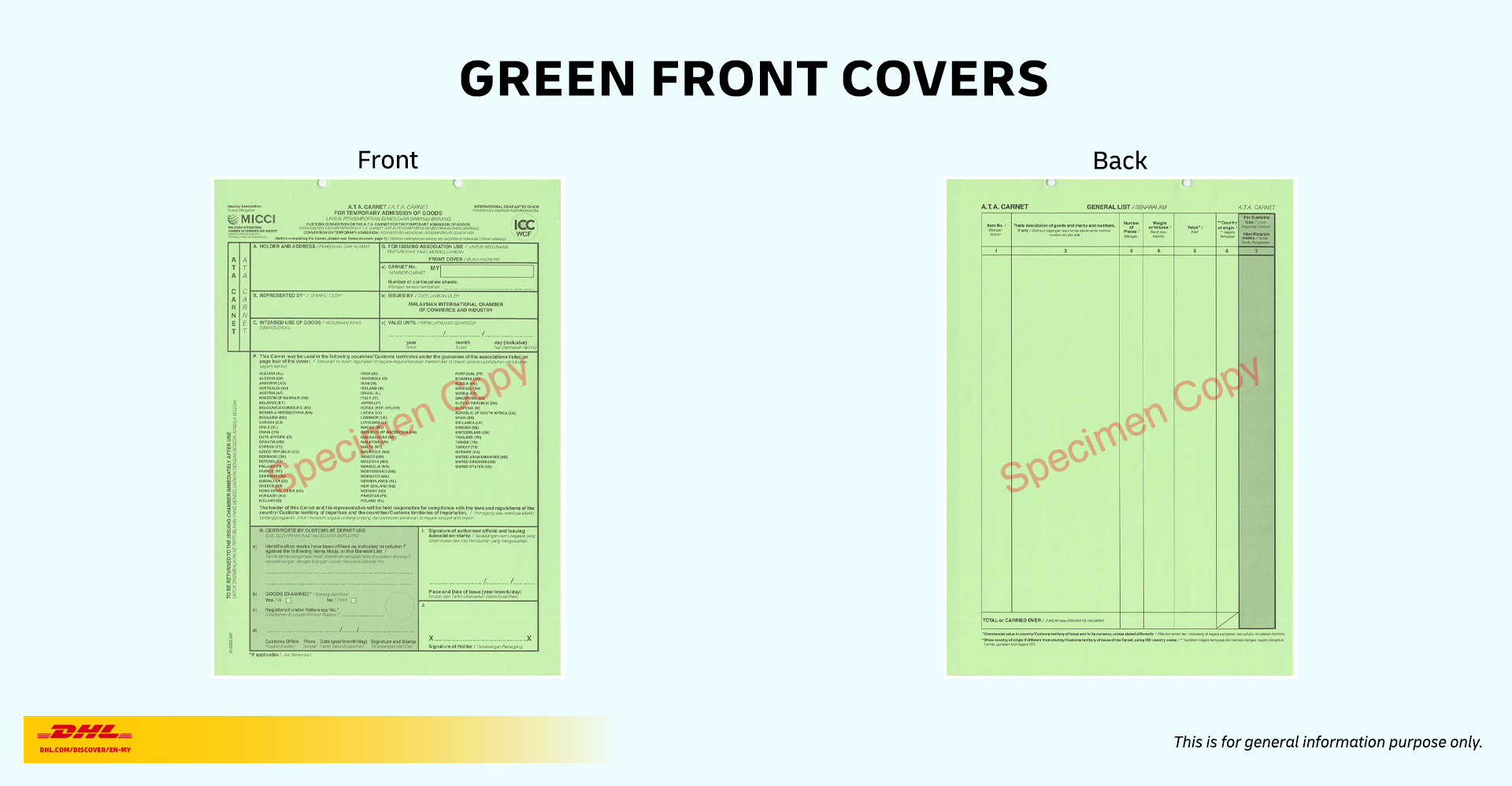

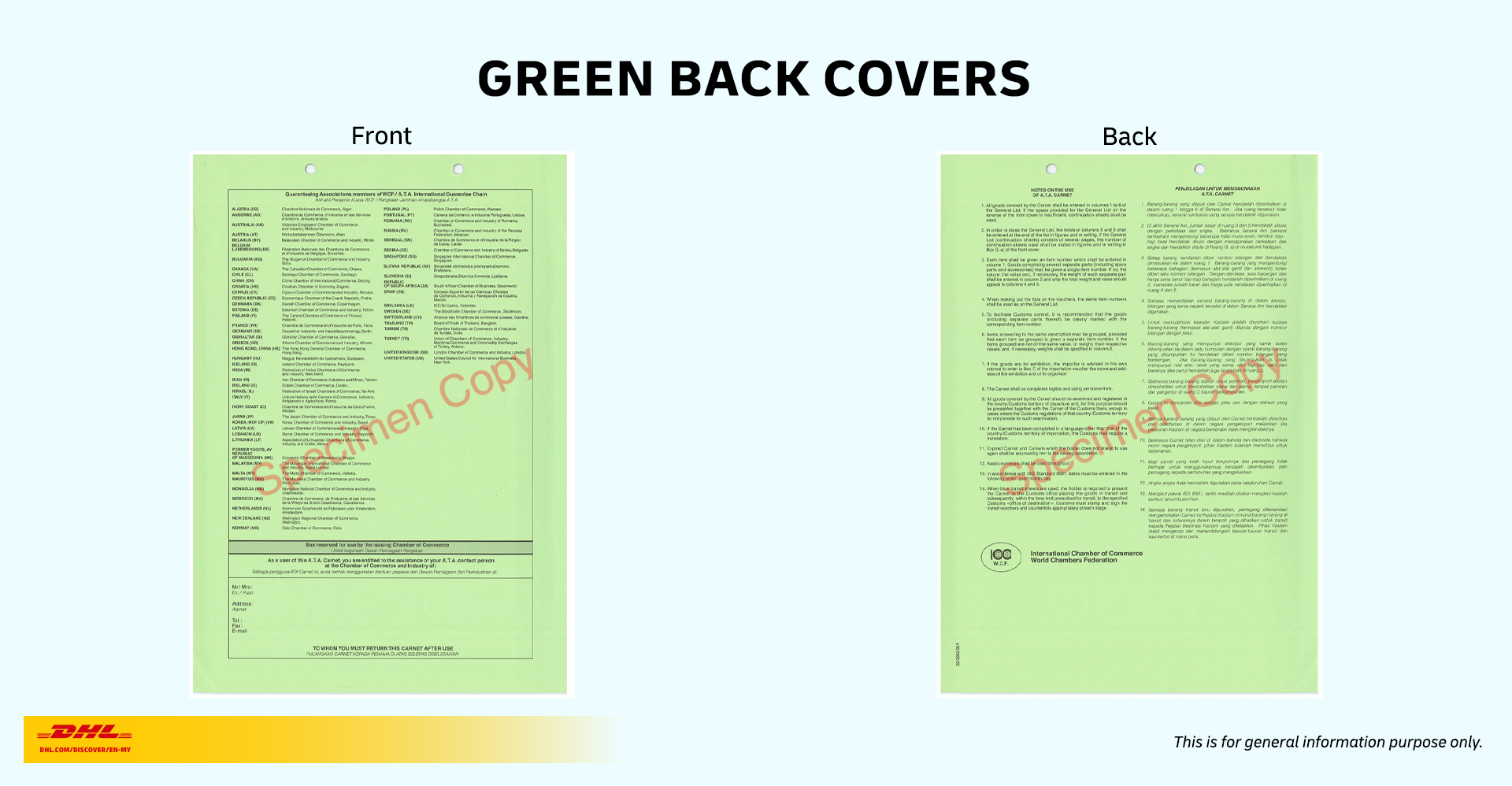

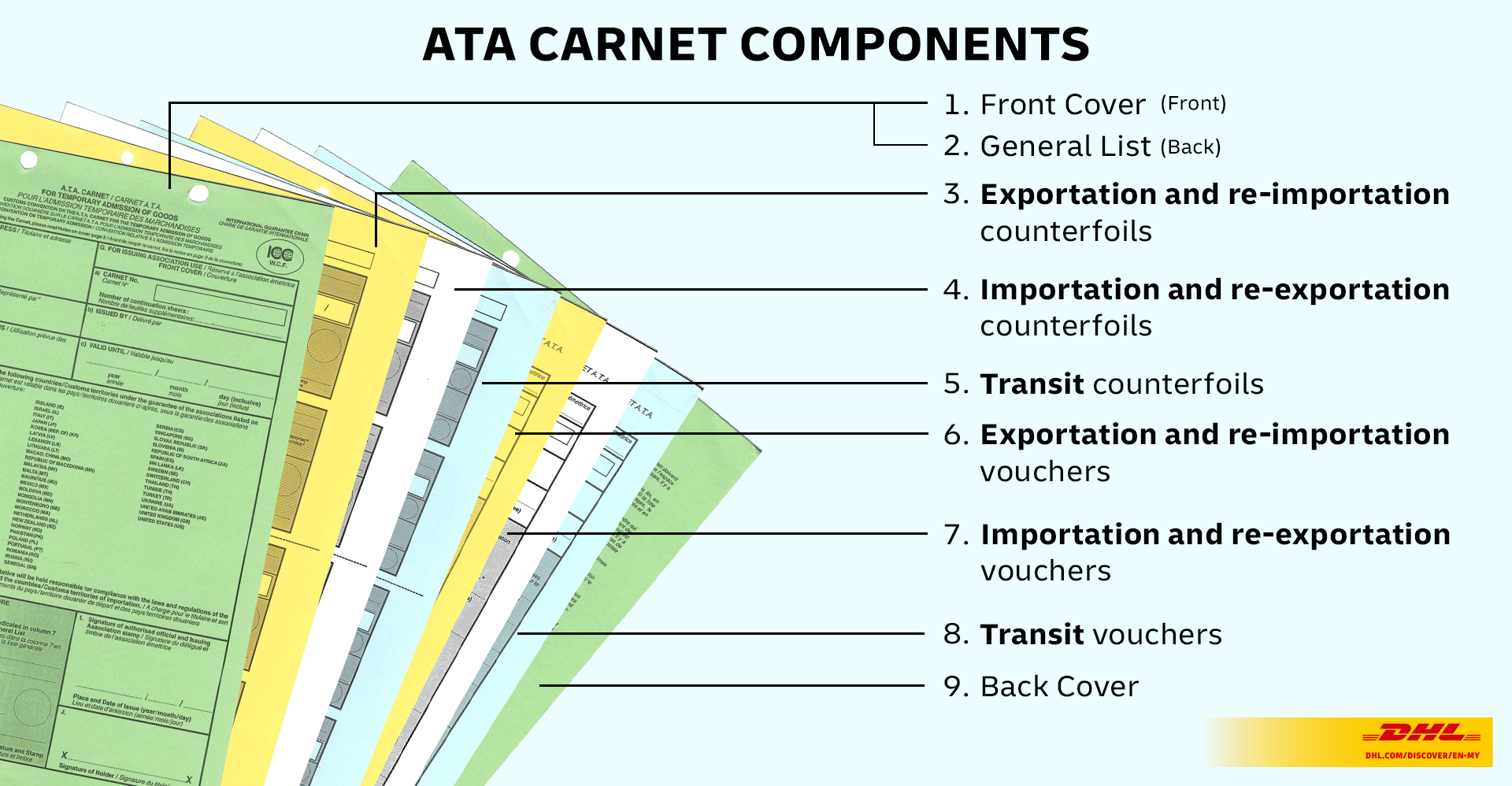

The Carnet consists of 2 major components: covers and counterfoils and vouchers, with each having its distinct function essentials for the effective use of Carnet.

The front green cover acts as the main page of the Carnet, encompassing vital information including:

This page must be signed by the Carnet holder or an authorised representative and validated by Malaysian Customs for initial departure.

Conversely, the back green cover contains “Notes on the Use of the Carnet.”

