MAKE, MANAGE & PAY FOR YOUR SHIPMENT

Make, Manage and Pay for my Shipments

get connected to the world

with a dhl business account

- Open An Account

- Make, Manage & Pay for my Shipments

- Understand Customs & Regulations

-

Tracking & Maintenance

- Quick Tracking on MyDHL+

- Proactive Tracking on ProView

- Account Access Management with eSecure

- Value-Added Service Options

- Resources to Learn More

1. Shipping for the First Time

Visit here and register for MyDHL+ with your DHL account number.

Register on MyDHL+ with your DHL account number. For DHL Express business account holders, your MyDHL+ login details will be emailed to you.

Create Password

Upon your DHL account setup, a login on MyDHL+ will be automatically registered.

You will just need to activate the login via an email sent to you from dhlSender@dhl.com.

Click on 'Create Password' to activate your login on MyDHL+.

Add Account

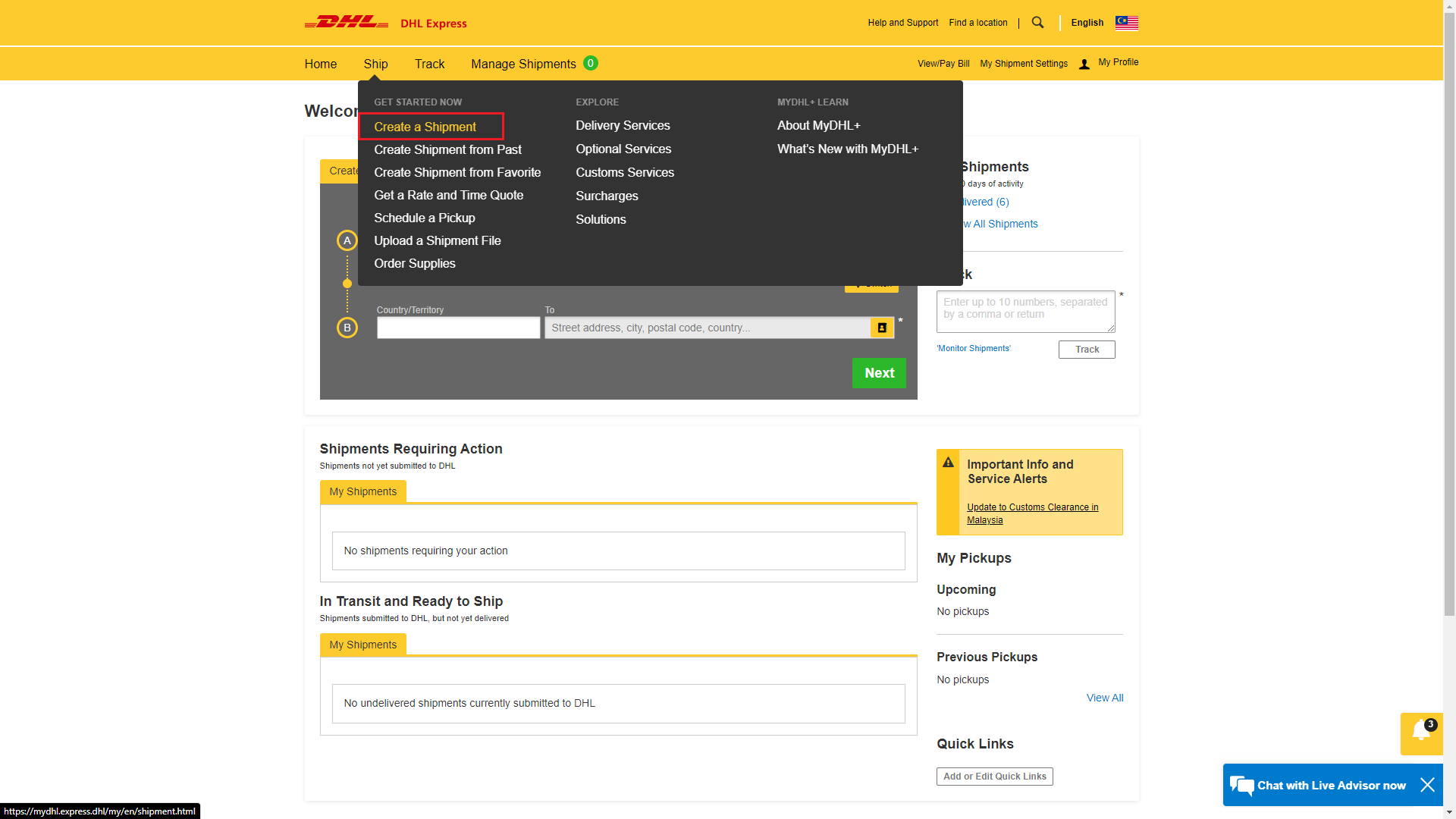

Click on ‘Ship’ then click on ‘Create a Shipment’ to begin

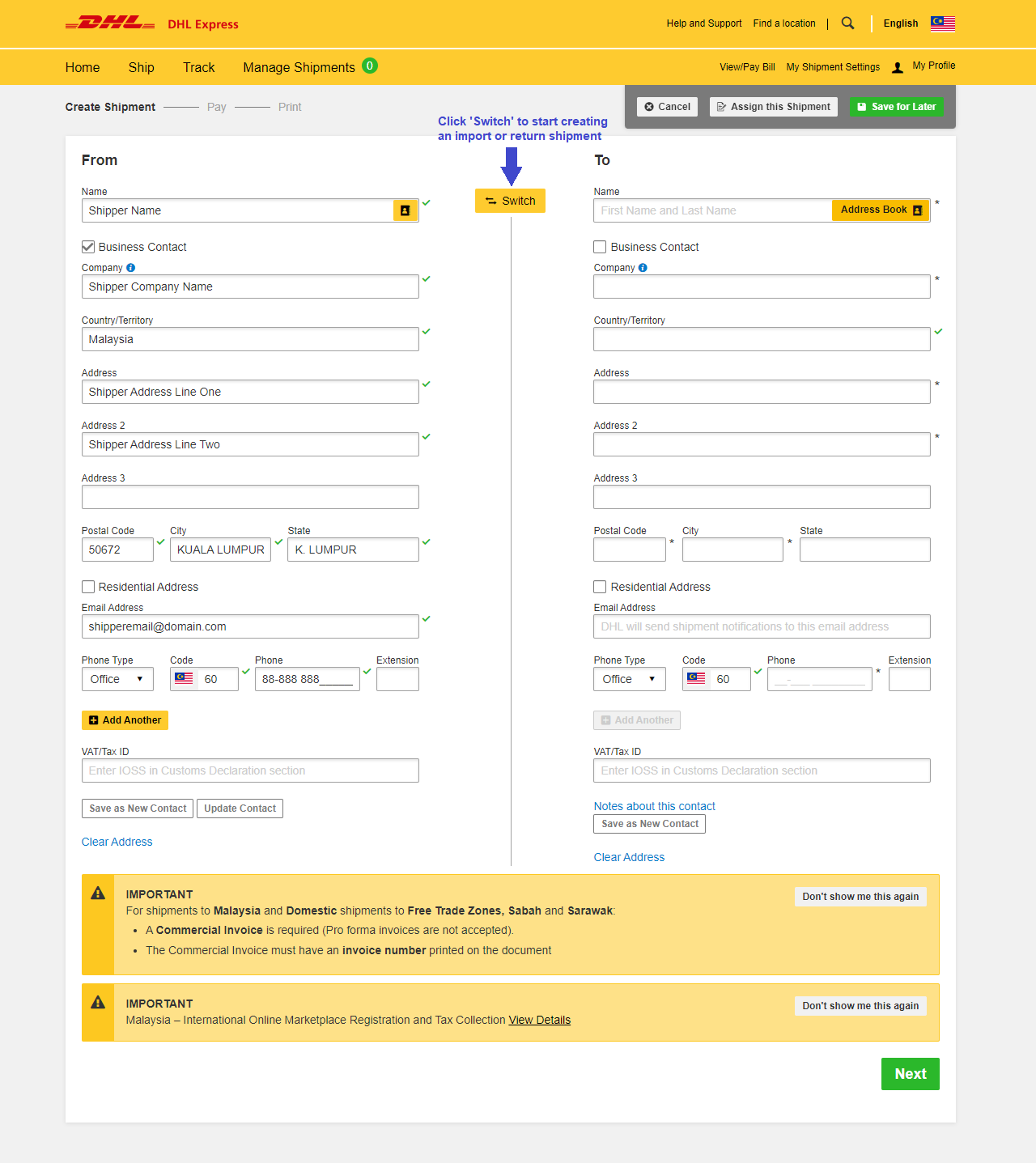

1. Fill in the mandatory columns marked with asterisk (*) symbol.

- The ‘From’ section with your details

- The ‘To’ section with the receiver’s details.

2. Once complete click ‘Next’

- The ‘Business Contact’ tick box under the ‘Name’ field requires the shipper to indicate if the shipper and/or receiver is a business entity

- You may save the receiver address by clicking on ‘Save as New Contact’ and select from the ‘Address Book’ for next shipment.

- If you have a DHL import account, you can create imports from around the world by simply clicking “Switch”.

