Grow your business with the Discover newsletter

Logistics advice & insights straight to your inbox

Subscribe now

Just like every IKEA DIY product, you’ll always need to read the manual first before you build it.

This is the same when you’re trying to build your very own business empire.

Imagine this: the type of business you choose will be the walls that protect your castle, truly you want to at least know what are the walls made of!?

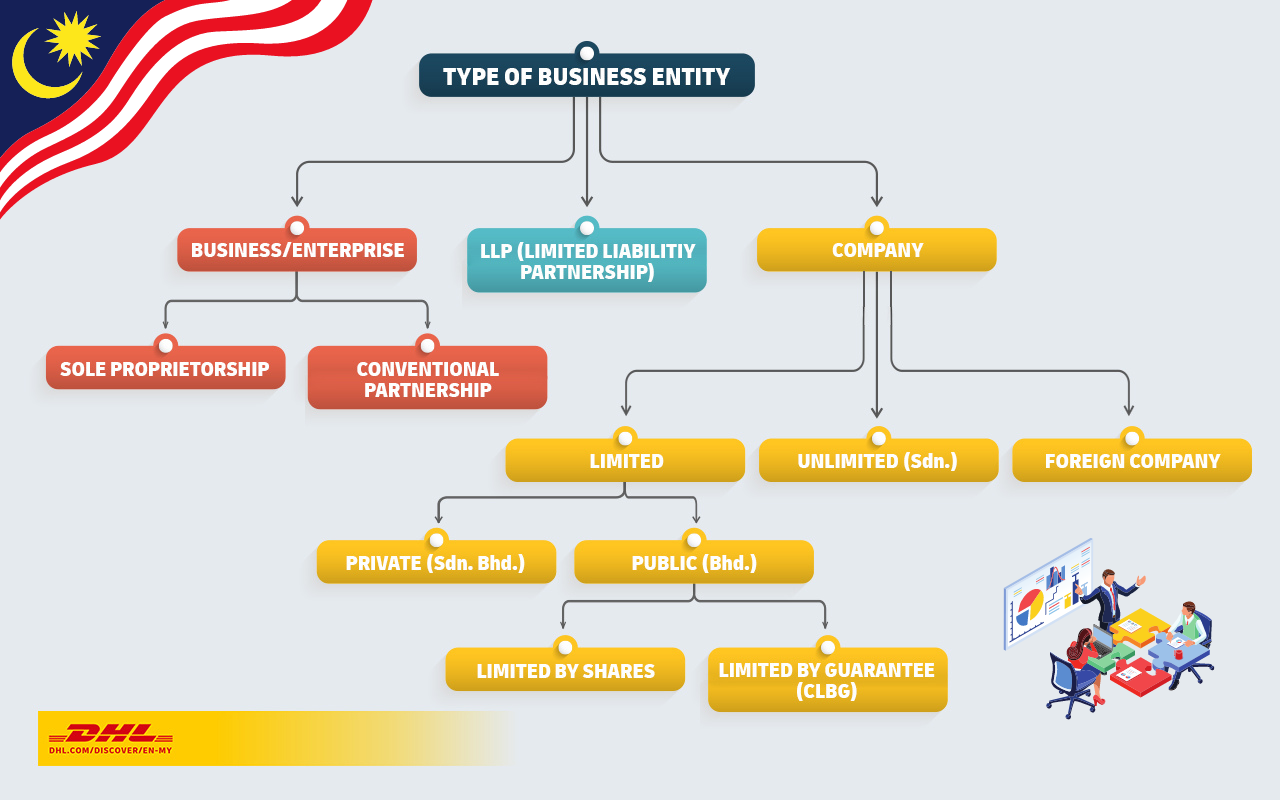

Just like the multicultural society in Malaysia, there is also a variety of business entities that are available in Malaysia. If you have read our pocket guide to start your very own business in Malaysia, you may already know that you generally have three choices when it comes to starting a business: Enterprises, Private Limited Companies (Sdn Bhd) and Limited liability Partnerships (LLP).

