Grow your business with the Discover newsletter

Logistics advice & insights straight to your inbox

Subscribe now

According to CNA, many companies in Singapore have ventured overseas in a bid to expand, as such they export their products internationally to market them. Such moves are largely due to the size of Singapore’s local market, which is unable to sustain the global ambitions of these corporations. One of the main considerations on how to choose the right products to export is to determine the correct target markets for your business. However, before you do that, there are rules and regulations to be adhered to, some of which include:

The Customs Act, Regulation of Imports and Exports Act, Strategic Goods (Control) Act, and the appropriate Competent Authorities (CAs) here in Singapore regulating the exportation of goods from Singapore.

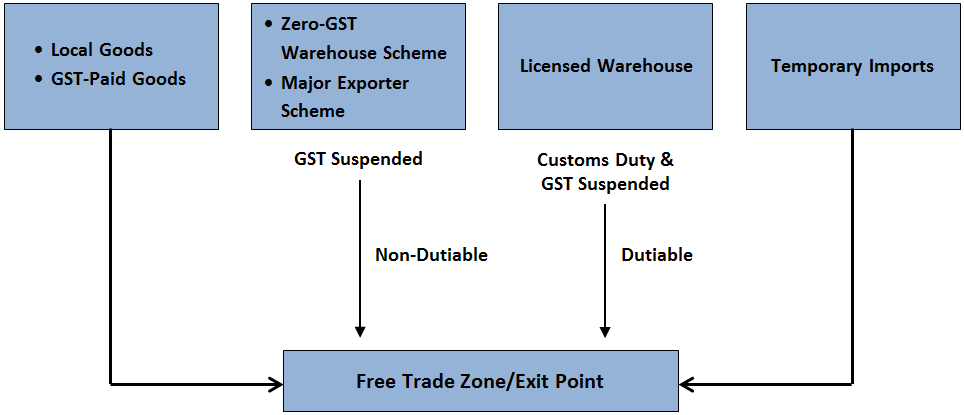

When exporting goods overseas, you’ll need to declare the goods to be exported to the Singapore Customs. Note that the Goods and Services Tax (GST) and duty fees are not imposed on these goods.

The following export trade procedure steps are as listed and to be followed to attain the necessary export permits and authorisation (if these goods are subjected to control) from the Singapore Customs.

The organisation should register with the appropriate Unique Entity Number (UEN) issuance agencies or the Accounting and Corporate Regulatory Authority (ACRA) to activate a Customs Account and obtain a UEN. This is in the event the organisation plans to participate in any importing or exporting activities in Singapore or attain import, export, and transhipment permits and/or certificates.

Here at DHL Express we always advise our customers to examine the merchandise they would like to export, as they might be controlled goods subjected to restrictions by the CAs. This can be done by searching the goods’ description, CA product, or Harmonized System (HS) code. You may wish to check personally with your CAs on their licensing requirements if the product is subjected to restrictions and control.

If you need guidance on the complete 8-digit HS code of the goods, you might want to consider applying for an official classification ruling, which involves a cost of S$75 per product. Do note that the classification ruling is only relevant in Singapore.

You can apply for customs permits on your own or as a proxy for your clients. However, you must register as a declaring agent and apply for a TradeNet User ID or assign a declaring agent for the application of the Customs export permit/s in your place.

These permit applications must be submitted electronically through TradeNet. You may access it through TradeNet’s front-end solution from any approved solution provider or Government Front-End Application. Every permit application is generally priced at S$2.88. You may ask your assigned agent about the charges incurred in obtaining a permit if you engage a declaring agent.

With regards to international customs clearance, it is not a straightforward process. With every country implementing their own set of rules and regulations, compliance must be observed, or companies will run the risk of incurring unnecessary costs or having their shipments detained or confiscated.

This is where DHL Express shines, as one of our greatest strengths is the ability to efficiently clear customs. Deploying an in-house customs clearance team within each country of operation – well-versed with the local regulations and requirements to facilitate smooth clearance, you can be assured that your shipment will be handled by the best in the industry.

Permits that are approved would be issued and given a validity time frame. Doing so would ensure that the validity of the licenses is presented for goods clearance.

For both containerised and conventionalised cargo, you must have the Customs export permit and supporting documents such as the invoice, packing list, and Bill of Lading/Airway Bill, which must be approved. Additionally, it needs to be sent to the checkpoint officers if specified in the permit conditions or if the cargo is dutiable or controlled. Do note that at the juncture of the lodgment of your cargo, you must have the permit number for authentication purposes.

Customs export permits are needed to export chargeable merchandise from licensed and bonded warehouses under the Temporary Export Scheme as well as the return of imported goods.

Remember that it is prohibited for goods with partial clearance to depart from Singapore, specifically via the checkpoints at Tuas and Woodlands. You’ll need to submit a permit application for every container or cargo vehicle.

You must keep the supporting documents that are appropriate linking to the purchases, imports, sales, or exports of goods for five years after the approval date of the Customs permit. You may store these documents in physical hardcopies or as scanned images.

Do note that upon request, you must provide the respective documents to the Singapore Customs.

There are various Singapore overseas expansion grants and resources for firms in Singapore exporting their brand overseas, some of them include the Market Readiness Assistance (MRA) Grant, Internationalisation Finance Scheme for Non-Recourse (IFS-NR), and Multichannel E-commerce Platform (MEP) Programme.

There are various export products that gain the highest dollar value in terms of Singaporean global shipments. These include machinery and equipment (43%), petroleum (19%), and chemical products (13%).

With many companies in Singapore venturing overseas, DHL Express can provide your business with quality logistics and overseas shipping services. As the global leader in the logistics industry, we specialise in international shipping, courier services, and last mile delivery. We are more than happy to export your products and services overseas. Start shipping with us by signing up for a DHL Express account today.