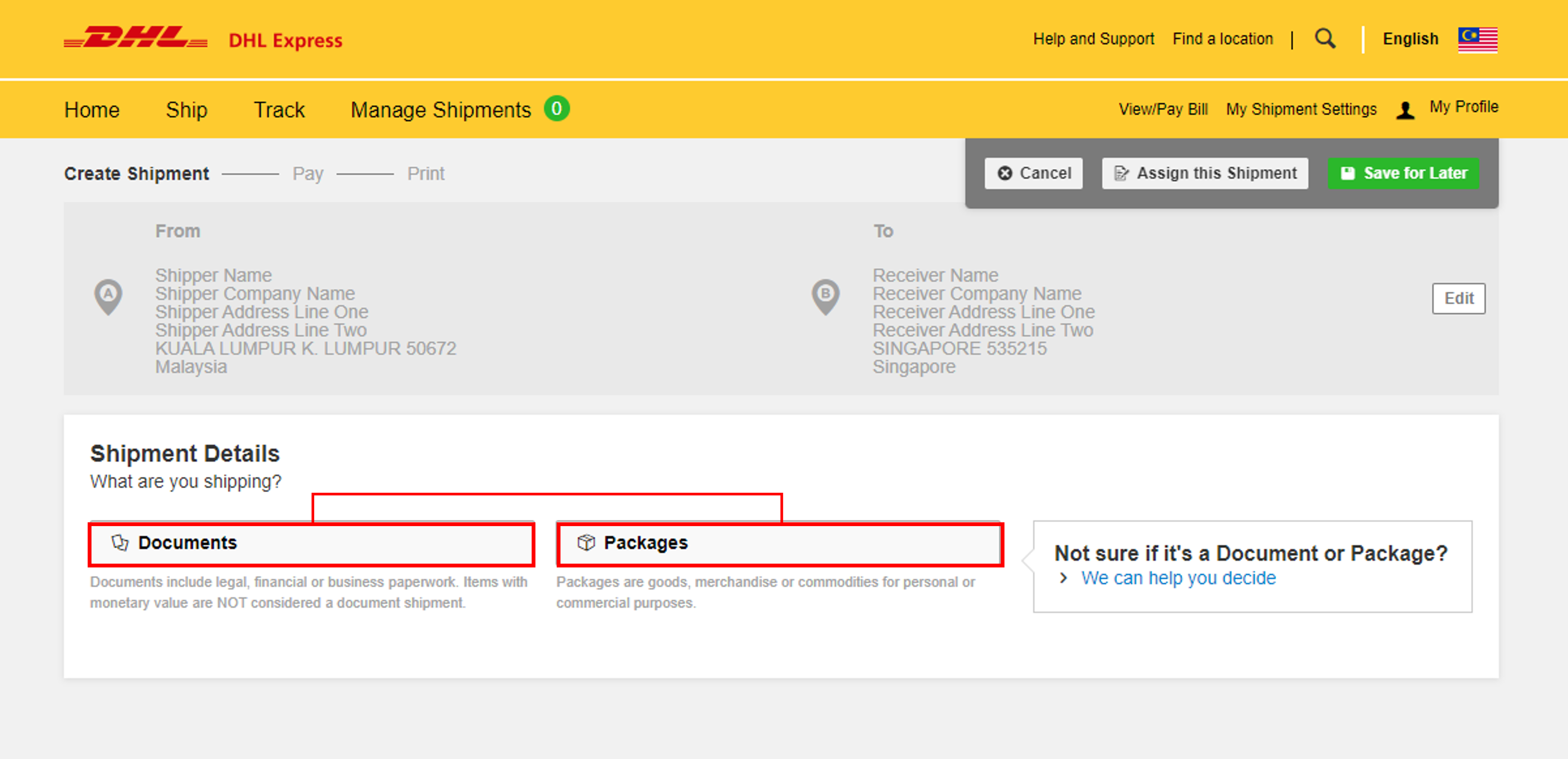

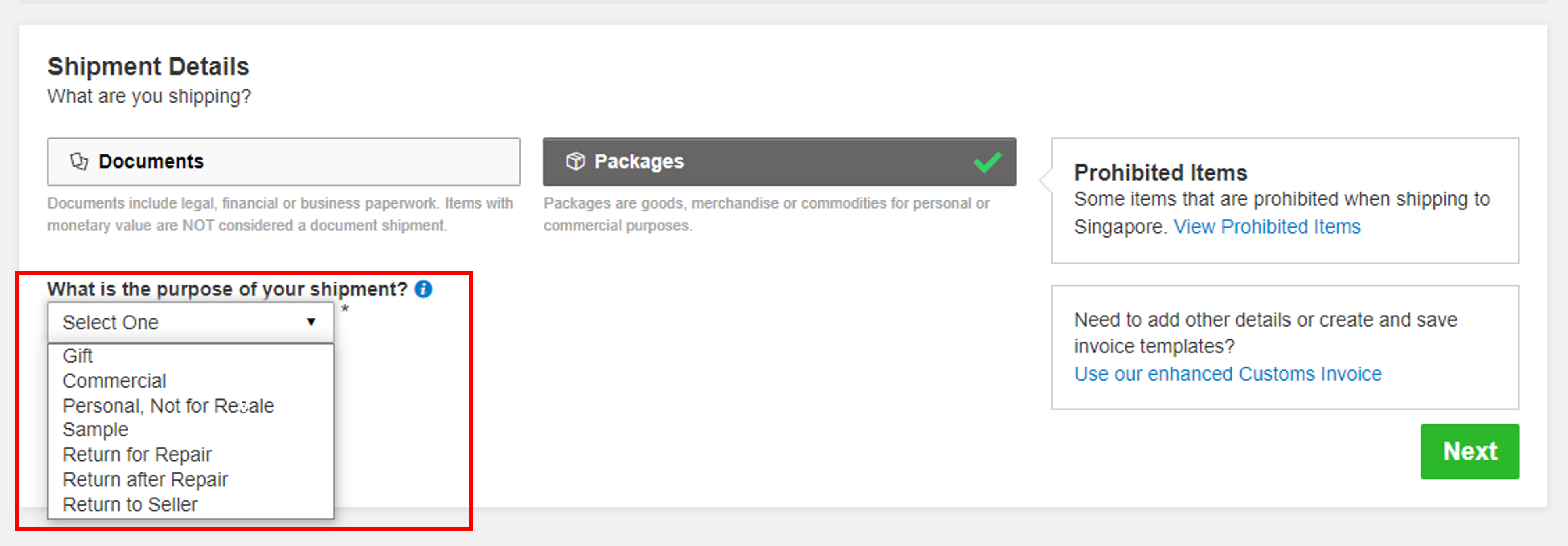

Select either ‘Documents’ or ‘Packages’ according to your shipment type.

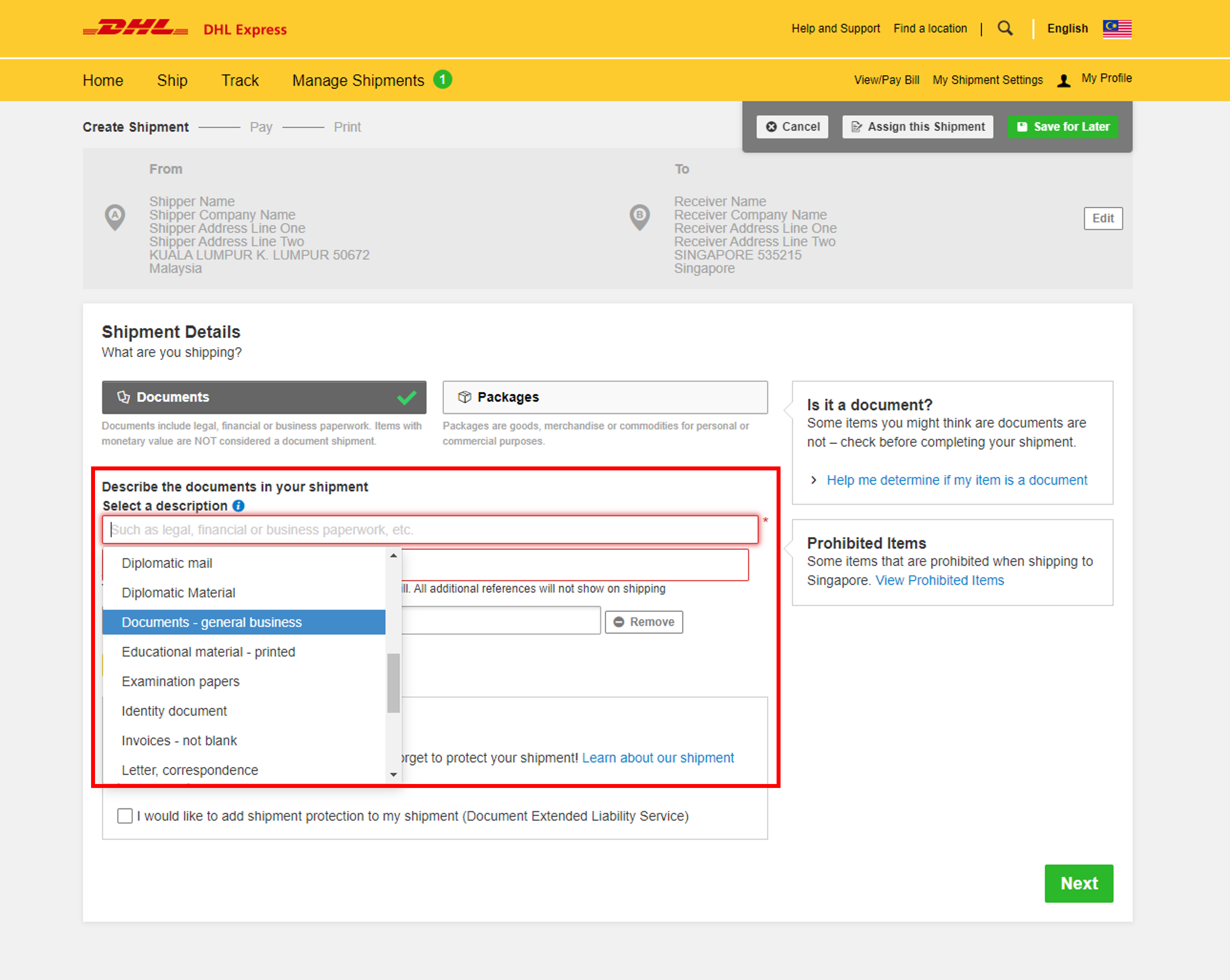

Shipment Details - Documents

Select the document type from the dropdown list available.

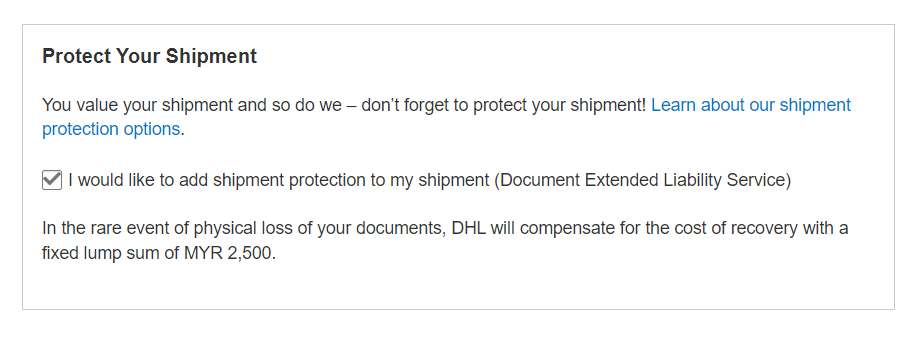

You may also opt to protect your document by selecting the ‘Extended Liability’ insurance service.

- Selection of this is recommended if you are sending valuable documents such as passports, visa applications or regulatory certificates.

- In the event of full or partial loss to a document shipment, a fixed compensation will be paid.

- Charges: MYR 20.00 per shipment

Shipment Details – Packages

For package shipment, please indicate the purpose of your shipment.

- For Repair and Return shipments, please indicate the serial number of the item for K2 declaration.

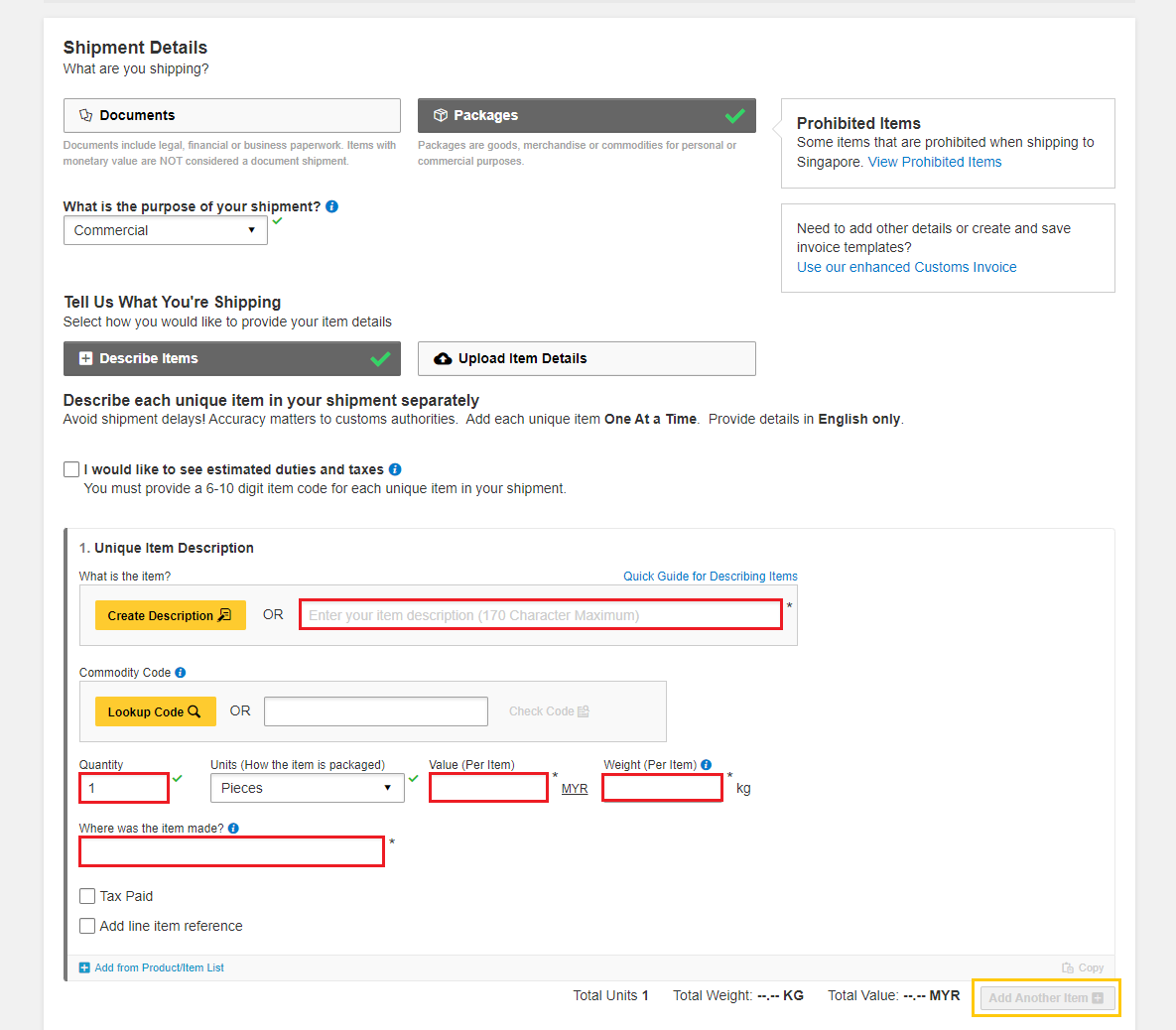

Next, you will be prompted to provide information about the items you are shipping. By entering the list of items in your shipment, this will help customs authorities in classifying your shipment accurately and speed up the clearing of your shipment.

Enter your item details as accurately as possible or you may use the ‘Create Description’ button to help.

- Declare the quantity for each individual items in your shipment and select the units on how it was packed.

