Grow your business with the Discover newsletter

Logistics advice & insights straight to your inbox

Subscribe now

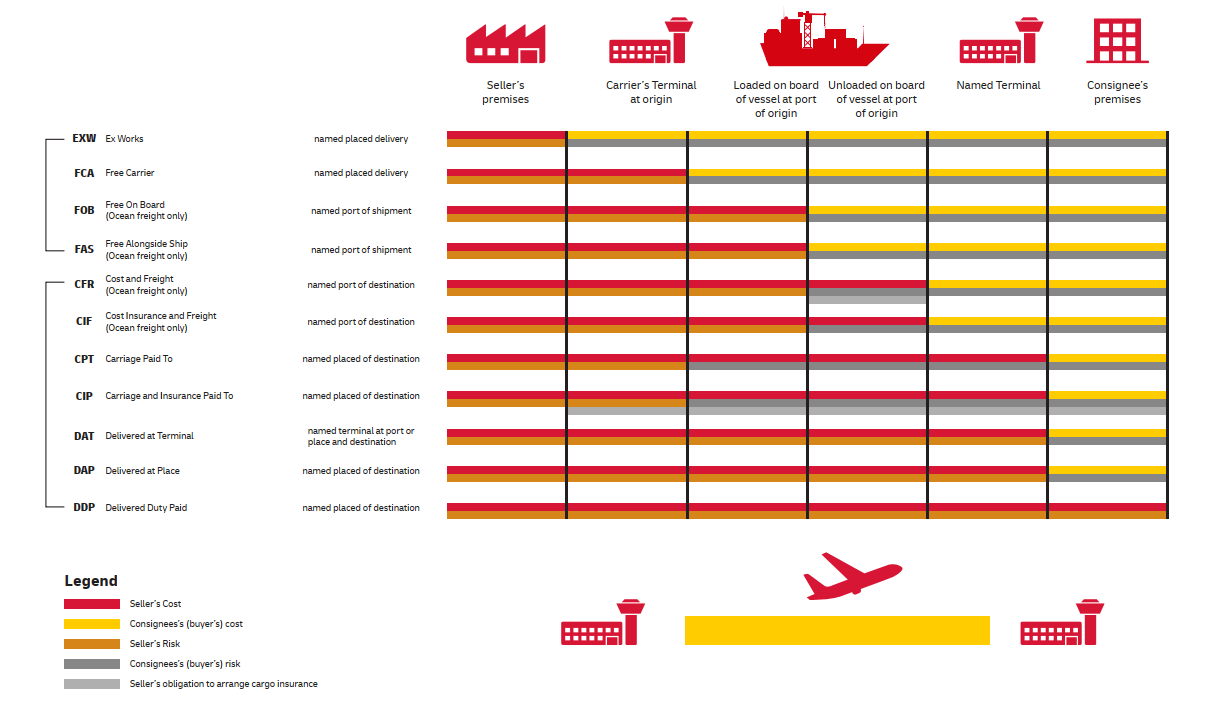

The Incoterms, or International Commercial Terms is a set of rules that outline the responsibilities and risks to be placed on the seller and receiver during an international trade process.

The diagram below will help you understand the responsibility between the seller and the buyer throughout the entire shipping process, from customs clearance and shipping insurance to exporting of courier services. Bear in mind that incoterms also has specific mode of transport that it covers and also Incoterms such as DDU is being replaced by a new term in compliance to INCOTERMS 2010.

Incoterms stated in the invoice is used for Customs Valuation Purposes. For importation into Malaysia, Cost Insurance and Freight (CIF) is being used.

Some customers may not have in depth knowledge of Incoterms or in certain situation the shipment is to be shipped by sea however due to urgency the mode of transportation is change at the last minute. FOB value is referred to by customs as the value agreed between buyer and seller as per item value stated in the invoice. This means that the value of Insurance and Freight has to be added in to determine the Customs Value.

There is a possibility of the above happening if the IATA TACT Rate value is higher than the stated freight value or the shipping cost stated is too low.

IATA TACT Rate is an annual shipping rates extracted from IATA TACT website to determine the shipping value based on the origin and weight of the shipment. This rate is agreed annually between Customs and the Express Companies in Malaysia in reference to the IATA TACT website. The rate table is updated at the back end of our DCE system and may only be shared to customers upon request.

FCA in incoterms is short for “Free Carrier”. It is the seller's responsible for export clearance and delivery of goods to the carrier at the named place of delivery.

Unless otherwise agreed upon, the seller is only responsible for loading the goods if the seller’s place of business is the named place of delivery.

DAP in Incoterms is short for "Delivered At Place". It states that the seller is responsible for arranging carriage and for delivering the goods, ready for unloading from the arriving means of transport, at the named place.

The seller assumes all risks involved up to unloading. Unloading is at the buyer’s risk and cost.

DDP is short for "Delivered Duty Paid". It states that the seller assumes all responsibilities and costs for delivering the goods to the named place of destination. The seller must pay both export and import formalities, fees, duties and taxes.

The buyer is free of any risk or cost until the goods are unloaded from the vehicle at the named place of destination, usually the buyer’s place of business.

EXW is short for "Ex Works".. It states that the seller is expected to have the goods ready for collection at the agreed place of delivery.

The buyer is accountable for all subsequent costs and risk, including all export procedures, starting with loading the goods onto a transport vehicle at the seller’s premises.

FOB is short for “Free on Board”. It states that the seller clears the goods for export and ensures they are delivered to and loaded onto the vessel for transport at the named port of departure.

The buyer takes over risk and costs, including import clearance and duties, as soon as the goods are loaded onto the transport vessel at the port of departure.