Grow your business with the Weekly Trade Update

Logistics advice & insights straight to your inbox

Subscribe now

To understand the dynamics of the new globalised economy, certain countries are often grouped together based on common traits, like growth rate, population and political circumstances. We all know about the G7 (formerly the G8), but what about BRIC and N-11? What do they mean for your business – specifically, the cross-border trade opportunities?

The recent edition of DHL’s Global Connectedness Report (2024) highlighted the strength of globalisation today, even despite disruptions from the Covid-19 pandemic and the war in Ukraine.

To understand the dynamics of the new globalised economy, certain countries are often grouped together based on common traits, like growth rate, population, and political circumstances. We all know about the G7 (Canada, France, Germany, Italy, Japan, the UK and the US), but what about the emerging market business opportunities with BRIC and N-11?

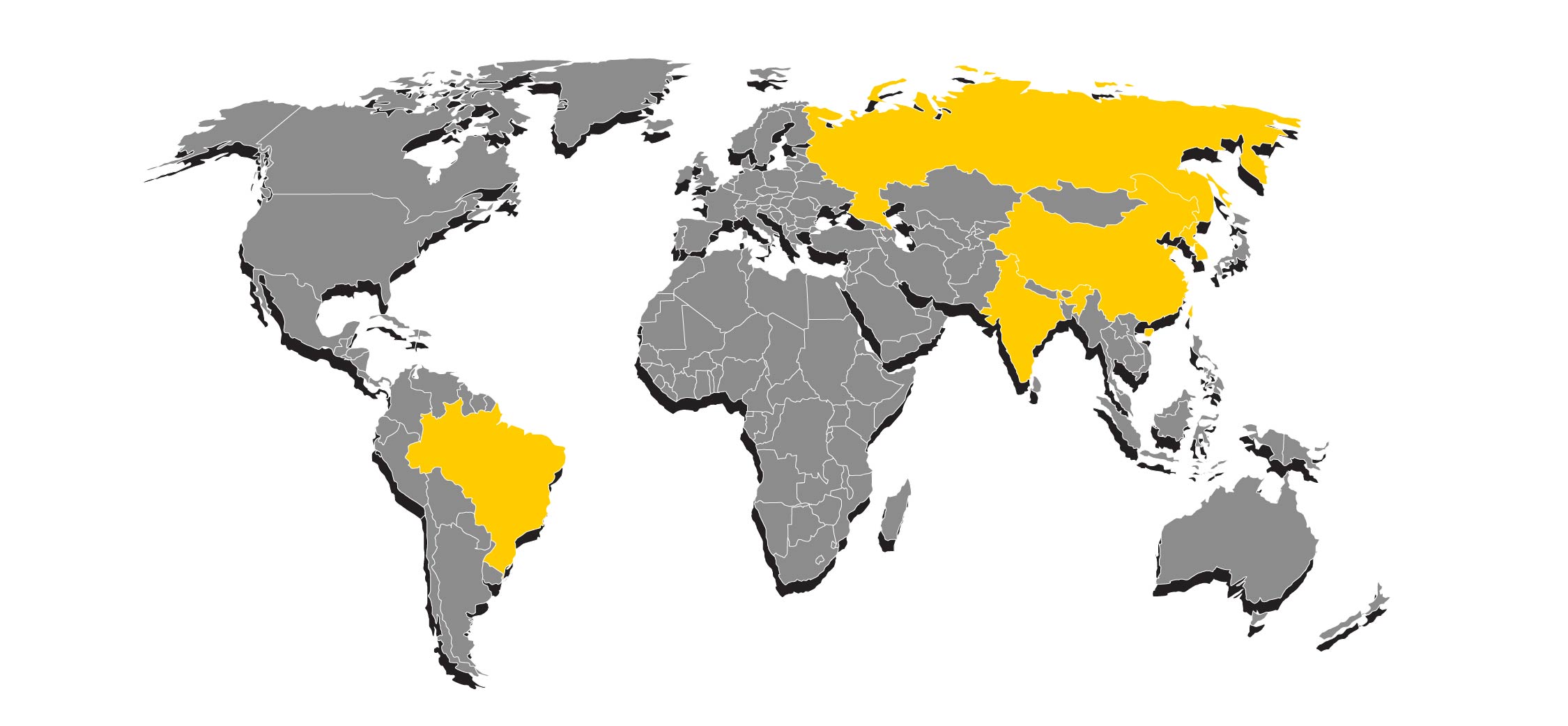

Coined by former Goldman Sachs economist Jim O’Neill in 2001, “BRIC” countries were identified as the world’s most important developing countries with the potential to overthrow the economic hegemony of the G7 nations.

In 2009, the leaders of the BRIC countries held their first summit, making it a formal institution and more than just an economist's shorthand. Then, in 2010, at China’s invitation, the term was expanded to “BRICS” to include South Africa (although it’s worth noting that O’Neill was highly critical of this move.)

Pre-Covid, PwC forecast that the emerging markets could grow, on average, twice as fast as the G7 over the next few decades1, making international business expansion to BRICS an enticing prospect. Currently, China is 2nd, India 5th, Russia 8th, Brazil 11th, and South Africa 37th in global GDP rankings2. If they’re not already on your international growth radar, they should be…