- The value per item can be entered up to 5 decimal places (e.g.: 0.00001 MYR)

- To declare in other currencies, click on “MYR” to display the list of currencies available.

- Weight (per item) is up to 5 decimals places (e.g.: 0.00001 kg) excluding any packaging materials

- ‘Where was the item made’ section refers to the country where the item was originally made, grown, or produced. If unsure, please follow the origin country of export.

- Please input the import HS code if available – this field is optional.

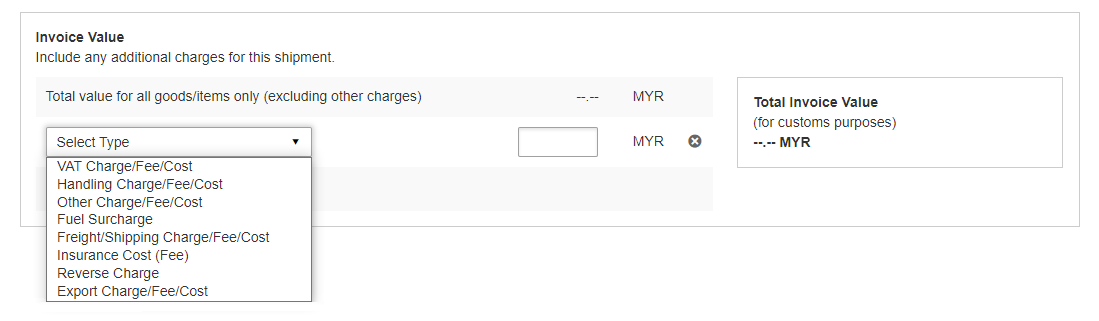

You may indicate additional charges involved in handling your shipment such as handling fee, packaging, insurance, etc. if applicable.

Click on Add Charges and a drop-down will be displayed for you to indicate the type of fees involved. It is important to declare all additional fees that make up the total value of your shipment as it determines how quickly your goods can move through the customs process. This section is optional.

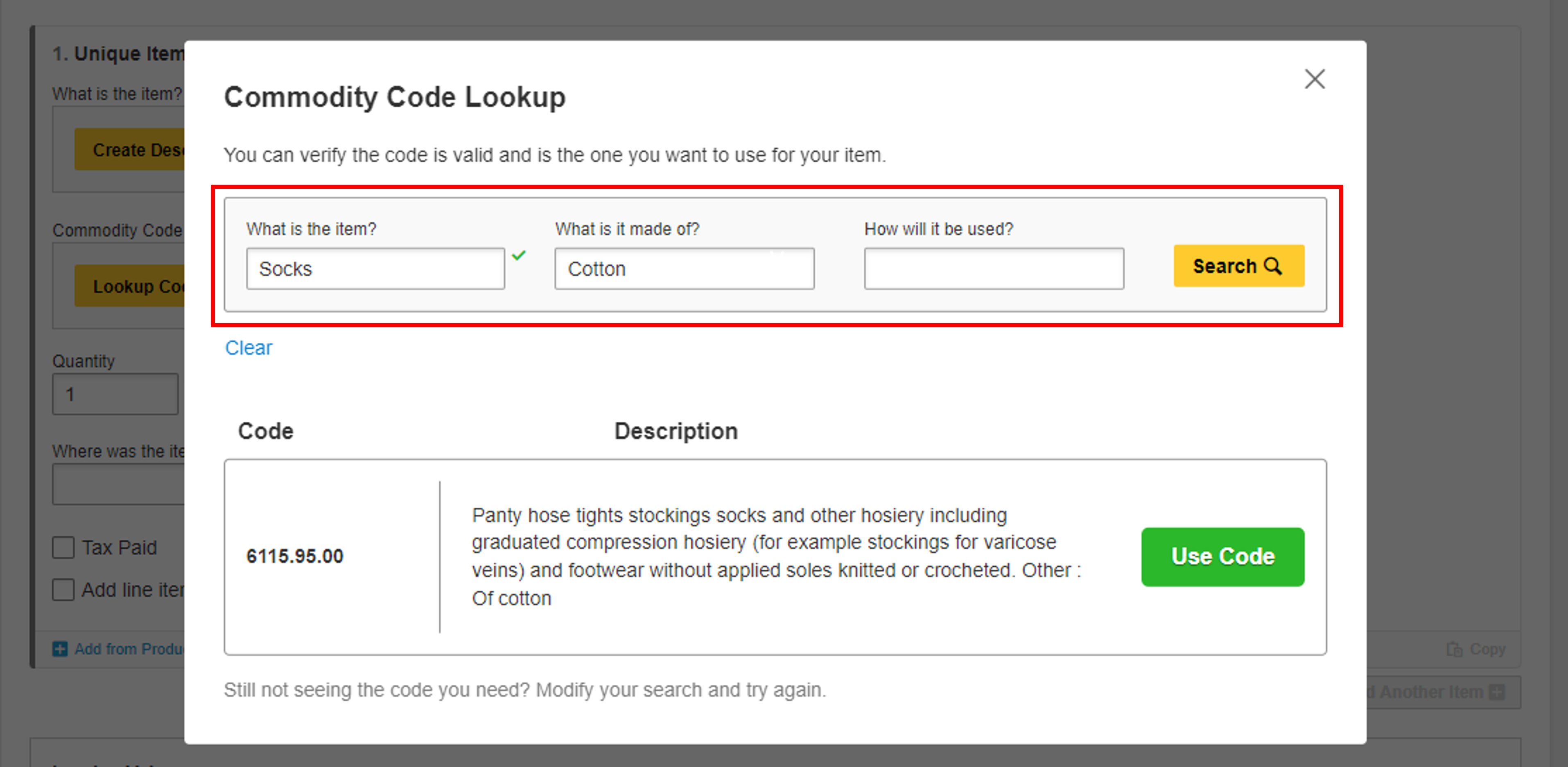

Optional: Preset commodity types are available and will appear as a drop-down when you enter a brief description of your product. Choose whichever is most similar to your item and a commodity code will be assigned to it.

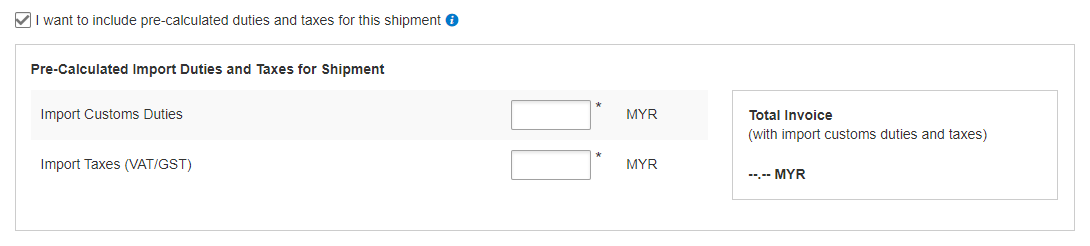

Optional: Please provide pre-calculated duties and taxes on the commercial invoice (if the receiver pays them as part of the price of goods being shipped)

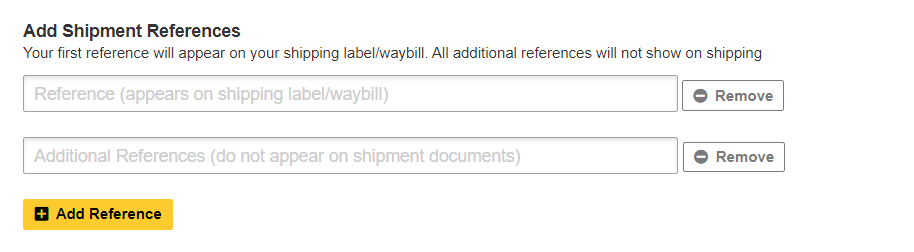

Optional: You may include your shipment reference in the field below. Click on the + sign to add additional reference if applicable. You may add up to 50 references in a single shipment. Please note that only the first reference will be printed on the waybill.

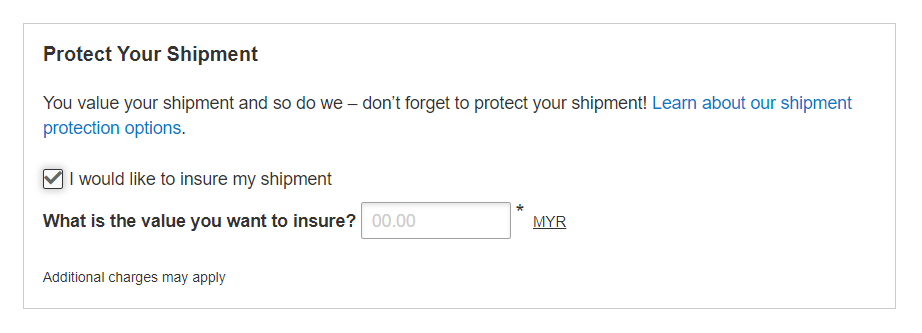

You may also opt to protect your shipment by selecting the insurance service.

- We recommend this comprehensive protection for your valuable or personal shipments, giving you peace of mind in the unlikely event of physical damage or loss.

- Please enter the value of the shipment you want to insure. For 100% protection, please input the amount to be the same as your total declared value.

- Charges: MYR 50.00 or 1% of the insured value if higher

Click HERE for more information on shipment protection options.

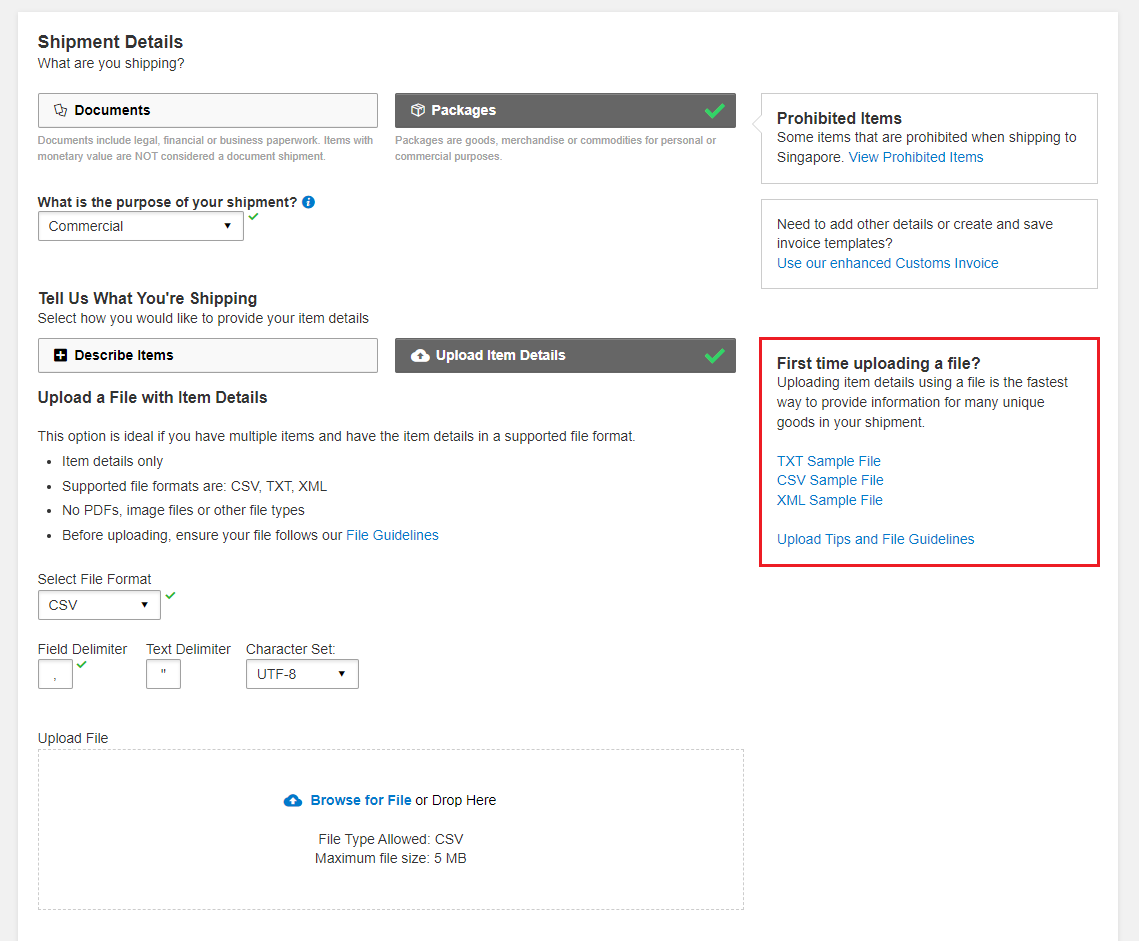

If you have multiple line-items, you may use the upload feature to provide the details. Sample template of the upload file is available on the right. Acceptable formats are TXT, CSV and XML only.

