The sixth largest country in the world by area1, Australia presents a huge opportunity for importers.

A small population with a big import potential, Australia is a developed economy with great potential for further growth. Its GDP growth, a key indicator of economic success, is looking strong for such a mature economy. It’s in line or ahead of Europe for GDP growth, but behind some regional neighbors such as the Philippines and Vietnam (although these economies are both emerging, so have more headroom for growth).

Let’s take a closer look at Australia’s economy and potential for overseas imports.

26.44 million people

As of 2023, Australia’s population is over 26 million. The majority live in urban areas, but there is a significant rural population(2).

96% internet penetration

Most Australians use the internet regularly. 96% internet penetration makes Australia the 18th most connected country in the world, alongside Singapore, Oman and Hong Kong(3).

1.8% GDP growth in 2023

Australia’s GDP is projected to grow by 1.8% in 2023, comparing well to similarly developed economies such as Germany, which is forecast to contract by 0.3% in 2023. The forecast for Australia in 2024 is 1.4% growth(4).

20% have made a cross-border purchase online

Australians are willing to buy from overseas retailers. 40% of Australian shoppers’ most recent purchases were from China(5).

7.4% e-commerce growth

Australia is the 12th largest market for eCommerce, placing it ahead of Brazil(6).

Shopping trends in Australia

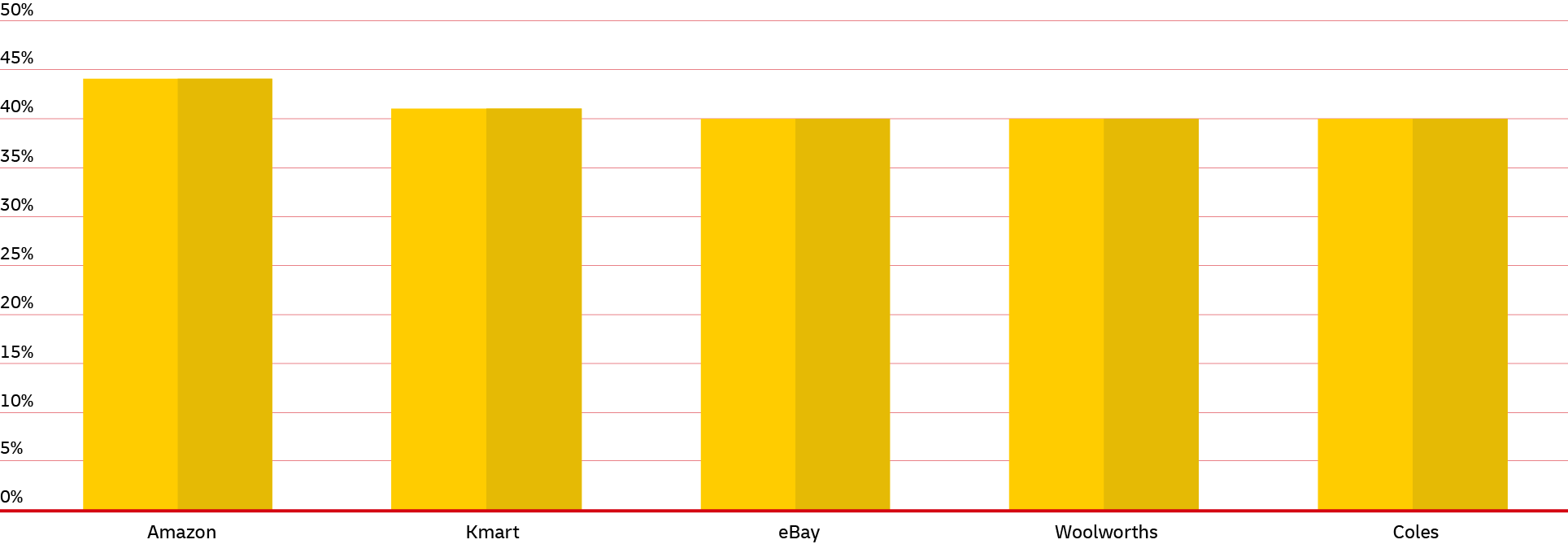

Australia’s most popular online marketplaces

Online retailers and marketplaces used by online shoppers in Australia in the 12 months to July 2023, according to a survey of online shoppers in Australia7.