However, surprise surprise, there are actually 7 types of businesses in Malaysia!

Here comes the first major decision you will have to make in your entrepreneurial journey. To choose the right type of business entity to kick start your business.

And to make that choice a slightly easier one, allow us to further explain the different types of businesses in Malaysia!

Let’s first recap the three common types of business entities in Malaysia.

In Malaysia, an ‘Enterprise’ or ‘Business’ is used interchangeably and mainly refers to two types of business entity: Sole Proprietorship or General Partnership. And both of these business entities are under the Registration of Business Act 1956 (ROBA 1956).

A Sole Proprietorship is defined as a business that is started and owned by only one individual. On the other hand, if 2 to 20 people come together to start a business, they will form General Partnership.

If you plan to start your own enterprise, you yourself (Sole Proprietorship) and your partners (General Partnership) will be the ones that will conduct the day-to-day business operations for your enterprise.

According to SSM’s own website, Enterprises or Businesses are considered one of the most popular choices in Malaysia with Enterprises at an amount of 8,8302,358 as of 31 December 2022 compared to the number of companies of 1,482,579.

A reason that Enterprises are so popular among Malaysians is the simplicity to register them. Entrepreneurs would just need to register an EzBiz account online and simply upload the registration form with an Identification Card (IC) to proceed with the registration.

Not to mention it also costs significantly low to register a business in Malaysia. It will only cost you around RM30 annually if you use your name as per IC as your business name (only applicable for Sole Proprietorship) or RM60 annually if you choose to use your desired trade name. On top of that, you will only need to pay an additional RM5 to any branch you choose to register your business physically.

Registering an enterprise also means that you will be getting to kick-start your business journey as soon as possible as registrations can be done within an hour.

However, if you choose to start your business journey as an enterprise, you as the business owner will be considered the same entity as its enterprise. This simply means that you and your business are considered the same ‘person’.

For starters, the money that you have made from your business will be considered part of your personal income. That might sound attractive to many entrepreneurs at first. However, if you think closely, this also means that you will be paying higher personal tax with the increase in personal income!

This goes the same for the legal responsibilities of an enterprise. If an enterprise were to face any charges, the owner(s) themselves will be held accountable! It does not stop there. If there is an unfortunate event where an enterprise was to be declared bankrupt or in debt, the business owners or partner’s personal income and assets will not be protected if they were to start an Enterprise.

Do you still remember what’s a Private Limited Company? Don’t worry, let’s recap what a did we mentioned last time, shall we?

‘Private’ means that the company is under private ownership and its shares are not traded in the public stock market. ‘Limited’ refers to the liabilities of this company being limited to only the amount of money or capital the shareholders invested in the business. Private Limited Companies are governed under the Company Act 2016 (CA 2016) and in Malaysia, every company that is a Private Limited Company must end their company with ‘Sdn Bhd’ behind their name.

If you’re planning to incorporate or start a Private Limited Company, do take note that the management of a company is tasked to the board of directors instead of the shareholder. However, fear not if you’d want to be involved in the business operations as a shareholder can also be the director of a company!

The first question that might pop up in your mind might be, what’s a ‘Shareholder’? Well, in a Private Limited Company, ‘Business Partners’ are generally referred to as ‘Shareholders’. And unlike a general partnership, A private limited company can be either founded by one single shareholder or co-founded by up to 2 to 50 shareholders.

If a few shareholders come together to start a private limited company, each shareholder will contribute a desired amount of paid-up capital in exchange for shares in a company. In other words, ‘shares’ refers to a portion of a company that was exchanged by the financial contribution of a shareholder to a company’s share capital (pot of money).

Unlike enterprises, a company is a different entity from its shareholders. That means that the law treats a company as a legal ‘person’ from its shareholders and is capable of earning income, owning properties, entering agreements and making its own decisions based on the benefit of the company. This also means that any third party and technically the shareholder of the company itself can actually sue the company and vice versa.