To ensure a successful upload – follow the guidelines to create and set up your file properly. You can save time by using one of our sample files. Just download the preferred file, edit it with your item details, save and upload it.

After file has been uploaded, you can view the list of items that was uploaded by clicking on  . If you have items that are not in the list, you may click on

. If you have items that are not in the list, you may click on  to add additional items.

to add additional items.

- The item list in the uploaded file cannot be amended, you will need to correct the source file and reupload with the correct data.

For more details, please refer to “MyDHL+ Reference Guide – Invoice Line-Items Upload”.

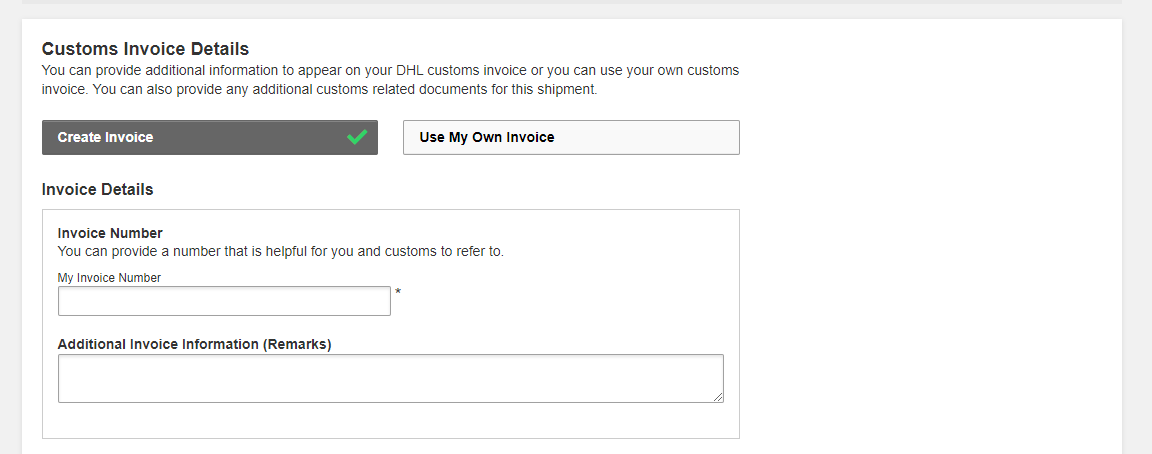

You will have an option either to: -

1. Create Invoice

- If you do not have your own invoice – this will be created using DHL invoice template

- Invoice number field is mandatory for export from Malaysia, please enter an invoice number of any format (e.g.: INV_DDMMYY)

2. Use My Own Invoice

- Please indicate your invoice number for this shipment

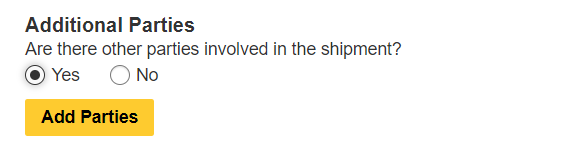

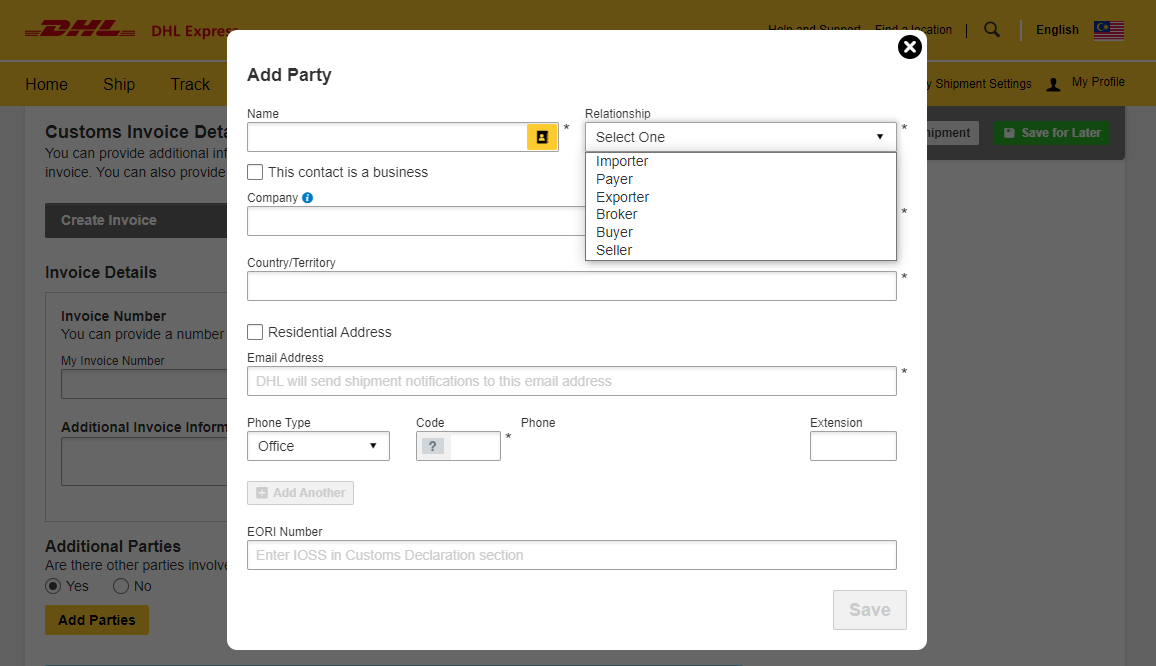

If there are any additional parties involved in this shipment, you may declare their information by clicking on ‘Add Parties’.

A light box will open for you to fill out information about the additional parties involved. You may import the existing contact details directly from your address book or input their details manually. Multiple parties can be added to a single shipment consecutively.

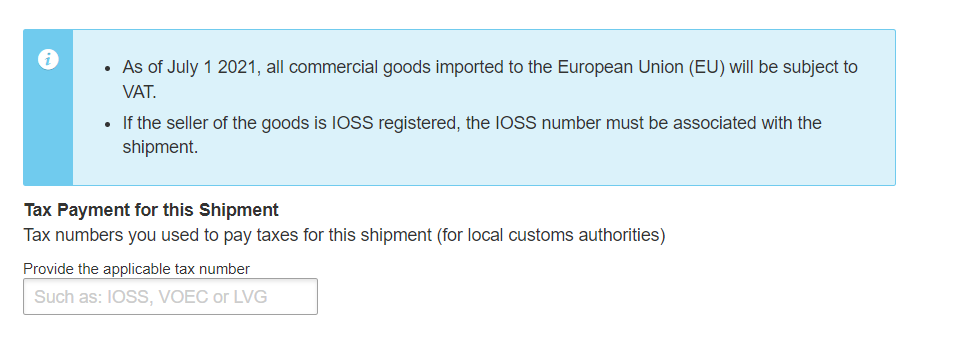

Shipments to EU & other applicable destinations: In the Shipment Tax ID field, you are urged to enter the relevant Tax ID number (if applicable), depending on the destination countries of your dutiable shipments. For example, enter your IOSS number for dutiable shipments entering the European Union if you have paid your Value Added Tax (VAT) in advance.

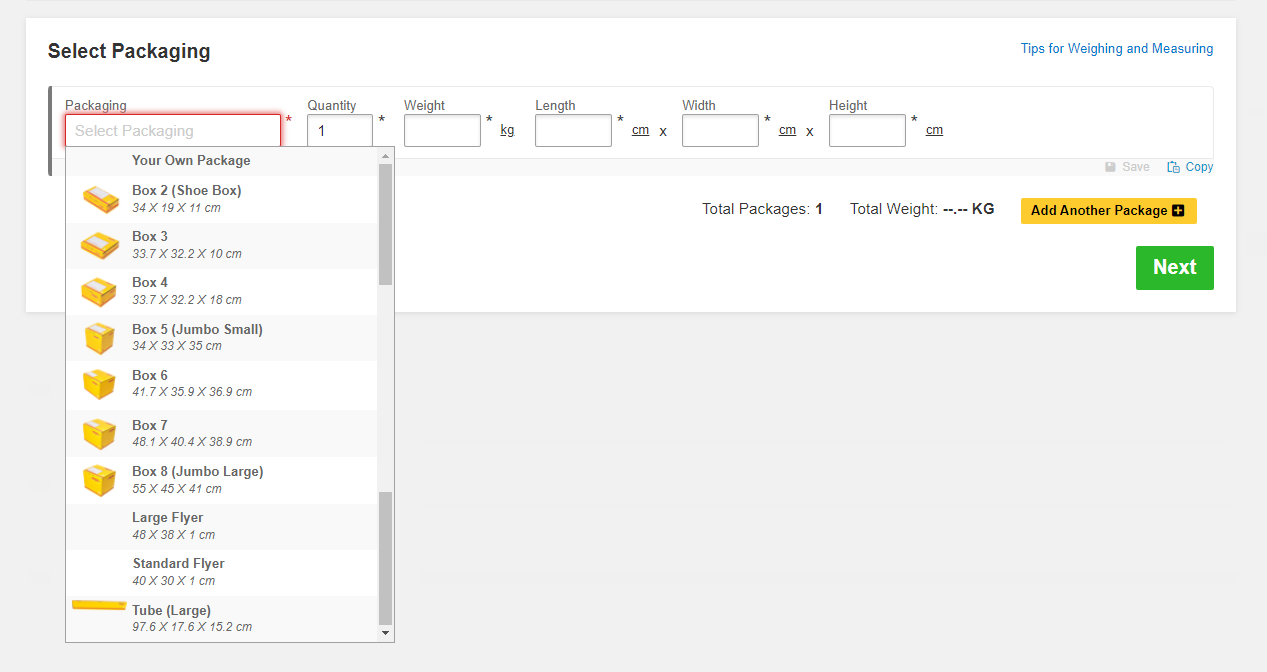

Click on the ‘Packaging’ column to see the dropdown list of packaging selections

- Document:

Common packaging type are either ‘Express Envelope’ or ‘Standard Flyer’ - Packages:

If you’re using your own box, select ‘Your Own Package’ on the top of the list - Fill in the Quantity (per box/packaging) and the Weight of each box

- If you have more than one package that is of different weight/dimension, click on

- DHL defined packaging has fixed dimensions and maximum weight limit. If you’re sending more than the defined limit, please select ‘Your Own Package’ in order to proceed.

- DHL’s Shipment charges are calculated according to the higher of actual or volumetric weight per piece and any piece may be re-weighed and re-measured by DHL to confirm this calculation.