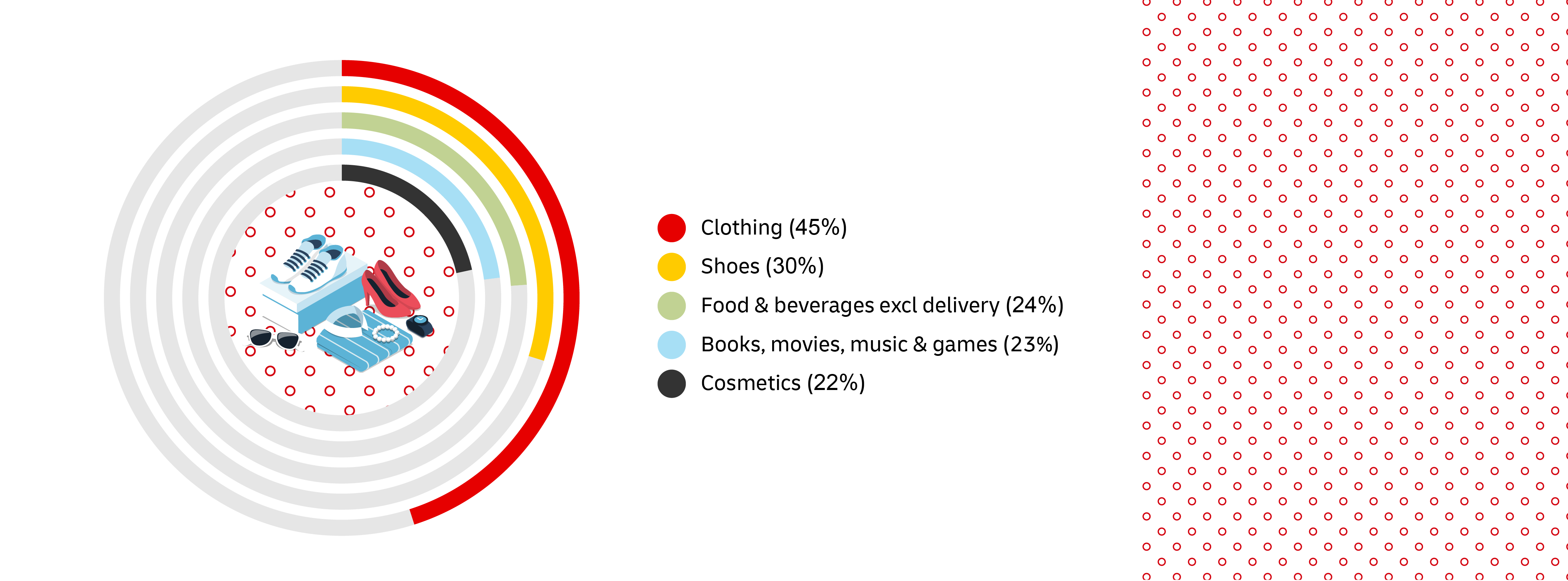

Most popular online product categories

The variety of products that can be purchased online is continuously growing. Among Australian consumers the two most popular categories for online purchases are clothing and shoes.