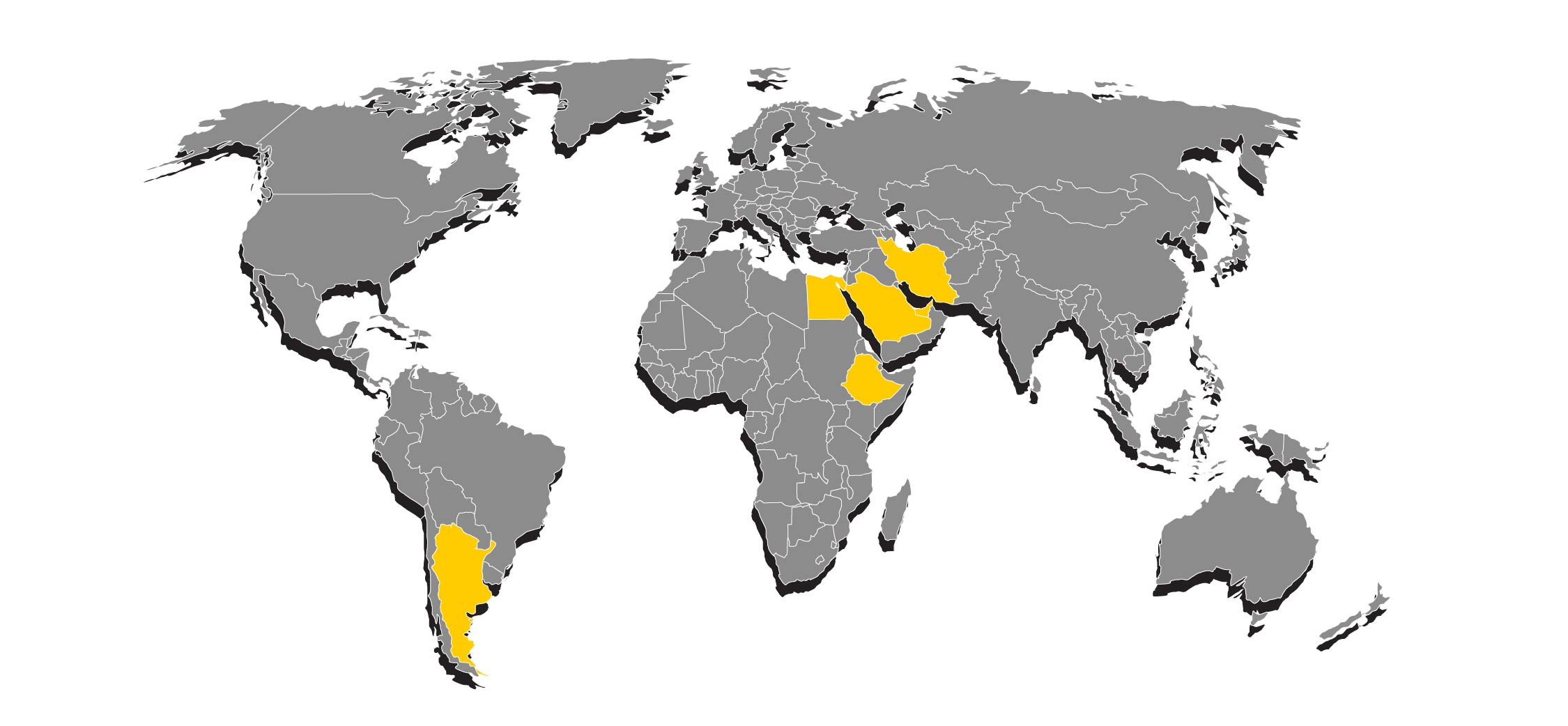

In early 2024, BRICS will formally welcome six new member states:

These additions will boost the group’s combined population to a whopping 3.5 billion – around 45% of the world’s inhabitants3.

Whilst impressive, the real barometer – GDP – is more modest. Because the new BRICS members are considered to be developing economies, their addition to the bloc will not have a major impact on its overall share of GDP.

However, there’s a powerful advantage to global trade with BRICS nations in the form of “liquid gold”, or rather, crude oil. With the addition of Saudi Arabia, the UAE, and Iran, BRICS more than doubles its members’ share of global oil production to 43%4. China has been pushing for oil trade to be denominated in yuan, which would significantly shift the spotlight from the US dollar and the West’s dominance of global financial markets. If BRICS starts accepting local currencies for oil payments, many countries will be swayed to join the group.

16 countries have already applied for membership to the BRICS, including Cuba, Indonesia and Vietnam. A group designed to bring together the world's most important developing countries, and bolster their position on the world’s political and economic stages, is doing just that.