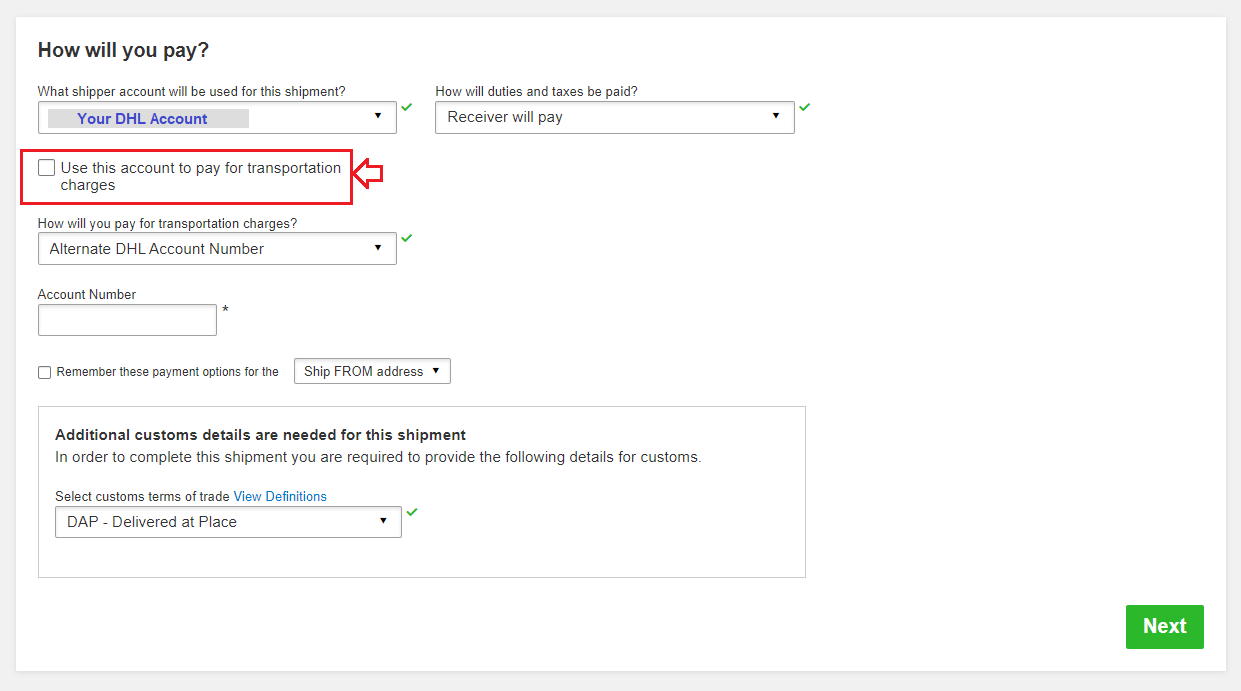

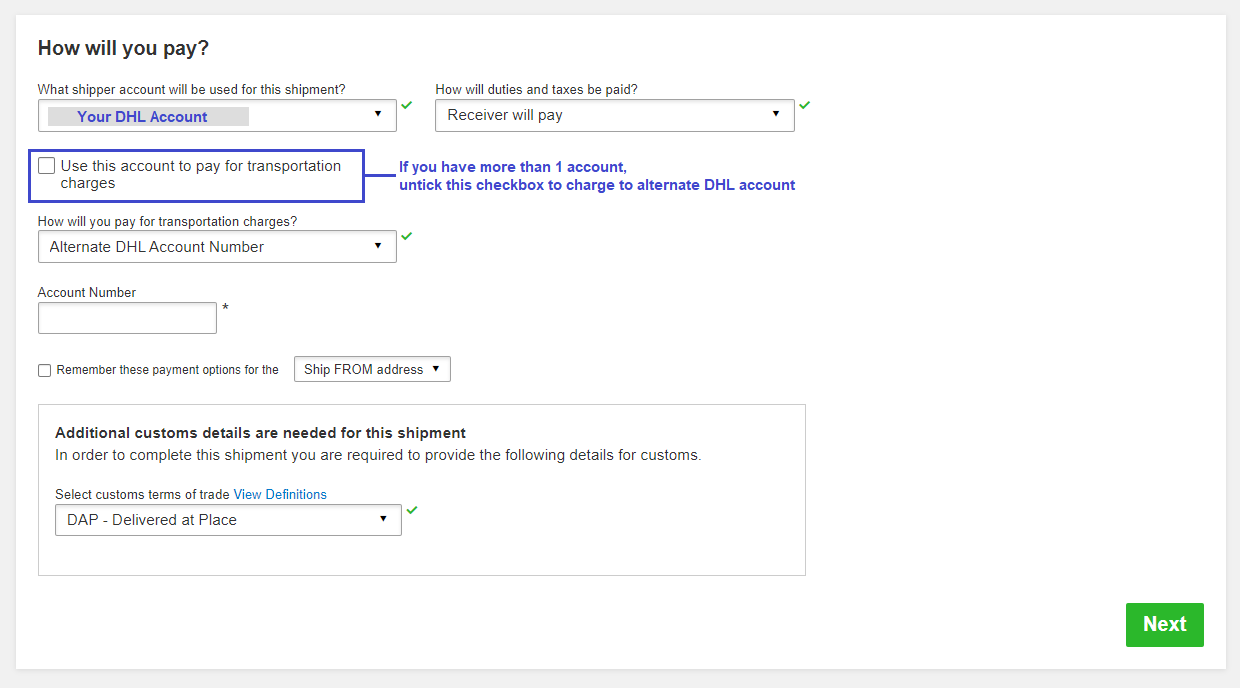

By default, your registered DHL account will appear for transportation charges and the duties and taxes will be under ‘Receiver will pay’. You can have more than one account registered in the profile.

If you wish to absorb the duties and taxes charges, please select your account or enter the 3rd party account number that will bear the duties and taxes. Duties and taxes charges are determined by the destination customs authorities. There will be an additional service charge of MYR80.00 per shipment for DTP service.

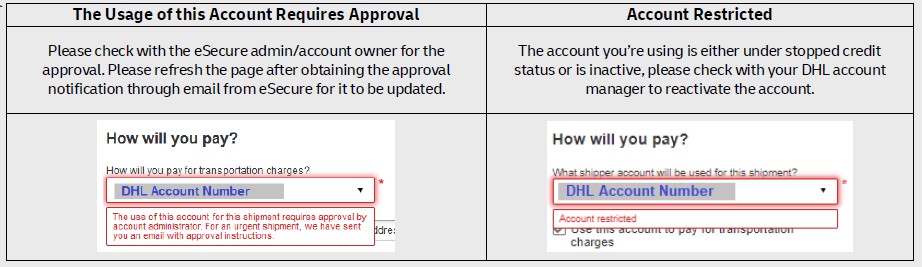

Typical errors of the account include: -

For transportation charges paid by receiver or 3rd party, please un-tick the checkbox and select ‘Alternate DHL Account Number’ to enter the payer DHL account number. The shipper account will be your registered DHL account number.

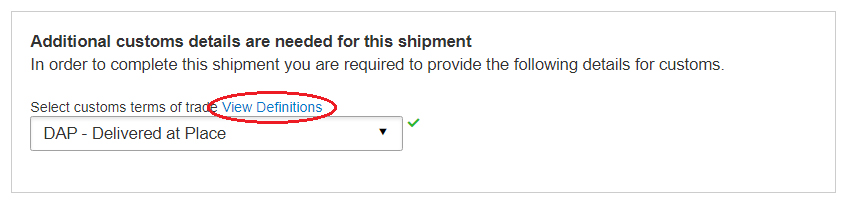

- The Customs Terms of Trade or more commonly known as Incoterms are a set of rules that define the responsibilities of sellers and buyers for the delivery of goods under sales contracts for domestic and international trade.

- You can click on ‘View Definitions’ or click HERE for more information on the list of selections.

- This does not determine the duties and taxes billing.

- For duties and taxes billing option, please refer to the previous page.

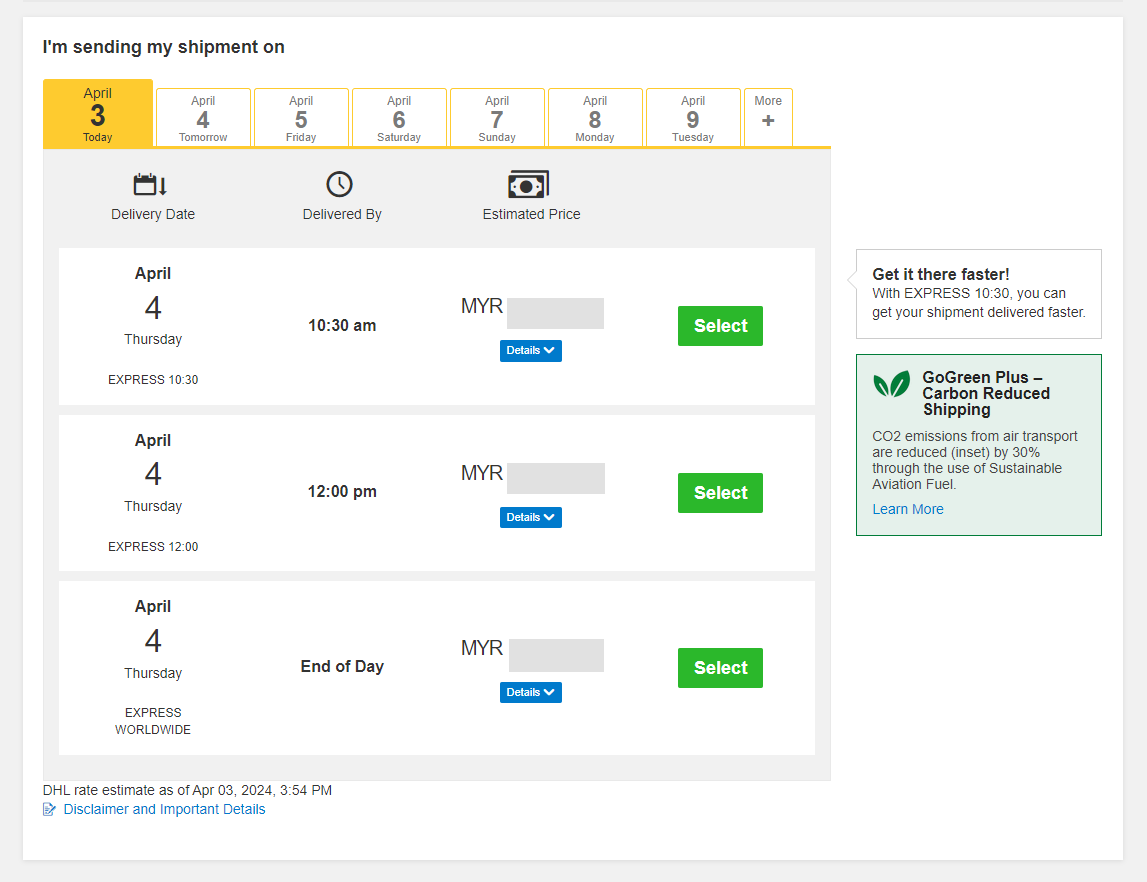

Select your shipment date (in yellow) and the estimated delivery dates will be shown below. Estimated delivery date and time is subjected to customs clearance for parcel shipments.

The product selection varies depending on the destination and limits that you have entered. Normal delivery option is under ‘Express Worldwide’. Time definite service will be incurred a premium when selected.

Price shown is an estimate based on destination, the higher net weight or volumetric weight, the declared value entered, and services opted in the Shipment Details section above.

- Click on ‘Details’ at the bottom of the price to show breakdown charges.

If you have selected for the transportation charges under an alternate account, there will be no price displayed.

- Click ‘Select’ to proceed to the next page.

If you encounter an error stating ‘No delivery options available’ it means that either: -

- The origin postcode/city is not offering pickup service

- The destination location is not serviceable

- The shipment weight has exceeded the maximum limit allowed

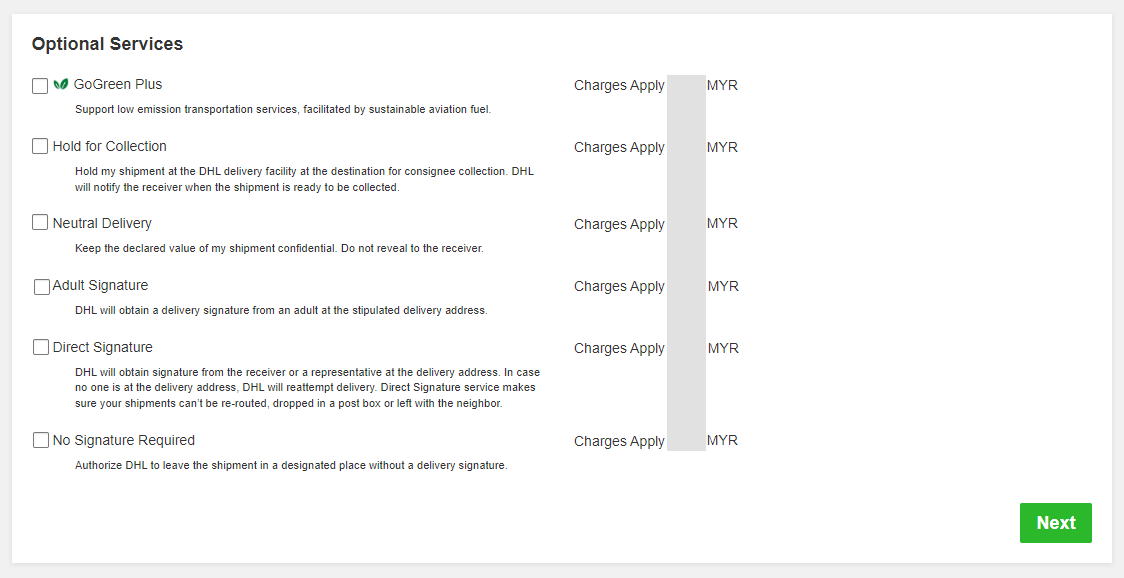

DHL offers a wide range of Optional Services. In this way, we give you the flexibility to choose the service that best fits your needs when using our express delivery services worldwide.

- Please note that the Optional Services selections varies depending on the destination.

- Additional charges may apply.