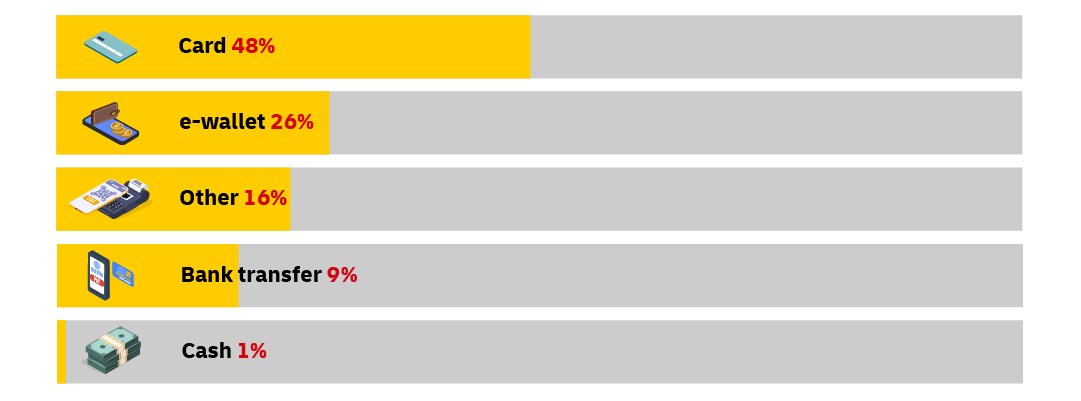

Preferred payment methods for online purchases

Australian online shoppers prefer paying by credit or debit card, with nearly half surveyed saying card was their preferred option, followed by e-wallets(9).

Buy Now Pay Later is on the rise

Australia’s biggest shopping events

Christmas is a major shopping season, with retailers offering special promotions and discounts. The period extends into New Year's sales.

Boxing Day is known for significant sales and discounts both in physical stores and online. Many Australians take advantage of post-Christmas deals.

Click Frenzy is an online shopping event featuring special deals and discounts. It includes various categories, such as fashion, electronics, and beauty.

Many retailers hold sales at the end of the financial year to clear out old stock and attract customers with discounts.

Afterpay Day is an event where retailers partner with the buy-now-pay-later service, Afterpay, to offer promotions and exclusive deals.

While originating in the U.S., Cyber Monday has gained popularity in Australia, with online retailers offering discounts and promotions.

Similar to Click Frenzy, Click Frenzy Mayhem is another online shopping event with exclusive deals and discounts.

Retailers often offer promotions on school supplies, clothing, and electronics as families prepare for the new school year.

VOSN is an event where various retailers, including fashion and beauty brands, offer discounts for online shoppers.

Customs and import regulations for exporting to Australia

Australia’s Customs office is called the Australian Border Force. It monitors all people and items entering the country.

Duties and taxes are typically applicable to all goods imported into Australia unless specific exemptions or concessions are in place.

Do I need a license to import? - Importers (companies or individuals) do not need to hold an import license to bring goods into Australia. However, depending on the nature of the goods, importers may be required to obtain permits to clear certain imported goods from customs control, regardless of their value.

Importers have a responsibility to guarantee that all imported products are correctly labeled. This means that products that require a trade description must be marked with the name of the country where they were made or produced, and if required, a true and accurate description of the product.

10% Good and services tax - More details on how this is calculated and what is liable for taxation are here.

Import De Minimis AUD$1,000 - Goods below this threshold don’t need to pay import tax. Items containing alcohol or tobacco related products pay duties and taxes regardless of value.

Biosecurity - Australia has strict biosecurity requirements for any person or item entering the country. If not followed, it could result in goods being disposed of or destroyed.

For more information and guidance, be sure to check out this Australian Government website: https://www.agriculture.gov.au/

Exporting to Australia: Official websites and useful links

Australian Customs (Australian Border Force) website

Australia’s customs agency has an easy-to-use website that provides comprehensive guides to importing to Australia.

For specific product import guidance and goods and services tax (GST) information, visit:

How to import to Australia (includes forms)

https://www.abf.gov.au/importing-exporting-and-manufacturing/importing/how-to-import

DHL’s expert tips for exporting to Australia

Looking to export to Australia?

DHL Express offer a complete international service for quick and reliable shipping.

Find out more- Worldometer | Largest Countries in the World

- Worldometer | Australia Population

- World Bank | Internet Users (% of Population)

- OECD | Australia Economic Snapshot | October 2023

- U.S. Department of Commerce | Cross-Border eCommerce | July 2022

- EcommerceDB | E-commerce Market in Australia

- Statista | Most Popular Online Retailers and Marketplaces in Australia | November 2023

- Statista | Most Popular Categories for Online Purchases in Australia | November 2023

- Statista | Australia: Payment Methods for Online Transactions | August 2023

- Statista | Australia: Share of Consumers Using BNPL by Purchase Category | December 2023