Grow your business with the Discover newsletter

Logistics advice & insights straight to your inbox

Subscribe now

The answer – a very simple answer – came in the shape of behavioral economics, a hybrid of economics and social psychology. In just a few decades it has redefined the understanding of how humans act and make choices.

Instead of spending money on welfare reforms or running expensive advertising campaigns to encourage workplace pension enrollment, the UK authorities simply changed the default: under the old system, workers had to actively opt-in to a workplace pension. While most people see pensions as an important part of their future, doing something about it in the here and now isn’t quite so easy. Apathy reigns supreme. So the UK government changed the game by making workplace pensions opt-out, not opt-in – switching that apathy to everyone’s advantage. This simple change has increased private pension enrollments from 2.7 million in 2012 to 7.7 million in 2016.

Today, we call ideas like this ‘nudges’ – small psychological techniques that can make a big impact on people and society. And there are hundreds of examples around the world, from lower cleaning costs at Amsterdam's Schiphol Airport to a simple way of reducing energy consumption through social proof. In the field of public policy alone there are nearly 200 separate behavioral insight teams around the world. Global companies like Google, Coca-Cola, and General Electric have all set up behavioral insight units to help them influence behavior inside and outside their businesses.

The term ‘nudge’ comes from the 2008 book of the same name by Richard Thaler and Cass Sunstein. It soon became a bestseller, launching the idea of behavioral economics and nudge theory as a way to change behaviors in everyone’s best interests. And nudges can work for all kinds of situations, from marketing campaigns to internal productivity hacks.

We all love to think that we make rational decisions. And we do try to be rational – our intentions are good. But, quite simply, we often aren’t rational at all. Classical economics paints everyone as perfectly rational, data-driven decision makers who always serve their own self-interests.

But we’re human and we make mistakes. We think with our hearts as much as our heads. In other words, economics has got it all wrong: humans hardly ever make 100% rational decisions.

So how do we make decisions?

In fact, we have two decision-making processes operating in our brains. We have a ‘fast’ process and a ‘slow’ process. The fast process, known as System 1 thinking, makes quick decisions based on emotions and instinct – it’s automatic and unconscious (but it can solve pretty complex problems). System 2 thinking (‘slow’ thinking) is cerebral and logical, and usually requires more effort. If you need to concentrate, you’re probably using System 2 thinking.

Want some examples? Here goes. System 1 (fast) thinking helps you complete tasks like catching a ball. If a ball is flying towards you, you could calculate all the variables: weight of the ball, wind speed, your reaction times, etc. But of course the ball will hit the ground long before you even pick up a pencil. So we automatically use our System 1 thinking to coordinate our limbs and successfully catch the ball.

It is this Nobel Prize-winning theory, proposed by psychologists Daniel Kahneman and Amos Tversky, that has transformed our understanding of individual behavior. When it comes to behavioral economics, nudges and changing someone’s behavior, System 1 is the most interesting. In fact, our intuitive System 1 thinking can, under the right conditions, be tricked.

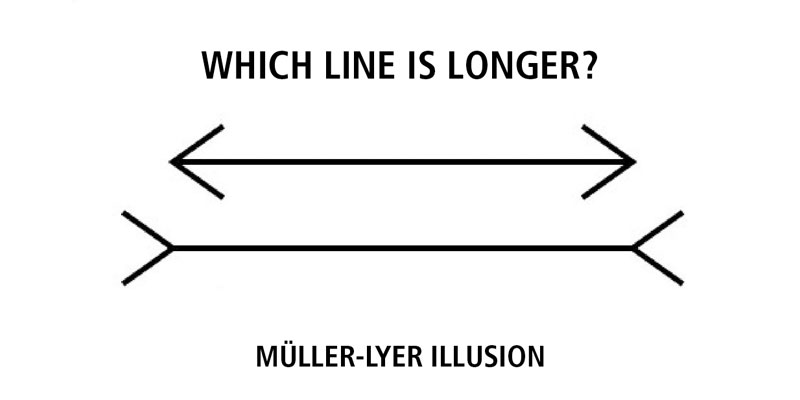

These tricks work like visual illusions. Take a look at the Müller-Lyer illusion, the hollow head illusion, and the checker shadow illusion for a few mind-bending examples.

Our mental decision-making processes are open to similar illusions. Although of the logical – not visual – variety. We call these illusions ‘cognitive biases’. You’re a sucker for them, whether you like it or not.

While nudges and behavioral economics might be relatively new concepts to economists, politicians and even psychologists, the marketing world has long suspected there's something going on when it comes to persuasion and cognitive biases. Of course, the real-world applications of nudge thinking have always been there. The work of Kahneman, Thaler, Sunstein and others has simply formalized and codified the ideas behind it.

Is it manipulation? Frankly, yes. But that doesn’t mean it’s necessarily a bad thing. Nudges are no more persuasive than a Pixar film manipulating you to care about the adventures of Woody and Buzz Lightyear. Someone who doesn’t want to buy a product will still not want to buy a product, no matter how many nudge tactics are used. But those who are undecided or in the consideration phase? That’s different.

If you’re still thinking 'behavioral economics sounds like some kind of subliminal mind control', you’re not alone. But Nudge co-author Richard Thaler is clear that nudges are only nudges if they’re politically agnostic. They’re not left or right. “We believe nudges must offer options. A penalty or a single-option nudge isn’t a nudge at all. Nudges are perhaps best described as being libertarian.” It’s no surprise that Thaler often signs copies of ‘Nudge’ with his name followed by ‘nudge for good’.

Marketing and psychology has produced pioneering ideas that neatly overlap with behavioral economics. Most famously, social psychologist Robert Cialdini has defined six pillars of persuasion that provide an intellectual framework for many proven, real-world nudges.

We’ll give the last word to a marketing expert. Ogilvy ad man Rory Sutherland is a vocal advocate of behavioral economics, and he sees a new age of enlightenment just around the corner: “When I say that the next revolution is psychological not technological, I fervently believe it.” And that sums it up nicely. Behavioral economics attempts to understand something we know precious little about: our own brains.

So, how do you use these theories in your business right now? Check out our 5 nudge techniques you can use right now.