- Refer to DHL website for the latest update on the service charges: https://mydhl.express.dhl/my/en/ship/optional-services.html

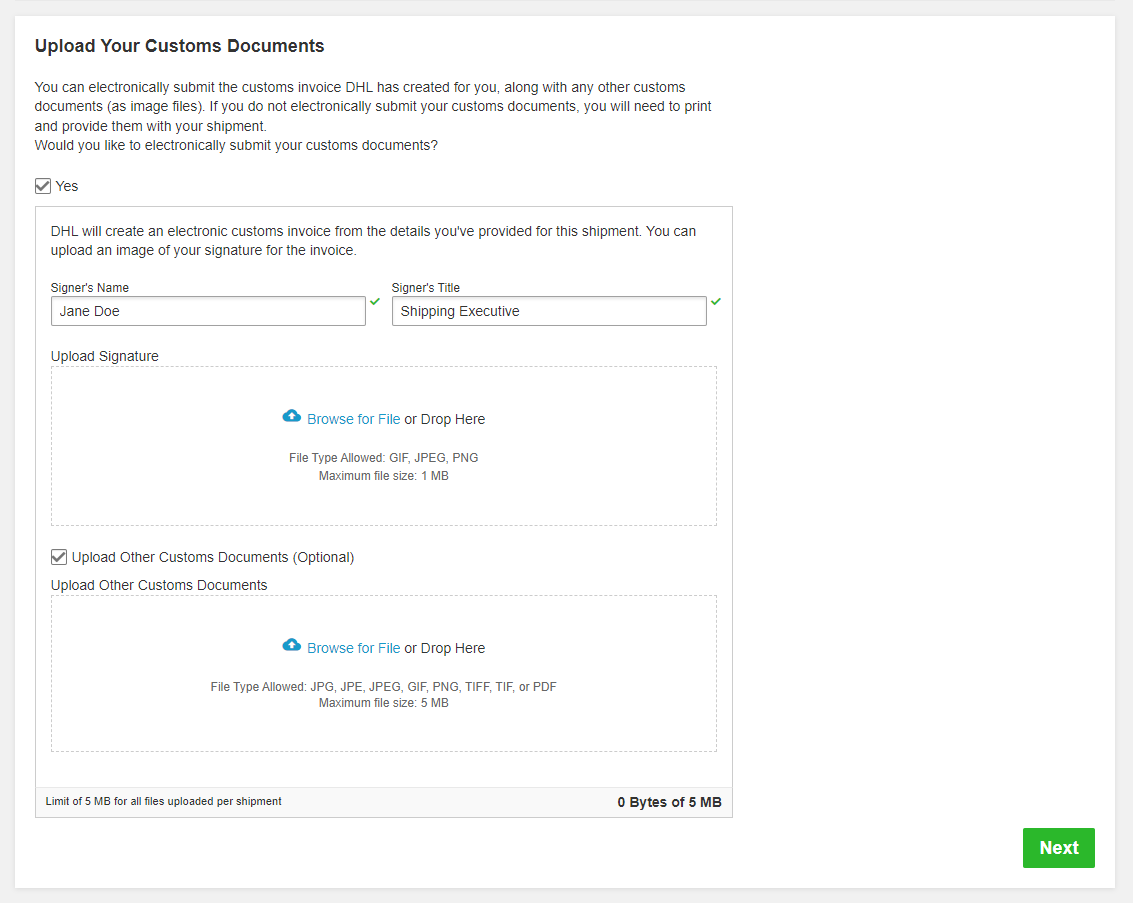

This service is only applicable for international parcel shipments. It is also known as Paperless Trade (PLT). With this service, you would no longer require to print the custom paperwork and attached to the physical shipment.

Click on ‘Browse for File’ to upload the paperwork (eg: invoice, packing list). Maximum file size is 5MB. Uploaded image clarity depends on scanned file. If you have selected to Create Invoice in the earlier section, you would only see one Browse button.

Digital Customs Invoices is available for many origin and destination countries and the list of participating countries is continuing to grow. If Digital Customs Invoices is not available to the destination country, it will not offer it for selection.

- If you have more than one file to be uploaded, please tick on “Upload Other Customs Documents (Optional) checkbox. You may select multiple files to be uploaded at a time.

- Limit of 5 MB for all files uploaded per shipment.

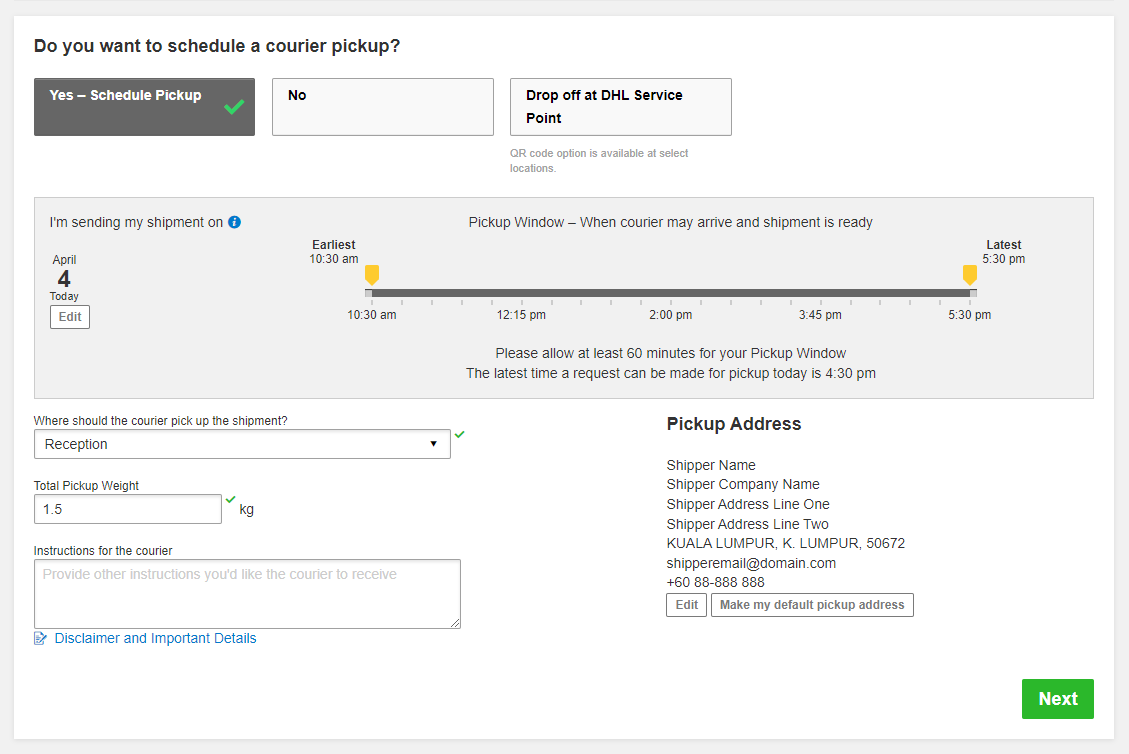

You have an option to either to drop off the shipment at the nearest DHL Express Service Points or you can choose to have a courier to come and pickup your shipment.

Please do note that DHL might not be able to attend to the preferred pickup time specifically as courier will be moving around on his planned route in his coverage area.

A. Export Pickup – from/within Malaysia

- Click ‘Yes – Schedule Pickup’

- Click ‘No’ if you have already a pickup scheduled

- Click ‘Drop of at DHL Service Point’ if you will be dropping off your shipments.

- Check the pickup date and time slider.

- The latest time available is the booking cut-off time for your area.

- Check your Pickup Address

- If it is in a different location, please click ‘Edit’ below the address to amend

- Click ‘Save’ below the address once confirmed.

- Pickup Address will not be printed on the waybill copy

- Select the location of the pickup and enter a pickup instruction for courier (if any).

- Click ‘Next’ once confirmed

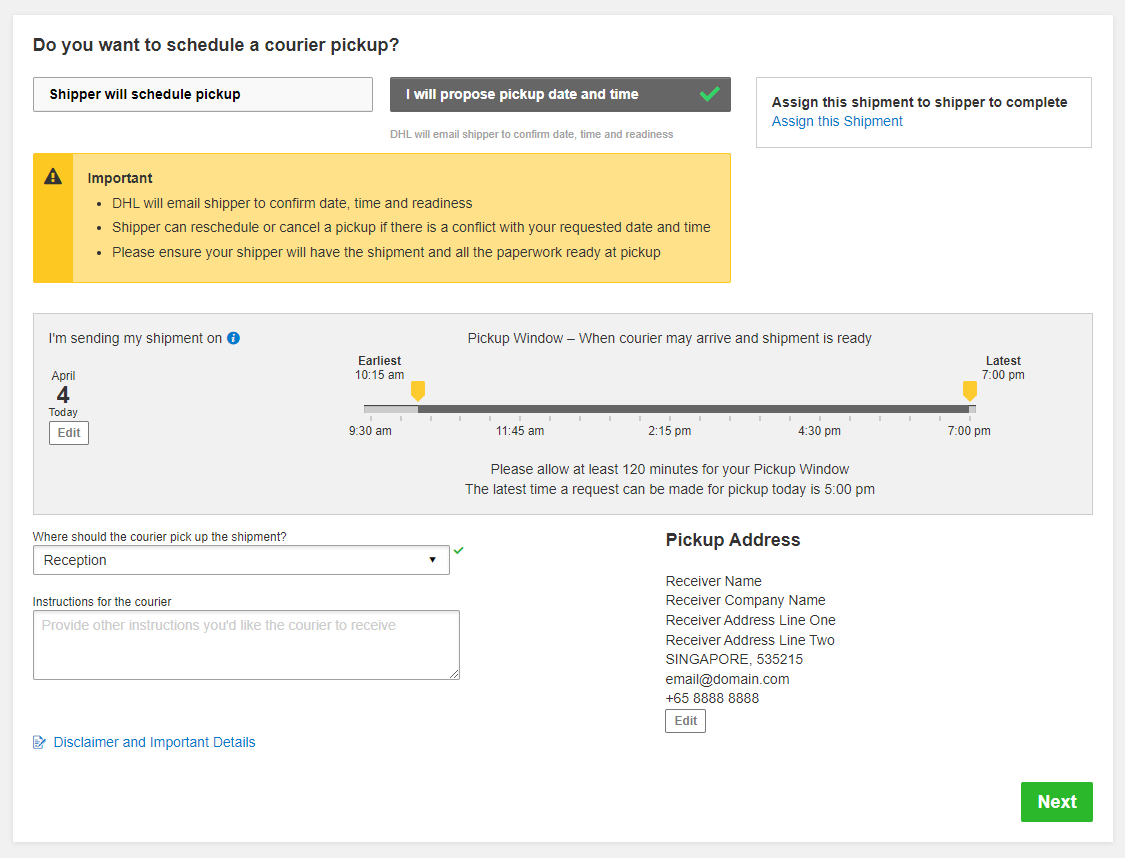

B. Import Pickup – from other countries/territories

- Click on ‘I will propose pickup date and time’ if you’ll be arranging the pickup on behalf of the shipper.

- Please send the pickup confirmation email to the shipper by clicking on ‘Send Documents’ after shipment completion – refer to Page 22 for more details

Remote Booking (import pickup) commitment is to schedule a collection within 24 to 48 business hours for AP region & within 48 to 72 business hours for US and EU regions with the exception of delays due to shipment unavailability or any inability to make direct contact with the shipper.

- You may opt for shipper to arrange pickup if shipment is not ready yet.

- Default pickup address is the same as shipper address.

- If pickup is from a different location, click on ‘Edit’ at the bottom and click ‘Save’ once amended.

- Click ‘Next’ once confirmed.

- This is typically meant for return delivery shipment (2-way).

- If you’re only sending a 1-way shipment, please click ‘No’ to proceed.

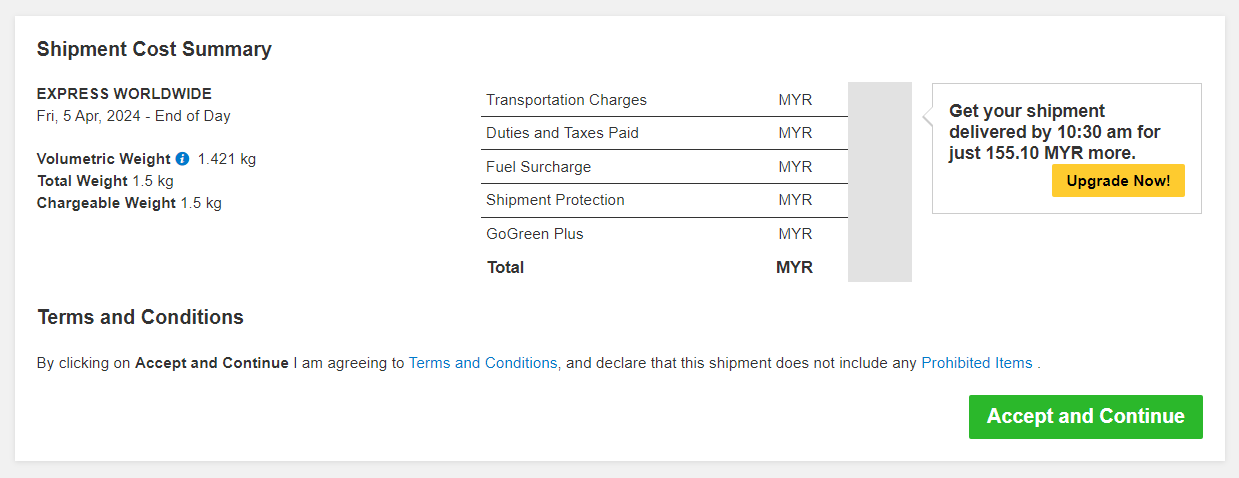

- Shipment cost summary is the estimated total breakdown charges for your shipment.

