All You Need to Know About Import Duty in Thailand

Malaysian imports into Thailand skyrocketed by 28.4% to 60.77 billion between 2021 and 2022. This signals a strong demand for Malaysian imports and makes it an attractive location for Malaysian businesses to expand into.

To start importing into Thailand, let’s first understand Thailand’s import taxes and duties

Types of Duties and Taxes

There are 3 types of duties and taxes levied on imported goods into Thailand.

Customs Duties

In Thailand, Customs Duties are determined using specific values or ad valorem rates, ranging from 0% to 80%, with the higher rate being applied. Since both Malaysia and Thailand are WTO members, they share the benefit of enjoying the most favorable tariff rates available under the MFN principle.

The MFN rate varies by product. In 2020, the average of MFN rate applied on Malaysia imports was 10.2%.

Here's the average rate of MFN for 2 different categories of products:

- Agricultural products: The average MFN applied tariff rate for agricultural products was 29.3%.

- Non-agricultural products: The average MFN applied tariff rate for non-agricultural products was 7.1%.

Additionally, Thailand has made a tariff commitment in the World Trade Organization (WTO). 75.2% of products' tarriff are bound, which means the tariff rate for these products will not exceed the rate agreed. The average bound tariff rate in the WTO is 28%.

Value Added Tax (VAT)

Thailand imposes a 7% VAT on all imported goods, including those valued at THB 1,500 or less, effective from 5th July 2024 until 31st December 2024.

Previously, imported goods under THB 1,500 were exempt from VAT, giving foreign sellers an advantage over domestic Thai businesses who had to charge VAT.

The new policy ensures all purchases in Thailand, local or imported, are subject to the same 7% VAT.

Excise Tax

Thailand levies Excise Tax on imported goods considered ‘luxuries’. Excise Tax is calculated based on an ad valorem basis. A percentage of the suggested retail price (SRP) and/or specific rates based on the quantity or weight of goods. Here's the table of the the taxable goods and services:

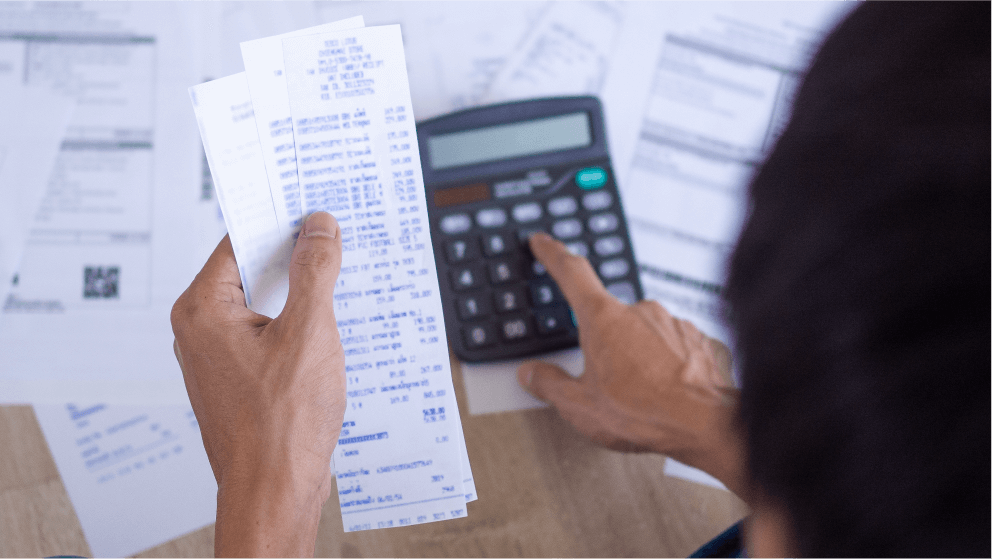

Calculating Duties and Taxes

Despite having 3 types of duties and taxes enforced, imported goods entering Thailand that are not considered luxuries are only subjected to customs duty and VAT.

Nonetheless, it's crucial to know the calculation of each duty to stay vigilant on how you're charged.

Calculating Customs Duty

To calculate customs duty, begin by identifying the Harmonised System (HS) codes of your goods, which can be found on the official site of Thai customs. Then, use the HS code to locate the tariff rates,which may follow either an ad valorem or specific rule.

Let's say if you're sending 2000 units of umbrella that worth BHT 100 each with an ad valorem rate of 100%. This is how the calculation looks like:

Calculate the total value of shipment

2,000 umbrellas x BHT 100 = BHT 200,000

Calculate CIF

BHT 200,000 + BHT 1,000 (insurance and freight cost) = BHT 201,000

Calculate Payable Duty

BHT 201,000 x 100%(ad valorem rate) = BHT 201,000

As conclusion, the customs duty applies on this shipment is BHT 201,000.

Calculating VAT

To calculate VAT, multiply the value of goods by the VAT rate.