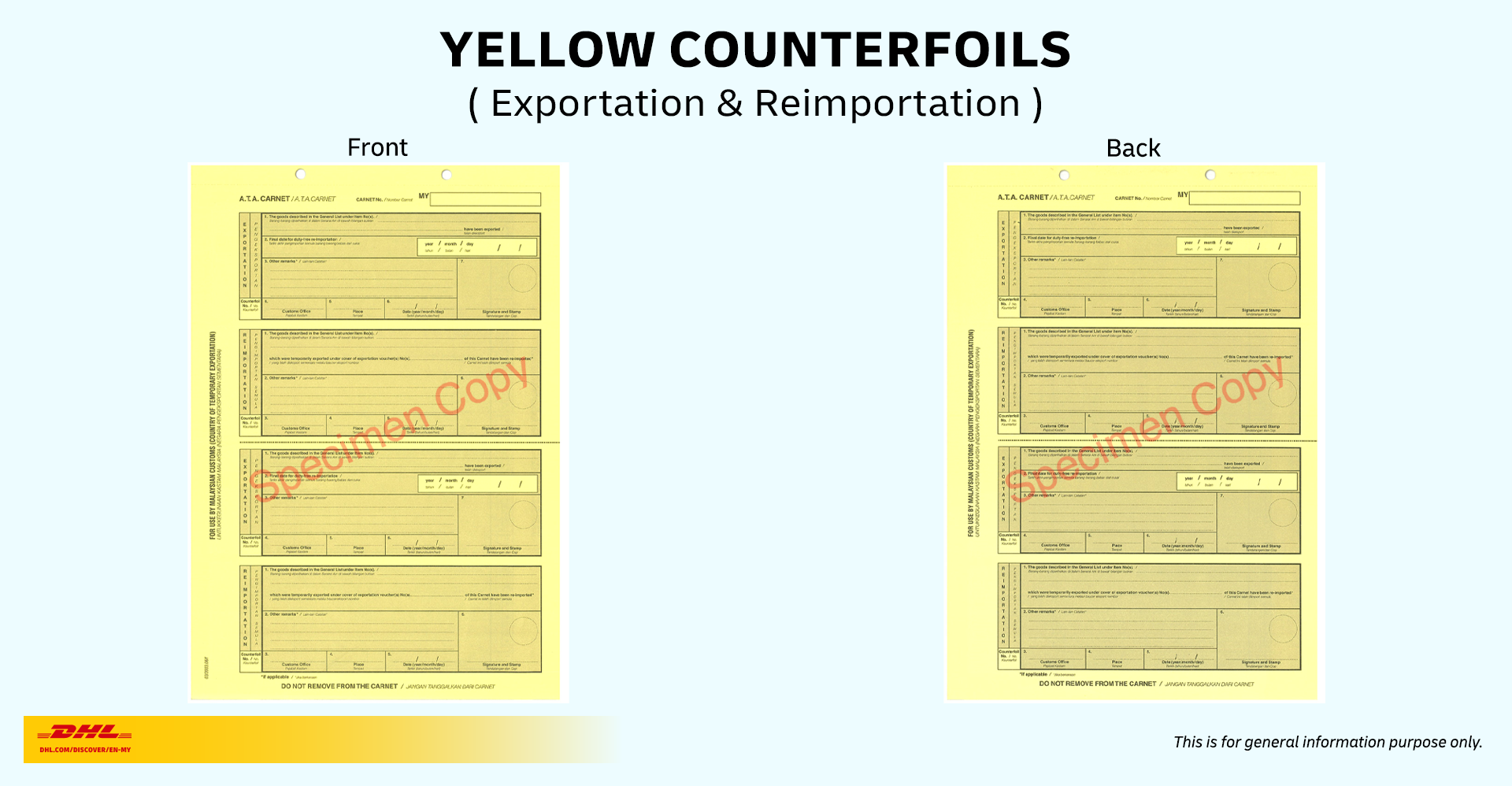

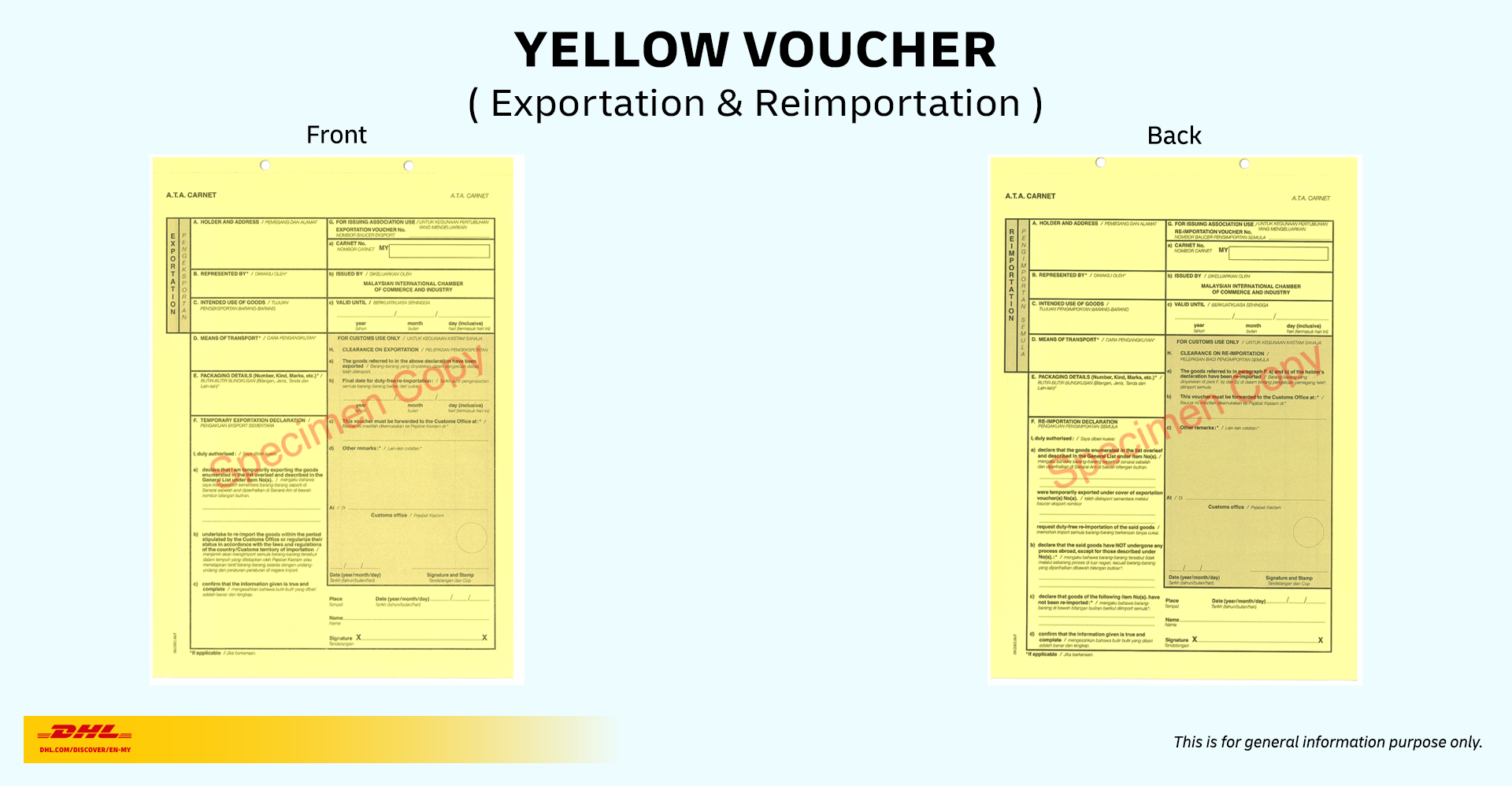

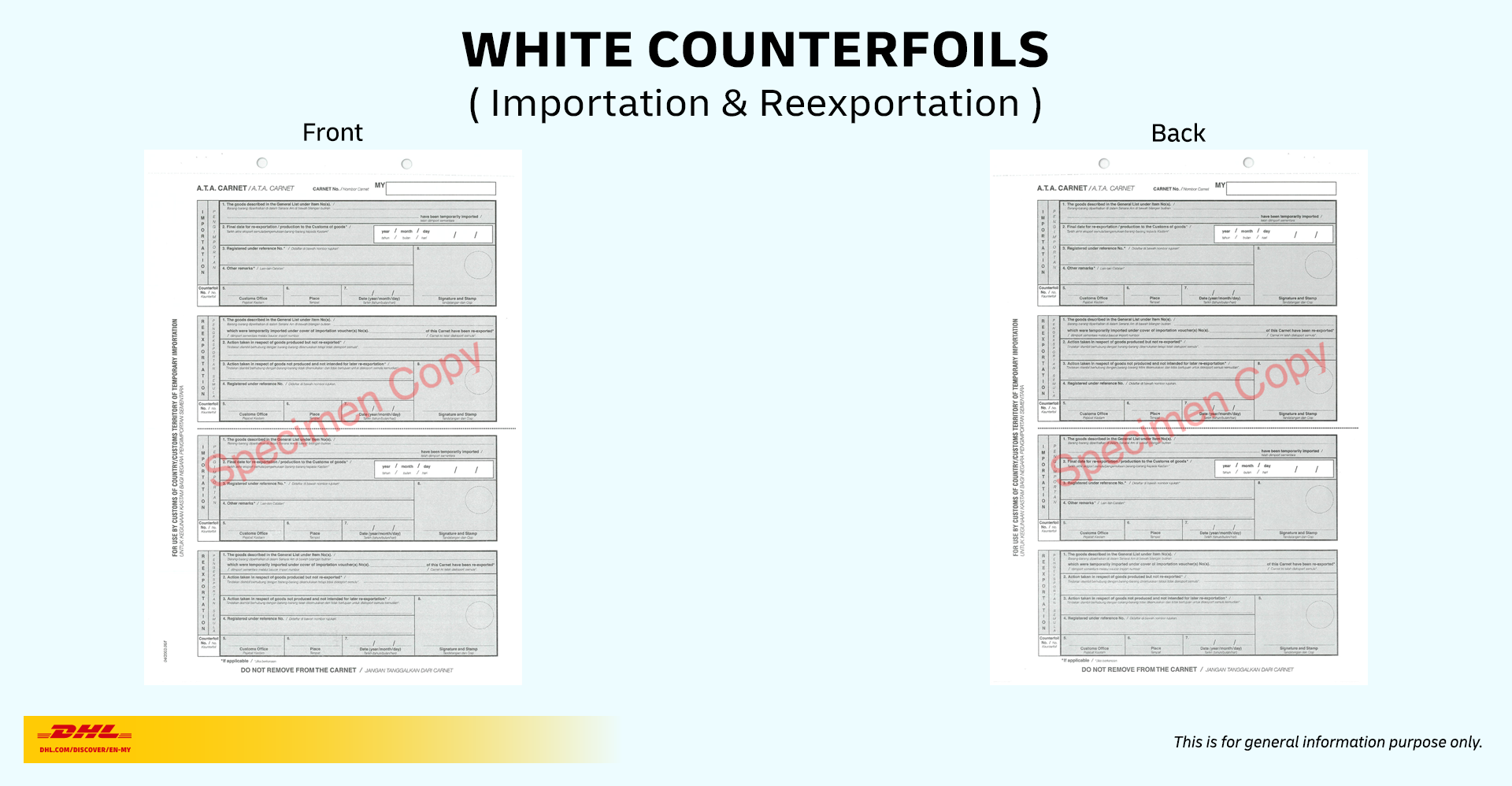

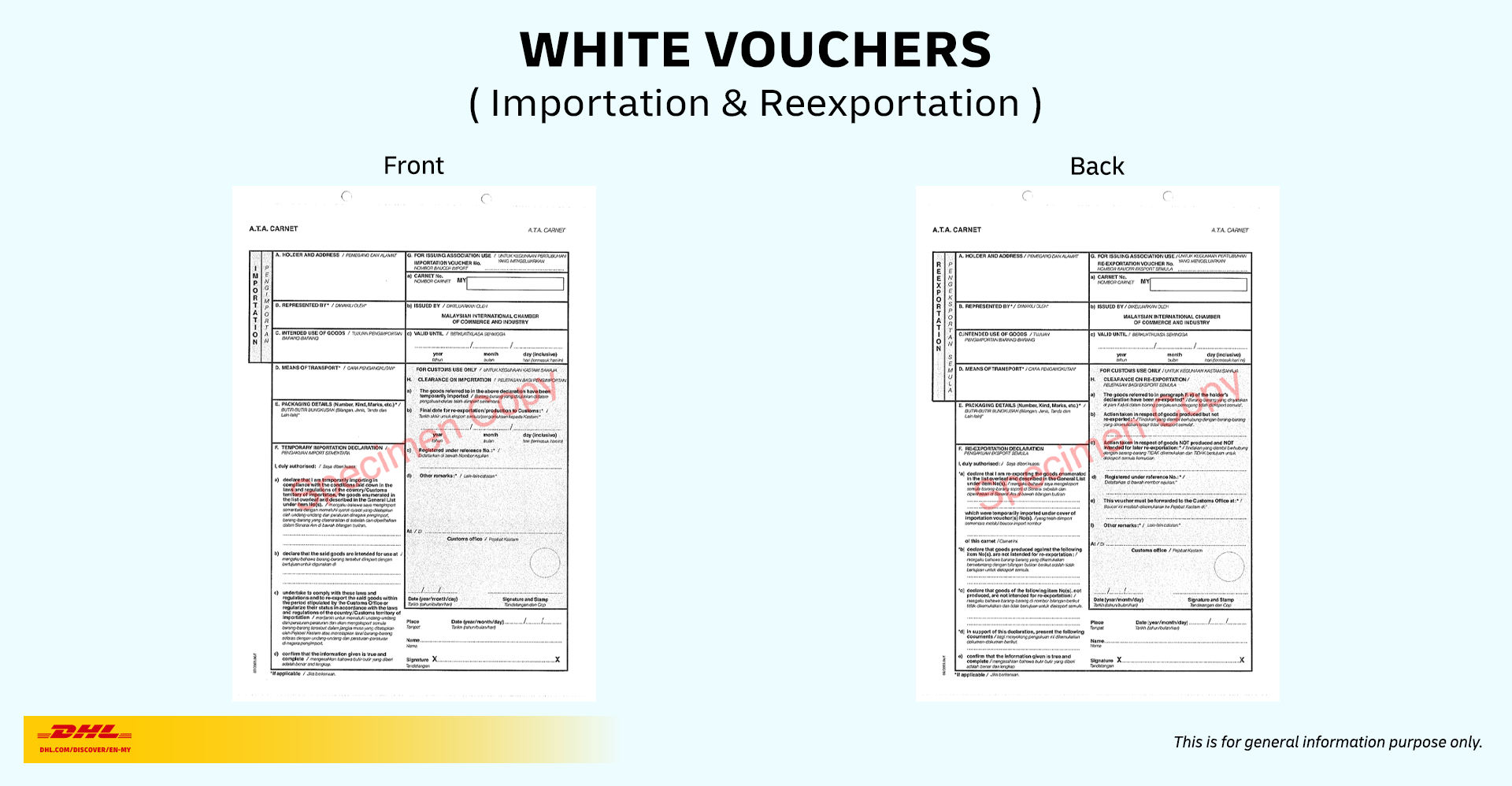

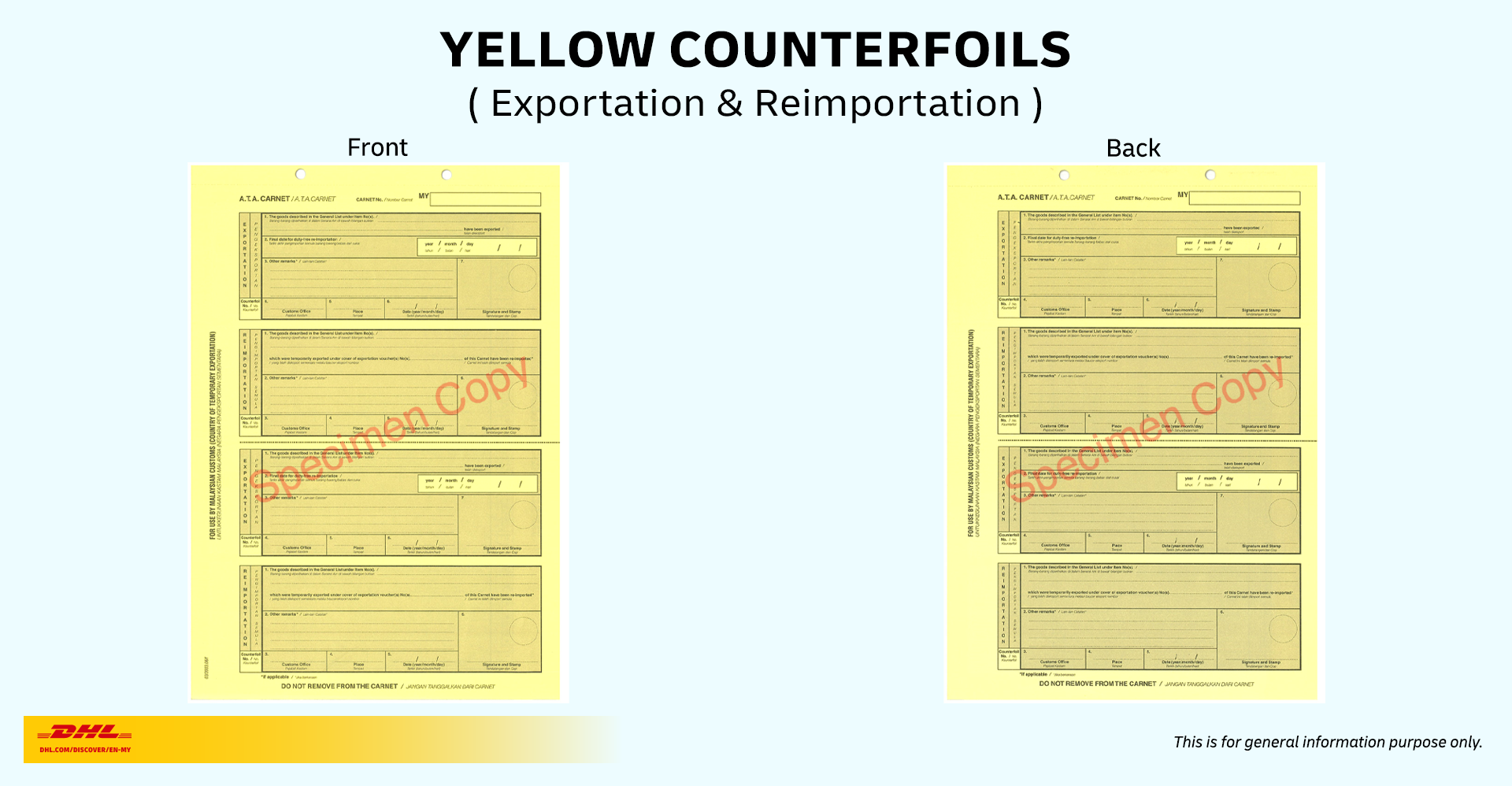

Within the Carnet, both counterfoils and vouchers serve as control documents, issued in pairs and color-coded. They contain records of all destination countries involved in a specific Carnet.

Counterfoils act as the Holder's records of customs validation, securely remaining inside the Carnet throughout the journey.

In contrast, vouchers are Customs' records of customs validation. They will be extracted and retained by the customs authorities of the country of origin or the destination during customs clearance.

In an ideal Carnet shipment tour, counterfoils are the only documents left at the end of the journey when the shipment returns to its country of origin.