- Amount will only be shown for transportation charged to shipper account

- If you need to amend any details, click ‘Edit’ on the fields above.

- Once details are confirmed, click ‘Accept and Continue’ to proceed.

- If you need to amend any details after confirmation, please create a new waybill.

- If you have opted for Digital Customs Invoice service, please click ‘Submit’ for the files to be uploaded.

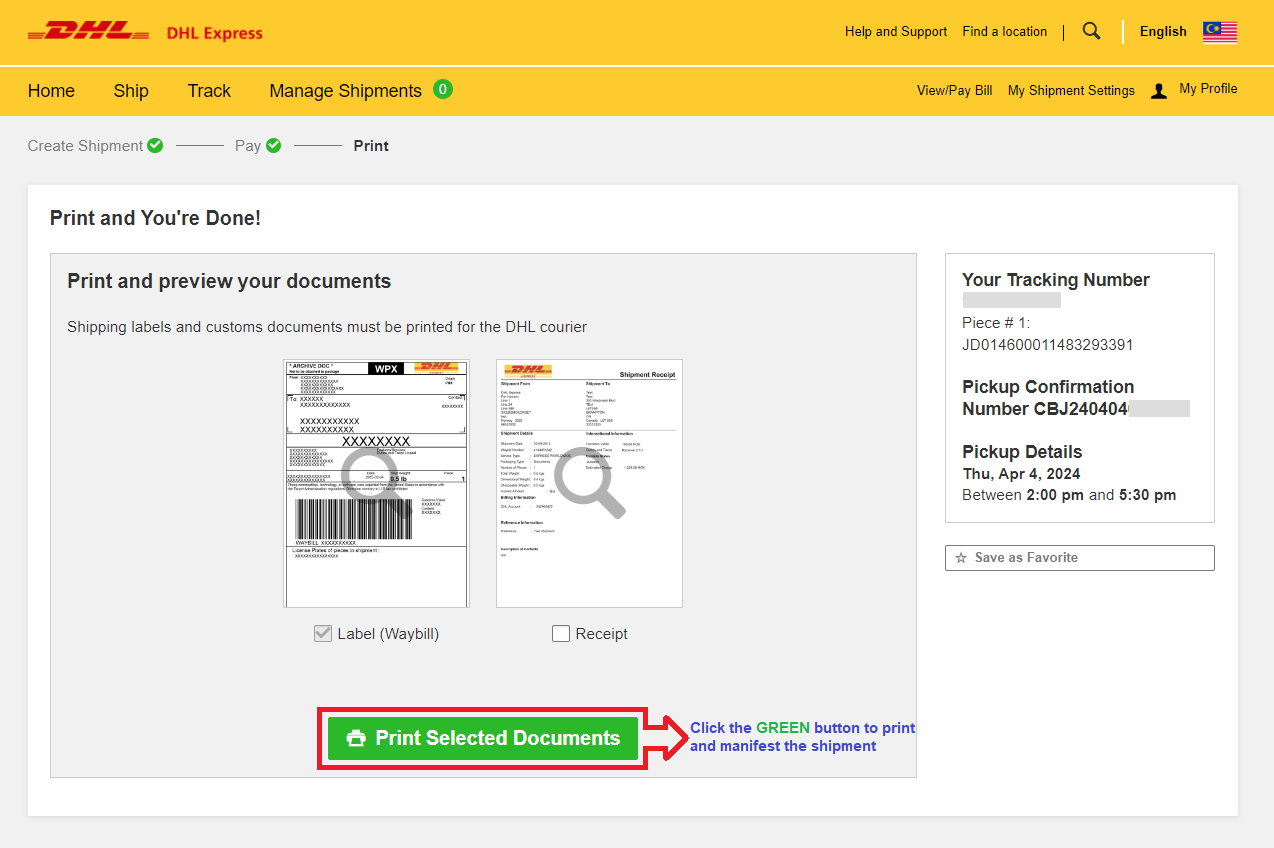

The shipper is required to print the shipping label (waybill) as it contains all the information DHL needs to know to keep your package moving through the network to its ultimate destination. Along with a shipping label (waybill), shipments may also need other documents such as a customs invoice or destination specific documents to accompany the shipment.

- Select the paperwork that you want to print and click ‘Print Selected Documents’

- Documents:

- You will only need to print out one set of the Transport Label that contains 3 barcodes

- Packages:

- You will need to print out one set of the Transport Label that contains 3 barcodes

- If you have opted for digital customs invoice, the documentation has been uploaded to DHL’s server and do not need to be printed.

- If digital customs invoice wasn’t selected or unavailable, please print out the Waybill Doc that contains 1 barcode and 2 copies of invoice to pass to the courier during pickup.

- DO NOT print from the image as it is only a preview.

- Preview image will contain the wording of “DO NOT PRINT – SAMPLE ONLY” and is not valid for shipping.

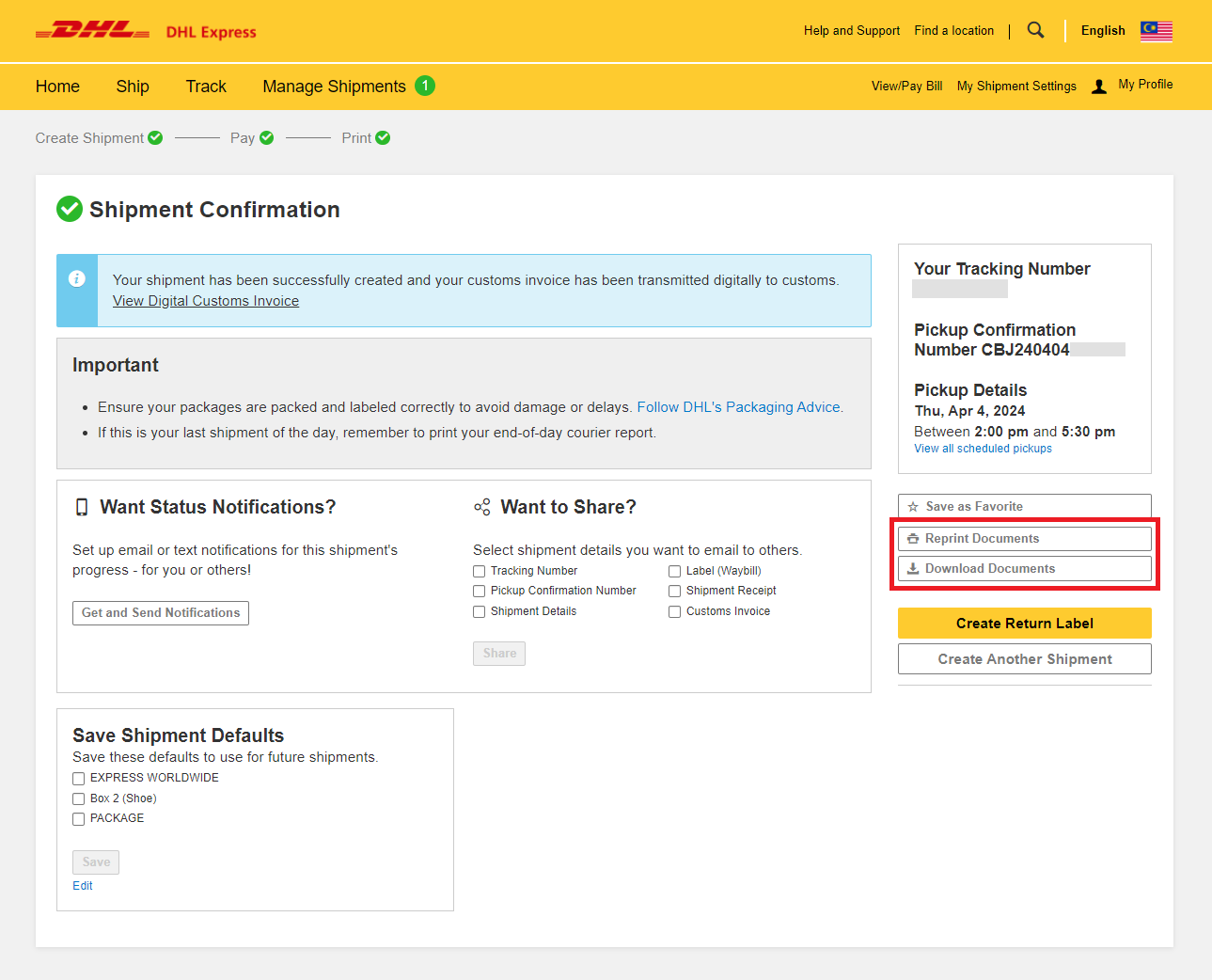

Reprint or Download Waybill

- After waybill is printed, shipment data will be manifested.

- You will see the Shipment Confirmation page below.

- If you need to reprint or download, click on the options on the bottom left.

- Shipment is completed once the paperwork is printed. You may either logout or create another shipment if any.

