Customs clearance has grown increasingly complex over the years as the explosion of goods being sent across borders has become more diversified. To avoid your packages being delayed at customs, you need to supply accurate data - and that means listing the products you are sending in detail. The Harmonized System code (or HS code) is designed to label all existing goods in precise detail, making it easier to identify products internationally.

What is an HS code?

Harmonized System (HS) codes are a unique identifier to classify the exact type of goods you are shipping.

HS codes were created by the World Customs Organization, and are internationally recognized in almost every country. As customs and government bodies now have a common point of reference to instill regulations based on HS classes, they are able to create a standard to approach each HS category the same way. This in turn creates a more organized importing/exporting structure and a good guideline for countries wanting to implement new regulations.

How to find the HS code

The responsibility of providing the HS code is always that of the shipper, so you’ll need to carry out a harmonized code lookup when you ship. You can find the HS code for your product via your country’s government website, or by using DHL Express’ dedicated Interactive Classifier tool.

How to get the HS code for a product

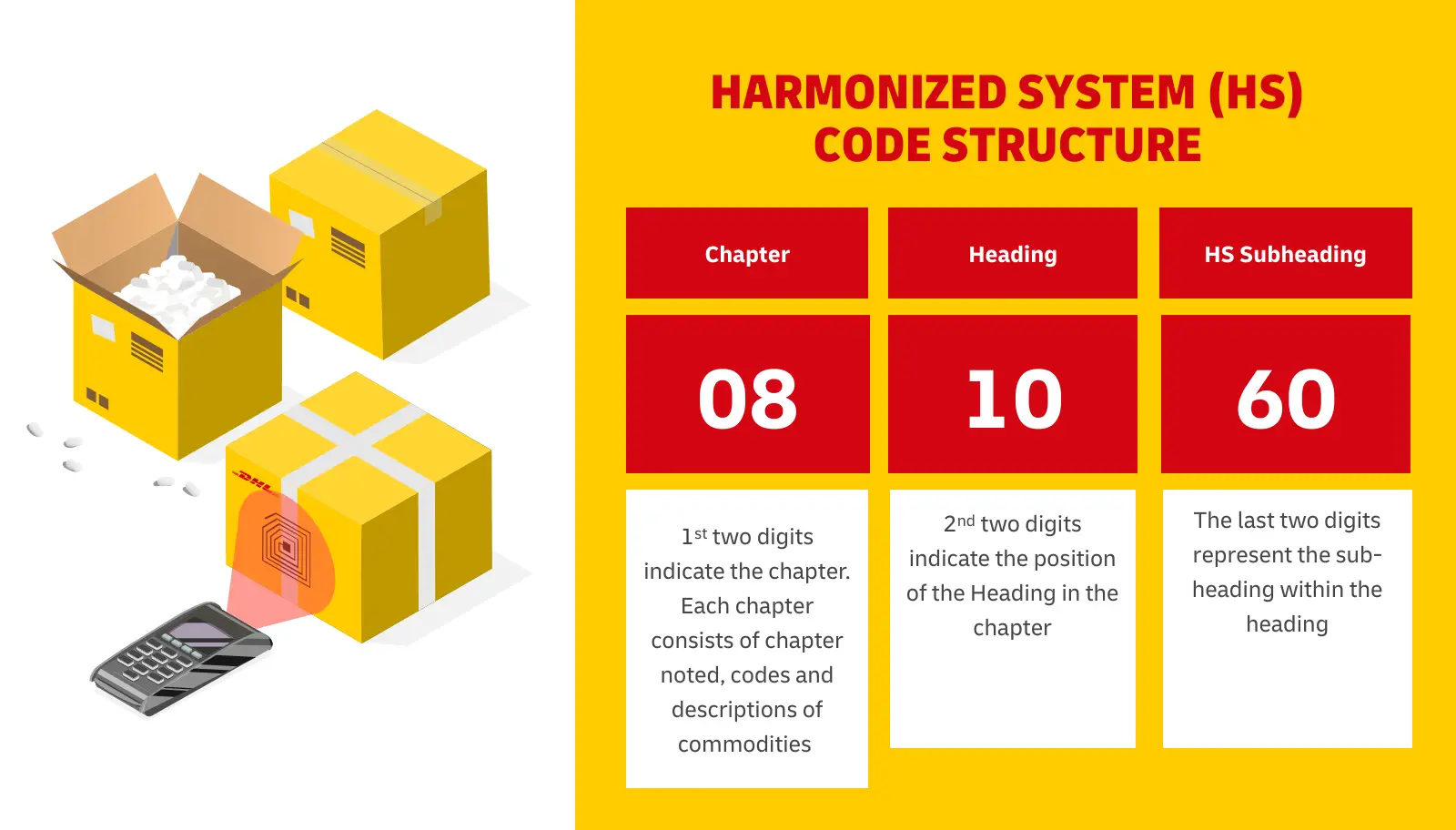

The structure of each Harmonized System comprises of six digits. The first two digits identify the chapter of which the HS code falls under. There are a total of 21 chapters; each chapter provides a description to generalize the category. The next four digits comprise of the heading and sub-heading within the chapter.