Colour | Usage |

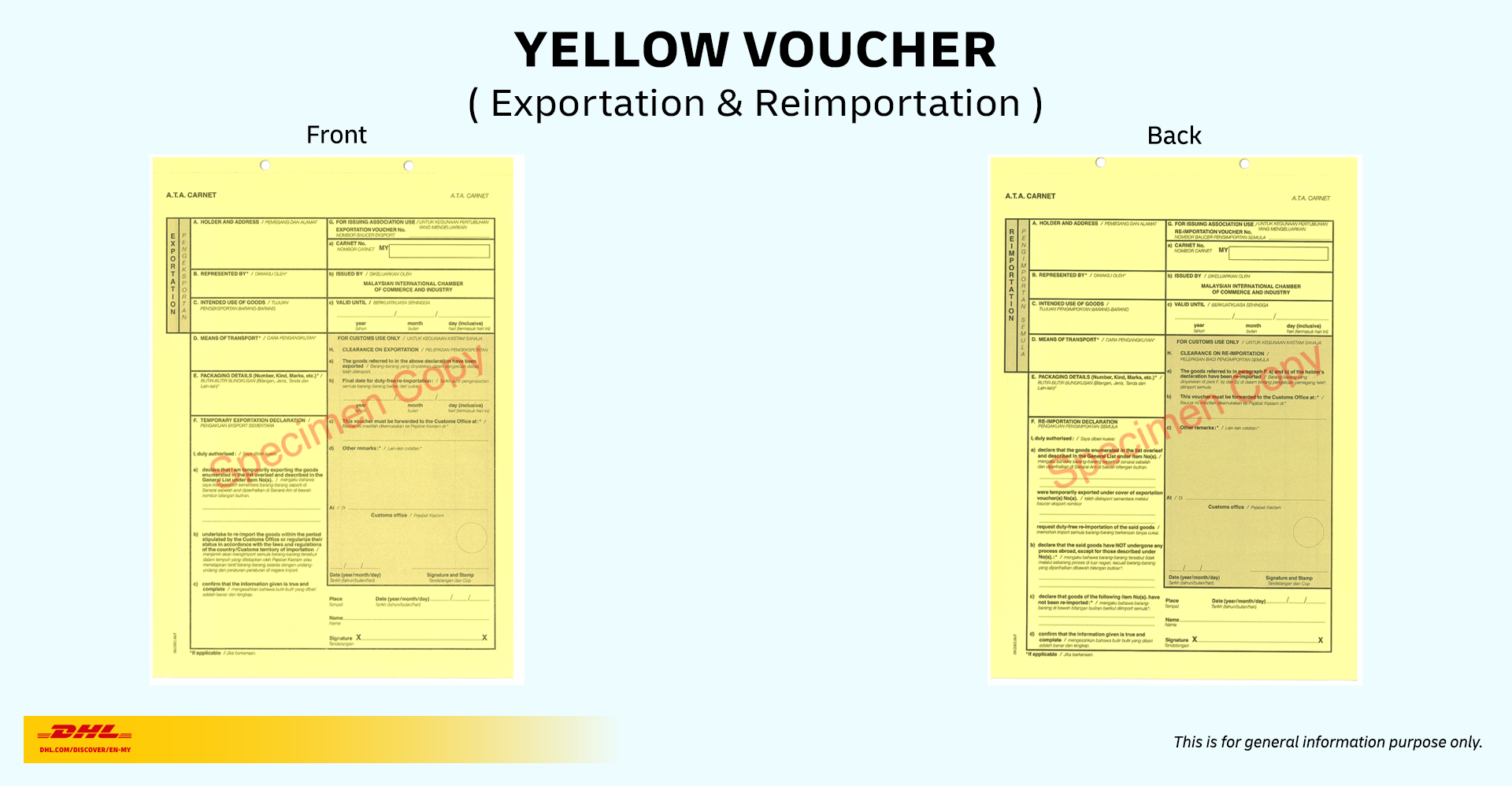

Yellow counterfoils and vouchers | Exiting from and returning to Malaysia |

White counterfoils and vouchers | Entry into and departure from foreign countries |

Blue counterfoils and vouchers | Transits (used when goods are transported by land and must pass through or stop in a country that lies between the country of departure and the next country of entry) e.g. leaving Austria to go to Italy, but passing through or stopping in Sweden. |

The ATA Carnet document remains valid for one year from the date of issue, providing Carnet holders with the flexibility to temporarily export goods to various countries throughout its validity period.

However, the duration allowed for the goods to remain in each foreign country varies. For instance, Mexico, China, and Singapore typically impose a maximum entry period of six months. It's important to note that this limitation applies to each specific entry and does not affect the expiration date of the ATA Carnet as a whole.

When ATA Carnet shipments from other countries enter Malaysia, they are granted a validity period of three months from the date of entry. Goods must be re-exported within this timeframe unless an extension is obtained.

To request an extension, Carnet holders must submit the application at least one month before the initial temporary permission expires. This only applies to goods that are still within their overall Carnet validity period.

To initiate the temporary export using ATA Carnet, there are 2 parties involved:

Carnet Holder:

The Carnet Holder is the entity responsible for any duties, taxes, or penalties if the goods are not re-exported from the foreign country within the required timeframe.

The Holder's information is listed in box A on the Carnet Green Cover.