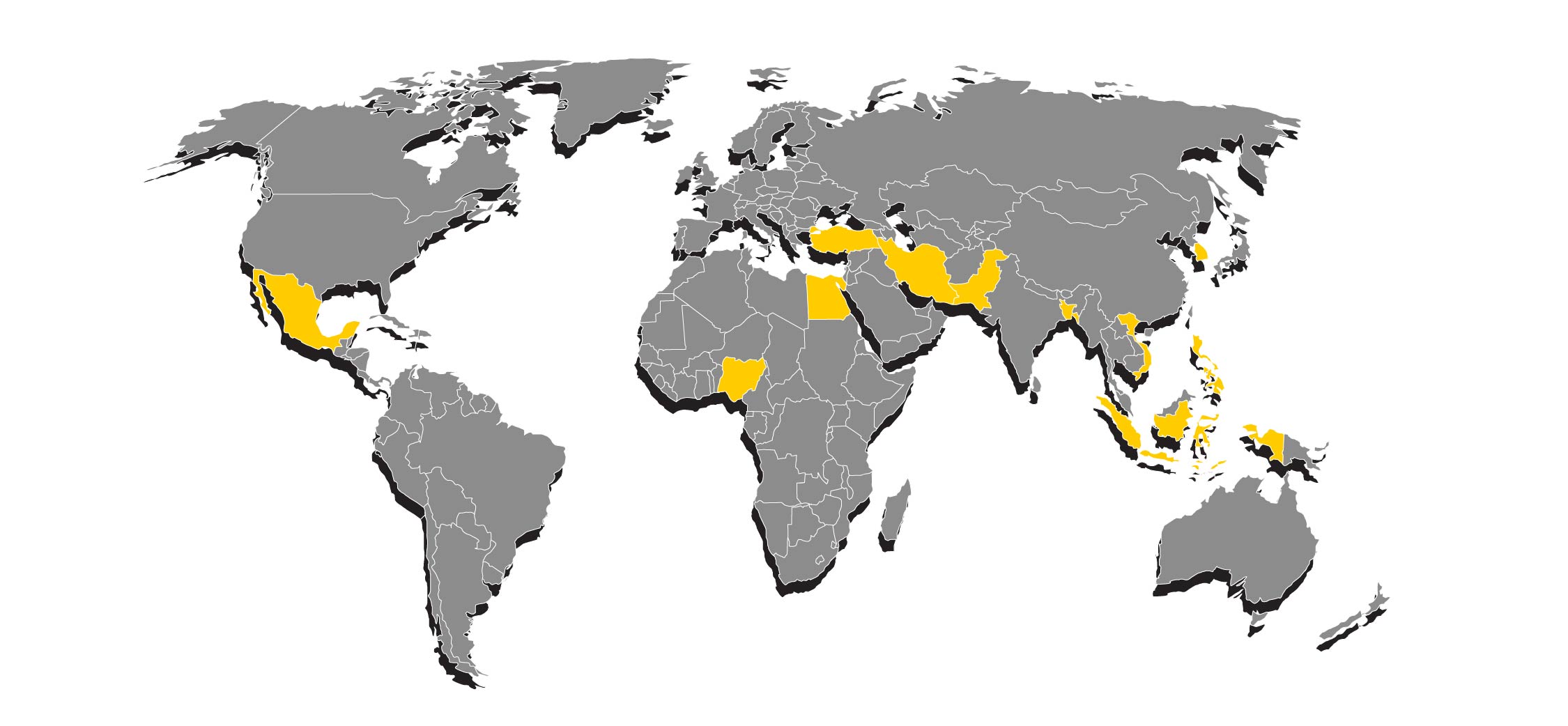

The Next Eleven – or “N-11” – was coined by Jim O’Neill and his Goldman Sachs colleagues in 2005 and consists of eleven emerging markets with huge economic potential:

Though on a slower growth trajectory than the BRIC countries, O’Neill & co still predicted that the Next Eleven could reach two-thirds of the size of the G7 economies by 20505. This theory was based on macroeconomic stability, technological capabilities, human capital, and political conditions.