Extending from the previous example of 2000 units umbrella worth BHT100 each, this is how the calculation look like:

Calculate total shipment value

2000 x BHT 100 = BHT 200,000

Calculate the VAT

BHT 200,000 x 7% = BHT 14,000

In this case, the VAT payable is BHT 14,000 for 2000 umbrellas worth BHT 100 each.

Calculating Excise Tax

The calculation for excise tax is divided into 4 parts:

Duties Exemption

Although there are no Free Trade Agreements between Malaysia and Thailand, both countries benefit from lower tariff rates under the Most Favoured Nation (MFN) principle of the World Trade Organization (WTO).

With the duties threshold set at THB 1,500, Thailand exempts customs duty for imported goods valued under THB 1,500.

Other than this, all imports are subject to duties and taxes based on their respective assigned rates.

Payment Method

There are 4 ways to pay import duties and taxes in Thailand:

In-person at the Customs Department

Payment can be made at the cashier located at the port of entry.

Upon payment, Thai Customs will issue a receipt for cargo inspection and release. Payments can be made in either cash or by check.

Accepted checks include:

Bank of Thailand (BOT) checks

Cashier’s checks

Checks with banks’ surety bonds

Drafts or Bills of Exchange

Electronic Fund Transfer via BAHTNET (Bank of Thailand Automated High-value Transfer Network)

Since January 1, 1998, importers have the convenience of paying customs via the BAHTNET system directly from their bank accounts:

Electronic Payment at Krung Thai Bank (Teller Payment System)

If you opt for this payment option, follow these steps:

Complete a duty Payment Form attached to Customs Notification No 77/2543 (with a duplicate copy)

Submit the form and payment at any branch of Krung Thai Bank to the Customs Department’s account (Customs Branch)

The bank will return the duplicate with a payment confirmation number to the importer. Each transaction incurs a bank fee of TBH 30.

Include the payment confirmation number on the first page of the Import Declaration submitted to Customs cashiers for the payment receipt used in cargo inspection and release.

Electronic Fund Transfer (EFT) via Electronic Data Interchange (EDI)

Here is how you pay through this method:

Tax/duty payers instruct their broker banks to electronically transfer payments to the Customs bank.

The broker bank assigns a Transaction Number to the payer and transfers the payment to the Customs bank upon receiving electronic payment authorisation.

Once full payment is received via EFT, the Customs bank electronically transmits payment details to the Customs Department, referencing the Transaction Number.

The payer also sends payment information electronically to the Customs Department using the Transaction Number.

The Customs EDI system cross-checks the received payment information from both the payer and the Customs bank against the Declaration.

If all information matches, the Customs Department sends an electronic message to the payer, instructing them to collect the payment receipt for cargo inspection and release.

There's no doubt that shipping to Thailand can be a complex process, primarily due to the intricacies of its import duties and tax requirements, particularly its excise tax.

This intricate tax structure can be a challenge, even for experienced shippers.

To avoid any shipping hiccups, consider partnering with DHL Express to ensure no complications with your shipping journey to Thailand as we have over 50 years of experience shipping internationally. With millions of packages delivered every single day, DHL Express proves to be a reliable logistics provider for your needs.

Create a DHL Express account today and we ensure your shipment’s journey to Thailand will be smooth as silk.

Thai Import Duties

Do I have to pay duty on items shipped to Thailand?

Yes, all imports value above THB 1500 (approx. MYR 198/200/ USD 44/46) are subject to duty.

Following the de minimis rules, with THB 1500 as the de minimis threshold, duties are incurred on anything above THB 1500, while goods below THB 1500 are exempt from duties.

How is import duty calculated in Thailand?

To calculate Thailand's customs duty for your shipments, multiply your shipment CIF value by duty rate.

This is how the formula looks like:

CIF Value × Duty Rate = Duty Amount

CIF value is the sum total of your shipment value and insurance and freight cost.

To determine the duty rate of your goods, check using its Harmonized System (HS) code.

How much can you import to Thailand without paying duty?

If the total value of your shipment – calculated based on its cost, insurance and freight (CIF) – is less than the de minimis value of THB 1,500 (approx. MYR 198/200/ USD 44/46), you are exempt from paying import taxes.

Who pays import duty in Thailand?

Import duties can be paid by either the sender or the receiver.

Typically, import duties are paid by the receiver, but the sender can choose to pay in advance

For DHL Express customer, this can easily be done through your DHL account.

Thai Import VAT

What is the import VAT rate in Thailand?

As of July 2024, the value-added tax (VAT) imposed on shipments entering Thailand is 7%.

Are there any exemptions to VAT for goods valued at THB 1,500 or less?

The only exemption to VAT is for document (DOX) shipments.

All other goods valued at THB 1,500 or less is subject to the 7% VAT when imported into Thailand.

Are there any changes to customs duties for goods valued at THB 1,500 or less?

No, there are no changes to customs duties.

Goods valued at THB 1,500 or less will continue to be exempt from customs duties.

Will VAT apply to all shipments under THB 1,500, whether personal or business?

Yes, a 7% VAT will be applied to all shipments valued at or below THB 1,500, whether they are personal or business.