Authorized Representative:

The Authorized Representative is an entity or individuals authorized by the Holder to submit the ATA Carnet application on their behalf and/or to present the Carnet to customs on their behalf.

Usually, this is where the freight forwarder or customs broker is listed in box B on the Carnet Green Cover.

The ATA Carnet application process is conducted by the Carnet Holder or an authorized representative. Here are the steps involved:

Purchase the Carnet form at any MICCI Branch office for RM 20 per set.

Prepare 2 copies of supporting documents:

Proforma invoice

Packing list

F.1, F.4, F.5 and F.7 forms

Letter of invitation/confirmation of participation (for exhibitions).

Ensure your Carnet form is typed with your information. Handwritten copies will be rejected.

Each Carnet can be used up to a maximum of 8 entries to a foreign country. Confirm the number of country entries in the application and pay RM50 per country during the application.

Submit the completed documents at any MICCI Branch office for processing.

All applicants need to pay for processing fee and security deposit.

1. Processing fee

The fee rate depends on the time it takes to process the application.

The below rates include 1 entry to a foreign country. For additional entries, you will be charged RM50 each and only allow for a maximum of 8 entries per Carnet document.

Processing time | Rate | Fees (RM) |

3 days | Member* | 550.00 |

Non-member | 700.00 | |

1 day | Member* | 650.00 |

Non-member | 800.00 | |

Half day | Member* | 800.00 |

Non-member | 950.00 |

Note: *Member rate applies to members of MICCI/DPMM/ACCCIM/MAICCI/FMM.

There are 4 methods of payment:

Online transfer (preferred)

Bank draft

Company cheque

Debit/credit card/e-Wallet (over-the-counter purchase only)

2. Security deposit

The amount of the security deposit is determined by whichever is higher: 50% of the value of goods covered by the Carnet or equal to the highest rate of duty and taxes applicable to the goods in any country of destination and transit.

There are 3 methods of payment:

Online transfer (preferred)

Bank draft

Bank guarantee (applicable only for amounts exceeding RM20,000 and must be valid for a minimum of 31 months from the date of issue)

MICCI will not release your carnet until all documents are complete and the required fees have been paid. Make sure all documents and payments are in order to avoid delays in issuance.

Contact MICCI’s Processing Department to confirm whether your carnet is ready, depending on the processing time chosen.

Phone: 03-6201 7708,

Email: carnet@micci.com

Once confirmed, collect the carnet from the Mont’ Kiara office.

As the Carnet holder/representative, you must clear the goods with Malaysian Customs authorities.

If the goods are numerous or complicated, a Customs inspection may be arranged before the date of departure.

The temporary exportation follows the same procedure as normal export except the ATA Carnet document is used for Customs endorsement in place of Customs documents.

The front green cover must be completed, signed, and stamped by Malaysian Customs, as indicated in the "Certificate By Customs Authorities" column.

Also, ensure that the yellow exportation voucher and counterfoil are completed, signed, and stamped by the Holder/Representative and Malaysian Customs.

Once the goods arrive in the foreign country, the Carnet holder/representative must present the ATA Carnet document and comply with any additional customs requirements.

The white importation vouchers and counterfoils must be completed, signed, and stamped by the Holder/Representative and customs authorities of the country.

Importation and Re-exportation Counterfoil:

After the goods have been used or exhibited in the foreign country, there are 2 routes to consider:

Importing the goods to the next country: Repeat the actions taken in Step 5.

Re-importing the goods back to Malaysia: The yellow re-importation voucher and counterfoil must be completed, signed, and stamped by the Holder/Representative and the Malaysian Customs.

When re-importing the goods back to Malaysia, it's important to inform the original station of entry if re-exporting is done through a different station of exit. This ensures smooth coordination between customs authorities and avoids any potential complications.

The deposit will be refunded when the Carnet is returned to the MICCI and found to be correctly discharged. To be eligible for a refund, all counterfoils and any unused vouchers must be returned intact within the front and back covers (green) of the Carnet. It's important to note that any used vouchers will have been retained by the relevant customs authorities.

If the Carnet is not returned by the stipulated date, customs duties and taxes will be deducted from the deposit based on the most updated customs import rate.

To conclude, throughout the ATA Carnet process, the responsibilities for customs clearance and paperwork are primarily handled by the Carnet Holder or their authorized representative. Whether you are an event organizer, exhibitor, or any other party involved in the ATA Carnet process, you can rest assured that the necessary customs procedures will be managed by the Carnet Holder. This allows you to focus on your specific role and responsibilities, such as accepting the goods once they arrive, while the Carnet Holder takes care of the customs clearance and paperwork involved in the temporary import and export of goods.

1. The Carnet must accompany the shipment at all times.

2. Customs officers will stamp the counterfoil when the shipment enters and exits a country.

3. A voucher will be removed from the Carnet during this process.

4. The same process will need to be done for the goods exiting the country. Customs will physically inspect the shipment.

5. After inspection, the ATA Carnet counterfoil and the remaining voucher (certificate sets) will be reattached to the shipment.

Temporary Import:

ATA Carnet:

Rock band world tour with show dates in ASEAN countries like Singapore, Thailand, and Indonesia.

Malaysian batik clothing brands participating in fashion shows in Europe, including France, the United Kingdom, and Spain.

An F&B company exporting their machinery to international halal food expos and trade fairs in Japan, China, Australia, and the United Arab Emirates.

It is advisable to provide specific descriptions on the General List to avoid customs issues.