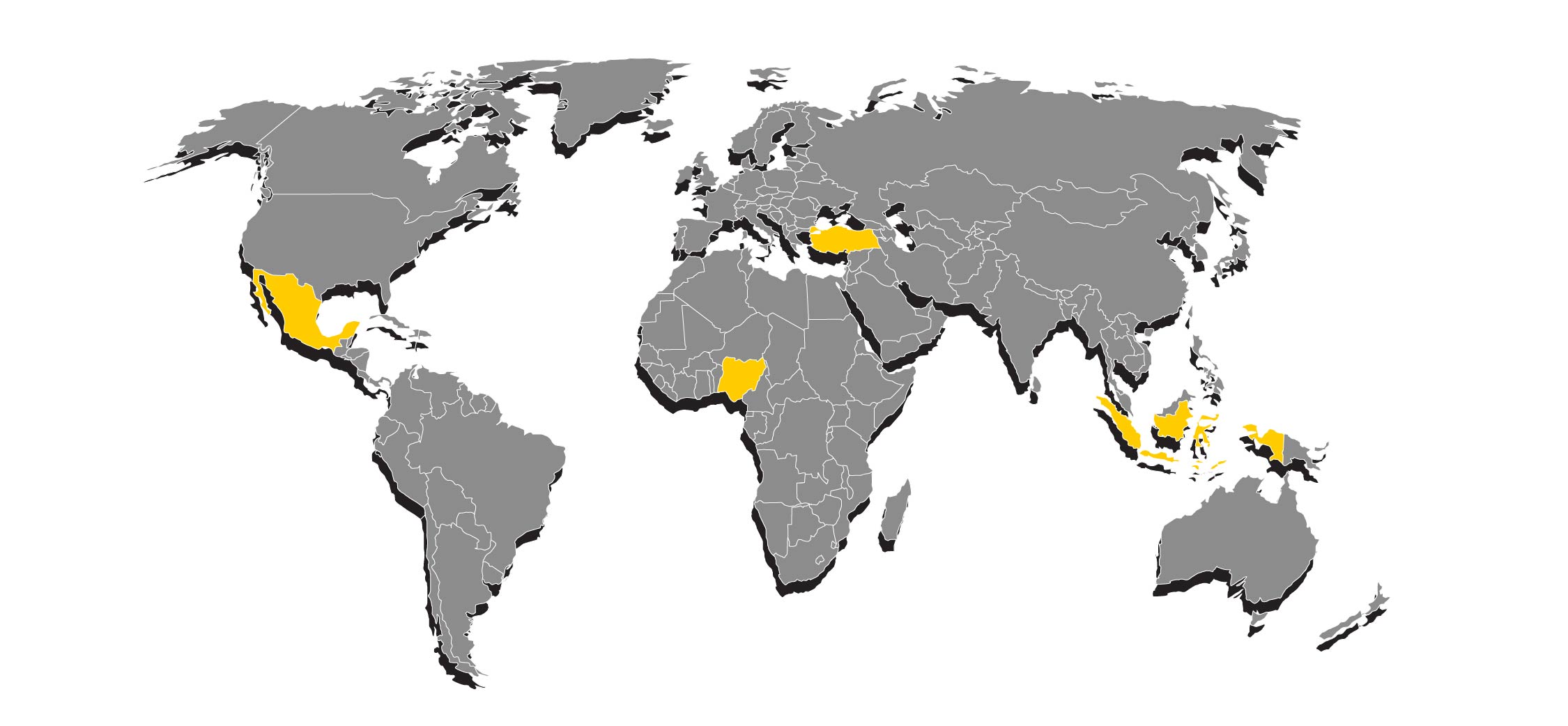

Introducing the ‘MINTs':

You’ll notice that all four of these appeared in the Next Eleven category – think of MINT as an update to N-11. The economic outlook for MINT countries is bright: Goldman Sachs predicts that all four nations could be inside the top 20 economies by 2050, with Indonesia and Mexico breaking into the top 10.

POSITIVES: Likely to overtake the US as the world’s largest economy by the end of the decade. Big opportunities for e-commerce businesses: in 2020, China’s online sales reached US$2.3 trillion13, just over half of the world's e-commerce market total. Supply chain disruptions caused by Covid and surging demand are expected to stabilise in the second half of 2022.

NEGATIVES: China’s growth is slowing down, with a possible knock-on effect to nearby economies (Indonesia, Thailand, Hong Kong). The pandemic has worsened domestic and external economic imbalances.

Major imports: Electrical equipment, fuels and oil, computers, ores, optical and medical equipment, vehicles, plastics, chemicals and copper.

Has it delivered on the BRICs promises? Most certainly, and there's more still to come.

Beyond the BRICs, which other countries are ones to watch?

The Next Eleven – or “N-11” – was coined by Jim O’Neill and his Goldman Sachs colleagues in 2005 and consists of eleven emerging markets with huge economic potential: Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, Turkey, South Korea and Vietnam.

Though on a slower growth trajectory than the BRIC countries, O’Neill & co still predicted that the Next Eleven could reach two-thirds of the size of the G7 economies by 205014. This theory was based on macroeconomic stability, technological capability, human capital and political conditions.

It’s worth noting that the Next Eleven markets were identified nearly 20 years ago, and each country has since had varied outcomes in meeting its forecast potential. Writing in 2018, Jim O’Neill said “South Koreans now enjoy a standard of living similar to that in the European Union, which makes many analysts’ persistent categorisation of South Korea as an “emerging economy” all the more baffling”, whilst noting that Mexico and Egypt’s performance has been “somewhat disappointing.”

Mexico, Indonesia, Nigeria and Turkey make up the MINT countries. You’ll notice that all four appeared in the Next Eleven category – think of MINT as an update. Each has a large and youthful population, and Goldman Sachs predicts that they could be inside the top 20 economies by 2050.

BRIC, N-11, MINT – they’re just acronyms used by economists, but play an important role in helping businesses with international ambitions identify the best markets to target.

The barriers to global trade are falling, just as new economies are finding their feet. Now's the time to partner with an international specialist who can help you reach customers across the world. Apply for a DHL account today and see where it takes you.