Grow your business with the Discover newsletter

Logistics advice & insights straight to your inbox

Subscribe now

When it comes to shipping goods from one port to another, more often than not, you’ll find your goods being caught up in the tedious customs clearance process. This mostly happens when you are unable to provide complete and accurate customs information. Customs authorities worldwide, regularly review and adjust regulations to enhance transparency and enable a more efficient process. In 2021, Europe Customs Regulatory authorities have brought in three major regulatory changes (i.e. BREXIT, ICS2 and VAT De Minimis Removal). These changes when implemented may result in potential clearance delays, penalties, or even fines by customs authorities if not duly complied.

We have been preparing for these changes and are here to help you understand them so that you can continue to enjoy a smooth shipping process with DHL Express.

Conforming to these upcoming European Regulatory changes will help you to:

Since the United Kingdom has left the European Union on January 1st, 2021, customs declaration is now needed for shipments from the UK to the 27 EU member states and vice versa.

What will you need to provide to DHL Express?

It is basically a security management system for any electronic declaration of goods that are destined for the European Union Customs territory. This regulatory change will lessen security-related risks and potential terrorist threats, such as explosives concealed in these consignments. As of March 2021, every shipper will need to submit certain data elements to be sent to the EU Customs authorities – prior to loading in the country of export on a flight into or transiting the EU, Norway or Switzerland.

What will you need to provide to DHL Express?

Europe will stop De Minimis levels for any imports into the Europe. Currently, no official customs declaration is needed for shipments below EUR 22 (goods value). But, as of July 2021, all inbound Europe shipments below EUR 22 will need a formal customs declaration data.

Please note: In certain European Member States (e.g. Bulgaria), the De Minimis level is €10 instead of €22, while the other European Member States (i.e. Poland, France, Sweden) have already decided to stop the use of this exemption to certain orders or in whole.

What will you need to provide for your EU shipment?

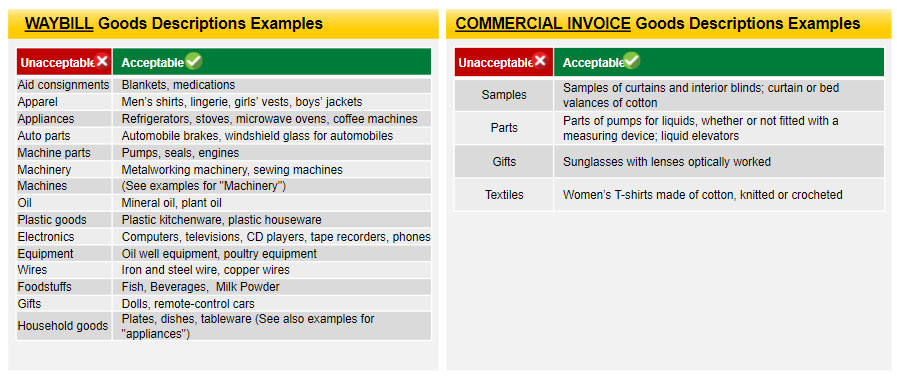

In addition to adhering to these points while shipping goods to Europe, customers also need to make sure that their waybill and invoice contains accurate information of the goods. Here is a list of examples of acceptable and non-acceptable goods description for your waybill and commercial invoice.

Once you’ve made sure that your goods descriptions on the invoice and waybill are complete and accurate, move ahead to transmit them electronically to DHL. Few of the electronic shipping options include:

Further, we have a dedicated site to share more information about all things related to these changes, including detailed examples of acceptable goods description on your AWB and invoice. So, head over here to stay updated