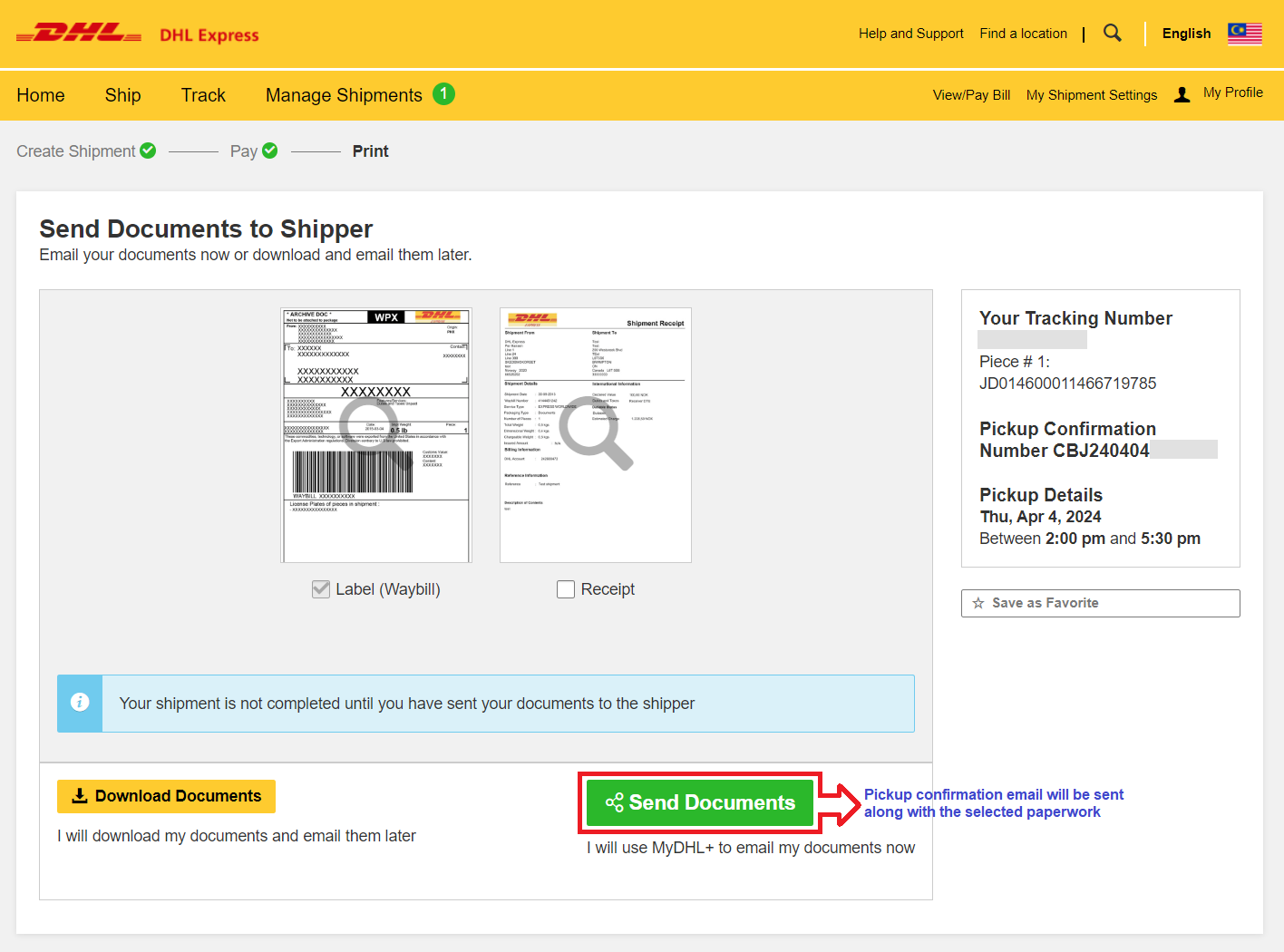

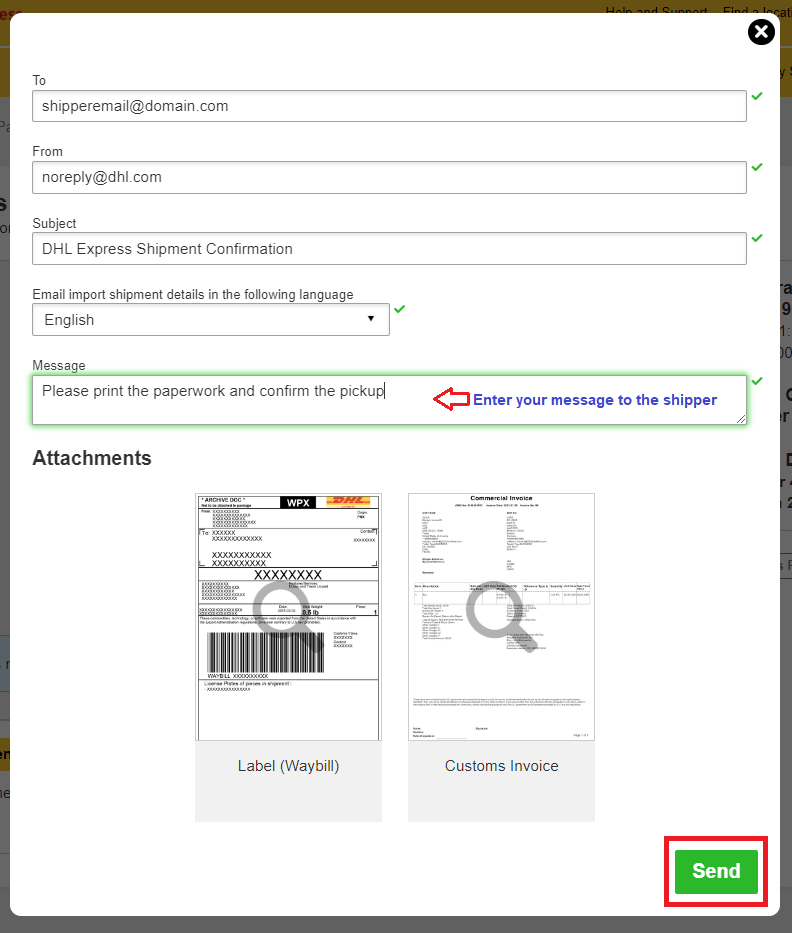

- Click on ‘Send Documents’ to send the paperwork and pickup confirmation to your shipper.

- The air waybill and customs invoice (if any) have to be printed for collection.

- Check the recipient email address and enter your message to the shipper then click ‘Send’

- Shipper would then receive an email with the paperwork.

- You will be redirected to page ‘Shipment Confirmation’ after sending the waybill to the shipper or after clicking ‘Complete Shipment’.

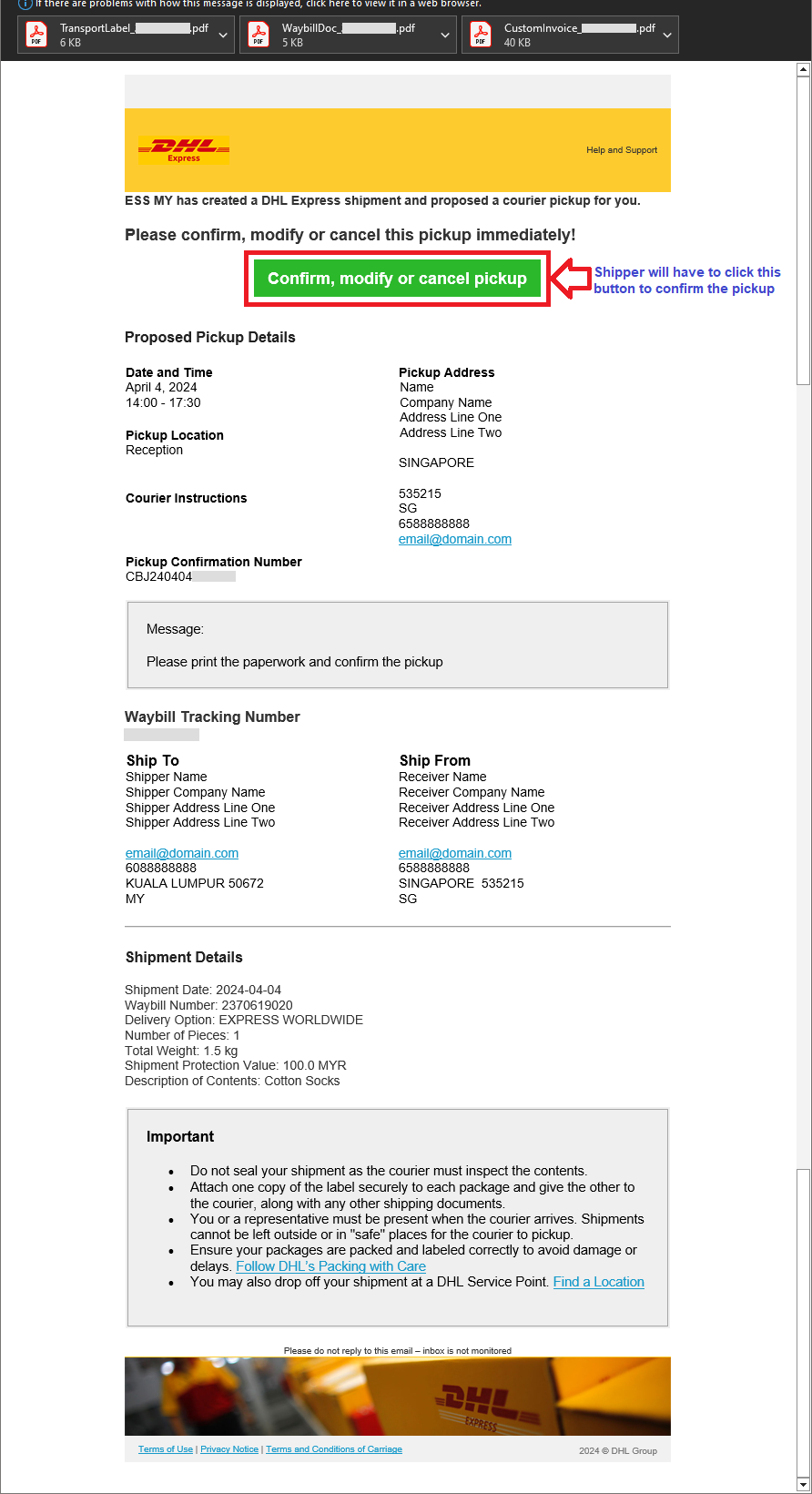

- Shipper will receive an email below once the send button is clicked. Shipper will have to confirm the pickup or modify/cancel if there are any changes.

2. Accessing Your Invoices for the First Time

For DHL Express business account holders, login with your MyBill account details.

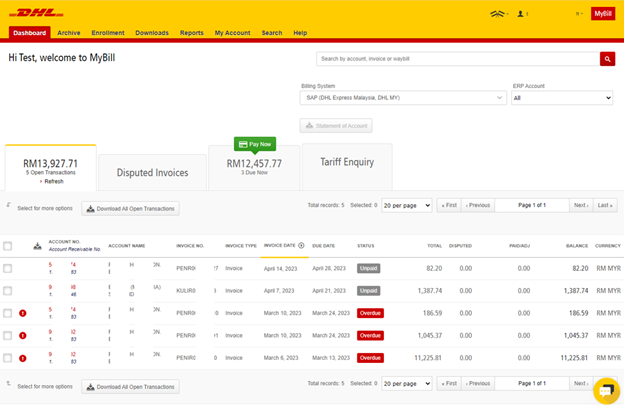

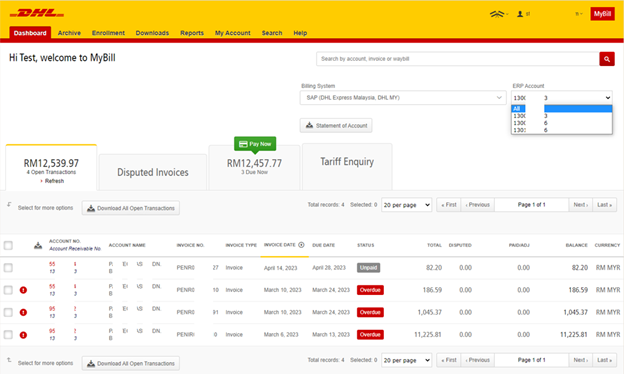

1) Navigate MyBill

See an overview of all your invoices on the dashboard.

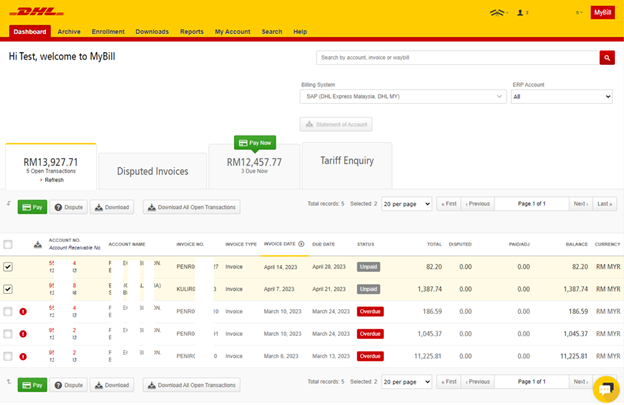

Pay a single invoice or multiple invoices by selecting them and clicking the green ‘Pay’ button.

Download your account statement by selecting the relevant account with the ‘Statement of Account’ search bar.

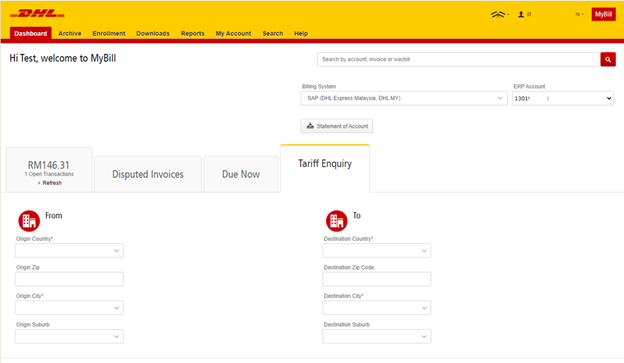

Get a cost and time estimate with the ‘Tariff Enquiry’ tab on your dashboard. It offers a simulation of shipment details such as transit times and pricing information.

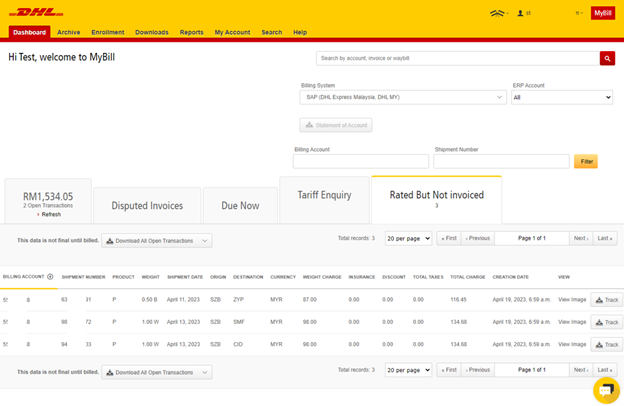

To view unbilled shipment

Login to MyBill and make payment with either credit card or telegraphic transfer.

Login to MyBill to add, remove and manage the users of your account.

3. Paying Your Customs Duties in Advance

The Advance Duty Collection or ADC portal calculates your customs-related charges and lets you pay them online before your shipment arrives.

We notify you via text messages or email for any payment that has become payable, with secure links to pay online via desktop or your smart devices.

Talk to your account manager to activate the ADC feature for your account.

4. Account Access Management with eSecure

eSecure is our advanced security feature preventing unauthorised use of your DHL Express account.

- Manage who can use your DHL Express account by whitelisting their email addresses.

- Approve or reject new user requests.

- Manage your users and view usage histories.