ASEAN countries follow the ASEAN Harmonized Tariff Nomenclature (AHTN) – where the first six digits still take reference from the international HS codes – but there are an additional two digits at the end that further break down the sub-headings. Commodities shipped within ASEAN normally use the eight digit AHTN classification, but the six digit HS codes are also considered valid.

How to use the HS code

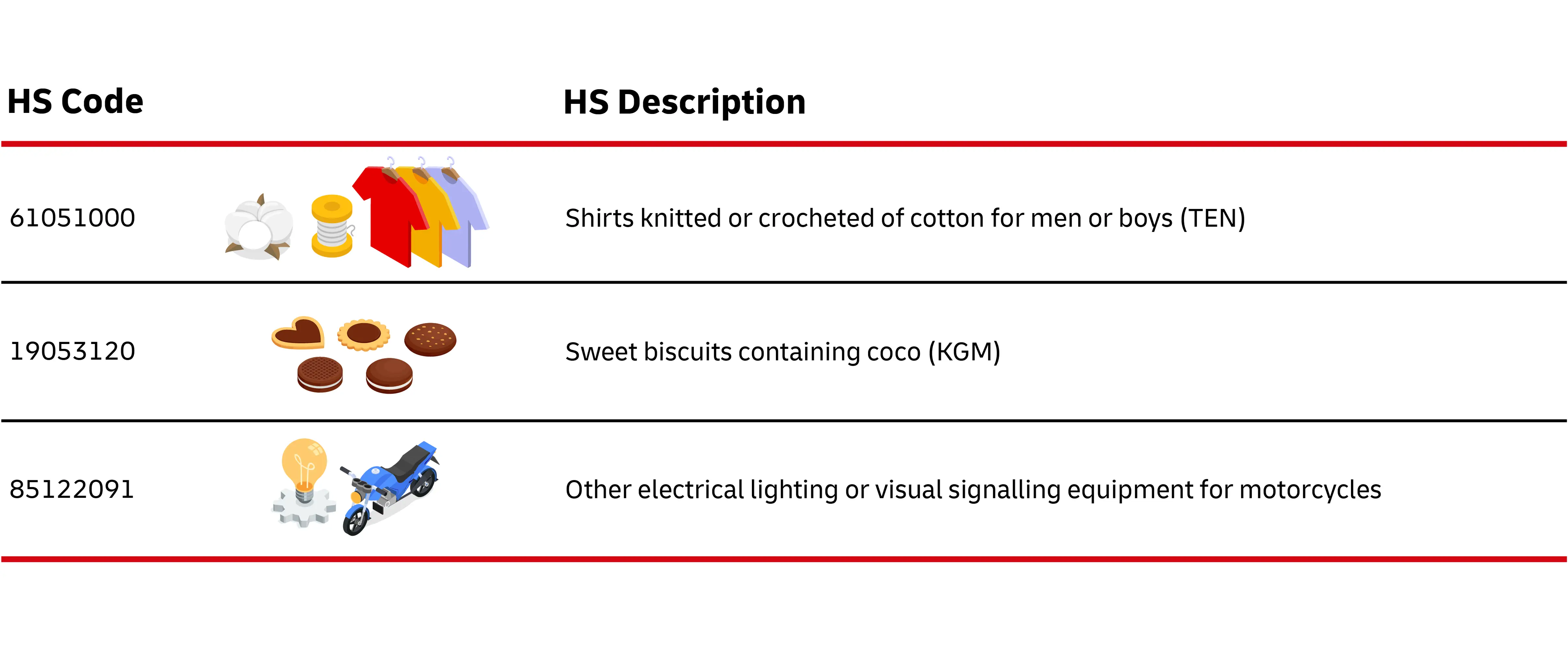

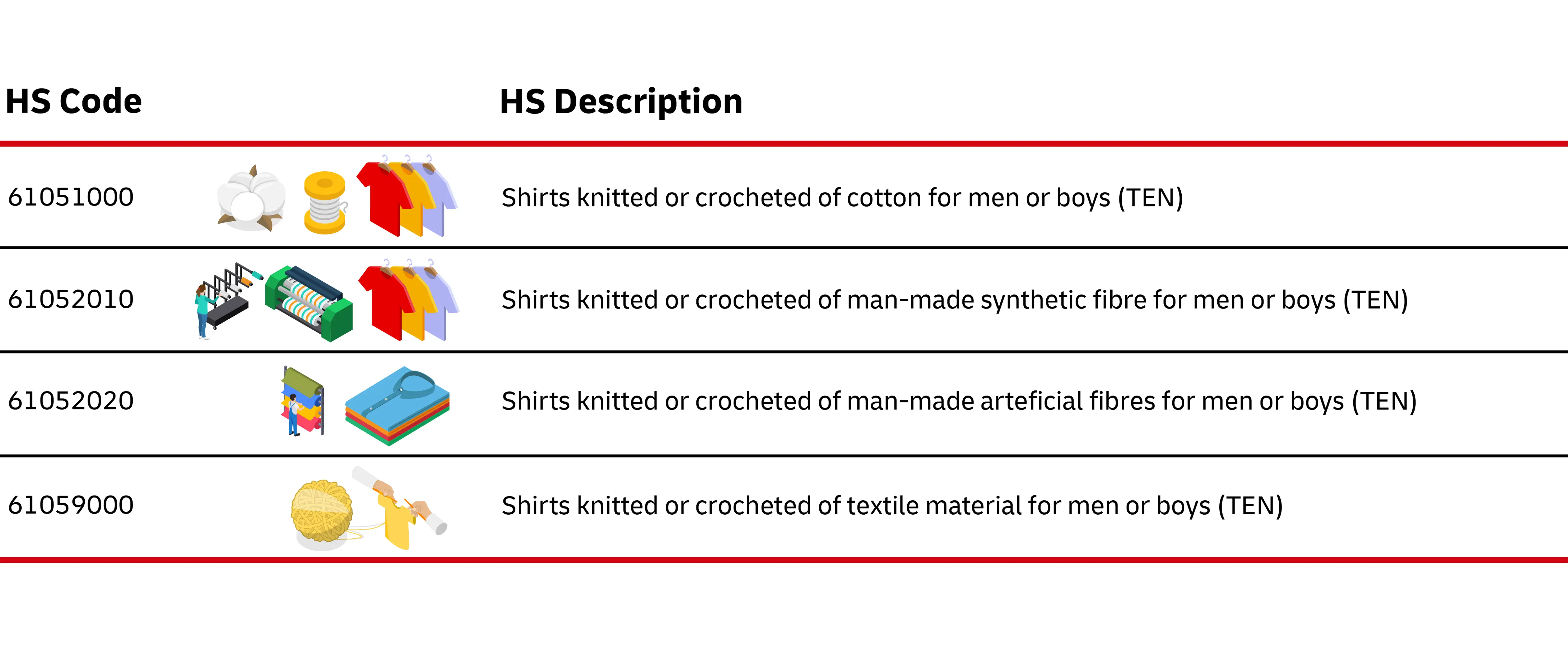

Businesses are encouraged to indicate the HS code in their shipping documents to ensure a uniform mode of clearance every time. There are thousands of different HS codes, but each commodity is further dissected into very specific descriptions.

In the example shown below, there are categories for men’s shirts made out of cotton, men’s shirts made of synthetic fibers, and men’s shirts made out of other textiles – the list goes on, totalling to about 10 different codes for the item ‘shirt’.

In some instances, certain commodities may contain overlapping codes, where two or more codes apply. In such cases, the shipper only needs to select one – usually the closest possible match to the actual item.

The customs department of almost every country would have already defined different regulations based on different classifications. When you include the incorrect code, there might be a risk of unintended duties and taxes, higher restrictions on importing, or in the worst-case scenario, rejection of entry into the destination country.

While it is not necessary to indicate your product’s HS code in any of the documents, it is always recommended to indicate it on your invoice to give a clear and accurate representation of the contents of your shipment, especially if the item you are shipping is very technical. Let’s use the example of “Television Parts” as a description on your invoice. Although the term to explain the product is straightforward, Television Parts can be further broken down into many different categories depending on the technicalities of the component. To truly define exactly which part you are shipping would require a HS code to clearly label the item.

HS Code FAQs

HS code stands for Harmonized System code.

An HS code is a globally recognized classification of a traded product, via a system of names and numbers.

