International shipping documents required for exports

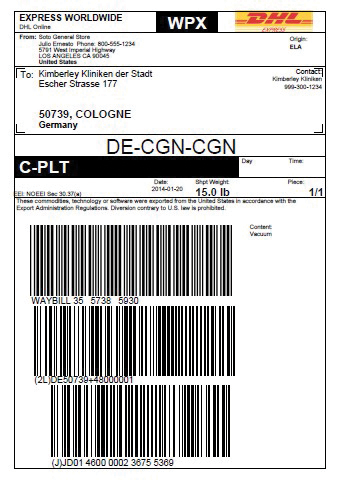

DHL Express Waybill – required for all shipments

Your waybill contains all the information DHL needs to know to keep your shipment moving. All DHL online shipping solutions make it easy to prepare your international shipment. By creating your waybill online you will have visibility to missing or incomplete information, as well as be advised of applicable DHL services.

To create a waybill you’ll need the following information

- Receiver’s information

- Shipper’s information

- Full description of shipment:

- Goods

- Quantities of each

- Shipment details:

- Total number of packages in the shipment

- Total (sum) weight of the shipment

- Shipment dimensions

- Services:

- Transit service

- Optional services

- Shipment Value Protection

- Payment information:

- DHL services

- Destination duties/taxes

- Non-document (dutiable) shipment information:

- Value of items shipped in U.S. dollars (Must match the value indicated on the commercial invoice)

- Schedule B Number/HTS Code (This is a predetermined unique number for export)

- When required:

- Export License No./Symbol

- Receiver’s VAT/GST or shipper’s Employer Identification Number (EIN) Individual shippers may use a Social Security Number

- Electronic Export Information (EEI)

Commercial Invoice – for dutiable shipments

A commercial invoice is the first international document that you prepare as an exporter. The commercial invoice serves as a bill for the goods from the importer to the exporter, and is evidence of the transaction.

Additionally, the importer uses the commercial invoice to classify the merchandise so that they can get the shipment cleared through customs and make sure that all duties and taxes have been accurately assessed.

GOOD TO KNOW

You can effortlessly create a Commercial Invoice when you prepare your electronic waybill with DHL tools.

A commercial invoice requires the following information:

- Your official company letterhead

- Sender’s full name and address, including postal code

- Sender’s telephone, fax or mobile number and VAT number

- Receiver’s complete address details for the recipient of the shipment, including telephone, fax or mobile numbers

- Invoice date

- Waybill number

- DHL as the carrier

- Shipper’s invoice number

- Sender’s reference

- Recipient’s reference

- Total quantity for each item

- Country of origin for each item

- Full description of the goods

- Customs commodity code for each item

- Unit weight

- Unit value of each item

- Subtotal of each item

- Net weight for this shipment

- Shipment gross weight

- Total number of shipment pieces

- Total value and currency of the shipment

- Freight and insurance charges

- Other charges

- Currency code

- Total invoice amount

- Type of export (permanent, temporary, repair)

- Terms of sale / terms of trade (Incoterms® 2010 Rules)

- Reason for export

- Additional notes

- Complete declaration with your name, company title

- Signature

- Company stamp (if required)

All DHL online shipping solutions make it easy to prepare a commercial Invoice, along with the waybill. Or you can complete a commercial invoice online.

Electronic Export Information – filed for high value shipments

Electronic Export Information (EEI) is an online submission of shipment information to the Census Bureau of the U.S. Department of Commerce to control exports and compile trade statistics. Shipments that require you to file EEI will generate an Internal Transaction Number (ITN) from the U.S. Government.

The following shipments require you to file EEI when:

- The value of an individual commodity exceeds $2,500

- The shipment is traveling under an export license

- The shipment is subject to International Traffic in Arms Regulations (ITAR), but is exempt from license requirements

- The shipment contains rough diamonds

- The shipment is destined to a U.S. Embargoed Country

If your shipment requires you to file EEI to receive an Internal Transaction Number (ITN) from the U.S. Government, you can submit this information directly through aesdirect.census.gov or you can have DHL file an EEI on your behalf (service charge will apply). To make shipping even easier, we handle all the processing on your behalf if the ITN is requested, received and included on your electronic waybill. DHL online shipping solutions that support this service will provide you the option to file your EEI as you create your waybill.