Money that is earned through a company will be considered the company’s own earnings instead of the shareholders. In other words, shareholders will not need to worry about their personal income increasing as the company itself will be taxed based on the earnings since it’s a separate legal entity from its shareholders.

Generally, if you’re a shareholder of a company, you will not be personally liable for any decisions made for the company. As mentioned, the liability of a company is only limited to its paid-up capital and is a separate liability from its owners.

However, if a company were to get involved in crimes of any kind, the law has the power to lift the corporate veil or protection and punish the shareholders behind it! So always be on your toes and do not let your company be a vehicle to conduct crime!

The final business type of Limited Liability Partnership (LLP) is the combination of a General Partnership and a Private Limited Company (Sdn Bhd). LLP can be created by a minimum of 2 people with no maximum limit.

Normally, you are able to identify if a business is an LLP by just checking the end of the business name. If you noticed that the business consists of ‘PLT (Perkongsian Liability Terhad)’ at the end of their name, these businesses are Limited Liability Partnerships.

Under the Limited Liability Partnerships Act 2012 (LLPA 2012), LLP was introduced in 2012 for professional bodies such as chartered accountants, lawyers or company secretaries, and engineers who are not able to choose to start enterprises. However, LLP is currently available to any business with the purpose of making a profit.

What makes LLP special is that it provides the same benefits as a Private Limited Company while being affordable and flexible like a General Partnership. And similar to a General Partnership, an LLP is managed, operated and overseen by the business partners.

Similar to a Private Limited Company (Sdn Bhd), an LLP is also a separate legal entity from its business owners. Any debts and liabilities that are incurred in an LLP will stay within the LLP and will not affect the partners. Also, as the name suggests, an LLP also has a limited liability in that the debts will only be limited to the total partner’s contribution.

An LLP is also treated the same as a Private Limited Company as capable of earning income, owning properties, entering agreements and making its own decisions based on the benefit of the LLP.

LLP is also taxed similarly to an Sdn Bhd. However, LLP will have fewer tax incentives compared to Sdn Bhd.

If you plan to start an LLP, you will have the flexibility to manage it as partners of an LLP can create a written agreement to better determine the distribution of profits among members. This allows greater flexibility when managing an LLP.

Wonder what happens when a private limited company has more than 50 shareholders? In short, it is converted into a ‘Public’ Limited Company! For some entrepreneurs that want to grow their business, ‘upgrading’ or converting into a Public Limited Company might also be a profitable option.

For instance, if you feel like your private limited company is sustainable, you can choose to expand your business by converting it into a public limited company to sell your shares to the public to gain an even higher capital.

A Public Limited Company in essence is similar to a Private Limited Company. The only major difference is that the shares in these companies are open to the public to acqui.

As the name suggests, an unlimited company is a private company with unlimited liabilities. And as you may have already guessed, if there are any losses or debts incurred in the company, the company members or shareholders will be held accountable. Naturally, this type of company is irrelevant for any future entrepreneur who plans to start a business.

A company that is limited by guarantee is a public company. These types of companies are often only for non-profitable organizations such as charitable companies, foundations or societies. The profit that is generated by these types of companies will not go to the members of the company. Instead, the profit will be then reinvested into the company.

Foreigners who have established their brand name in other countries and want to set up a branch office in Malaysia are considered foreign companies in Malaysia. Since a branch office is not a separate legal entity from its parent company, the parent company will be held accountable if any liability and debts were to occur to the branch office.

A foreign company can also come in the form of a representative office. The representative office cannot engage in any business activities that might generate income for the company and is only restricted to collecting and processing information to evaluate the Malaysian market.

So, do you have a better understanding of each of these business entities? Well, it’s time to make up your mind on which type of business you’d want to start as. Buckle up as next we’re going to talk about the different business models that you can choose that best suit your new business.