The first six digits of an HS code are standardized globally by the World Customs Organization. This ensures a common foundation for classifying goods internationally. However, some countries, like those in APAC, may add two additional digits for more specific classifications within their region.

A: Incorrect HS codes can lead to several issues:

Unforeseen Duties and Taxes: Your shipment might be subject to higher or unexpected fees.

Import Restrictions: The product may face stricter import regulations than intended.

Shipment Delays or Rejection: In the worst-case scenario, customs officials may delay or even reject your shipment.

A: While not strictly mandatory, it's highly recommended. Providing the HS code on your invoice and other shipping documents ensures accurate customs clearance, minimizes delays, and helps avoid potential issues with duties and taxes.

A: The World Customs Organization reviews and updates the Harmonized System (HS) codes every five years to reflect changes in technology, trade patterns, and emerging products.

A: If you're having trouble identifying the right HS code, you can:

Consult Your Country's Customs Authority: They often provide resources and guidance.

Use Online HS Code Lookup Tools: Many online tools, including DHL Express' Interactive Classifier, can help you find the correct code.

Seek Advice from DHL Express: Our international specialists are experts in customs regulations and can help you organise all your paperwork - apply for an account today.

A: Yes, HS codes are used universally for classifying goods in international trade, whether they are being imported into a country or exported from it.

A: While both are used for classifying goods, HS codes are used internationally, while Schedule B numbers are specific to the United States and are used for exporting goods.

A: No, each product should have its own unique HS code that accurately reflects its characteristics and composition.

What does DHL Express offer?

DHL Express handles thousands of documents, parcels, and cargoes every single day. Its global network of international specialists are well-versed in customs regulations and HS code variations so that every shipment moves on to its destination without delay. Whether you're importing or exporting, opening a DHL Business Express Account means all the hassle of customs will be taken care of for you, so that you can focus on the business of selling!