6 Payment Gateway Essentials for eCommerce

In today's rapidly growing e-commerce market, businesses must be equipped with the right tools and strategies to stay ahead of the curve. One crucial aspect of your online success is selecting the most suitable payment gateway for your checkout process. It is the backbone that enables smooth and secure transactions, keeping your customers happy and returning for more. However, with a myriad of options available, from Stripe to PayPal, how do you determine the best fit for your business in Malaysia?

This article will guide you through the top factors to consider when selecting a payment gateway for your e-commerce business.

1. Security and fraud prevention

Ensuring the security of customers' sensitive information is a primary concern for any e-commerce business. As such, choosing a payment gateway that prioritises security and fraud prevention is essential.

Look for a payment gateway provider that adheres to the latest security standards, such as the Payment Card Industry Data Security Standard (PCI DSS) compliance. Payment gateways must comply with this set of security requirements for safeguarding cardholder data. Compliance with PCI DSS ensures that the payment gateway follows best practices for data storage, encryption, and security protocols, thereby reducing the risk of data breaches and fraud.

On top of that, seek a provider that comes with built-in fraud prevention tools to detect and prevent fraudulent transactions. Some of the commonly used fraud prevention tools include:

Address Verification System (AVS): AVS is a tool that verifies the billing address provided by the customer against the address on file with the card issuer. This helps in identifying potential fraudsters who may have stolen card information but do not have access to the correct billing address.

Card Verification Value (CVV) checks: CVV is a 3-digit or 4-digit security code found on the back of a credit or debit card. By requiring customers to provide the CVV during checkout, payment gateways can ensure that the person making the transaction has physical possession of the card, reducing the likelihood of fraudulent transactions.

3D Secure: With 3D Secure, customers must authenticate themselves with their card issuer before completing a transaction, typically through a one-time password (OTP) sent or an authentication app on their mobile devices. This feature can substantially decrease the risk of unauthorised transactions and chargebacks, providing a more secure payment experience for both you and your customers.

2. Transaction fees

When comparing payment gateway options, it is important to understand the transaction fees associated with each provider. Most payment gateways charge a percentage of each transaction, and some may also include a fixed fee per transaction. These fees can vary widely depending on the provider, the type of transaction, and the volume of transactions your business processes.

When evaluating payment gateway providers, take some time to grasp the full cost of using their services. This includes not only the transaction fees but also setup fees, monthly fees, and any additional charges that may apply. Understanding the complete pricing structure allows you to make an informed decision and select a payment gateway that aligns with your business model and budget.

3. Payment types

Additionally, take into account the types of payments you want to accept in your e-commerce business. Malaysia has a diverse range of preferred payment methods, including credit and debit cards, e-wallets, and bank transfers. To accommodate a wide audience, your chosen payment gateway should support an array of payment options, both local and international.

For instance, choosing a payment gateway like Stripe can be beneficial as it supports an extensive range of payment methods, including major credit cards, e-wallets, and popular Malaysian payment solutions like Financial Process Exchange (FPX) and GrabPay. Consequently, leveraging an international payment gateway can significantly contribute to your business’ growth by allowing you to accept payments from customers in various countries and currencies.

4. User experience

In addition to this, your payment gateway should also provide a quick and easy checkout process that minimises friction and encourages customers to complete their purchase. Look for a payment gateway that offers a responsive design, ensuring that your checkout process is optimised for both desktop and mobile devices.

Moreover, evaluate the payment gateway's capacity to support convenient features such as one-click payments, guest checkouts, and stored payment methods for returning customers. Implementing these functionalities can significantly decrease cart abandonment rates while improving customer retention. By providing a seamless and user-friendly checkout experience, you can effectively boost customer satisfaction, loyalty, and overall online sales.

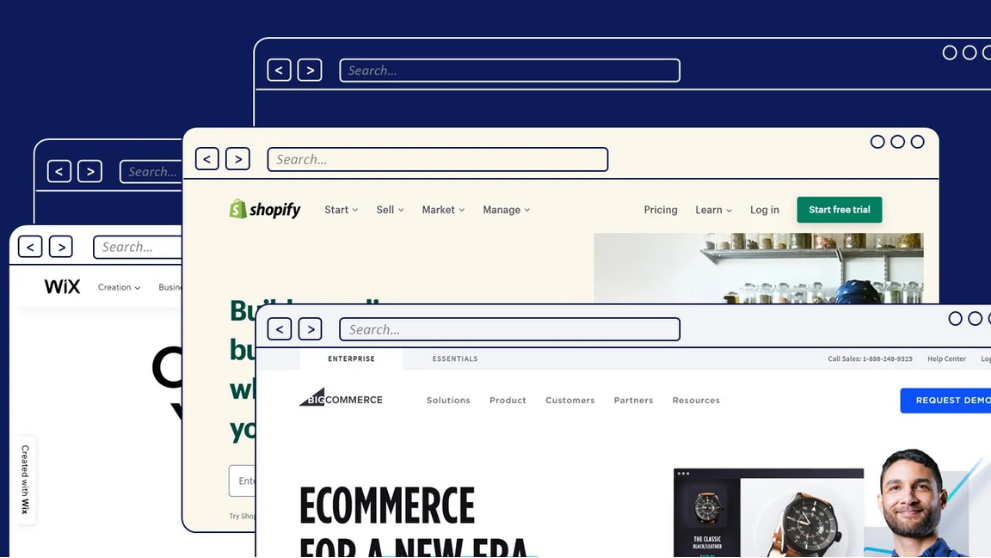

5. Integration and compatibility

It is also worth considering the ease of integration when selecting a payment gateway. It is essential to choose a payment system that can be easily integrated with your e-commerce platform, shopping cart software, and other tools your business relies on.

Research how compatible a payment gateway is with your existing systems and whether it offers plugins, extensions, or Application Programming Interfaces (APIs) for seamless integration. Payment gateways, like Stripe, provide extensive documentation and pre-built integrations for popular e-commerce platforms such as Shopify, WooCommerce, and Magento.

6. Customer Support

Finally, the quality of customer support provided by your payment gateway provider can make a difference in how quickly and efficiently you resolve payment-related issues. Before committing to a payment gateway provider, be sure to research their customer support options, such as availability of live chat, phone support, and email support.

Additionally, consider their hours of operation and response times, particularly if you operate in different time zones or have customers overseas. You can also check out their support resources like Frequently Asked Questions (FAQs) and help centres, which can provide quick and useful information to address common payment issues. Opting for a provider with a strong reputation for customer support can save you time and effort in the long run, allowing you to focus on growing your e-commerce business.

Grow your e-commerce business

Overall, choosing the right payment gateway is crucial for setting your e-commerce business up for long-term success. By considering the above-mentioned factors, you can make an informed decision that drives growth and customer satisfaction. If you want to learn more about creating a positive customer experience, you can also get tips on improving the user interface on your online store.